Home Of The Setting Solar

There’s a home in the usA. they name the “Setting Solar.” And it’s been the destroy of many a poor investor, however not you, my Nice Ones.

Not less than not if y’all’ve been studying your Nice Stuff, that’s…

Sure, we’ve seen all of your housing memes … and now we’re doing The Animals?

There are solely so many songs about homes, y’all. I’m doing what I can.

Anywho, there are two causes we’re discussing housing once more. So let’s dive proper in!

First, the Nationwide Affiliation of House Builders (NAHB) Wells Fargo Housing Market Index — holy cow that’s a mouthful! — simply fell six factors to a studying of 49 in August.

For reference, any studying below 50 signifies contraction out there. What’s extra, that is the eighth straight consecutive decline within the NAHB’s index.

Moreover, the index’s final journey into unfavourable territory (i.e., beneath 50) was a short jaunt in March 2020 as a result of pandemic. Earlier than that, the NAHB’s index hadn’t been unfavourable since June 2014.

However like I stated, should you’ve stored up together with your Nice Stuff, you already know all of this.

You most likely anticipated NAHB Chief Economist Robert Dietz to name this a “housing recession.” However you additionally know that Dietz isn’t overlaying all of the bases when he blamed the recession on “tighter financial coverage from the Federal Reserve and persistently elevated development prices.”

No, sir! Y’all Nice Ones know that Dietz forgot to speak about firms and hedge funds including the to drawback by snapping up homes by the armload … thus serving to to cost most common homebuyers out of the market.

Did the Fed’s tightening negatively influence the housing market? Positive, in that mortgage charges at the moment are steadily rising.

Did rising materials and development prices additionally negatively influence the housing market? Positive, in that it received costlier to construct homes.

However as y’all know, firms shopping for complete neighborhoods didn’t assist issues … in any respect. There’s completely no method the common Joe can outbid a hedge fund. No. Method.

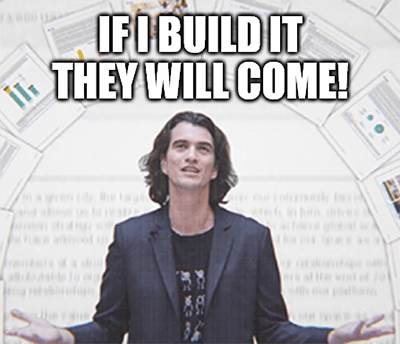

However by no means worry, Nice Ones! Enterprise capital agency Andreessen Horowitz believes it has discovered an answer! And that resolution is Adam Neumann’s new residential actual property firm Move.

Adam Neumann? THAT Adam Neumann?!

Sure. The Adam Neumann of WeWork fame. So you recognize that is gonna be simply soooo good. Right here’s what Horowitz stated lately in a weblog publish about Move:

In a world the place restricted entry to residence possession continues to be a driving power behind inequality and nervousness, giving renters a way of safety, neighborhood, and real possession has transformative energy for our society.

That’s a variety of fancy phrases that actually imply nothing.

Truthfully, what does any of that imply?

Proudly owning homes is nice?

However individuals have hassle proudly owning homes?

One thing like that? No matter…

The actual query is: What does Move do?

Based on The New York Occasions, Move is “successfully a service that landlords can staff up with for his or her properties, considerably just like the best way an proprietor of a resort may contract with a branded resort chain to function the property.”

A property administration firm. That’s what Neumann has invented. A property administration firm.

Mainly, Move is simply American Properties 4 Lease (NYSE: AMH) with Keurig coffeemakers, beanbag chairs and a bar.

Or in much less flattering phrases: Neumann has invented a technique to make it simpler for enterprise capitalists to purchase up extra homes and lease them to you. As a result of not like American Properties 4 Lease, Move doesn’t have conventional shareholders. It has enterprise capital buyers. And so they have much more cash.

So, no. I don’t suppose Adam Neumann is the housing market savior we’re in search of. He’s not even the droids we’re in search of.

Adam Neumann and actual property go collectively about in addition to grandma and a rental residence with asbestos insulation. Positive, it’s low cost to get began, however the long-term prospects are gonna depart everybody in tears.

Now, I’m not saying that you simply shouldn’t spend money on actual property. Property values at all times come again. At all times. Even throughout a recession.

However … be sensible about actual property. Don’t go full Adam Neumann and reinvent the wheel. Don’t go flipping homes and chasing waterfall windfalls. What you do want is Fundrise.

Fundrise offers you a straightforward technique to spend money on actual property belongings for as little as $10. That’s proper: Actual property for $10.

Eat your coronary heart out, Adam Neumann!

With Fundrise, you may get entry to a portfolio with a variety of belongings, all managed for you.

And the most effective half … you may receives a commission for “holding” actual property with Fundrise.

You’ll be able to be taught all about it proper right here.

Feelin’ Supersonic

Give me gin and tonic … American Airways (Nasdaq: AAL) can have all of it, however how a lot does it need it? Properly … how a lot do you need to go supersonic? As in, Mach 1.7? An entire 1,304 miles per hour?

American Airways is banking on the return of business supersonic journey, and it simply ordered 20 Overture planes from Growth Supersonic.

An airplane-maker known as “Growth?” Ummm…

You stated it, not me. Personally, I already hear the complaints from people in high-traffic flight paths … like severe Concorde flashbacks … assuming the corporate lives as much as its title. However in response to Growth CEO Blake Scholl:

Passengers need flights which might be sooner, extra handy, extra sustainable and that’s what Overture delivers. Flight occasions might be as little as half as what we now have right this moment, and that works nice in networks like American the place we will fly Miami to London in lower than 5 hours.

So the draw back? Annoying individuals with sonic booms. (And I’d hate to be within the lavatory after they make the soar to hyperspeed.)

The plus aspect? Your time “sharing” an armrest with the man cracking up over an Adam Sandler film simply received minimize in half.

Editor’s Notice: 4X Much less Threat … As much as 3X Higher Beneficial properties

Mike Carr’s not one to mince phrases. He is aware of most People are financially conservative — and that their wants aren’t being met.

That’s why he’s finished one thing about it.

Mike was one of many first to create a “first of its variety” funding fund after the fallout in 2008 to grant buyers the possibility at higher returns with much less threat.

Now he’s making this technique out there to the general public for the primary time ever.

Click on right here for particulars.

Lumber? I Hardly Know Her

House Depot (NYSE: HD) has come fairly a good distance since these heady days of the pandemic’s labor scarcity… First it was catering to these stuck-at-home DIY-ers … then the contractors who inevitably returned as soon as all that stimulus cash ran out for the DIY-ers.

And thru all of it? House Depot has posted one bang-up quarterly report after one other, and its newest report is not any totally different. Earnings and income each beat expectations, whereas same-store gross sales went up 5.8%.

Positive, House Depot noticed fewer transactions in the course of the quarter, however consumers spent extra, because of a mixture of inflation and … you recognize … contractors needing to purchase extra stuff than your common home-owner:

Our staff has finished a unbelievable job serving our prospects, whereas persevering with to navigate a difficult and dynamic setting. — CEO Ted Decker

Decker? I hardly … by no means thoughts.

We’re All Very Impressed Down Right here

So if House Depot’s reporting glowing earnings, the retail massive pictures like Walmart (NYSE: WMT) must be doing simply tremendous too, proper?

Properly … as with mainly all the things associated to retail … it’s sophisticated.

By the numbers, Walmart beat each income and earnings estimates, even when these numbers are roughly on par with final 12 months’s meh-worthy outcomes. Identical-store gross sales rose 6.5% in the course of the quarter, with Sam’s Membership gross sales ticking up 9.5% as extra individuals flip to bulk purchasing.

That’s all tremendous and dandy, however then Walmart goes and spoils all of it by saying earnings per share will drop between 9% and 11% in fiscal 2023. It’s higher than Walmart’s earlier, extra pessimistic steerage for a drop of 11% to 13%. However nonetheless, what the heck, Walmart?

Bear in mind when Goal began discount-selling all its previous merch to preempt the earnings hit? Yeah, Walmart left that memo on “learn.”

Total, it’s not good steerage, however Walmart’s sustaining it … in order that has to depend for one thing. “It’s sophisticated,” certainly.

Every part Outdated Is New Once more

Besides you, AT&T (NYSE: T).

No, AT&T remains to be the identical bloated media corpse it at all times has been — and now Warner Bros. Discovery (Nasdaq: WBD) is caught managing the harm.

Ever since AT&T spun off (learn: untethered) WarnerMedia from the telecom’s umbrella to merge with Discovery, it was solely a matter of time earlier than the brand new streaming firm “restructured” … as in, minimize 14% of HBO Max’s workforce.

Them’s the breaks if you’re, you recognize, not Disney.

AT&T screwed up HBO so dangerous that Discovery was at all times going to should cope with this ultimately. AT&T and WBD buyers alike ought to have anticipated this … and this can be a step in the best course.

Most of those layoffs, whereas unlucky, affected the center administration execs at HBO Max — not the artistic, content-producing sorts that the corporate desperately wants to remain related within the streaming market.

And that’s the crux of this complete factor: Warner Bros. Discovery is chopping all of the fats that AT&T left behind … however the place will the streaming market be when the corporate lastly fixes this mess? Not ready on Warner Bros., that’s for positive.

What do you suppose, Nice Ones?

The place’s the housing market headed? Do you will have sturdy ideas on Adam Neumann’s “revolutionary” post-WeWork hustle? Would you journey in a supersonic aircraft? Have you ever ever flown in a supersonic aircraft? Can you fly supersonically? Like, with no aircraft?

Let me know within the inbox: [email protected]. Write to us!

Within the meantime, right here’s the place you’ll find our different junk — erm, I imply the place you’ll be able to take a look at some extra Greatness:

Regards,

Joseph Hargett

Editor, Nice Stuff