AzmanJaka

Investment Summary

Waste Management, Inc. (NYSE:WM) is a company operating in the United States. They offer a range of waste management services, from collecting and transporting waste and recyclables to processing and disposing of them responsibly, this wide array of services is what I think has made them an industry leader. Waste Management serves a diverse range of customers, from homeowners to businesses and government agencies resulting in the company generating almost 45% more revenue than the second-placed company.

This strong position has led the company to have a very successful run, but the valuation might have gotten a little bit out of hand. I think there are little doubt revenues will see any drastic decline given the moat the company has managed to gather up. But right now, paying 28x earnings is too much. But as the company screams quality from a fundamentals view I will rate them hold for now.

Looking At The Industry

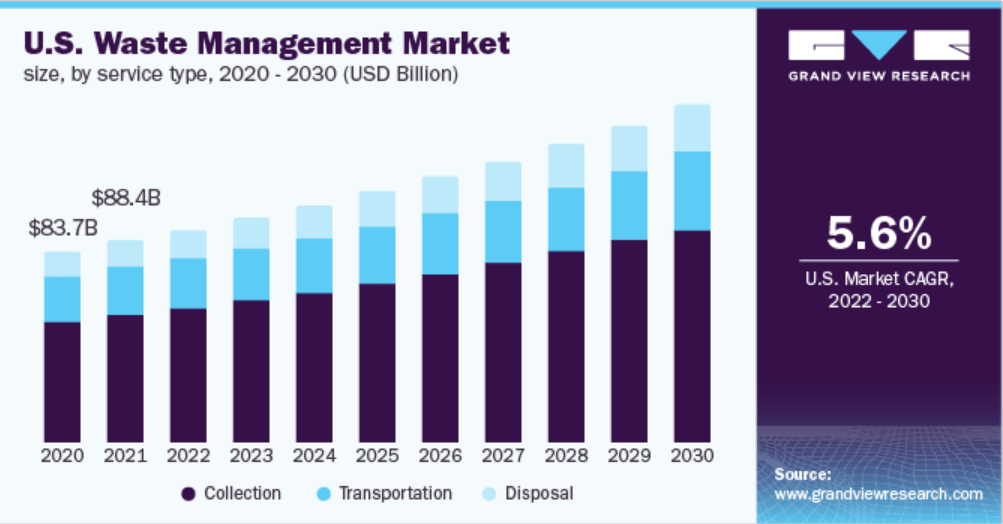

The waste collection industry plays a vital role in managing and handling waste. It involves the collection, transportation, processing, and disposal of solid waste and recyclables from households, businesses, factories, and cities. Over the years, the waste collection industry has grown immensely due to several trends and factors that have spurred its growth. According to GrandViewResearch the estimated market growth for the industry is 5.6% CAGR between 2022 and 2030.

Market Report (grandviewresearch)

I think that this growth should definitely be reflected in WMs earnings. They are after all a leader and they have managed to have a “churn rate of 9%” within the company. This means, as explained by the company the average customer stays with them for more than 10 years at least. I think this makes it more intriguing as an investment as they have will have steady long-term revenues being generated without large or rapid disruption.

The industry is also getting a boost from various favorable conditions. Among the most notable of these is the population growth in the USA which directly benefits WM. As WM holds an industry-leading position I think they will be able to see the most impact and overall growth from this continued trend. Although population growth has slowed down, in the USA it is still increasing YoY.

Risks

Companies in the waste collection industry face various risks, which can significantly impact their operations. One of the most critical risks is regulatory compliance. Environmental regulations are stringent and constantly evolving, and companies must comply with them to avoid severe legal consequences and hefty fines. WM has become an industry leader after being a company for many decades so I expect them to know the game better than anyone and risks like this are unlikely.

The waste collection industry is also susceptible to economic downturns, which can impact waste production. During an economic recession, businesses and households may reduce their waste production, leading to a decrease in demand for waste collection services. Companies must be prepared to navigate through economic fluctuations and adapt to changes in demand to remain competitive. I think however, WM has a sufficiently strong enough position to weather these storms quite well.

One risk worth mentioning that is more specific to WM is the trend of taking on long-term debt without a strong cash position. I will touch on this further down, but I think this is slightly worrying some. Having a robust cash position before taking debt is always the better option.

Financials

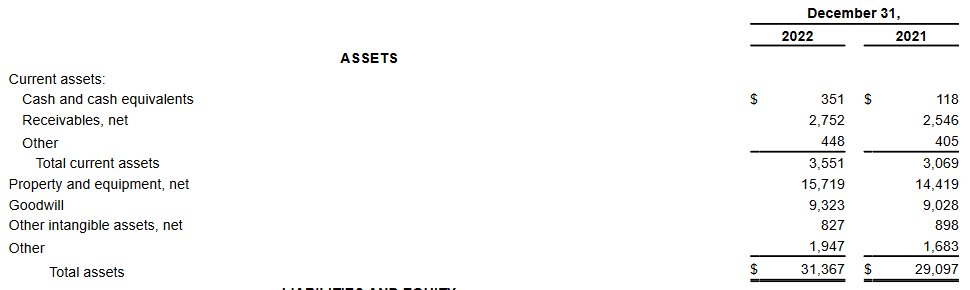

Waste Management, Inc.’s balance sheet as of December 31, 2022, shows significant improvements in the company’s financial position compared to the previous year. The company’s total assets increased by $2.27 billion to $31.37 billion, primarily due to an increase in property and equipment, goodwill, and other intangible assets. The company increases its cash position by almost 3x from 2021, going from $118 million to $351 million. I think that they are running a pretty tight ship right now and I would have much preferred they have a larger cash position to battle short-term debt.

Company Assets (Earnings Report)

Looking at the company I don’t think they will have any issues paying off debt when they generate over $1.7 billion in cash flows. But despite them being a leader in the industry, it’s vital to have a strong war chest of cash to make necessary and strategic investments to stay ahead of the competition. If the company decides to build out this position more I could lean more towards having a more bullish look on the company.

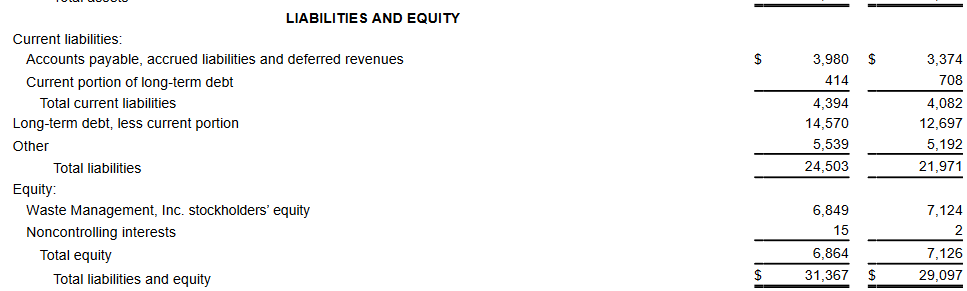

Company Liabilities (Earnings Report)

On the liability side, the company’s total liabilities increased by $2.53 billion to $24.5 billion, primarily due to an increase in long-term debt. This is a major move by the company and if it was any other company without the cash flow generation WM has I would be extremely worried. It will be interesting to see how the company utilizes this new debt to further solidify its position. So far it has netted them a 7.13% ROA which beats out the sector’s 5.2% which I think makes the case the company has been good with handling its balance sheet and making the most from it.

While this increase in debt could be seen as a potential negative, it is important to note that the company’s debt/EBITDA ratio remains relatively low, indicating that it has enough equity to support its debt. As of the last report that number was 2.77, which I find acceptable. Of course, I would like it to be lower, but WM generates a ton of free cash flows so I don’t particularly see the debt as a major hurdle or challenge for the company.

Valuation & Wrap Up

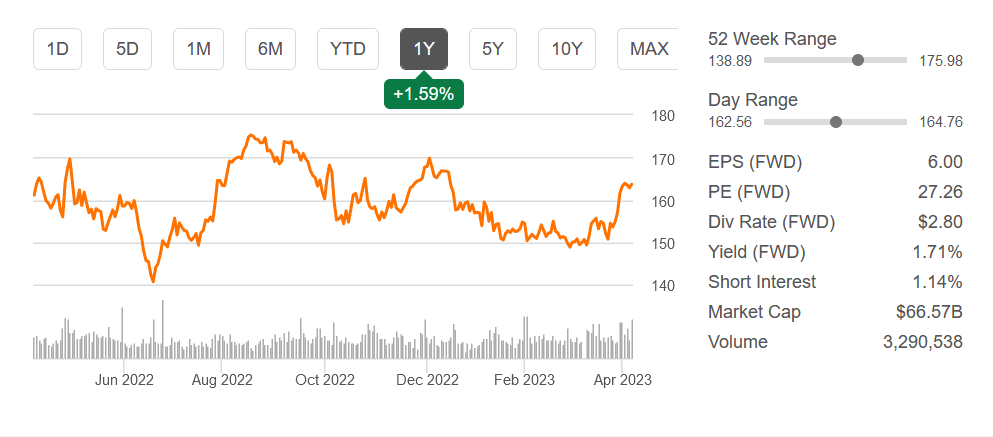

Right now I don’t think WM is a screaming buy as they are trading at around 28x earnings compared to the sector’s average of around 15-16. Despite the company having a strong moat and a leading position I think valuations are incredibly important when making an investment decision.

The company has strong cash flows but is yet trading at almost 16x times that which doesn’t really help the buy case either. I think that the uncertainty in other sectors across the market has made investors willing to go for overvalued but “safe” companies like WM to wait out the storm and stay invested.

Stock Chart (Seeking Alpha)

I think WM will be able to grow at least at the same rate as the CAGR for the industry in the next decade, but that isn’t fast enough to justify the current valuation. But with all that said there are some benefits to holding onto shares. Firstly you will be able to collect a nice 1.6% dividend and enjoy your share’s increase in value as the company has a strong history of share buybacks. I think that the relative stability of the company and the reputation they have worked up is enough to give them a hold rating for now.