sefa ozel

Introduction

On October 11th, ASML Holding N.V. (NASDAQ:ASML) hosted its annual investor day and this year many people were looking forward to this event. The main question of analysts and investors was how ASML was planning on expanding the business to satisfy the massive demand for its products. ASML also planned to give new insights into their updated outlook until 2030, which would give investors a better idea of the company’s potential. I, for one, was very curious about this event as a long-term investor in ASML.

ASML gave a very detailed outlook and opinion on the semiconductor industry and painted a clearer picture of what to expect from the industry going forward, represented by the iShares Semiconductor ETF (SOXX).

Within this article, I will take you through all the news items that are of importance to any investor in ASML or the SOXX. This article will serve as additional information to my recently released article on ASML following its third-quarter earnings update. Within that article, I took a deep dive into ASML, its business fundamentals, finances, monopoly, and long-term potential. I would recommend reading that one first to get to know ASML from top to bottom (if you are not already familiar with the company). I will try not to repeat myself too much across the two articles.

Let’s get into it!

Megatrends

ASML sees the world is changing fast as it gets more and more digitalized. This worldwide change is a strong tailwind for ASML as this means there is an increasing demand for the highest semiconductors, which can only be manufactured using ASML machines. The world is getting ever more connected with smarter cities, smarter cars, and smarter homes. Data volumes are going through the roof and privacy/cybersecurity is the talk of the day, every day.

Climate change is another aspect of the fast-changing world. Rising energy usage, exploding energy costs, and accelerating climate change are huge problems and the reason for many new laws/bills as we saw in the U.S. with the Inflation Reduction Act. The rising population and more need for tech talent are among the social and economic trends and are having an impact on ASML. In fact, everything named above has in some way an effect on ASML.

ASML does see the potential for technology to help with most of the ongoing shifts. Connectivity should be boosted by 5G, cloud infrastructure, and edge computing. Climate change should be slowed down by using more green energy initiatives, electrification, and agricultural innovation. MedTech and automation should help with social and economic problems. These are just some examples given by ASML to illustrate how the world is changing and how technology is at the forefront of this change.

Now, ASML believes the energy transition will be one of the semiconductor market drivers over the next decade as semiconductors are crucial in the generation, storage, distribution, and consumption of electrical energy. ASML is seeing an acceleration in the migration of the energy mix, driven by the extreme prices of fossil fuels and the scarcity of them. The energy crisis in Europe, and most extreme in Germany, is the perfect example of how dependent we are on fossil fuels. Also, the consumption of green energy is being boosted as it is expected that 70% of car sales will be electric vehicles (“EVs”) by 2030 from 15% in 2021. Every EV needs 2x the semiconductors of any traditional fuel-powered car, and ADAS systems are an additional driver. This shows once more that semiconductor demand will keep growing rapidly.

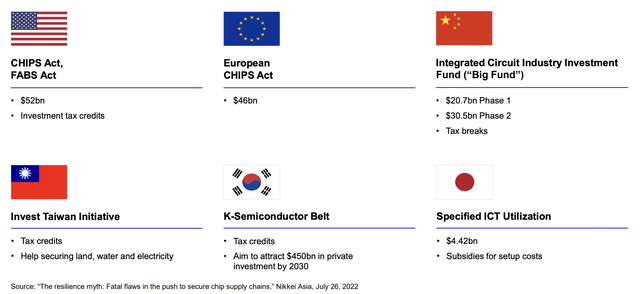

To satisfy the expected increase in demand for semiconductors over the next decade, many billions of dollars are being pumped into the industry. This is also out of fear of being reliant on manufacturing in other countries, as we know that the U.S. wants more domestic semiconductor manufacturing because they want to be less reliant on Asian manufacturing. The picture below shows an overview of some of the many billions of dollars being invested in the semiconductor market by countries all over the world.

Semiconductor industry investment by countries (ASML)

Everything I have stated so far in this article is not only good news for ASML, but it probably is for the whole industry. I see the confidence of ASML and the things they point out as a crucial source of information, as ASML has a very good feel for the general semiconductor market as they talk with all the largest producers. To me, this information is another sign that the semiconductor sector is the way to go into the future and a positive sign for other semiconductor companies within my portfolio such as Nvidia (NVDA), Broadcom (AVGO), and Qualcomm (QCOM).

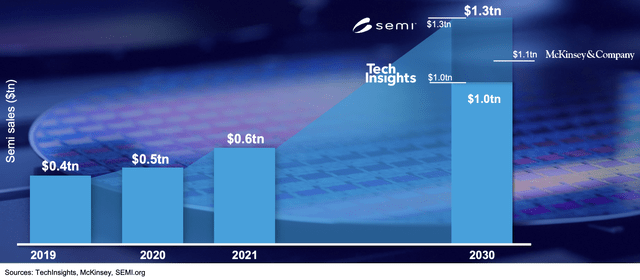

ASML expects the semiconductor market to double in 10 years and, according to analysts, the market will be worth between $1 trillion and $1.3 trillion.

Semiconductor market outlook (ASML)

In addition to this, ASML expects all semiconductor end markets to average a 9% CAGR through 2030. They think all markets will grow with datacenter, automotive, and industrial expected to outperform with a CAGR of 13%, 14%, and 12%, respectively. And I will state again, this is a strong tailwind for all semiconductor stocks, as represented by the SOXX, and I, therefore, highly recommend taking a look at opportunities within this industry since the market is offering real bargains like Qualcomm and Broadcom at incredibly cheap prices. With the outlook for semiconductors the way ASML describes it, this sector is a strong buy.

Changes to the 2021 investor day

ASML gave its expectations last year, just as it did this year. But this year they reflected on the changes they are seeing all around the industry, which are impacting ASML.

One of these changes in outlook is the faster growth of advanced markets as they are seeing faster node migration and a better outlook. More products are moving to advanced nodes, especially in the smartphone industry. The server and cloud industry is seeing a better outlook and therefore more future growth potential. Also, the increase in emerging applications like VR/AR is boosting this increase in growth.

Mature market growth is also driven by smart grids and automotive. There seems to be a new boost in growth after being stable for years. Renewable energy, IoT, and automotive, are all boosting growth for semiconductors.

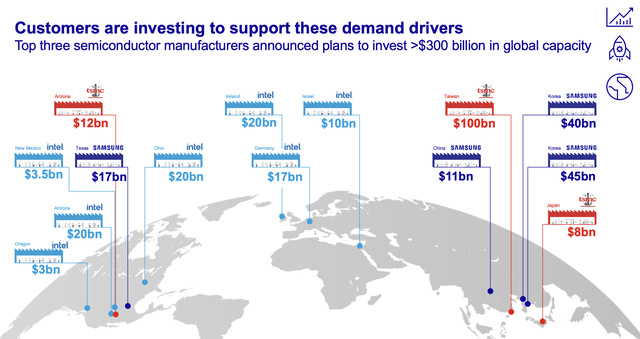

ASML

The incredible amount of spending by the three main customers of ASML shows the incredible amount of potential growth there is for the machines of ASML.

Capacity expansion

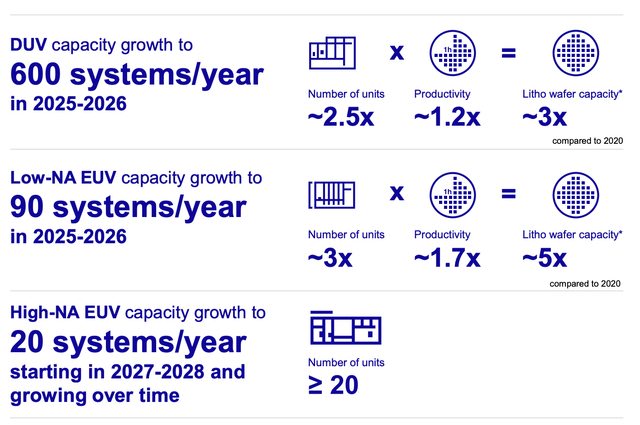

Now, to the most anticipated part of this investor day, probably: the expected news about the capacity expansion plans. After all the strong tailwinds explained above, it is clear that ASML needs to increase its capacity to meet demand.

- ASML wants to increase DUV capacity to 600 systems per year by 2025/26

- Increase low-NA EUV capacity to 90 systems per year by 2025/26

- 20 systems per year for high-NA EUV starting in 2027/28.

ASML expects to increase production space by 65,000 m2. This increase in capacity should put ASML in the position to satisfy demand and massively increase revenue growth over the next decade.

Capacity expansion (ASML)

Historical shareholder creation and future potential

ASML devoted part of its investor day presentation to looking back at the past. Sometimes the past can be the best indication of the future, so I felt like it was important to reflect on this part as well.

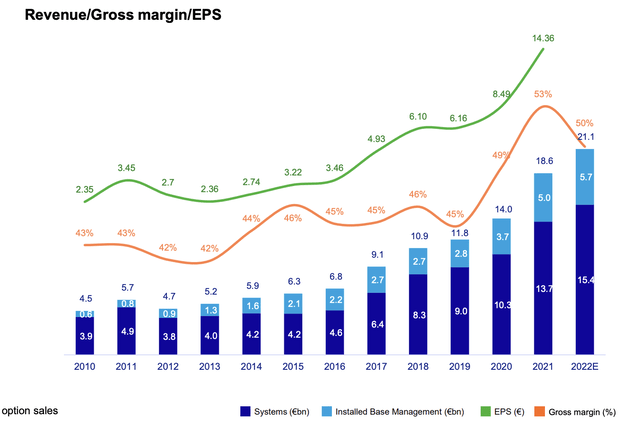

ASML earnings per share have grown at an impressive 18% CAGR since 2010 driven by revenue growth, improved margins, and share buybacks. ASML saw revenue from machines increase at a CAGR of 12% over the same period and installed base management grew at an even stronger 21%. This is not a surprise, of course, as the installed base grows larger and larger and, therefore, outpaces machine revenue growth.

ASML growth since 2010 (ASML)

But this has not even been the highlight for investors over the last 12 years. Total shareholder return within this period came in at an annualized 24%. This outpaces the 18% CAGR of the SOXX and 14% CAGR of the Nasdaq. These are very impressive returns over such a period. And we can add to this that demand for its systems is not easing at all, but will most likely increase at an even faster pace over the next 10 years as discussed within this article so far. It is, therefore, safe to assume that shareholder returns over the next 10 years will beat the previous 12.

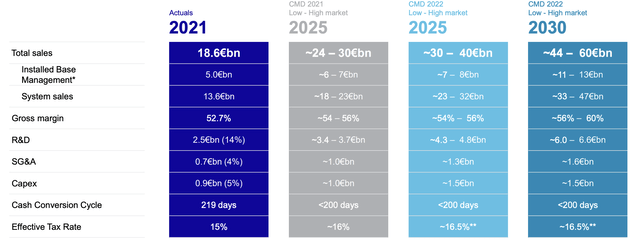

I already discussed the increase in capacity. Combine this with the increase in user base discussed above, and the increase in demand and margins, and we get to some very interesting financial results. For this reason, ASML now projects revenue in 2025 to be between €30 – €40 billion and revenue will reach between €44 – €60 billion by 2030. 2030 revenue is a very significant increase from the €18.6 billion in revenue from 2021. At the top end, ASML then expects to increase revenue by 3x in 9 years. Margins will increase from 52.7% in 2021 to between 56% – 60% in 2030. A complete overview of ASML’s financial expectations for 2025 and 2030 can be seen below.

Overview of ASML financial outlook (ASML)

ASML is not planning on stopping its exceptional shareholder value creation and part of this is maintaining a strong and flexible balance sheet. ASML will keep returning excess cash to shareholders in the form of dividends and share buybacks. Even more, ASML announced a new €12 billion share buyback to be executed before 2025.

Concluding thoughts

I believe the investor day gave us great insight into the plans of ASML for capacity expansions and the financial growth outlook. I would like to call these highly impressive, and ASML seems to be poised for solid growth over the next decade and shareholder returns to be above a 20% CAGR.

To me, ASML is a no-brainer investment. It was already before this presentation, as I explained in my previous article, but this just once more confirms my thought on ASML. The one single problem I have with ASML is that the share price has now increased by over 40% since my previous article and since its earnings release. This makes the stock significantly more expensive and harder to recommend buying. Yet, I believe ASML is not cyclical at the moment as order and backlog keep increasing.

Yes, a P/E of over 40 is richly priced, but you must pay for quality, reliability, and incredible shareholder returns. This stock might very well have bottomed last month. Therefore, I will still put a gentle buy on the stock at its current price. I believe that as a long-term investor, any price below $650 is still okay. I would recommend buying bit by bit as the market uncertainty remains.

I believe the SOXX is very much a buy as well, as illustrated within this article. ASML has a clear view of the market conditions and outlook, as some of the largest in the industry are close clients of ASML. In fact, the news reached me today that Warren Buffett has taken a position in Taiwan Semiconductor (TSM) (“TSMC”) over the last quarter, indicating Buffett believes the industry is at a low and a clear long-term buy. TSMC is the most important customer of ASML after all. The outlook for the semiconductor industry remains strong over the long term, and the weakness we witnessed so far this year gives us a great opportunity to pick up some beaten-down beauties.