tum3123

Emerging market stocks are trading significantly below the valuations seen during the height of the Covid crash. Weakness in Chinese stocks has weighed heavily on EM benchmarks, with the Vanguard FTSE Emerging Markets ETF (NYSEARCA:VWO) falling due largely to the crash seen in the mainland following President Xi’s consolidation of power at the Party Congress. The ETF may continue to face heightened near-term volatility, but the combination of cheap valuations and rock-bottom sentiment suggests that strong positive returns are likely over the coming months and years.

The VWO ETF

The VWO tracks the performance of the FTSE Emerging Markets index and offers exposure to large-cap EM stocks with a very low expense ratio of 0.1%, which compares favorably to the 0.7% charge for the iShares MSCI Emerging Markets ETF (EEM). China has a higher weighting in the VWO, comprising 31% of the index versus 27% in the EEM. This largely reflects the absence of Korean stocks in the index, which contrasts with the EEM’s 12% weighting. The absence of Korean tech giant Samsung also means a slightly lower weighting towards Technology. Despite the higher weighting of Chinese stocks, the VWO has actually outperformed the EEM this year due in large part to the former’s higher weighting of Taiwanese stocks and exclusion of Korean stocks.

Valuations Are Near Record Lows

The VWO’s underlying FTSE EM index now trades at its cheapest level since the global financial crisis, cheaper even than the height of the Covid crash. With a price/earnings ratio of 8.5x, the index trades at just over half of the MSCI world, and its dividend yield, at 3.7%, is 1.5pp higher. On a forward basis the VWO looks slightly less cheap as earnings are expected to fall significantly over the next 12 months, but at 10.5x it is still cheap relative to its own history and the developed world. Dividend payments are also expected to rise slightly, with the forward dividend yield currently at 3.9%.

FTSE EM Dividend Yield Vs MSCI World (Bloomberg)

Previous such declines in valuations in the VWO have always occurred during periods of global deflation concerns, but the current selloff has actually occurred alongside a rise in inflation expectations. If we add the current dividend yield to the rate of 10-year U.S. breakeven inflation expectations, we can get a sense of what the market is likely to return if valuations remain unchanged and dividends keep pace with inflation over the next decade. As the chart below shows, the current figure of 6.3% dwarfs previous peaks.

FTSE EM Dividend Yield + Inflation Expectations (Bloomberg)

China Risks Appear Priced In

The main source of volatility in the VWO comes from the performance of Chinese stocks, with the 30-day rolling correlation between the VWO and the Hang Seng China Enterprises Index (HSCEI) currently up at 0.95%. It is difficult to imagine any decoupling between these two indices given the outsized weighting of China in the ETF and the country’s importance to the overall EM growth outlook.

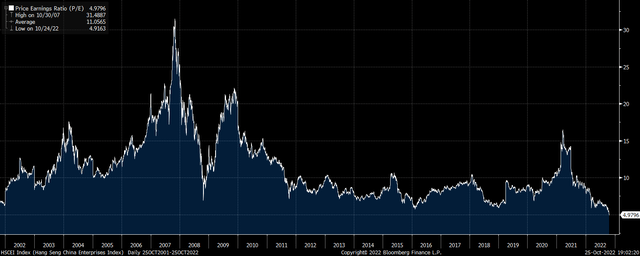

The good news is that Chinese stocks are now trading at record low valuation levels, with the PE ratio of 5.0x fully 40% below the ratio seen at the global financial crisis low and 85% below the bubble valuations seen in 2007. The Hang Seng Index, where data on valuations goes back further than the HSCEI, trades below the valuations seen at the height of the 1998 deflationary crash.

HSCEI P/E Ratio (Bloomberg)

The financial media has attributed yesterday’s weakness in Chinese stocks to President Xi’s tightening grip on power seen at the country’s Party Congress, with the prospect of free-market reforms further diminishing. However, these trends have been in place for several years now and did not prevent the HSCEI trading at double current valuations just 12 months ago. Interestingly, Chinese stock futures actually opened up over 1% on Monday morning following the conclusion of the Party Congress, before erasing their gains and plunging to new lows. The weakness therefore appears more the result of panic selling and stop losses being triggered, rather than any real deterioration in the corporate sector’s fundamentals, which created potential for a sharp recovery rally.

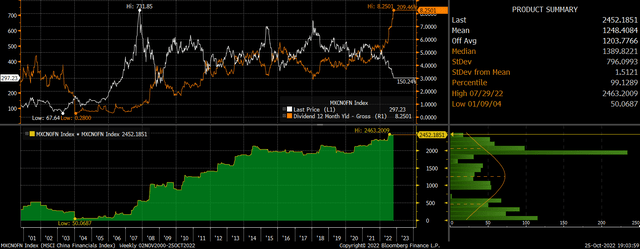

It is certainly true that Chinese stocks are high risk investments at present due to the uncertainty around the prospects of economic growth and the treatment of minority shareholders. However, Chinese companies continue to raise their dividend payouts. This is particularly true in the financial sector, where payouts have risen by almost 5% per year over the last decade, resulting in a dividend yield of 8.3%.

MSCI China Financials, Dividend Yield (Bloomberg)

Summary

The VWO is now extremely cheap relative to both its own history and developed market benchmarks, against which it trades at record discounts. While the high weighting of Chinese means that the ETF will likely be subject to high volatility, the 3.9% yield provides adequate compensation for the risks, particularly in the context of elevated global inflation expectations.