Beneath the settlement with the Justice Division, Trident should make investments greater than $20 million “in impacted communities of coloration in Pennsylvania, New Jersey and Delaware,” Clarke mentioned in ready remarks she gave on Wednesday at Malcolm X Park in West Philadelphia.

“The funds might be used to offer credit score alternatives in areas that have been redlined by Trident, together with neighborhoods round this park,” she mentioned.

RELATED STORY: Regardless of excellent ranking, banks nonetheless aren’t lending to black enterprise house owners like they need to be

Legal professional Basic Merrick Garland mentioned within the information launch asserting the historic settlement that the Justice Division probe follows his announcement final fall promising to “mobilize sources to make truthful entry to credit score a actuality in underserved neighborhoods” beneath the division’s Combatting Redlining Initiative.

RELATED STORY: Redlined Black and brown neighborhoods at the moment are targets for oil drilling, research present

“As demonstrated by in the present day’s historic announcement, we’re rising our coordination with federal monetary regulatory businesses and state Attorneys Basic to fight the modern-day redlining that has unlawfully plagued communities of coloration,” Garland mentioned.

Learn each phrase of Clarke’s ready remarks:

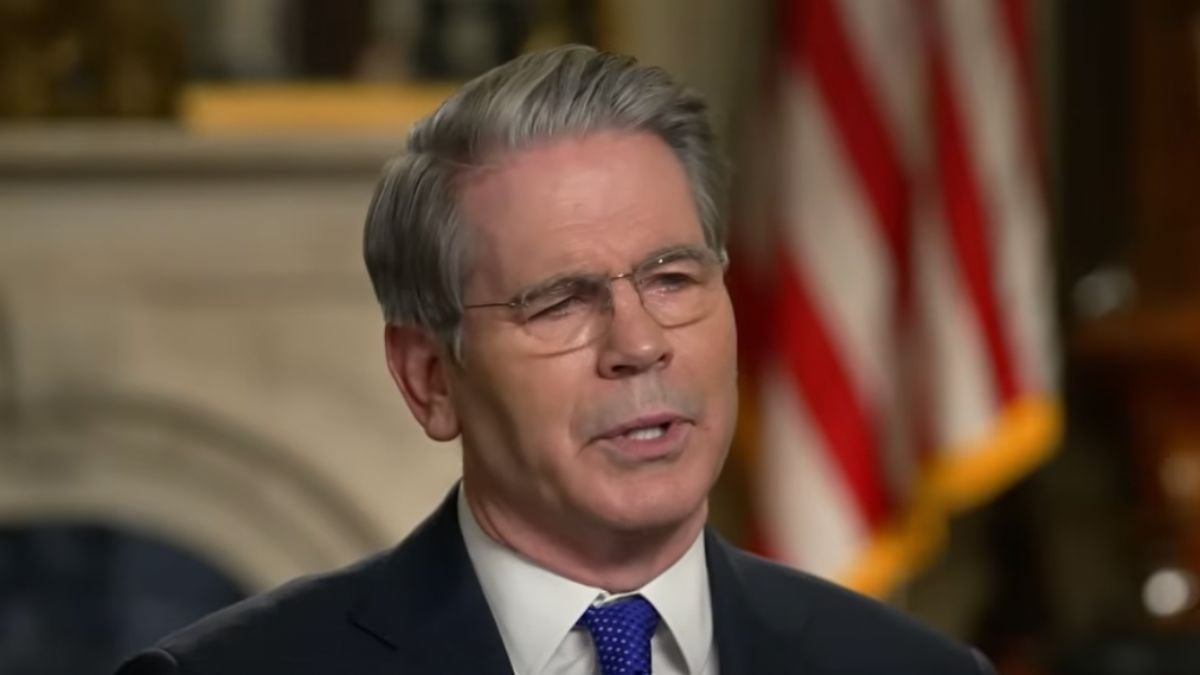

Good morning. My title is Kristen Clarke, and I’m the Assistant Legal professional Basic for the Civil Rights Division on the U.S. Division of Justice. I’m joined in the present day by Josh Shapiro, the Legal professional Basic of Pennsylvania; Rohit Chopra, the Director of the Client Monetary Safety Bureau; Jacqueline Romero, the USA Legal professional for the Jap District of Pennsylvania; Lyndsay Ruotolo, the First Assistant Legal professional Basic of New Jersey; and Kathy Jennings, the Legal professional Basic of Delaware.

I’m happy to be standing with you all in the present day at Malcolm X Park in West Philadelphia to announce that the Justice Division and the Client Monetary Safety Bureau (CFPB) have secured an settlement with Trident Mortgage Firm to resolve our claims of redlining discrimination within the Philadelphia metropolitan space, together with communities in Camden, New Jersey, and Wilmington, Delaware. As well as, our state companions in Pennsylvania, New Jersey and Delaware have reached agreements with Trident and its affiliate firm, Fox and Roach.

Our grievance, filed in federal courtroom in the present day, alleges that Trident violated the Truthful Housing Act and the Equal Credit score Alternative Act. Particularly, our grievance alleges that Trident’s workplace places have been concentrated in majority-white neighborhoods, that Trident’s mortgage officers weren’t directed to serve – and didn’t serve – the credit score wants of neighborhoods of coloration and that Trident’s outreach and advertising and marketing prevented these neighborhoods. The grievance additionally alleges that Trident staff exchanged emails the place they referred to neighborhoods of coloration as “ghetto” and made racists jokes; there’s even a photograph of a senior Trident supervisor posing in entrance of a Accomplice flag. Our grievance was filed together with a proposed consent order outlining the aid that we’ve got secured.

Right now’s settlement is historic for 2 causes. First, that is the primary redlining settlement that the Justice Division has secured with a mortgage firm. Mortgage corporations like Trident difficulty over 50% of the mortgage loans in the USA, so they’re vital gamers within the credit score market and their lending practices have a big impact on the provision of credit score. Different non-depository lenders ought to be on discover that the Justice Division will proceed to implement federal housing legal guidelines to make sure equal alternative to entry credit score.

Our settlement with Trident can also be the Justice Division’s second largest settlement in historical past. Beneath this settlement, Trident should make investments over $20 million {dollars} in impacted communities of coloration in Pennsylvania, New Jersey and Delaware. The funds might be used to offer credit score alternatives in areas that have been redlined by Trident, together with neighborhoods round this park. This infusion of lending sources into neighborhoods of coloration, together with right here within the Philadelphia metropolitan space, will assist redress the hurt attributable to Trident’s illegal exercise.

West Philadelphia has lengthy been the house of sturdy and vibrant Black and Latino communities. Sadly, it additionally been the house of extended residential racial segregation, identical to so many different communities throughout the nation. Even with the passage of the Truthful Housing Act greater than 50 years in the past, banks and mortgage corporations, like Trident, proceed to search out new methods to change their lending practices in ways in which trigger hurt to communities of coloration. These discriminatory practices exacerbate wealth disparities and promote financial injustice.

And we all know that the present wealth disparities between Black and white households are staggering. Right now, the median wealth of a Black household is roughly $24,000. The median wealth of a white household is roughly $188,000. A white household is 30% extra more likely to personal a house than a Black household, which means the homeownership hole is bigger in the present day than it was in 1960, earlier than the passage of the Truthful Housing Act.

Regardless of these grim statistics, the Justice Division is dedicated to aggressively implementing our nation’s civil rights legal guidelines to make sure equal alternative and financial justice for all Individuals. Right now’s settlement demonstrates that dedication.

Our enforcement motion towards Trident is a part of the Justice Division’s Combatting Redlining Initiative. The initiative is drawing on the strengths of the division’s partnerships with the U.S. Attorneys’ Places of work, CFPB, different monetary regulatory businesses, in addition to State Attorneys Basic. Collectively, we’re sending a powerful message to banks, mortgage corporations and different lenders that they are going to be held accountable for partaking in illegal, modern-day redlining.

I need to thank our group contained in the Civil Rights Division of the Justice Division for his or her work on this matter. I additionally need to commend our companions at CFPB, the U.S. Legal professional’s Workplace in Jap Pennsylvania and the State Attorneys Basic for Pennsylvania, Delaware and New Jersey for his or her work on this case. Collectively, we mark a big step ahead in our collective efforts to make sure all folks have equal alternative to entry the American dream.

I’ll now flip it over to Josh Shapiro, the Legal professional Basic of the Commonwealth of Pennsylvania.

RELATED STORY: Kristen Clarke confirmed and both Republicans are eerily quiet or their voices aren’t registering