[ad_1]

Mongkol Onnuan

Vertex (NASDAQ:VERX) is a comparatively undervalued tax software program participant. Whereas the corporate’s income has grown within the teenagers, its low FCF margin has presumably led to a depressed valuation (on an EV/S foundation). Nevertheless, we predict a possible re-rating is on the playing cards with the expansion on the again of Vertex’s integration with its ecosystem, which is presumably not nicely understood.

Enterprise

Vertex offers tax-related SaaS choices and providers for enterprises utilizing a frequently evolving database of over 500 million data-based tax guidelines that assist the corporate function in over 19,000 jurisdictions worldwide. Vertex is headquartered in Pennsylvania and employs over 1,300 professionals globally.

Enterprise segments

The corporate offers industry-specific options for tax willpower, compliance and reporting, tax knowledge administration and related providers.

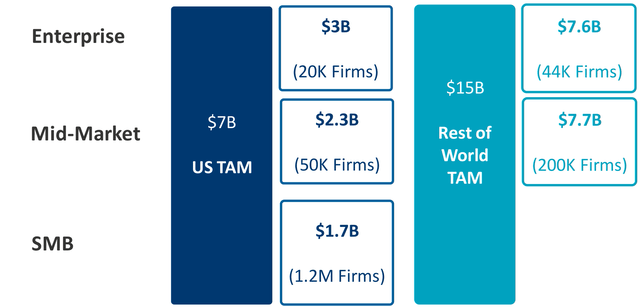

Vertex estimates the entire addressable market to be c. $22 billion with lower than 10% software program adoption.

Firm filings

Whereas gross sales, advertising and marketing, finance, accounting and human assets departments of organizations have been fast to embrace expertise, the taxation a part of the enterprise has remained insulated from expertise as a result of inherent challenges to adoption, corresponding to complexity of calculation, jurisdictional features, and many others.

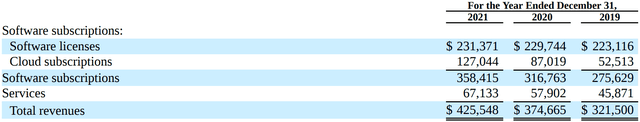

Vertex’s 40 years of operational expertise has helped it productize its providers, and the corporate reviews its income as software program and providers.

Firm filings

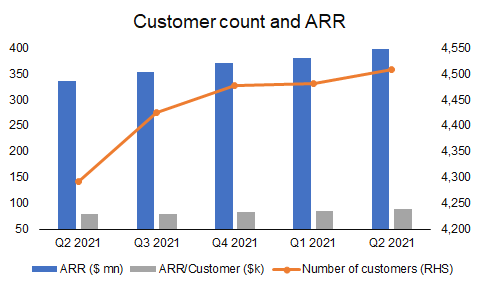

The regular progress in software program income is notable and is accompanied by a rise in ARR.

Firm filings

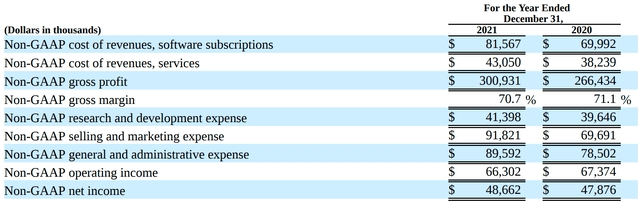

The income progress should be seen at the side of the gross margins, that are 70%+

Firm filings

The software program part of Vertex’s enterprise is significant and interprets into FCF.

Firm filings

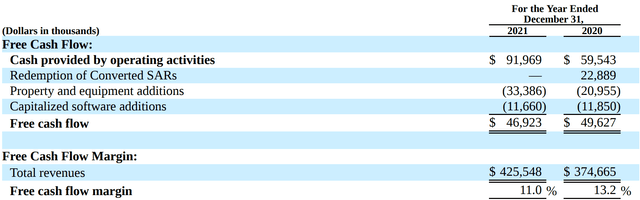

What appears to be like a bit regarding is the weak spot within the FCF margin, which is because of the continued funding. Nevertheless, we discover the income progress and stability in gross margin (at 70%+ ranges) comforting.

Market

Tax is without doubt one of the major income sources for governments throughout. Vertex matches in nicely within the total scheme of issues as a supplier of options to estimate taxes and handle the related documentation. The altering regulatory setting in response to evolving enterprise and expertise landscapes has elevated taxation complexity. The elevated publicity because of the rising geographical presence is additional amplified by firms providing newer services.

Traditionally, over the previous 60 years, it has been proven that oblique taxes present a extra constant technique of presidency funding throughout hostile financial cycles relative to revenue and property tax, that are the opposite major sources of funding. Because of this, oblique tax revenues play a key half within the international economic system and function a major income for governments around the globe.

In truth, authorities income from oblique taxes is greater than double that of revenue tax. And it will solely proceed to extend with increasing necessities for digital commerce and real-time reporting in a rising variety of international locations. All of this places added stress on firms of all sizes and market segments to automate oblique tax compliance to maintain tempo with altering necessities.

Supply: Q2 2022 Earnings name from Looking for Alpha

Vertex’s place as a veteran participant within the {industry} lends the corporate credibility, together with system-level intelligence, that has allowed Vertex to see sustained progress.

Whereas Vertex competes instantly with Thompson Reuters within the enterprise market, the corporate competes with Vista, Avalara and ADP within the mid-market.

Financials

The corporate bolstered its steerage throughout its Q2 2022 earnings launch:

- Income: $479-483 mn

- Adj EBITDA: $72-75 mn

Vertex’s income progress has three triggers:

- Enterprise mannequin transitions: When firms supply newer services, the taxation of latest income requires extra inputs from the tax groups, resulting in enterprise for Vertex.

- Change in regulatory necessities: The rising rules and consequent granularity in audit processes is one other set off for the corporate’s merchandise’ adoption.

- Methods change: A brand new e-commerce system or a brand new ERP system is usually accompanied by a revamp in taxation.

Referenceability (or the power to seek out adoption) is one other issue driving progress in Europe. It’s at all times advisable to go for a tax accountant who has labored on the same task. The identical holds for Vertex’s software program. Particularly in Europe, referenceability for Vertex has been such an important factor that whereas different software program firms have known as out weaknesses in Europe, Vertex has been profitable prospects.

EBITDA weak spot was attributed to the sustained funding in analysis and gross sales in the direction of rising the enterprise. The Vertex administration expects 2022 to be the heaviest yr of funding the place margins backside out.

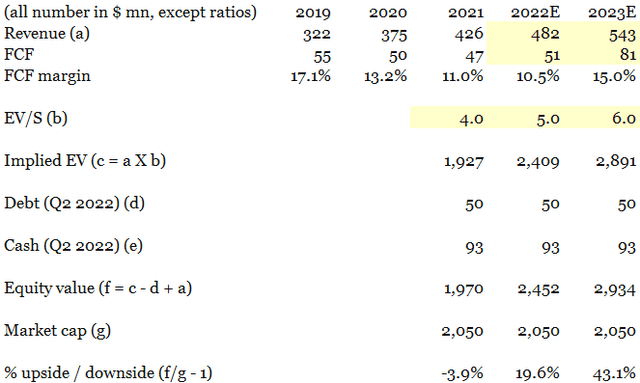

Consensus estimates recommend 2022 and 2023 revenues might be $481.8 and $543.3 million, respectively, implying a compounded annualized progress fee of c.13%.

Rising OCI adoption: Development catalyst

Vertex has been fairly depending on the oblique channel. Whereas it’s arguably extra depending on exterior events, the character of Vertex’s enterprise is such that from a GTM standpoint, it’s simpler to piggyback. That is the second dimension of Vertex referenceability, the place Vertex comes on board utilizing the goodwill of its companions.

Vertex presents pre-built integrations with a number of companions corresponding to Adobe/Magento (ADBE), Coupa (COUP), Microsoft (MSFT) Dynamics, NetSuite, Oracle (ORCL), Salesforce (CRM), SAP (SAP), SAP Ariba, Workday (WDAY), and Zuora (ZUO), and many others.

Moreover, the corporate presents technology-specific options for SAP and Oracle, the place Vertex’s options are deeply built-in inside SAP and Oracle’s expertise stacks. Whereas the dependence on SAP is obvious as a result of Chain Move Accelerator and LCR (SAP-oriented choices from Vertex), the darkish horse is more likely to be Vertex’s integration with Oracle Cloud Infrastructure or OCI.

Oracle has slowly emerged as doubtlessly the fourth main cloud participant behind AWS (AMZN), Microsoft, and Google (GOOG) (GOOGL). Whereas the Larry Ellison firm has had its share of points, its market share in databases has helped it conjure up a $2.8 billion OCI and Cloud@Buyer enterprise which is rising at 50%.

A big a part of the expansion in OCI is more likely to proceed from migrations of legacy on-prem programs to the cloud. Vertex’s stack-level integration with Oracle is anticipated to assist Vertex piggy-ride on Oracle’s progress. In fact, the chance right here is that OCI and autonomous database progress have lengthy been coming and in case of any hiccups, Vertex might not have the ability to obtain the anticipated alpha in progress.

Valuation

Because of the sustained opex and capex investments, whereas the corporate trades at a premium on a P/FCF foundation, the corporate is comparatively underpriced for a SaaS enterprise on an EV/S a number of.

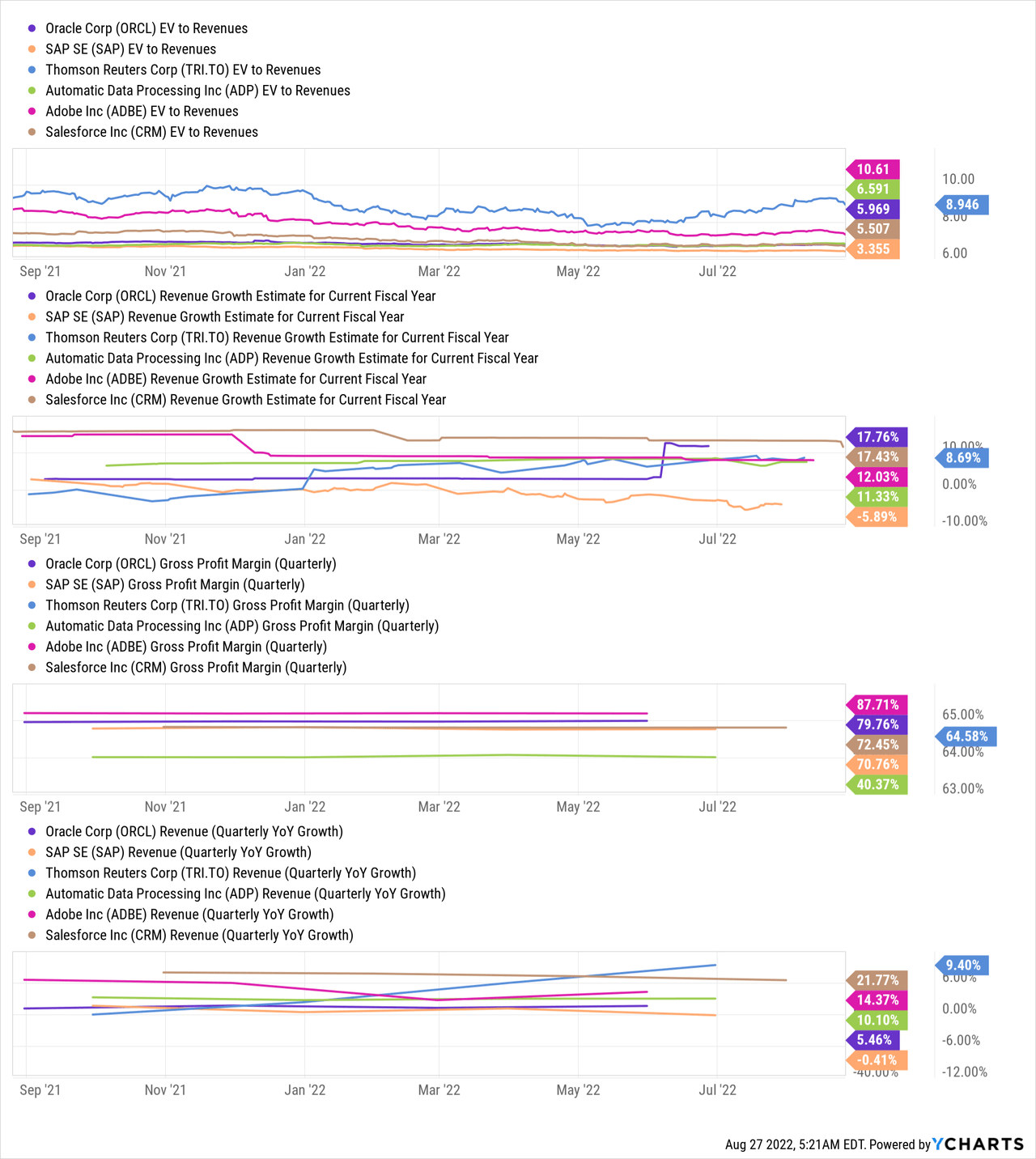

We expect the teenager income progress fee, coupled with a 70% gross margin, makes a compelling case for the corporate to be valued at an EV/S a number of.

We use the Bessemer Enterprise Companions Nasdaq Rising Cloud Index and take a look at the gross margin, FCF margin and income progress versus the EV/Gross sales.

On regressing the income progress, gross margin and FCF margin with the EV/S a number of, we discover the corporate’s EV/S a number of ought to be round 5x.

Regression equation: EV/S = -1.2 + 12.7 X Income Development + 4.7 X Gross Margin + 13.2 X FCF margin

Firm filings, Looking for Alpha, Creator’s Evaluation

Within the base case of EV/S at 5x, the inventory might doubtlessly witness an upside of 20%. Within the extra bullish situation (EV/S of 6x), the inventory might see an upside of 40%; in a more difficult setting (EV/S of 4x), we see a restricted draw back of 4-5%.

Dangers

- Gross sales investments take time to kick, and Vertex’s investments appear to reap dividends as ARR grows. Nevertheless, a delay in working leverage kicking in will defer the anticipated progress in FCF, making the inventory proceed to look costly.

- The expansion in direct purchasers has considerably been muted. Whereas Vertex has benefitted from referenceability and gross sales focus, change within the international macro might erode a few of this profit.

Conclusion

Vertex’s enterprise mannequin resilience stems from the give attention to the tax market. The corporate’s secure progress ought to enable working leverage to kick in, serving to it obtain GAAP profitability. We expect the corporate is buying and selling at a comparatively cheap 4-5x occasions income and might see a pointy up transfer because the enterprise model-led re-rating in multiples occurs.

[ad_2]

Source link