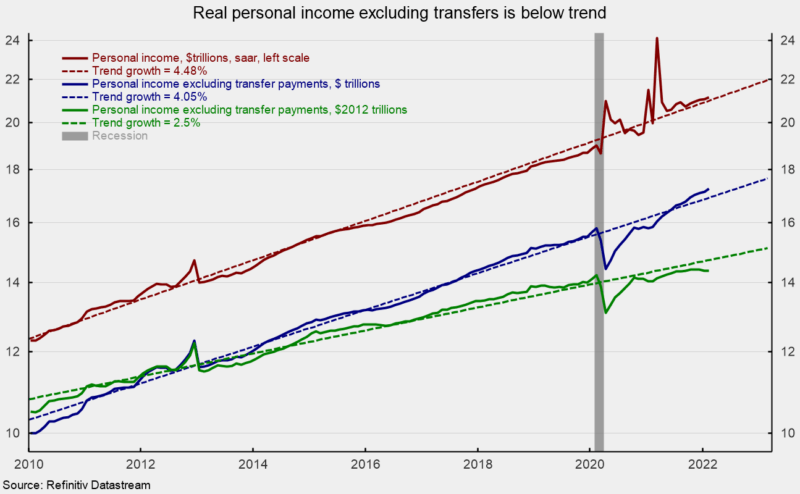

Private earnings rose 0.5 % in February, in keeping with information from the Bureau of Financial Evaluation (see first chart). Private earnings information over the previous two years have been sharply distorted by lockdown insurance policies which prompted large layoffs, and authorities stimulus applications that despatched switch funds skyrocketing. As distortions fade, private earnings is returning to latest development progress round 4.5 % (see first chart).

Excluding private switch funds, private earnings rose 0.7 % in February and is up 9.0 % over the most recent 12-month interval. It’s also 2.2 % above the 4.1 % development line (see first chart).

In actual phrases (adjusting for worth modifications), private earnings excluding transfers rose 0.1 % in February, leaving that measure up 2.5 % for the 12 months however 2.2 % under the two.5 % development line, and about equal to its September 2021 degree (see first chart).

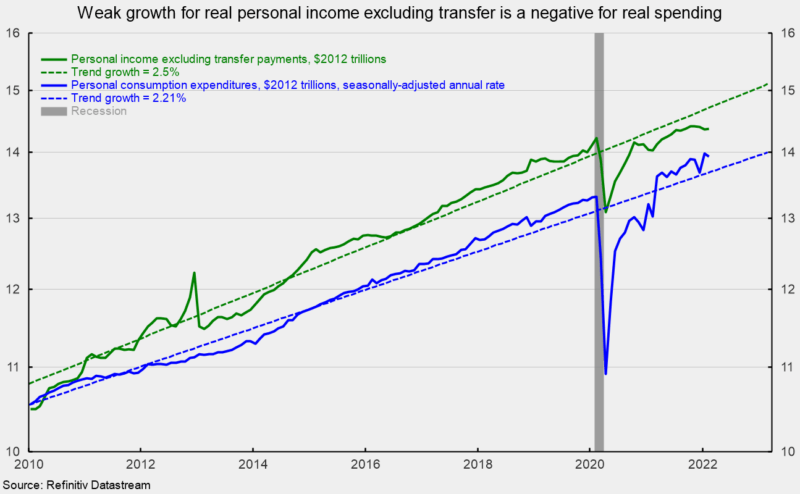

Weak progress for actual private earnings excluding transfers is a priority for the outlook for actual client spending. Complete private consumption expenditures (PCE) rose 0.2 % in February following a 2.7 % leap in January. Among the many elements, sturdy items fell 2.5 % whereas nondurable-goods spending fell 0.1 % however spending on companies elevated 0.9 % for the month.

In actual phrases, PCE fell 0.4 % as actual sturdy items spending fell 2.5 %, actual nondurable items spending decreased 1.9 % and actual companies spending rose 0.6 %. Regardless of the autumn, actual PCE stays 1.8 % above the two.2 % development progress line (see second chart).

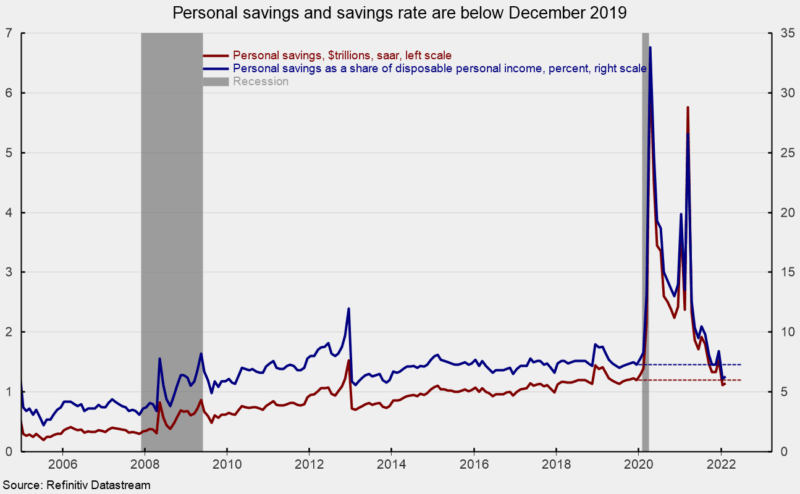

Private financial savings rose 3.5 % for February, however the degree stays under the December 2019 degree and about on par with the July 2019 degree. The private financial savings charge additionally ticked up in February, coming in at 6.3 % of disposable earnings following charges of 6.1 in January and eight.4 in December, however it’s under the December 2019 pre-pandemic charge of seven.3 % and in keeping with December 2013 (see third chart).

The value indexes from the report on private earnings and spending are the first measures adopted by the Federal Reserve. The whole PCE worth index elevated 0.6 % in February as durable-goods costs had been flat, nondurable-goods costs elevated 1.8 %, and companies costs elevated 0.3 %. The PCE worth index excluding meals and power rose 0.4 % for the month.

Over the previous 12 months, the PCE worth index is up 6.4 %, versus 6.0 % within the prior month. The core PCE index, which excludes meals and power costs, is up 5.4 % from a 12 months in the past. Each measures have been operating properly above 2 % since April 2021.

Total, ongoing disruptions to labor provide and manufacturing, shortages of supplies, and logistics and transportation bottlenecks proceed to exert upward strain on costs. Whereas cresting numbers of recent Covid instances in late January and early February had the potential to assist companies’ efforts to enhance provide chains and broaden manufacturing, geopolitical turmoil surrounding the Russian invasion of Ukraine has had a dramatic influence on capital and commodity markets, launching a brand new wave of potential disruptions to companies. For shoppers, quickly rising costs are hurting actual incomes and fraying confidence within the outlook for private funds, suggesting a menace to actual spending. The outlook for the financial system has develop into extremely unsure and excessive warning is warranted.