Shopper and enterprise sentiment affect each factor from momentum in stock markets, to elections, to purchasing selections. Nevertheless what components drive shopper and enterprise sentiment? To answer that question, we checked out measures of sentiment — additionally known as confidence — and their underlying determinants going once more to the Eighties. We found that the weather which have historically exactly signaled the route of sentiment should not reliable.

We examined the School of Michigan Shopper Sentiment Index (UMCSENT), the Shopper Confidence Index (CCI), and the Enterprise Confidence Index (BCI). We then pulled information on quite a few macro components. These included unemployment, charges of curiosity (Fed funds price), inflation, GDP improvement, mortgage delinquency expenses, non-public monetary financial savings expenses, stock market returns, and labor energy participation expenses.

Subsequent, we regressed each of our shopper and enterprise sentiment measures in direction of each of the macro variables, partitioning the sample by decade. Decide 1 presents the outcomes for our model using UMCSENT as a result of the dependent variable. Decide 2 makes use of CCI, and Decide 3 makes use of BCI. Throughout the tables, a “+” picture denotes that the coefficient in our model was important and inside the acceptable route, (i.e., based totally on historic expectations). An “x” picture denotes that the coefficient was each insignificant or inside the incorrect route (i.e., not what now we’ve got seen historically).

Decide 1. School of Michigan Shopper Sentiment Index (UNCSENT)

Decide 2. Shopper Confidence Index (CCI)

Decide 3. Enterprise Confidence Index (BCI)

The first fascinating discovering is that in our shopper sentiment measures all through the Eighties, practically all the variables had been important and inside the route you’ll anticipate. GDP improvement led to good shopper confidence; increased unemployment led to lower shopper confidence; increased inflation led to a lot much less shopper confidence, and so forth. Nevertheless as time went on, our model turned a lot much less predictive. By the post-COVID interval, an increase in GDP didn’t end in an increase in shopper sentiment. An increase in unemployment moreover had no affect on sentiment. Really, solely two variables out of eight had important vitality in predicting the route of customer sentiment: inflation and the stock market returns.

To put some numbers to the coefficients in our model, all through the Eighties a one proportion degree improve in inflation led to a 3.4-point drop inside the Michigan index, and a 1% improve in unemployment led to a 3.6 drop inside the Michigan index.

Actually, all through the post-COVID interval our model has transform way more muted. From 2020 forward, a 1 proportion degree improve in inflation led to solely a 1.1-point drop inside the Michigan index, and a 1% improve in unemployment led to solely a 2.3 drop inside the index.

Extra, the facility of our model (i.e. the predictive vitality) has moreover decreased over time. The Adjusted-R^2 was 0.88 inside the Eighties and dropped to 0.72 inside the present day. We see associated results in the BCI model as correctly nevertheless to not the similar diploma that we see in our shopper sentiment outcomes.

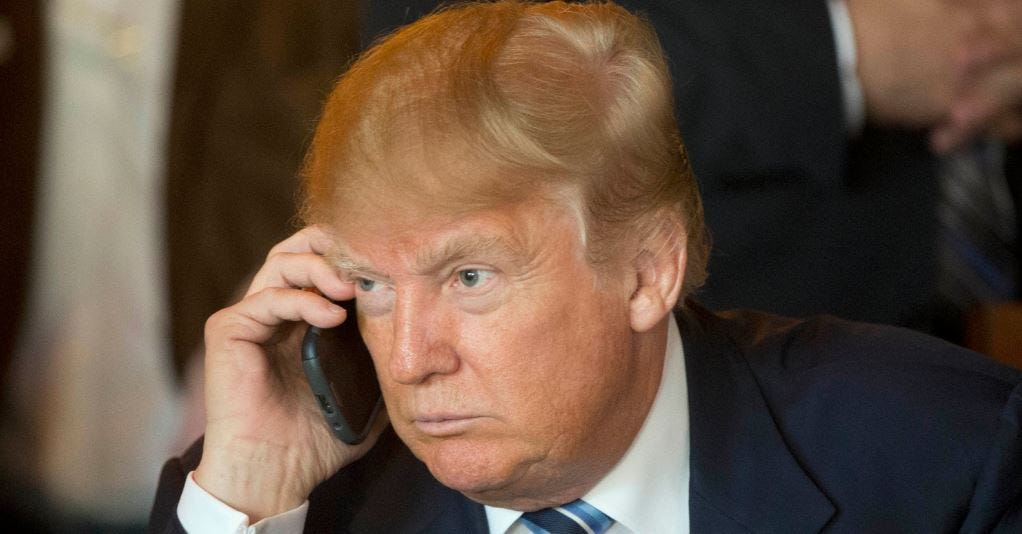

What could be the underlying motive behind all this? There are most likely many components, nevertheless one highlighted by earlier literature is likely to be partisanship. Individuals have well-known that individuals change their views on the monetary system and sentiment to a loads increased extent inside the present day based totally on who holds political office. The upcoming US presidential election is likely to be one in all many underlying components that we omitted in our analysis.

Whatever the case, unemployment, labor energy participation, and GDP improvement not make clear how consumers are feeling about their prospects. The inspiration causes of this phenomenon deserve further cautious analysis.