xefstock

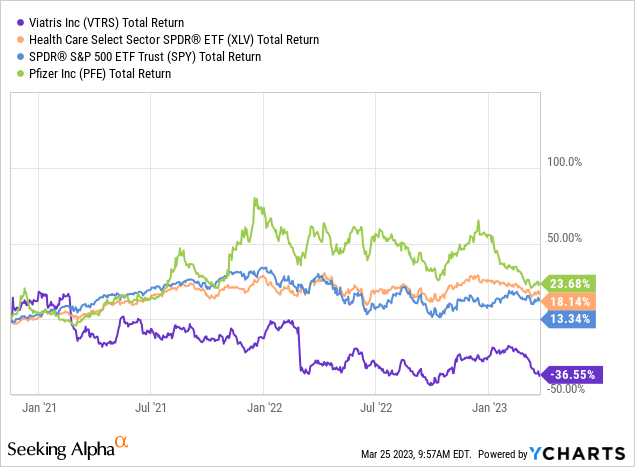

If you fell in love with Viatris (NASDAQ:VTRS), you are probably among those singing, “Baby, don’t hurt me, don’t hurt me, no more”. The stock which listed post spin-off in November 2020, has underperformed the broader S&P 500 (SPY) and the Health Care Select Sector SPDR ETF (XLV) by over 50%. It has also hugely underperformed Pfizer Inc. (PFE), the company which contributed assets to this spin-off.

Certainly not an outlook you would have envisioned for a company that listed at a P/E multiple of under 4.0X. We look at what has happened in context of the recently released Q4-2022 results and the 2023 guidance.

Q4-2022

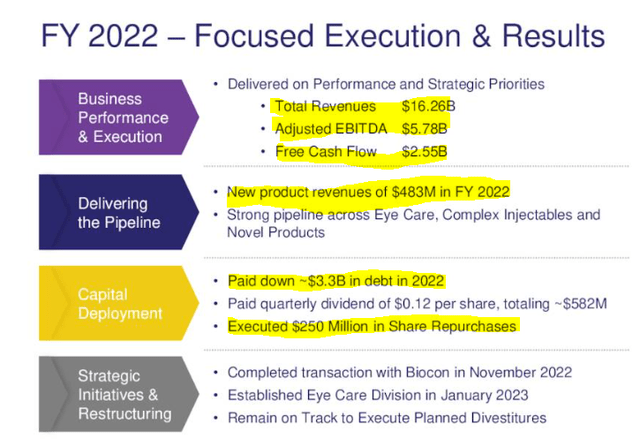

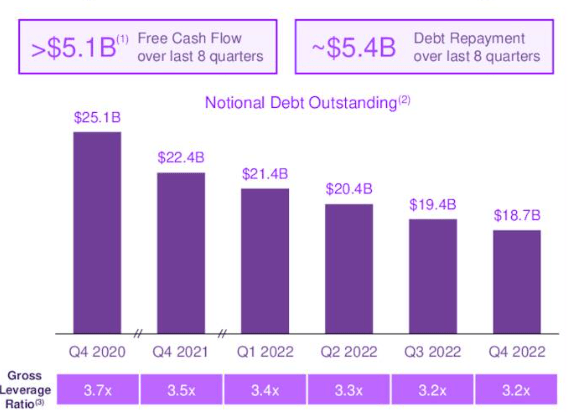

The presentation slides appeared to highlight some positive aspects for the company’s results. Investors must have noted the big debt paydown and the start of the buybacks.

VTRS Q4-2022 Presentation

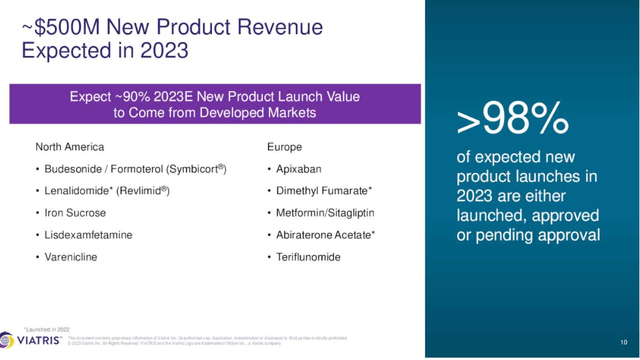

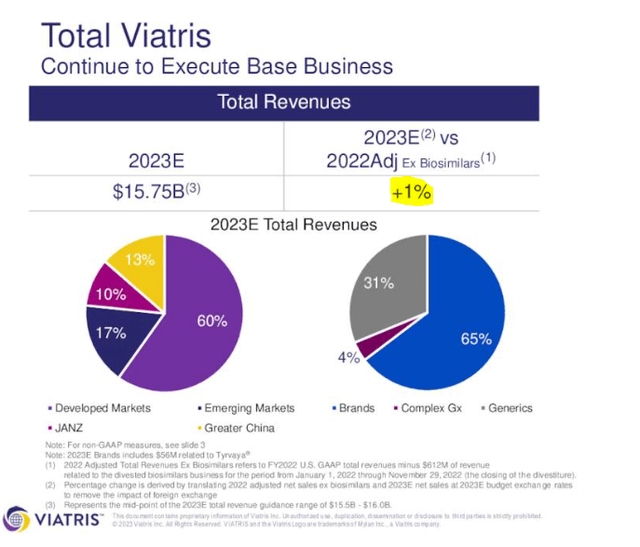

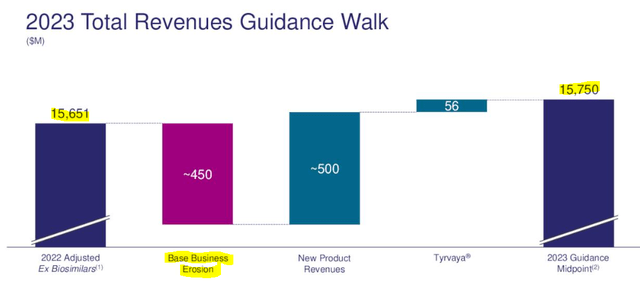

For 2023, VTRS has lined up $500 million of product launches. These are in the latter stages of development or approval, or have already been launched.

VTRS Q4-2022 Presentation

Hence there is a good amount of certainty that this will come to pass. Overall revenues will still be extremely lackluster adjusted for the Biosimilars sale.

VTRS Q4-2022 Presentation

The problem as always, is the base business erosion.

VTRS Q4-2022 Presentation

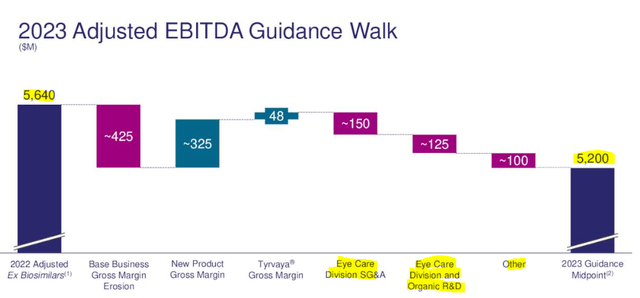

In fact the numbers call for a growth of only 0.6% and it is only by generous rounding do we reach 1%. The comparatives get far, far worse when you get into the adjusted EBITDA. Keep in mind that this is adjusted for the Biocan sale.

VTRS Q4-2022 Presentation

So on flat revenues the adjusted EBITDA will drop by about 8%. There are two drivers for this. The new product launches will have lower EBITDA compared to that lost on base business erosion. In addition the new Eye Care Division will have massive new costs. $275 million in selling and general and administrative expenses. We also have a “other” category with $100 million. So $375 million total in new expenses which are not even one-time. This comes after management spoke about capturing $250 million in synergies.

VTRS Q4-2022 Presentation

So all in all, there is a very solid erosion ahead of the earnings power of this company and there are good reasons why the stock continues to struggle.

The Walk Of Shame

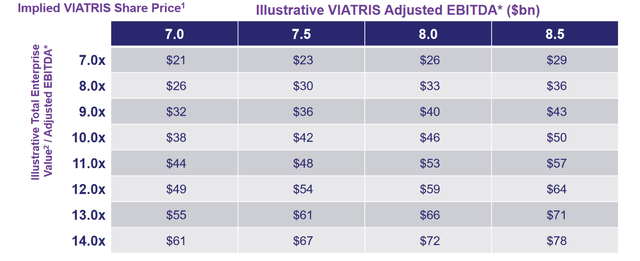

The “next year” has always been the one in which VTRS promised to deliver. It is like the spider riddle where the creature travels half the distance it is supposed to, every day. The spoiler is that spider never makes it and for that matter, neither does VTRS. The company started the spin-off with adjusted EBITDA in the range of $7.0-$8.5 billion and comically assigned the possibility of a 14X multiple on top of that.

VTRS August 2020 Presentation

Here we are with 2023 a quarter way through and we are looking at $5.2 billion. Yes, $250 million of adjusted EBITDA was related to the Biocan sale, but even after that, we are nowhere in the ballpark of the $7.0 billion (low end) initial guidance. Even the much vaunted debt paydown is nothing to get excited about. Look at the slide below, which shows the $5.4 billion debt paydown.

VTRS Q4-2022 Presentation

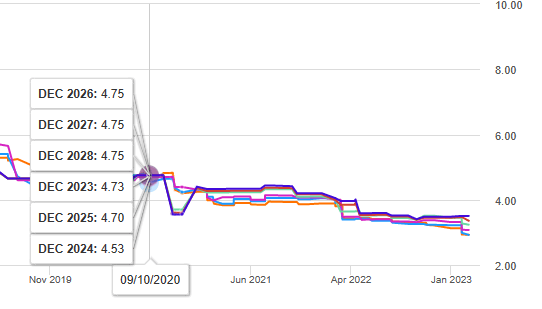

Anything strike you as odd about it? No? We will help you out. That leverage ratio is backward looking and calculating on a trailing 4 quarters basis. If you take that $18.7 billion and apply the 2023 $5.2 billion in adjusted EBITDA, you are back up to 3.6X. That 3.6X is a micron away from the initial leverage. So that has been the cycle. Deleverage and talk about it as forward EBITDA numbers keep dropping. To maintain ratings they actually have to continue to deleverage. In fact, we expect at least $1.5 billion of additional debt payments in 2023. If they don’t rating agencies will start the downgrade process. This brings us to the “walk of shame”. We are referring to how earnings estimates keep coming down over time as analysts “walk-down” these numbers after every quarter. This is VTRS at around the time of the spin-off.

Seeking Alpha

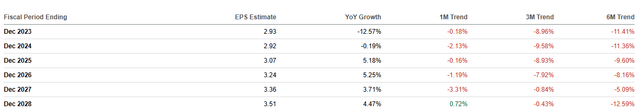

Nobody apparently had a clue of what the future held, so you see analysts slapping about the same number for 6 different years into the future. Those numbers have been walked down quarter after quarter. Here we are today with a number starting with “$4” completely MIA.

Seeking Alpha

Verdict

Of course you can get excited about the P/E ratio of 3. Just as you would be with the P/E ratio of 3 when it started trading. Of course you can get excited about the $5.4 billion of debt paydown. Just as you will be when it pays another $1.5 billion in 2023. If you think this cycle of declining revenues and declining EBITDA creates value for you, well, good luck.

Our thinking is the same as before. At the low end of the range, you possibly can make some money as the market balances out probabilities of stabilizing revenues with the probabilities of a declining cash flow stream. That tactical trading aside, it is very difficult to call this a “value stock” based on fourth grader math relying on P/E ratios. This is about as perfect a value trap as one can find.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.