Stocks for the Long Run is one of my favorite books. If you were to ask me what the single most universally held belief in all of investing is, I’d say it is that “stocks are the best way to build wealth”. I don’t disagree. After all the largest fund I manage is a long only US stocks fund!

But I don’t necessarily agree either.

US stocks are the STARTING POINT and the largest allocation for every investment portfolio. And they likely should be as they are the world’s largest stock market at 60% of the total (10 times larger than #2 Japan, which is astonishing).

US stocks have compounded at 10% forever, and the crazy math behind that is if you hold them for 25 years, you 10x your money, and after 50 years you 100x your money.

$10,000 plunked down at the age of 20 would grow to $1,000,000 in retirement. Badass!

So it’s natural that when we poll investors on Twitter that US stocks are the most universally held investment category.

But stocks can go a painfully long time with flat performance, as well as nauseating bear markets. And they can go through painfully long periods underperforming other assets too.

So what if there is another way? What if you can build wealth and own zero US stocks?

Blasphemy!

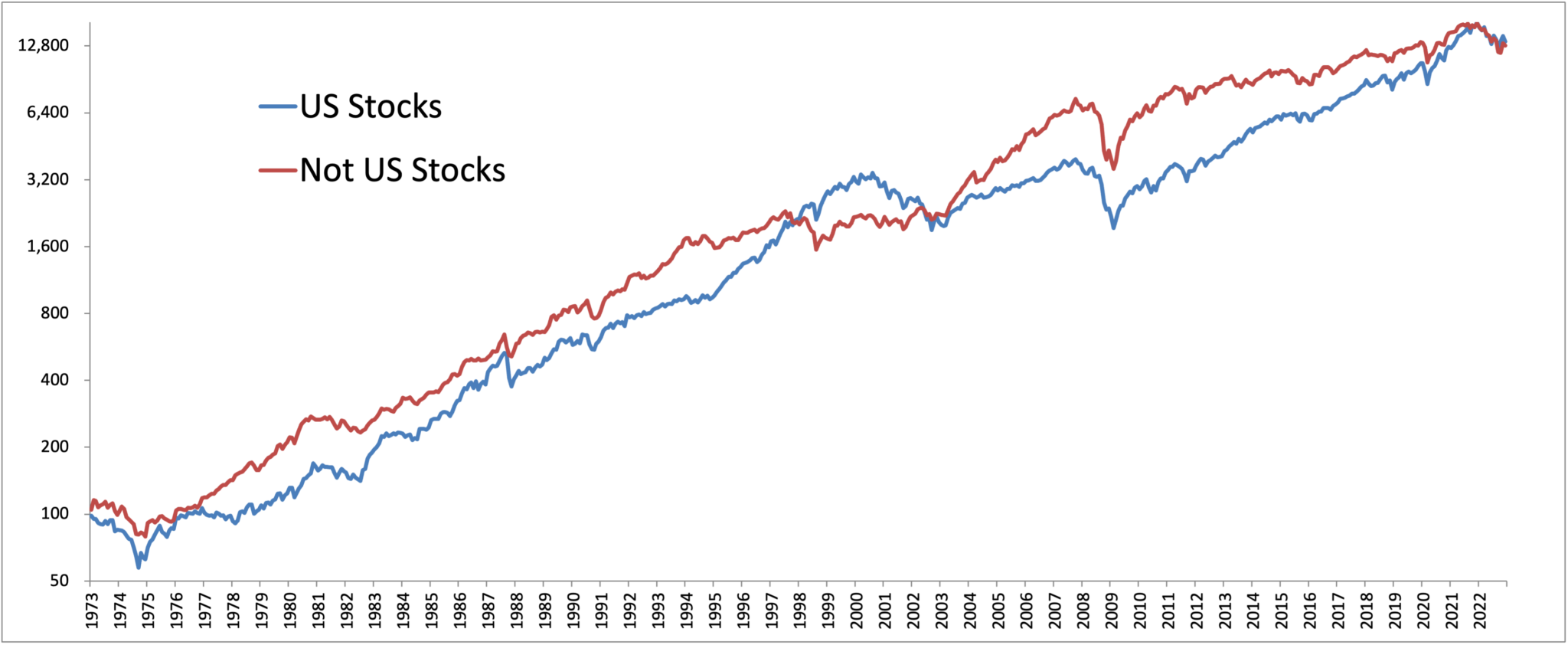

I had a little fun over coffee this morning with our asset class backtester. Below are some stats for US stocks, as well as an allocation I’ll call “Not US Stocks”. I limited it to market cap weighted assets, it took about 10 minutes to come up with. The percentages don’t really matter, I’m just trying to make a point. The stats across the board are near identical!

(The allocation includes REITs, ex-US stocks, corporate bonds, US and foreign bonds, and gold.)

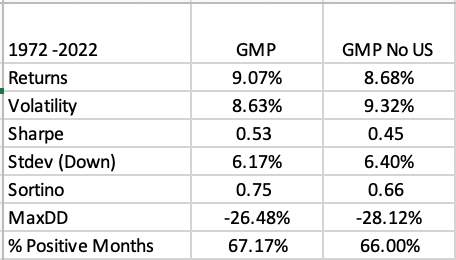

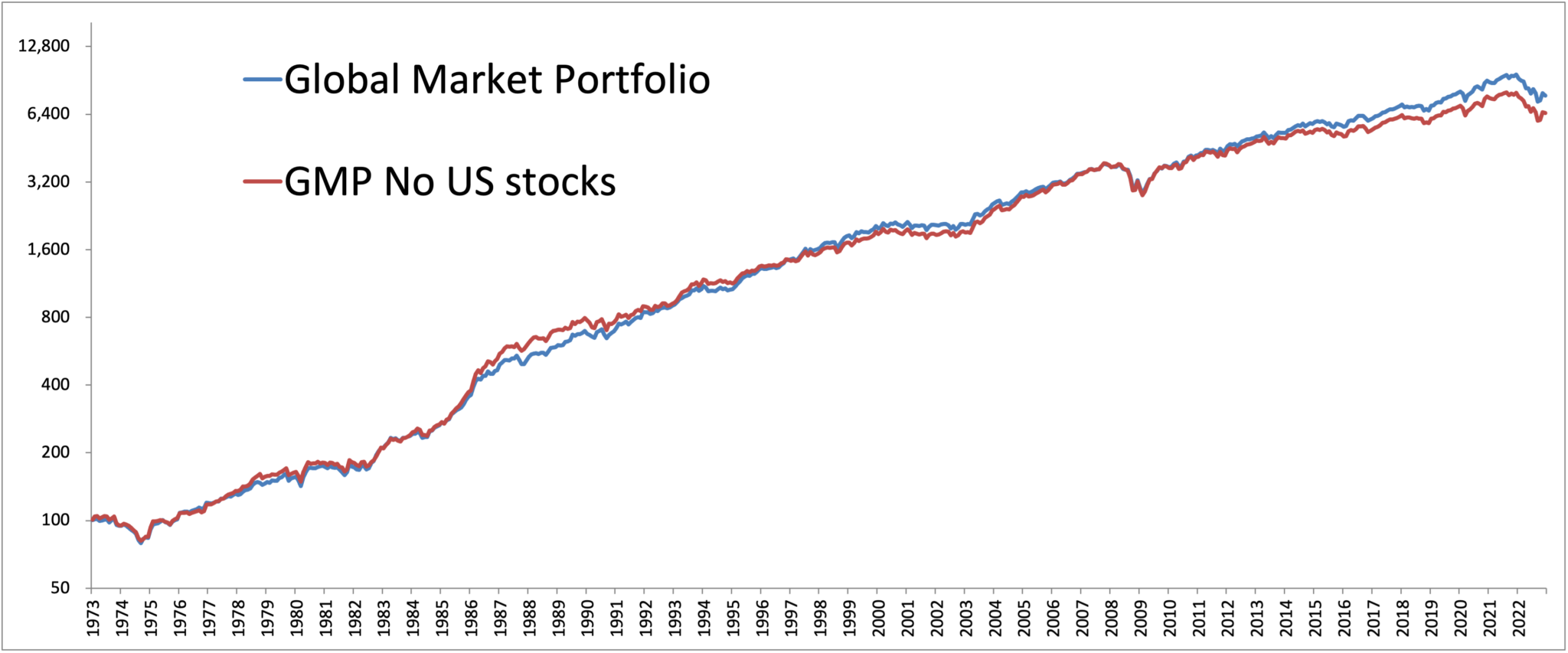

Here’s another real world example. Most people don’t ONLY own US stocks. So they may own a 60/40 portfolio, or perhaps a global market portfolio of all assets.

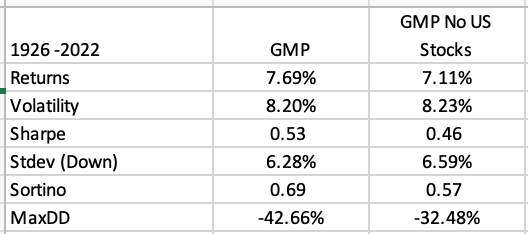

So let’s compare those if you take US stocks out altogether and replace them with ex-US stocks.

Here is the GMP today, and held consistently back in time.

Voila! Not optimal, but still totally fine.

And in reality, my belief is that things like taxes and fees will be more important than the exact percentages of what you own…

these results are consistent all the way back to 1926 too…

(Results for global 40/40 are similar…)

The whole point is that you have to own SOMETHING. For many Americans, it’s a house, but my point is that it really doesn’t matter so much what you specifically own as the mindset of BEING THE OWNER.

Now, if you really wanted to have some fun and look at something that really moves the needle, you could use strategies like active management (gasp, trend?) or factor tilts (gasp, value and momentum)….

Personally, I believe that can get you higher returns with lower volatility and drawdown with these additions, all the while including NO US stocks, and can direct you to our old Trinity Portfolio white paper…