Khosrork/iStock through Getty Pictures

“Do not be afraid to surrender the nice to go for the good.”

– John D. Rockefeller

Traders preserve getting reminded that 2022 is likely one of the worst begins of a yr for equities because it has been accompanied by any variety of destructive headlines. Nevertheless, the entire indices are coming off fabulous beneficial properties achieved within the final 12 months. So the 13% correction for the S&P is not unhealthy contemplating that some of these corrections do come every year on common.

Bespoke Funding Group tells us simply how risky it has been this yr;

“Over half of all buying and selling days this yr have seen beneficial properties or losses of greater than 1%. 57% of UP days have been in extra of 1% whereas 48% of DOWN days have been larger than 1%.”

Traders had been ready for a bounce off of oversold ranges for a while they usually lastly acquired it. “March Insanity” took the S&P 500 down ~4.5% on the month whereas the NASDAQ was down practically twice that at –8.2%. BUT in simply 4 buying and selling days the tide was turned and each indices now present beneficial properties in March. There was extra up and down motion this week that added to these beneficial properties, and after I look extra carefully each main index ended the week UP for the month.

All of this constructive motion occurred AFTER the Fed stated it’ll increase the Fed Funds fee one-quarter of some extent for the following 8 conferences. AFTER analysts acknowledged the very fact there might be a recession after tightening. The yield curve and credit score spreads don’t provide a lot readability. The “battle” is additional stressing world provide chains, Inflation is raging, and “out of the blue”, the market went full risk-on. Some are labeling this market “maddening” and touting their view that shares are divorced from actuality. Right here is the issue, shares are solely divorced from “your” actuality.

Inventory costs are by definition, the truth. What that value motion tells us is what each investor has to acknowledge and are available to grips with to achieve success. Markets can and sometimes do rally on unhealthy information. When issues are at their worst, the inventory market has acknowledged the problems and has already adjusted. It is the “subsequent” set of circumstances the market is taking a look at that’s vital, and for now, the message appears to be “some reduction” is forward.

It additionally confirms that the technicals matter much more than buyers may need to consider. There may be one other delicate message embedded within the value motion. Investor sentiment has informed us that almost EVERYONE determined to dismiss ANY constructive, and it’s these positives that I’ve highlighted to members of my service that had them prepared for this fast “turnaround”. The primary quarter is coming to an finish and one wonders if Q2 can be simply as maddening bringing extra challenges than what we’ve got already witnessed this yr. With the unsure and questionable coverage backdrop in place, I would not be betting on easy crusing, however that does not imply buyers cannot revenue from the disarray.

The Week On Wall Road

The S&P entered the buying and selling week coming off a 4-day surge that noticed the index publish a 6% acquire. The S&P waffled round all day earlier than staging a late-day rally and closed flat on the day. Traders have witnessed a determined change in value motion within the late day patterns as now it’s extra of a risk-on shopping for occasion relatively than a promote into the shut mentality. Together with the final hour on Monday, over the past 5 buying and selling days, in the midst of a battle in Europe the place you’d assume issues of in a single day headline danger could be at their highest, the S&P 500 has gained not less than 0.33% within the final hour of buying and selling for 5 straight days. It might not be unusual to see one or two days of comparable beneficial properties within the final hour of buying and selling, however to see 5 straight is extraordinarily uncommon.

The index remained sturdy within the final hour on Tuesday as properly, holding on to beneficial properties and shutting up one other 1% because the S&P made it 5 of the final 6 buying and selling days with beneficial properties. On a closing foundation, the S&P entered Wednesday’s session up 8% within the final 6 buying and selling days, whereas the NASDAQ posted a 12% acquire in the identical interval. So, I assume you can say the market was due for a pause.

Nevertheless, the indices shortly went again to the sample they had been utilizing earlier than this rally began. A poor session, the place the entire indices fell, and the one bight spot was, you guessed it, Vitality shares. The buying and selling week ended on a constructive word. It nearly took a complete quarter however the S&P 500 posted its first back-to-back weekly beneficial properties in all of 2022. For the Nasdaq, the primary back-to-back weekly acquire since November.

The Fed

Now that the Fed’s first fee hike is out of the best way, the market goes again to information watching the inflation indicators to gauge what the Fed’s subsequent transfer can be. Proper now, bond markets are pricing in a 46% probability of a 50 foundation level transfer in Might. Though the current CPI report was in keeping with expectations, power coverage and geopolitical occasions will seemingly ship near-term inflation larger. This can preserve strain on the Fed to maintain mountain climbing and volatility elevated till the month-to-month numbers begin to roll over or demand begins to recede.

It’s vital to grasp that the Fed’s concentrate on inflation continues to be deeply conditional; in different phrases, if inflation does begin to decelerate quickly, we might be pretty sure that the FOMC gained’t really feel a must tighten as quick as practicable. Alternatively, a forecast that sees inflation proceed to evolve alongside an identical trajectory to its current one must assume very aggressive fee hikes not less than as quick as present market pricing.

In case you are BULLISH, you must be BEARISH on inflation, as a result of the BEARS are very BULLISH on Inflation. There may be very restricted “center floor” right here.

The Economic system

GDPNow for 1Q22 from AtlantaFed has popped again as much as round 1% (again inside Blue Chip consensus vary).

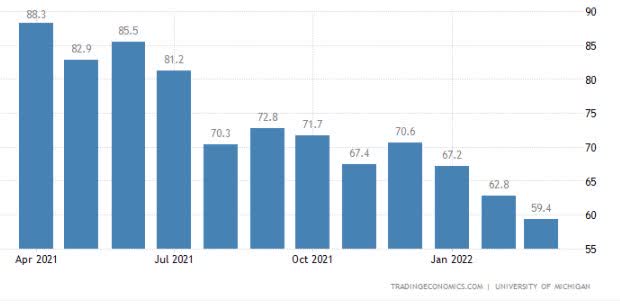

Client sentiment was 59.4 for the ultimate March print. That’s down one other 3.4 factors after falling 4.4 to 62.8 in February. That is the bottom since August 2011. Confidence has been in a gentle decline because the starting of the yr and is now at an 11 yr low.

Client sentiment at 11 yr low (www:tradingeconomics.com/united-states/consumer-confidence)

A knowledge level that feeds into the slowing financial system narrative.

Manufacturing

Chicago Fed’s nationwide exercise index dipped 0.08 ticks to 0.51 in February however stays in enlargement mode. To date this month, regional Federal Reserve District readings on manufacturing have been blended with a stronger than anticipated studying out of Philadelphia and a a lot weaker than anticipated studying out of New York.

This week’s launch of the Richmond Fed’s index noticed the composite studying rose by 12 factors to 13 relatively than the modest single-point enhance that was anticipated. The identical for the Kansas Metropolis Fed Manufacturing Index. It surged to 37 in March vs. 29 in February; costs paid spiked to 81 -the highest since Oct 2021.

Markit Manufacturing PMI rose 1.2 factors to 58.3 within the preliminary March studying and is on the highest studying since late final yr. The companies index for March jumped 2.4 factors to 58.9 after surging 5.3 factors to 56.5 in February.

Housing

New residence gross sales decreased 2% to a seasonally adjusted annual fee of 772,000 models final month, declining for a second straight month. January’s gross sales tempo was revised all the way down to 788,000 models from the beforehand reported 801,000 models.

Pending residence gross sales tumbled 4.1% to 104.9 in February, a steeper decline than anticipated, following January’s 5.8% drop to 109.4. It’s because the index was enhancing from the pandemic shock. It’s a fourth straight month-to-month decline and is the bottom since Might 2020. An absence of stock continues to be a significant component. NAR’s chief economist; “Purchaser demand continues to be intense”.

The World Scene

Flash PMIs from Markit for March had been blended, with manufacturing exercise selecting up in Australia and Japan versus declines in France, Germany, the Eurozone, and the UK amidst the impression of Russia’s invasion of Ukraine. Providers exercise picked up for flash PMI nations that reported aside from Germany and the Eurozone combination.

Backside line; In combination, information stays at or above pre-pandemic ranges.

Russia/Ukraine

One of many issues after the Russians invaded Ukraine was simply how bold they deliberate to not solely take Ukraine however to begin shifting into different surrounding nations. The Ukrainian resistance has nearly put an finish to the thought that Russia goes to merrily march into different elements of close by territories. The considered Russia making any try to embark on one other battle with a NATO member must be thought of not possible.

The Ukrainian resistance has taken the Russian military to its limits. The Russian tabloid Komsomolskaya Pravda, an outlet that’s extensively considered as a quasi-official supply of the federal government, reported Russian Ministry of Protection killed-inaction (KIA) and injured numbers. Per the report, 9,861 Russian troopers have been killed in Ukraine with one other 16,153 injured because the invasion began lower than 4 weeks in the past. Placing that in context, the U.S. misplaced 5000 troops throughout your complete Iraq Battle.

What was presupposed to be a 3-day siege to take the capital we are actually on day 31. In order horrible as this scene has been, I believe that is the extent of their aggression in that area. Another excuse to suspect why the inventory market isn’t displaying any indicators of concern for the every day headlines because it as soon as did.

Traders may additionally extrapolate this to the entire Cyber threats being bandied about. IF Russia decides to play on that stage they may most assuredly really feel the brunt of cyber retaliation. It’s going to successfully be an OPEN SEASON on their infrastructure that can have the flexibility to ship their reeling financial system to the brink of a melancholy.

It is solely an opinion, however I am not so certain they may take that danger.

Meals for Thought

China is not taking a again seat to anybody and the Chinese language model of final week’s name with President Biden alerts who’s sitting on the head of the desk.

China won’t ever settle for US threats and coercion. The Chinese language facet is not going to sit by and will definitely make a powerful response if the US facet takes measures to violate the rightful pursuits of China and the reputable rights and pursuits of Chinese language enterprises and people, the official stated, including that the US facet shouldn’t be below any phantasm or misjudgment on this regard.

China will even proceed to induce the US to honor its phrases and comply with by on Biden’s dedication made on not looking for a brand new Chilly Battle, not looking for to alter China’s system, not looking for to focus on the revitalization of its alliances in opposition to China, not supporting “Taiwan independence”, and having no intention to have a battle with China.

China urged the US to subscribe to the precept of mutual respect, peaceable coexistence, and win-win cooperation, work with China to implement the consensus between the 2 heads of state and push China-US relations again heading in the right direction of sound and steady improvement as quickly as potential.

On the Ukraine state of affairs, the worldwide group is crystal clear about who’s easing the state of affairs, facilitating peace talks, guarding peace and stability and who’re flaring pressure, including gas to the turmoil and fanning up bloc-based confrontation.

Because the initiator of this disaster and a contracting social gathering, the US ought to replicate on the position it has performed to date, substantively shoulder its historic duties, take concrete actions to resolve the disaster in Ukraine, and win the belief of the worldwide group.”

There’s a lot to unpack there nevertheless it’s obvious China is taking a powerful stance and is not able to be informed what to do. There are lots of indicators round now suggesting CHINA goes to wind up being a transparent winner throughout this world turmoil. As an American Capitalist that makes me cringe, and it ought to be fairly worrisome to each investor within the U.S. markets. Russia will greater than seemingly grow to be subservient to China as they now are depending on them to purchase their pure assets. All to maintain their broken financial system afloat. So it is no coincidence that China is NOT popping out condemning the invasion, they usually most likely by no means will.

U.S dependencies on China stay terribly excessive and until steps are taken it makes them a way more dominant drive within the world financial system. That opens up the controversy about investing in China. Some view that as un-American, and I “get-it”, BUT whereas there are dangers with the China funding scene which are loads of “rewards” available as properly in the event that they proceed to dominate many areas of the worldwide financial system.

The SEC and Local weather?

March Insanity is an ideal description of what the SEC is as much as today as they need to make their mark on the local weather agenda. The SEC Advances Aggressive Local weather Disclosures that can require public firms to reveal considerably extra info associated to their climate-related dangers and their greenhouse gasoline (GHG) emissions below a proposed rule launched Monday by the Securities and Trade Fee (SEC).

The proposed rule, which seeks to be applied for FY23, goals to supply a standardized method for public firms disclosing climate-related info. The SEC contends that this info is important for buyers to make knowledgeable choices in regards to the impression of climate-related dangers, whereas critics contend this rule is exterior the scope of the SEC’s authority. Whereas this rule is concentrated on disclosure, we at all times word that disclosure-related guidelines are supposed to alter behaviors.

For my part, the proposed rule is a colossal waste of company funds and is not the essential piece of knowledge that an investor must make funding choices. Commissioner Hester Pierce agrees with that evaluation and hopefully, she will be able to persuade her colleagues to begin utilizing frequent sense.

Sentiment

The Each day chart of the S&P 500 (SPY)

One other constructive week for the S&P left the index approaching a stage the place there may be loads of overhead resistance.

S&P March 25 (www.FreeStockCharts.com)

On the index stage, the technical image exhibits what has been a directionless market that has pissed off each the BULLS and BEARS. A sequence of sharp strikes that shortly reverses. I believe we might see extra of the identical because the market digests the altering funding scene.

Funding Backdrop

S&P 500 firms purchased again a powerful $259 billion in inventory final quarter, however have already outlined plans to repurchase ~$240 billion within the first two months of this quarter alone. So not solely ought to it far outpace 4Q21, nevertheless it might probably attain $1 trillion for the yr. This isn’t the one shareholder-friendly motion happening both, as dividend progress ought to be ~8% for the yr – the very best since 2019 and the second-best over the past seven years.

May it’s equities that may shortly return capital through dividends, ought to proceed to supply potential outperformance in excessive inflation, rising-rate surroundings?

Following a Plan

It’s vital to tell apart between macro, huge image funding alternatives and shorter-term buying and selling alternatives. I focus on each sorts of alternatives in my every day experiences to buyers and my objective is to have my portfolio full of candidates that fulfill each varieties. If, as an illustration, longer-term funding positions are pulling again, that most likely means one thing else is shifting larger to take their place in the interim, and far of the work I do managing my capital is continually recycling and rebalancing these concepts.

I need to have as a lot “working” at any given time as I can, and that hasn’t been really easy this yr because the checklist of sectors which are working has shrunk. Whereas a number of the different sectors have proven developments which were a lot shorter in period. I’ve emphasised the “themes” I need to be concerned in with my new playbook and they’re the nonetheless favorites for funding alternatives over the following a number of months.

This current rally has produced a bounce within the HIGH progress shares which were punished. Nevertheless it has additionally proven respectable follow-through from most of the former leaders. Apple (AAPL), Nvidia (NVDA), and Tesla (TSLA) are just a few that come to thoughts.

The 2022 Playbook Is Open For Enterprise

Thanks for studying this evaluation. In the event you loved this text to date, this subsequent part supplies a fast style of what members of my market service obtain in DAILY updates. In the event you discover these weekly articles helpful, you might need to be a part of a group of SAVVY Traders which have found “how the market works.”

Bifurcated Market

HIGH Development is staging a modest comeback throughout this current rally, and in some respects together with Vitality and commodities, it has been a frontrunner. Lots of the actual HOT names suffered 70%-80% losses and now speculative ETFs like Ark Innovation ETF (ARKK) have rallied 25% in lower than 2 weeks. Whereas that is happening the extra steady defensive names like CVS Well being (CVS), Pfizer (PFE), and UPS (UPS) have traded sideways.

I’ve pulled the set off on what seems to be good short-term buying and selling setups and to date they’ve paid huge dividends. I do not plan to overstay my welcome and can go away the scene for what I really feel may have extra endurance into the following quarter.

Small Caps

Over the last two weeks, the emphasis right here has been the “message” from the Russell 2000 small caps. Over the last sell-off, the index went right into a sideways buying and selling sample whereas the opposite indices stayed of their downtrends. So, as a substitute of the small caps falling aside and following the opposite indices down, the alternative has occurred. I believed the small caps did ship a message, and if they will proceed to outperform, it’ll assist stabilize the fairness market.

After all, the place a market participant has their cash invested on this group is vital. As of the shut on Friday, Small-cap Worth (AVUV) is UP 2.5% YTD, whereas Small-cap progress (VBK) is DOWN 12.8% YTD.

Sectors

Aerospace and Protection

The “battle” has positioned the highlight on this group, and what has occurred in Ukraine will increase the likelihood {that a} secular transfer is being cemented in place. U.S. Army spending is beneath the 2011 highs and there are overtures from the Eurozone that spending will must be elevated. The Ishares Aerospace and Protection ETF (ITA) is nearing a 52 week excessive, and in true stair step style is prone to proceed to its all-time highs set earlier than the pandemic.

Raytheon (RTX) has been a Savvy favourite because the inception of my playbook and it’s the largest holding in ITA. RTX has already cast a brand new all-time excessive this yr and I do not see a purpose to desert this firm anytime quickly.

Client Discretionary

The sector ETF (XLY) has firmed up properly recaptured its long-term pattern on the again of a pleasant rally in Amazon (AMZN). From the closing low on March eighth, AMZN has rallied 21%, far outpacing the indices. Client Discretionary has posted back-to-back weekly beneficial properties totaling 10% and might be able to energy to extra beneficial properties.

Vitality

Whereas there was loads of uncertainty round, one factor that is still fixed is the Vitality commerce. WTI moved again to over $110/barrel this week and power shares moved larger. After a short interval mid-month the place the sector took a again seat performance-wise, Vitality (XLE) finds itself again on prime of the leaderboard with a acquire of ~10 from the lows within the prior week. For the yr, Vitality is up practically 40% and as soon as once more stays the one sector in constructive territory for the yr. Technically, oil’s uptrend stays intact, and I proceed to view any weak point within the sector as a chance to build up favored names as wanted.

Oil value volatility could stay heightened, however sector fundamentals are very sturdy and valuations are nonetheless enticing. Moreover, power coverage will preserve oil costs elevated and business capital self-discipline proceed to end in strong free money stream progress utilized in shareholder-friendly methods.

Financials

With this week’s rally, the sector briefly broke into the constructive column for the yr. Nevertheless, as of Friday’s shut, the Monetary ETF (XLF) is up 2% for the month and 0.70% for the yr. The group has settled right into a sideways sample and relying on what analyst you take heed to its with time to ditch the group solely or begin including to this group.

I by no means go all out on a sector that has “‘worth”, so I will not be discarding BANK shares within the close to time period. I am additionally not including in the meanwhile. As an alternative, I am staying with chosen regional banks that proceed to publish sturdy fundamentals with respectable progress prospects.

Industrials

The sector (XLI) continues to construct relative power. Not solely is power from the Transports a constructive indication on the general financial surroundings, however it’s also supportive of internals for the sector. Areas just like the rails have damaged to new highs recently, and I proceed to view their backdrop enticing as inventories get replenished.

Elsewhere, as talked about the aerospace & protection subsector has come roaring again this yr on elevated geopolitical issues; and better protection spending might in the end be a multi-year tailwind for a lot of names within the group. After getting overbought within the short-term a few weeks in the past, the subsector has pulled in nearer to assist at prior highs. For buyers making an attempt to extend publicity, I’d look to build up favored names as they method these assist ranges.

Homebuilders

The homebuilders are reporting strong earnings and are well-positioned with record-breaking backlogs normally. Nevertheless, for the second or third quarter in a row, they’re handcuffed by the unending provide chain points. For no matter purpose, no options are being provided on the issue apart from ‘lip service”.

The business is on the nexus of main provide issues. KBHomes (KBH) not too long ago reported orders beat estimates by greater than 4%, BUT closings had been nearly 10% beneath forecasts due to very weak backlog conversion on barely above expectations common promoting costs. In different phrases, KBH is seeing loads of demand, it simply can’t meet it.

Commodities

I not too long ago talked about that Uranium has been my “gold” because the metallic continues to attract consideration. I’ve owned Uranium positions since October ’21 and the current addition bought on the final dip on February twenty eighth has produced a 29% acquire. Nuclear power goes to be wanted as THE various that produces not one of the dreaded greenhouse gases that retains the “chicken-little” mindset in place. If the greenies are actually critical in regards to the local weather then they may undertake nuclear power. Till such time the argument for “every thing inexperienced” is shallow and filled with hypocrisy.

Then we’ve got the so-called geniuses that need to be known as environmentalists who’re by their mindset and actions growing greenhouse-gas emissions by forcing the untimely closing of serviceable nuclear-power crops. These actions are irresponsible and illogical. In some unspecified time in the future, the “steadiness” between residing in the present day and planning for tomorrow must be a DUAL objective. We have already seen how the ONE objective mindset had brought on havoc, and financial hardships. That ache may simply be getting began IF the outcomes of those actions end in a world recession.

Healthcare

I proceed to see the Healthcare ETF (XLV) as one of many better-looking charts (apart from Vitality) within the general market. The sector stays a favourite and there are many shares within the group worthy of accumulation.

Expertise

Throughout a fee mountain climbing cycle, Expertise is considered one of two sectors that present 20% beneficial properties on common a couple of yr after the cycle begins. The ten-year rose 48 foundation factors prior to now 2 weeks and the NASDAQ together with the Expertise ETF (XLK) rose 9.6% and eight% respectively. I reiterate – I am not a believer {that a} rising fee surroundings is poisonous for expertise.

Semiconductors

I watch the relative power of the Semiconductor ETF (SOXX) versus the S&P 500 because it has traditionally been a great main indicator of the broader market. Thursday was a great day for the fairness market, nevertheless it was particularly sturdy for semiconductors because the SOXX rallied shut to five%, and each inventory within the index was up not less than 2%. The ETF has posted a ten.5% acquire within the final 2 weeks and shares like Nvidia (NVDA) have led the best way.

ARK Innovation ETF (ARKK)

HIGH progress portrayed by the Ark Innovation ETF (ARKK) has staged a rebound rally (+25%) that has dwarfed many different sectors. That is not so uncommon given the truth that ARKK continues to be down about 60% from its all-time excessive. This sector is not for the faint-hearted however aggressive buyers can grind out earnings by selectively including a place and using a lined name technique.

Cryptocurrency

The 2 largest cryptocurrencies, Bitcoin and Ethereum, have managed to not too long ago spherical out bottoms after having sat in downtrends because the fall. As proven beneath, Bitcoin has been making some larger lows because the begin of the yr and has not less than held up at assist round this yr’s lows.

For my part, the one solution to be concerned on this asset class is with the usage of technical patterns. I keep away from getting caught up within the notion that crypto can rise above 100k or grow to be a nugatory asset altogether. BTC continues to commerce between 41k-44k, beneath its sideways trending 200-Day shifting common, and at varied factors, in the course of the yr the 50-day MA has additionally been a good resistance stage.

Bitcoin (www.bespokepremium.com)

Nevertheless, the 50-day has turned upwards and BTC is utilizing that as assist now. I proceed to HOLD Grayscale Bitcoin Belief (OTC:GBTC) ($30), and Coinbase (COIN) ($189). Each have damaged above very short-term resistance and could also be able to rally larger.

Ultimate Ideas

The fairness market has rallied off the correction lows and now it is time for the inventory market pundits to voice their opinions on whether or not this can be a BEAR market rally, a lifeless cat bounce, OR the springboard to larger inventory costs. For some time now, I’ve emphasised that we’re in a distinct kind of market surroundings. Lengthy gone are the “shares solely go up” days of early 2021 when all you needed to do was load up on calls on probably the most speculative, least worthwhile firms available in the market or purchase any little dip in shares anticipated to maintain compounding on the similar excessive progress charges indefinitely. Whereas I take note of the indices for a really feel of the final market route the emphasis has been on “particular person” and “sector” setups.

The funding backdrop modified and it grew to become apparent that the “straightforward” market scene was changed by a harder backdrop and that too is the best way the market works. Subsequently, it grew to become obvious to me it was going to be way more tough to make and preserve cash available in the market until a brand new playbook was used, and that is been the message because the latter a part of ’21.

ALL of the “points” which are presently cemented in place in the present day, had been identified as potential issues final yr. So my change in technique was well-timed and it stays in place in the present day. I comply with “continuation” patterns that make the most of the route within the underlying pattern. That’s a lot simpler than following reversal patterns and hoping for a change within the underlying pattern.

“Our prayers and ideas ought to be targeted on the plight of the Ukrainian people who find themselves below unimaginable stress.”

Postscript

Please enable me to take a second and remind the entire readers of an vital problem. I present funding recommendation to shoppers and members of my market service. Every week I attempt to supply an funding backdrop that helps buyers make their very own choices. In some of these boards, readers carry a bunch of conditions and variables to the desk when visiting these articles. Subsequently it’s inconceivable to pinpoint what could also be proper for every state of affairs.

In several circumstances, I can decide every shopper’s state of affairs/necessities and focus on points with them when wanted. That’s inconceivable with readers of those articles. Subsequently I’ll try to assist type an opinion with out crossing the road into particular recommendation. Please preserve that in thoughts when forming your funding technique.

THANKS to the entire readers that contribute to this discussion board to make these articles a greater expertise for everybody.

Better of Luck to Everybody!