Pascal Le Segretain/Getty Images News

Vivendi (OTCPK:VIVHY) has an interesting business diversification, but its relatively weak growth prospects justify why its shares are trading at less than 12x forward earnings and a re-rating doesn’t seem likely in the short term.

Company Overview

Vivendi is a French holding company owned by the billionaire Vicent Bollore, which owns 29% of the company while the rest trades as free-float, focused on the media and telecommunications sectors. Through its subsidiaries, Vivendi is exposed to several industries, including pay-TV, media agencies, video games, publishing, and telecommunications.

Indeed, as I’ve covered in a recent article, Vivendi is Telecom Italia’s (OTCPK:TIIAY) largest shareholder, with a stake of 23.75%, while in the media segment it owns Canal+, the largest pay-TV operator in France, Havas (media agency), Editis (publishing), and Prisma Media (specialized press company). It also owns Gameloft, and has a stake of 10% on Universal Music Group (OTCPK:UMGNF).

Therefore, Vivendi’s business mix is quite diversified both across companies and industries, even though it has a clear bias to the TMT (technology, media, and telecoms) sector. Its current market value is about $9.7 billion and trades in the U.S. on the over-the-counter market.

Its business strategy is to actively manage its portfolio, making several acquisitions and disposals to generate value over the long term. The company’s profile is currently undergoing a reshaping phase, which started in 2021 when it performed the IPO of Universal Music, of which it retained a small stake (10% of total capital).

Following this transaction, Vivendi acquired a 45% stake in Lagardere (OTCPK:LGDDF) from Amber Capital at the end of 2021, increasing its exposure to the media segment in France. During 2022, Vivendi increased its stake to 55% and launched a takeover offer for the remaining capital, which is still pending approval from the European Commission due to antitrust issues.

While the acquisition and full consolidation in its account is expected to be approved in the coming weeks, Vivendi announced some weeks ago its agreement to sell 100% of Editis to address antitrust concerns. This happens because Vivendi would control the two largest publishing companies in France following this deal, being negative for competition in this industry.

Assuming that Vivendi will receive approval to acquire 100% of Lagardere and will successfully dispose Editis, its revenue and earnings profile will change considerably. Lagardere will represent the largest asset, with a pro-forma weight of about 43% in Vivendi’s annual revenues, followed by Canal+ with a weight of some 36%. Havas’ contribution will decline to 16%, while other companies such as Gameloft and Prisma Media will account each one for only 2% of total revenue.

Note that this split does not include Telecom Italia, as the company is not consolidated in its accounts and therefore only contributes to its earnings under the accounting line ‘income from equity affiliates, non-operational’.

Geographically, pro-form for the integration of Lagardere, Vivendi’s largest market will remain France, accounting for some 39% of revenue, while the rest of Europe will be responsible for 29%, Americas will have a weight of 21%, while the rest (about 11%) is expected to be generated in Africa, Asia and Oceania.

Financial Overview

Regarding its financial performance, Vivendi has a good track record even though due to its strategy of active portfolio management, historical results aren’t a good indication of its future earnings power as the company’s portfolio is changing considerably.

Nevertheless, Vivendi has reported positive top-line growth until 2021, when it performed the Universal Music IPO, which led to much lower reported revenues on a consolidated basis. Indeed, revenues amounted to €9.6 billion in 2021, compared to more than €16 billion in the previous year. However, adjusted for the Universal Music disposal, its revenues increased by 10% YoY, given that 2020 adjusted revenues were €8.7 billion.

In 2022, Vivendi’s subsidiaries maintained a positive operating momentum, with revenues increasing by 10.1% YoY to €9.6 billion, while its EBITDA was €868 million (+35.6% YoY). Its net income, excluding Telecom Italia, was €677 million, representing an increase of 19% YoY.

On top of strong revenue and earnings growth, Vivendi also reported positive cash flow generation which is a strong support for its shareholder remuneration policy, given that is operating cash flow of €594 million was enough to cover its dividend and share buyback. On the other hand, Vivendi’s reported loss for the year was about €1 billion, due to losses on discontinued operations and a €1.3 billion loss on the deconsolidation of Telecom Italia.

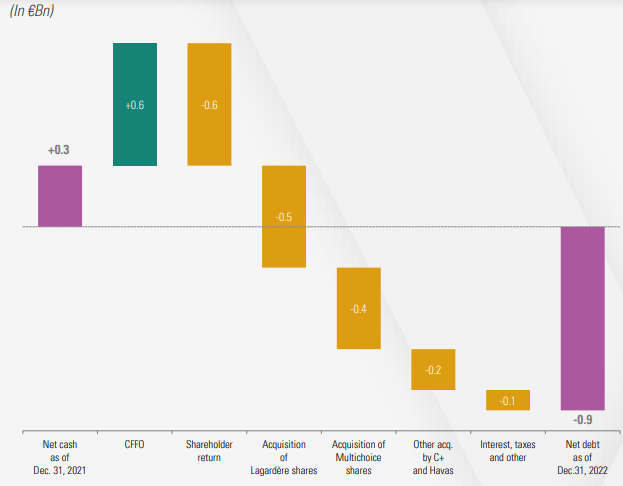

Its net debt increased to €860 million at the end of 2022, due to cash outflows related to Lagardere’s investment and other smaller acquisitions. Its financial leverage ratio, measured by its net debt-to-EBITDA, was 1x, which is a relatively low level of leverage.

Debt (Vivendi)

However, its leverage is expected to increase following the acquisition of Lagardere, which will represent a cash outflow of about €1.3 billion for the remaining 45% that Vivendi currently doesn’t hold, while the agreement to sell Editis will reduce the net cash outflow, but the financial terms of the transaction were not disclosed.

Considering that Vivendi performed a €300 million goodwill impairment related to Editis in 2022, and its remaining goodwill amounted to €546 million at the end of 2022, it’s likely that this sale will represent a cash inflow of more than €500 million. This means that net debt should increase by about €800 million if its acquisition and disposal proceed as expected in the coming weeks, to a level of about €1.6 billion.

While net debt will double, its leverage ratio will not increase in the same proportion because Vivendi will lose EBITDA from Editis (some €30 million in 2022), but will fully consolidate Lagardere. Therefore, Vivendi’s pro-forma EBITDA taking into account these transactions is expected to be between €1.2-1.3 billion per year, representing a leverage ratio of about 1.3x. This is an acceptable leverage ratio for an investment grade credit rating company, allowing it to continue to perform smaller acquisitions and distribute a good part of earnings to shareholders.

During the first three months of 2023, like many French companies it only reports top-line performance, with Vivendi delivering positive revenue growth, increasing to €2.29 billion in the quarter (+3.3% YoY). This positive performance was supported by Canal+, Havas, and Gameloft, showing that its largest businesses are performing well. Lagardere reported revenue growth of 4.3% YoY, which bodes well for consolidated revenue growth ahead.

Nevertheless, the consolidation of Lagardere will increase Vivendi’s exposure to legacy operations in the media sector, not particularly bullish for its long-term growth prospects. Additionally, Lagardere’s EBITDA margin was 10% in 2022, below Vivendi’s level, which means the consolidated group will have a lower profitability than reported last year.

Indeed, according to analysts’ estimates, Vivendi without full consolidation of Lagardere is expected to report an EBITDA margin of 13% in 2023, which is likely to decrease if the acquisition of Lagardere is approved and closes in the coming months.

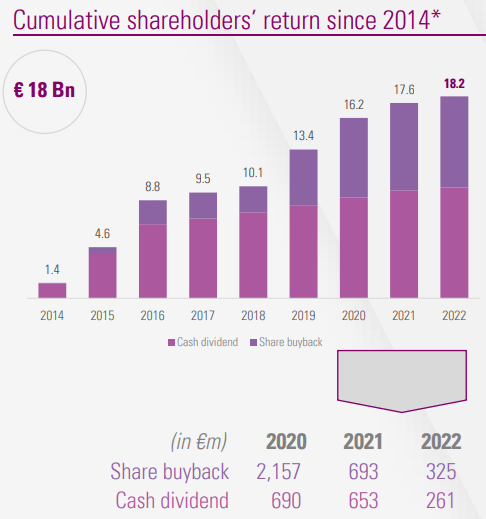

Regarding its shareholder remuneration policy, Vivendi has a good history of delivering most of its earnings to shareholders, both through dividends and share buybacks. Its last annual dividend was €0.25 per share, stable from the previous year, which at its current share price leads to a dividend yield of about 3%. On top of that, the company also repurchased its own shares, increasing total capital returns, which represented more than 3% of the company’s market value.

Capital return (Vivendi)

Conclusion

Vivendi is a different company within the European TMT sector due to its holding profile, with exposure across several industries. However, its strategy to sell Universal Music and reinvest the proceeds in legacy media assets (Lagardere) is questionable, as growth prospects and profitability will be much weaker in the future.

Not surprisingly, Vivendi’s valuation is currently quite low considering that it’s trading at less than 12x forward earnings, but this seems to be justified by its weak growth prospects and lack of catalysts in the near future to justify a higher valuation. Thus, Vivendi does not seem to be interesting enough for me, and I’m not planning to add its shares into my portfolio for the time being.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.