Stanislav Tarasov/iStock by way of Getty Photographs

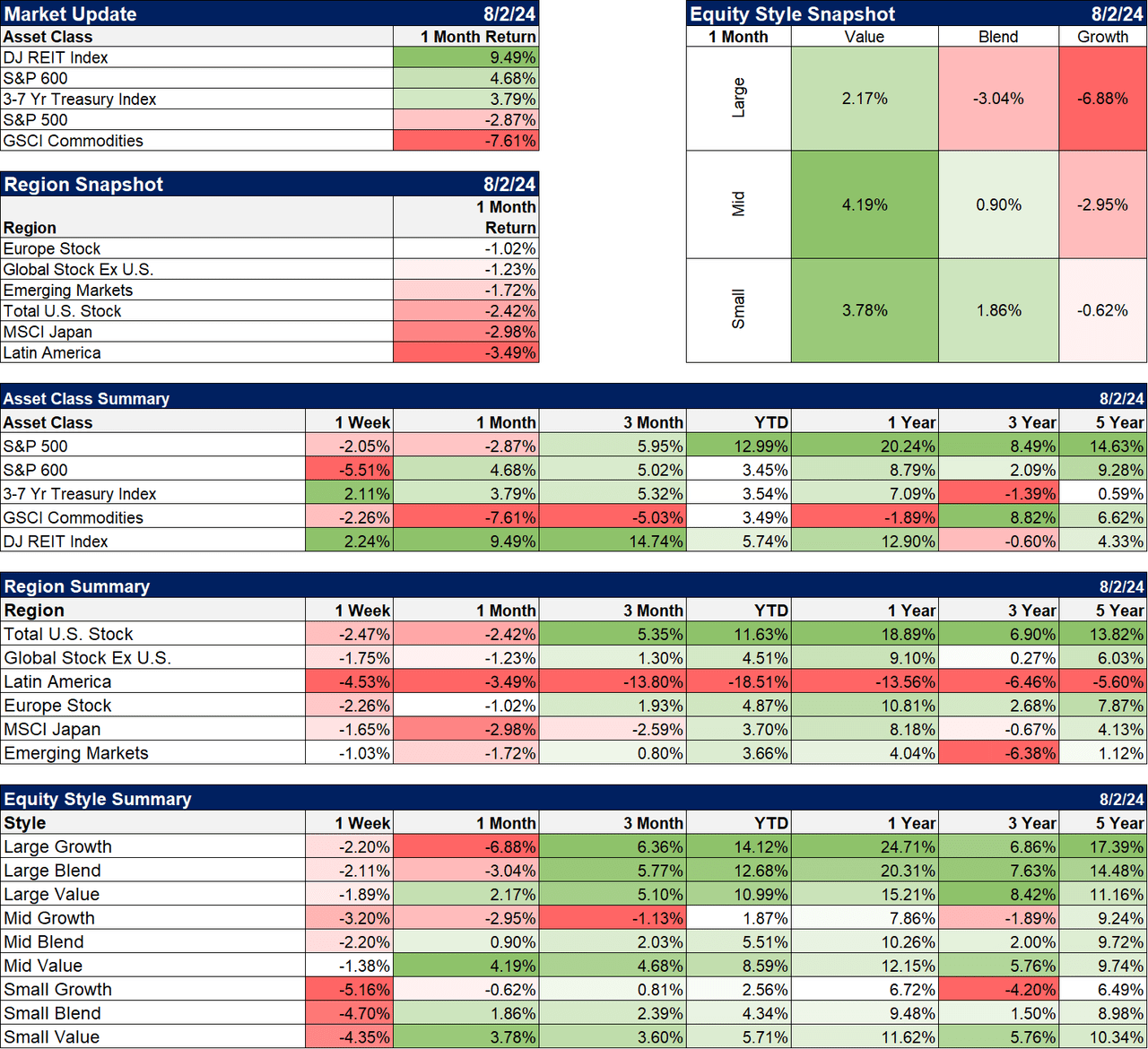

What a distinction a day makes! After a two-week correction of virtually 5%, the S&P 500 (SPX) spent the first part of last week rallying in anticipation of a pleasing Fed meeting. That Fed meeting Wednesday produced the anticipated, significantly {{that a}} cost scale back in September was most likely. That pushed the S&P 500 up over 2% from the Fed meeting to the extreme the subsequent day. Small and midcap shares moved within the an identical regular path as the huge caps nevertheless with wider swings. Then…each little factor went down in a straight line. The S&P 500 fell 4% from Thursday’s extreme to the shut on Friday; the Russell 2000 index of small shares fell 8.6%. The totals weren’t that harmful for the entire week, with the S&P down 2.1% and the Russell down 6.8%. Bonds moreover had a wild week, with the 10-year Treasury yield down 41 basis elements and the 2-year Treasury down 50 basis elements on the week. Credit score rating spreads moreover widened, nevertheless solely about 25 basis elements, and are nonetheless underneath the highs of the 12 months and method underneath the levels of ultimate 12 months.

So, what modified between Thursday morning and Friday afternoon? The explanation supplied by most commentators is that each one of this was ensuing from fears of recession, produced by three monetary tales launched after the FOMC meeting:

- Preliminary jobless claims – Claims rose 14,000 to 249,000 from last week’s 235,000.

- ISM Manufacturing PMI – The index fell to 46.8 from last month’s 48.5. Employment and new orders moreover fell, whereas prices rose barely.

- The employment report – The financial system added merely 114,000 jobs last month, down from 216k in May and 179k last month.

Seen in isolation, it’s obvious that these tales all seem to degree to a slowing financial system, nevertheless in context, they don’t look all that individual.

- Jobless claims have been 245,000 merely two weeks up to now and didn’t induce any type of response obtainable out there. Claims have been moreover larger last summer time season: 261k in June of ’23 and 258k in August. They’ve been rising all 12 months, starting the 12 months slightly below 200k, nevertheless aside from the COVID recession, we haven’t had a recession start with claims beneath 300k since 1973 when the civilian labor energy totaled spherical 90 million vs over 168 million proper now.

- The ISM manufacturing PMI has been underneath 50 (denoting contraction) for 20 of the ultimate 21 months. The manufacturing sector continues to be attempting to get higher from the COVID present chain factors. Wholesalers and retailers every overstocked all through COVID, and they also have been working down inventories for the ultimate two years (which is why this indicator has been harmful for 20 of the ultimate 21 months). Inventory to product sales ratios have come down, nevertheless apparently not ample to set off a restocking cycle merely however. I’d moreover degree out that this indicator, similar to the part of the financial system it covers, could possibly be very unstable. It sometimes prints underneath 50 all through an monetary cycle with out a recession.

- The number of jobs added on a month-to-month basis is especially solely a guess, and I don’t know why so many consumers take it so critically. The numbers could be revised a lot of situations sooner than the last word finding out that may embody the annual benchmark revisions in January subsequent 12 months. The month-to-month amount is solely appropriate to + or – 100,000 jobs. So the exact amount might in the long run be over 200,000 or near zero. Furthermore, this wasn’t even the worst month of the 12 months. That was April’s 108k, although to be truthful, that was initially reported as +175k. See how these revisions work? The unemployment cost did rise to 4.3%, up from the cycle low of three.5% last July. Nonetheless, the unemployment cost rose primarily because of, based mostly on the Household Survey, the workforce grew by 420,000 last month and the number of employed solely rose 67,000. Nonetheless that 420k amount is method above the standard since 2022 of 194k/month. Long run, the standard is even lower, about 100k per thirty days courting once more to the Nineties. So the unemployment cost may be rising, nevertheless it absolutely’s perhaps being overstated.

So if it wasn’t the monetary tales, what was it? I don’t really know, nevertheless large strikes in such a short timeframe are generally associated to the unwinding of leveraged positions. One potential offender in last week’s selloff – and presumably the selloff inside the large caps and tech shares since July tenth – is the Yen carry commerce. Hedge funds and completely different leveraged players have been borrowing in a low-yielding, depreciating Yen and purchasing for completely different, higher-yielding belongings. That options places like Mexico and Brazil, nevertheless it absolutely moreover comprises trades inside the US stock and bond markets. Expectations for a cost hike from the Monetary establishment of Japan have been rising and have been vindicated as soon as they did exactly that on Wednesday last week. It wasn’t a whole lot of a switch – about 0.15% – nevertheless it’s the trail that points. With the Fed elevating hopes for a scale back in September, the unfold between the two yields is narrowing. The biggest affect has been inside the overseas alternate markets, the place the Yen is up over 10% since July tenth, with virtually half of that coming from Wednesday to Friday last week.

A leveraged fund that has been transient Yen and prolonged EM currencies started to get injury in late May when the Mexican Peso plunged after the election there. The Brazilian Precise has been falling given that beginning of the 12 months nevertheless accelerated to shut the 2021 low in July. Now with the BOJ in a cost mountaineering cycle and the Fed about to embark on a cost slicing cycle, the Yen is rising shortly, hurting the other aspect of the commerce. It will possible have merely been the tip results of a lot of harmful months for these funds.

Market sentiment has turned harmful in a short while, with the VIX (VIX) (volatility index) rising to shut 30 on Friday sooner than closing at 23 and alter. A VIX over 30 has been a reliable buy signal before now, although larger readings are sometimes needed for full blown bear markets. Nonetheless getting there so quickly in such a lightweight correction would seem to level some extreme nervousness on the part of consumers. Put/Title ratios moreover rose last week, indicating an urge to hedge portfolios and the extreme VIX displaying a willingness to pay up for it.

I don’t assume the monetary outlook modified all that quite a bit last week, although I’ll admit that I’m further nervous regarding the financial system now than I’ve been all through this whole COVID restoration. I’m not an enormous believer inside the vitality of the Fed, nevertheless I really feel they should have started slicing costs two conferences up to now. That’s when the Taylor rule indicated the need for a scale back, and it hasn’t modified. Nonetheless the market is providing what the Fed hasn’t; with the 10-year cost coming down, so have mortgage costs, with the standard 30-year hitting 6.375% last week and the 15-year falling to 5.89%. These are the underside costs given that spring of ultimate 12 months, and properly down from the 7.5% the 30-year hit last fall. Mortgage costs are nonetheless elevated relative to the 10-year Treasury as properly, so they may proceed to fall. I can’t take into consideration that acquired’t have a optimistic affect on housing market train.

The biggest affect on the financial system from the Fed’s cost hikes has been on housing and associated sectors. Certainly one of many causes sturdy objects product sales and orders have been stagnant is as a result of stasis inside the housing market. Homeowners with low mortgage costs have been unwilling to advertise, and customers have been unwilling to buy with costs this extreme. Nonetheless that was starting to ease even sooner than costs started falling in earnest. Present dwelling inventory has been rising, and new dwelling inventory is at a 14-year-high. The prospect of transferring may also be rising and virtually once more to the pre-COVID stage. Irrespective of mortgage costs, people’s lives change, and sometimes that entails transferring (change of job, retirement, and so forth.).

From the New York Fed’s Survey of consumer expectations:

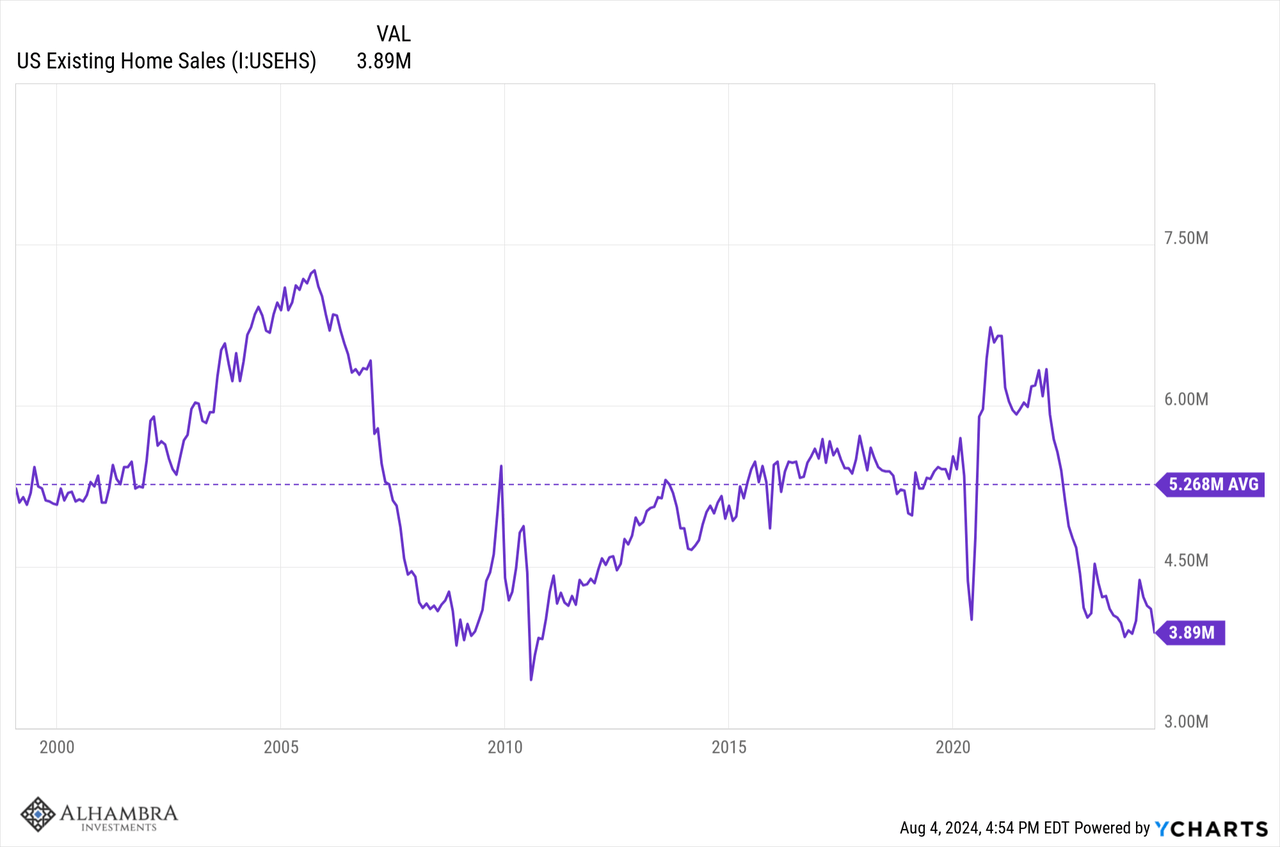

If the financial system has been slowing attributable to larger costs, then lower costs ought to treatment it. Economies are, to a degree, self-healing, and whereas the Fed may not be ready to cut costs, the market has already taken care of that to an enormous diploma. As I’ve acknowledged many situations, the Fed is a follower of the market, not a pacesetter. Can the housing market – and industrial precise property – flip spherical fast ample to take care of the financial system out of recession? I don’t know, nevertheless with current current dwelling product sales annualizing beneath 4 million and the standard since 2000 at 5.3 million, there’s loads of room for enchancment.

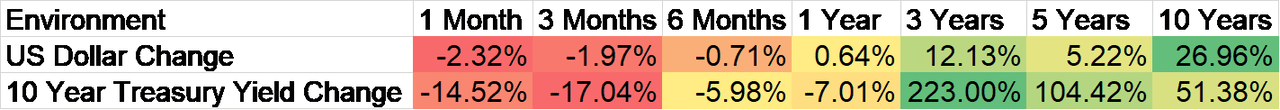

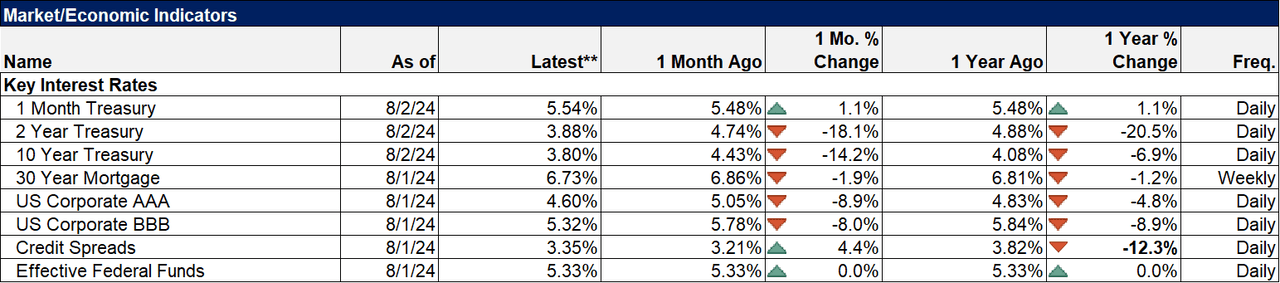

Environment

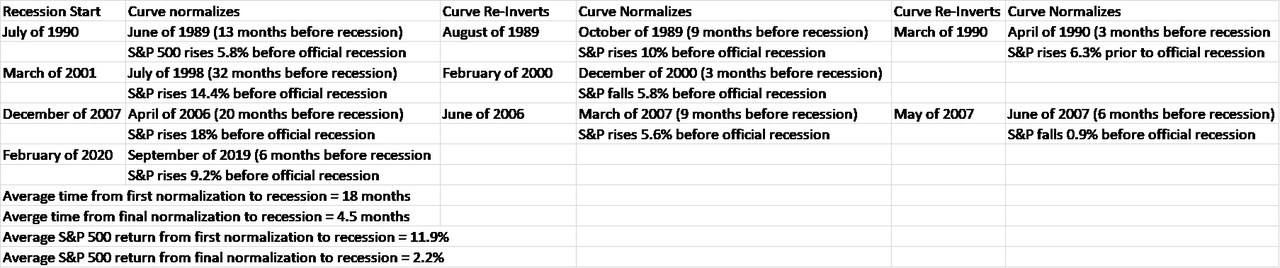

The short-term downtrend inside the 10-year Treasury yield accelerated last week. Charges of curiosity have been down all through the curve nevertheless further so on the transient end, so the yield curve continued its steepening growth, although the 10-year/2-year unfold stays harmful by 10 basis elements. That’s the narrowest unfold since mid-2022. The type of steepening before now has signaled that recession is near. How near? Correctly, that depends on if the curve normalizes and stays that method until the recession or whether or not or not it subsequently re-inverts. Inside the last 4 recessions, the standard time from the first normalization to the official start of the recession is eighteen months, nevertheless from the ultimate normalization to recession is solely 4.5 months. The return of the S&P 500 from the first normalization to recession is 11.9% whereas the standard return from the ultimate normalization is 2.2%.

The curve hasn’t even normalized however, so the clock isn’t even ticking, and there’s the prospect that the curve normalizes with out a recession. There isn’t a rule that claims the financial system ought to enter recession after an inversion. Reverse to widespread notion, the inversion and normalization of the yield curve don’t current a market signal for consumers. The one issue the yield curve is assured to do is induce concern when it inverts and additional concern when it normalizes and even that could be a relatively new phenomenon. I’m uncertain exactly when info of the yield curve’s earlier accuracy in predicting recession grew to turn into widespread, nevertheless Campbell Harvey’s dissertation on the subject – the first to acknowledge the time interval development as crucial – wasn’t printed until 1986. It positively wasn’t well-known inside the Nineties, and likely not even inside the early part of this century. At best, it’s solely the ultimate two recessions when most consumers have been acutely aware of the yield curve. The one issue I can say for optimistic regarding the yield curve is that when its historic previous grew to turn into widespread info, its effectiveness as an indicator modified. Why? Because of info of the indicator modifications investor habits, which modifications markets, which in flip impacts the yield curve.

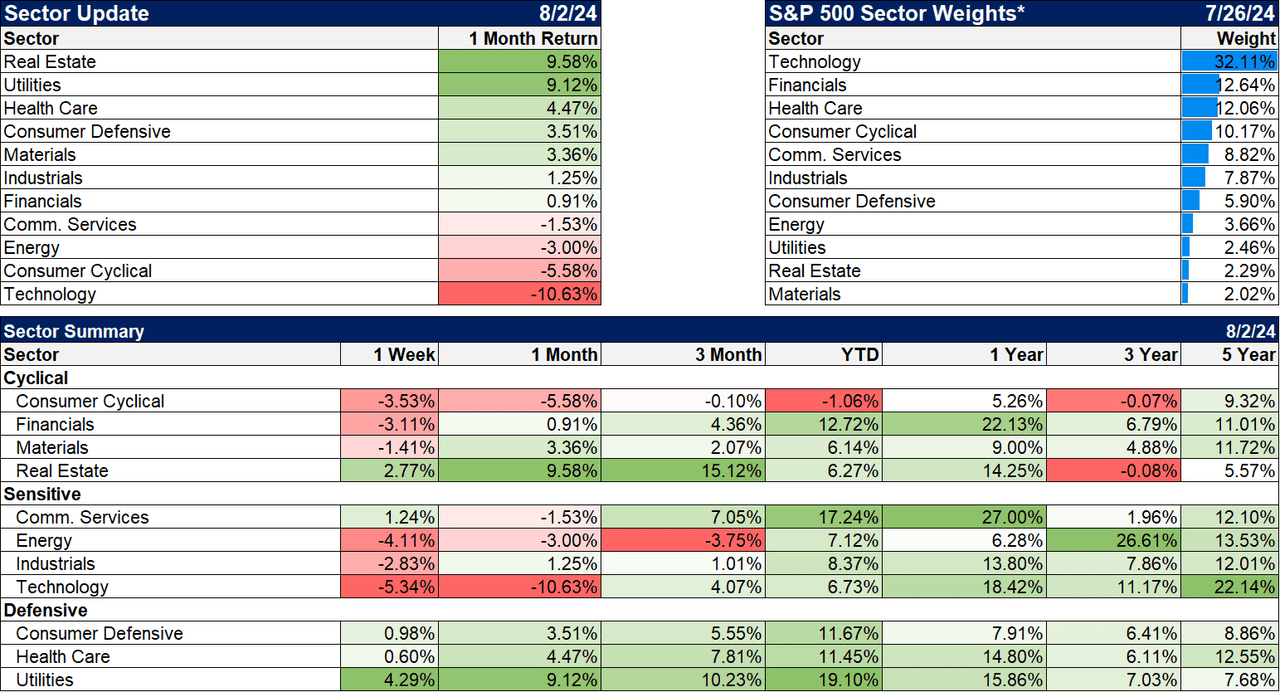

So what will we really know? Everyone knows that charges of curiosity are in a short-term downtrend and have been since last October. We moreover know that the ten year-yield is unchanged over the previous 21 months. We moreover know {{that a}} falling 10-year yield signifies that expectations for NGDP progress are falling. That could be because of inflation expectations are falling (and so they’re, down 45 basis elements since October) or because of precise progress expectations are falling (which they’re, down about 70 basis elements since October). We moreover know what belongings often perform properly when charges of curiosity are falling. Bonds clearly do properly, nevertheless dividend progress and extreme dividend strategies moreover do properly. Healthcare and utilities, standard defensive sectors, perform increased than their long-term frequent. REITs and top of the range shares moreover outperform. The poor performers when costs are falling embrace commodities and gold (surprisingly), provides, experience, and energy.

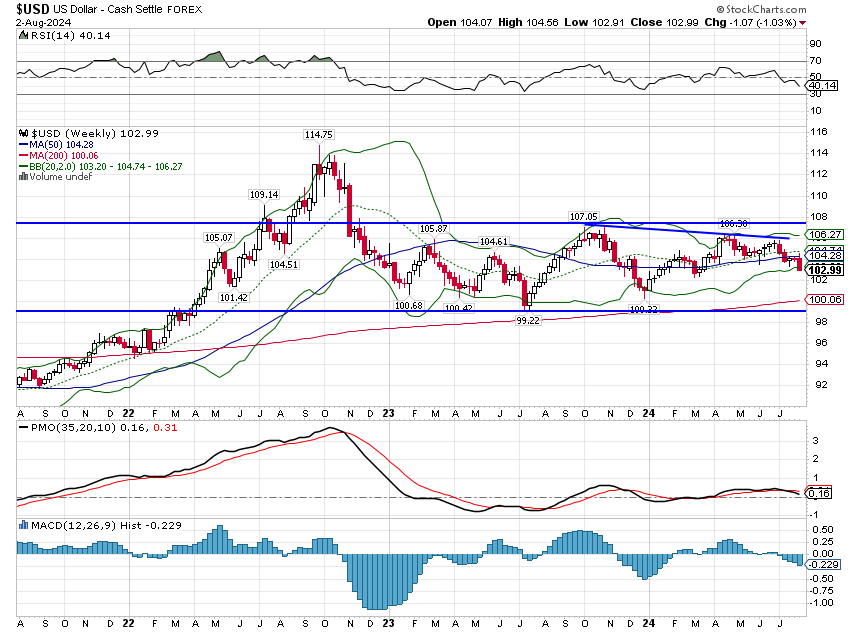

The buck’s short-term downtrend moreover accelerated last week, nevertheless not as quite a bit as yields. The buck was down merely over 1% last week and is up decrease than 1% over the previous 12 months. And, like yields, it’s nonetheless in a shopping for and promoting range, mainly unchanged over the previous 20 months.

Markets

It was a tricky week, nevertheless there have been some positives. Lower costs meant an enormous switch in bonds, with the intermediate part of the curve up over 2%. REITs continued their win streak, up one different 2% last week as properly. Certainly one of many causes I’d question the recession is nigh urge is that REITs perform properly when costs are falling, nevertheless not in recession. Thus far, REITs are nonetheless responding favorably to lower costs.

The shift to price continued last week, even with markets lower. Value fell decrease than progress, and the opening over the previous 12 months continues to slender.

Worldwide markets carried out even worse than the US last week, nevertheless a lower buck will in the end be a optimistic for non-US markets.

Sectors

It was a down week, nevertheless 5 of 11 sectors managed to finish inside the black last week. Defensive sectors led largely, nevertheless precise property and communication suppliers have been larger too. Know-how took crucial hit, adopted intently by energy. Crude oil was down 3.7%.

Market/Monetary Indicators

There have been one other monetary tales last week as properly, nevertheless nothing that was market-moving:

- Dallas Fed Manufacturing index – fell to -17.5 from -15.1 last month. That’s largely about drilling train nevertheless the Texas financial system has diversified over the previous decade so not solely about oil. It has been harmful since April of 2022 so no change.

- Case Shiller dwelling prices rose 1% mom and 6.8% yoy in May, down from 1.4% and 7.3% in April. This has been trending down and I depend on it to proceed.

- JOLTS job openings fell to eight.18 million in June from 8.23 million in May. Nonetheless properly above pre-COVID ranges. The quits cost moreover fell and is once more to pre-COVID norms.

- The employment worth index rose 0.9% down from a 1.2% rise inside the first quarter.

- Non-farm productiveness rose 2.3% in Q2.

- Constructing spending fell 0.3% in June after falling 0.4% in May.

The slowdown in constructing is wise as a result of the manufacturing unit developing improve winds down, nevertheless investments in instruments – which could look like the following logical part – started to decide on up in Q2.

Joe Calhoun

Distinctive Put up

Editor’s Phrase: The summary bullets for this textual content have been chosen by Looking for Alpha editors.