Sean Gallup

Background

Vonovia (OTCPK:VONOY) (OTCPK:VNNVF) is Germany’s main residential actual property firm. Vonovia presently owns and manages ~550k of residential models largely in Germany however with some residences additionally in Austria and Sweden.

While rental earnings from holding residential residences is its predominant enterprise, it additionally has further segments that embrace:

1) Property growth section

2) Recurring gross sales (disposal of non-core residences)

3) Worth-add companies (e.g., craftsmen, media, and many others.).

Vonovia (VNA) shares stay beneath important strain and at the moment are buying and selling at simply over 0.4x web asset worth (“NAV”). I see this as a completely compelling alternative with an uneven threat/reward profile. I additionally see a transparent path for Vonovia to retrace a lot of the share value decline suffered this yr.

I’ve already written 2 articles on this chance right here and right here. For readers which might be unfamiliar with VNA, I counsel that they learn these articles so that you’ve got the complete background.

On this article, I’ll replace my thesis and talk about the upcoming catalysts.

To recap, the primary motive for the share value collapse is the elevated value of capital attributable to increased charges within the Eurozone. Presently, Vonovia’s value of debt is 1.2% with an efficient maturity of seven.7 years. To refinance the debt presently, Vonovia’s value of debt is prone to be within the vary of three% to 4%. As such, this renders its earlier enterprise mannequin of debt-funded inorganic M&A not tenable any longer. Additionally it is not economical for Vonovia to refinance its debt at such prices and it’s successfully pressured to deleverage.

The administration group reacted and has earmarked EUR13 billion of belongings for disposal. Nevertheless, it did not decide to particular timelines for apparent causes (by no means factor to barter with a deadline gun to your head).

The proceeds must be utilized for debt discount in addition to share buybacks.

The obvious concern available in the market is that Vonovia won’t be able to promote properties rapidly sufficient or at a value that’s shut sufficient to guide worth given macroeconomic uncertainties and better rates of interest. Each of those fears are considerably unwarranted in my opinion. In a current interview with Bloomberg (referred to on this article), the CEO Mr. Buch offered an replace:

“We’ve got hardly ever seen such robust curiosity in properties that we now have on the market,” Buch instructed Bloomberg not too long ago. In contrast to some warning voices, the supervisor sees no threat of a crash for the German actual property market. In response to him, the properties on the market embrace condo buildings in main German cities, resembling Munich, which might usually appeal to rich consumers, households and municipalities.

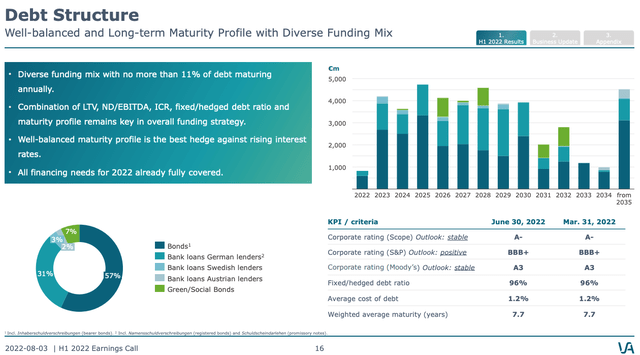

The debt construction

It is very important perceive Vonovia’s debt construction and refinancing schedule. As famous above, the typical value of debt presently is 1.2% and the weighted common maturity is 7.7 years. The refinancing schedule is proven within the beneath slide:

Vonovia Investor Relations

Total, Vonovia has EUR43.5 of adjusted web debt however maturities are unfold over a few years. For 2022, the refinancing wants have already been addressed. Vonovia additionally expects its subsidiary Deutsche Wohnen to get rid of the nursing portfolio (~EUR1.2 billion), so the remaining refinancing wants for 2023 are ~EUR3 billion and for 2024 round EUR3.8 billion. That is very manageable given the disposal program introduced and commentary as per above from the CEO on sturdy demand from buyers.

The JV Construction

Vonovia can also be within the technique of assessing a JV construction. Primarily, this entails institutional buyers buying an curiosity in sure portfolios. That is above and past the EUR13 billion portfolio earmarked on the market. There are an a variety of benefits to this construction and these embrace:

- Vonovia can execute a big transaction rapidly and launch capital (versus the piecemeal disposal program.

- There are not any tax leakages as Vonovia just isn’t promoting the underlying property, however quite points shares in a Particular Goal Automobile (“SPV”) holding the designated portfolio

- Vonovia retains the earnings stream for asset administration of the portfolio.

All in all, it is a very enticing construction and accretive for shareholders particularly if priced close to guide worth and proceeds are utilized for share buybacks in addition to debt discount.

The catalyst

The catalyst may be very easy. Vonovia must exhibit that it might promote properties at or close to guide worth, deleverage (ever so barely to low 40s LTV), and buyback shares. A JV construction could be an enormous optimistic as mentioned above. Progress introduced will probably create a brief squeeze.

Remaining ideas

Traders appear to be throwing the child with the bathwater. The present share value doesn’t make sense in any way, even for those who assume a ten% nominal decline in German actual property.

There are additionally various further tailwinds. These embrace synergies from the acquisition of Deutsche Wohnen of EUR105 million. Rental earnings also needs to materially enhance as current Mietspiegels point out a a lot increased adjustment for rents (albeit it will present within the financials materially from 2024 onwards).

Lastly, the German actual property market is in continual quick provide in the important thing geographic areas Vonovia operates in. The emptiness charge may be very low, substitute value is extraordinarily excessive and development of latest residences is properly beneath demand ranges. Vonovia is properly positioned to capitalize on these secular traits together with modernization and power effectivity.

I see this as a generational alternative to arbitrage the personal and public marketplace for actual property in Germany. I stay very bullish.