Adam Smigielski

With all of the speak of commodities these days, let’s not overlook Development/Tech

The inflation trades had been due for an oversold bounce (a minimum of). However earlier than I began shopping for again some commodity associated gadgets and according to the drop in inflation expectations and therefore, yields, I added some Goldilocks gadgets (Tech/Development) and others that are likely to do higher when yields are easing (e.g. Biotech).

Listed below are a couple of charts of things I presently maintain (till tomorrow or subsequent 12 months, relying available on the market view) sporting some good backside/potential backside conditions. Not like commodities, which I’ve purchased due to a horrible tank job to help however few different chart-based causes, these former darlings are grinding out bottoming conditions after on line casino patrons took the Fed severely and received the heck out of Dodge.

As a aspect notice, there are lots extra conditions and charts like these on the market. It isn’t like that is something however an inventory of those I selected so as to add. You may and may have your personal if you happen to assume that the bounce can proceed and want to speculate on it.

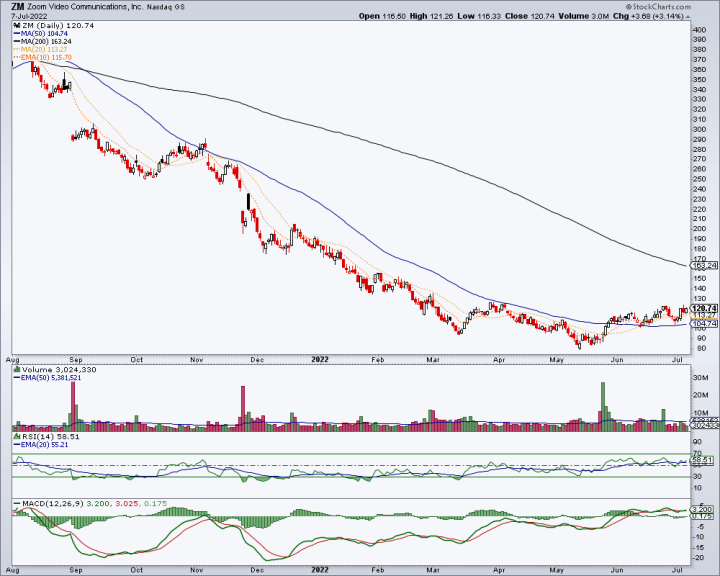

ZM has fashioned a pleasant sample and held the SMA 50 after its massively overdone investor sponsorship ran for the hills. RSI and MACD are inexperienced and whereas it is nonetheless not a “worth”, it is ridiculous valuation of yore has been mounted.

ZM, each day chart (stockcharts.com)

CRM is in a cool grind, not a transparent bottoming sample. But it surely was added for its much less overvalued standing to see if it may hammer out a sample. What’s forming right here would even be in step with a “continuation” sample and with the development down meaning it may theoretically proceed down. So I’m keeping track of it.

CRM, each day chart (stockcharts.com)

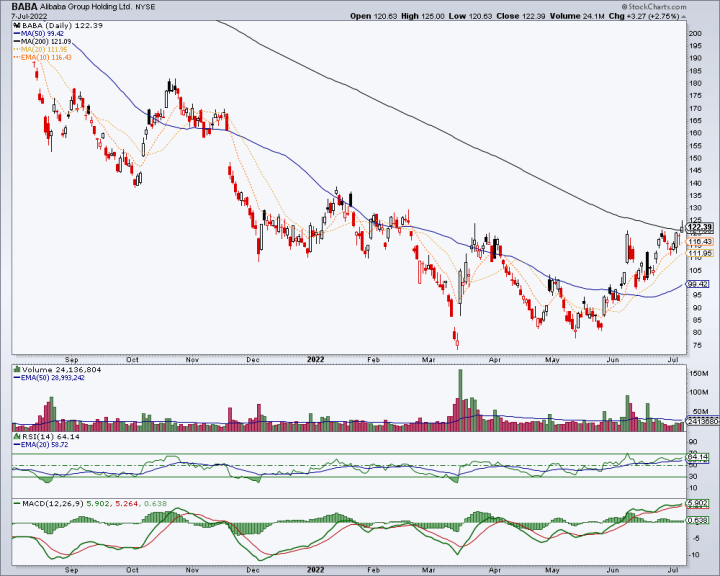

I’m in BABA for a second time after a profitable first purchase/promote. It was first purchased in Could not for the chart however as an alternative for a private “I believe it has been clubbed sufficient” sentiment. It was. Now it is also received a sample; a basing one. Massive Chinese language shares went into bear markets effectively earlier than the US headline indexes did. Who’s to say they can not prepared the ground out effectively forward of time?

BABA, each day chart (stockcharts.com)

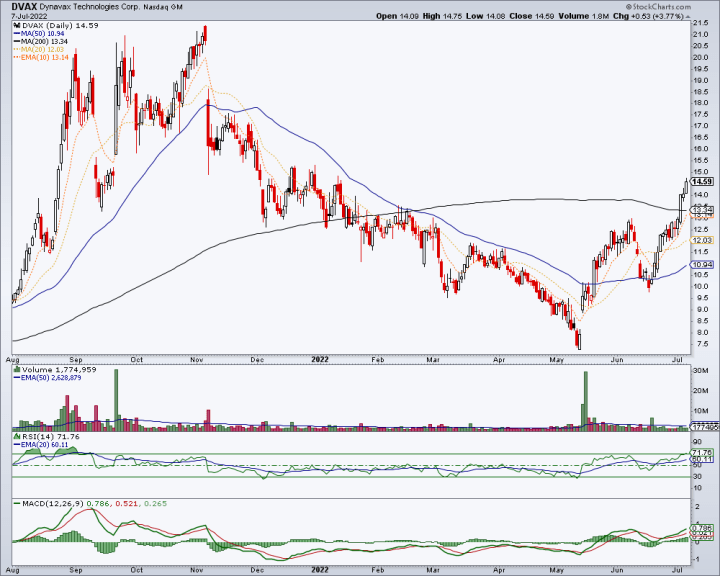

DVAX is definitely not a darling of Wall Road. Not that I’ve been capable of decide up on. Certainly, most entities that tout it accomplish that for the COVID-19 adjuvant. However I personal this Hepatitis “B” vaccine maker for the execution of its market alternative in Hep. Chart clever, it was purchased on the June drop to the SMA 50 and since then the chart says “to date, so good” and the break above the SMA 200 could even trace at a future attempt on the hole round 21. You by no means know.

DVAX, each day chart (stockcharts.com)

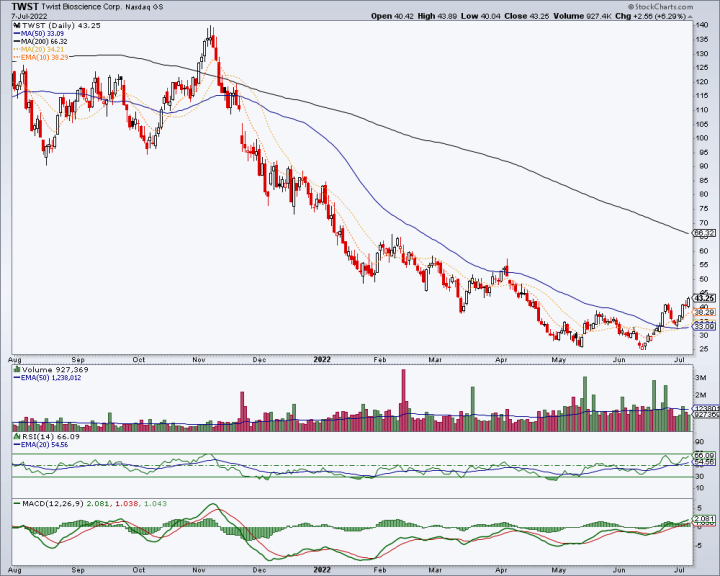

Lastly, in a call between Biotech-related story inventory CRSP and Biotech-related story inventory TWST, I went with the latter. It accomplished a profitable take a look at of the SMA 50. It is already tacked on 19.5% after being added lower than every week in the past.

TWST, each day chart (stockcharts.com)

A number of different family names had been added as effectively after on line casino patrons stampeded out of them, however they don’t have chart patterns just like the above. As with commodities, they have an inclination to have declines to help areas.

With the S&P 500 not having reached my minimal draw back goal of 3200-3400 I will be conscious that is most likely a bear market rally, however I believe it is received an opportunity to be a powerful one. Additionally, I used to be being miserly in 2020 ready for a transparent help degree in SPX earlier than committing to purchase closely. It by no means got here. It bottomed larger. So, lesson discovered there too. Classes… that is what this racket is all about.