Khaosai Wongnatthakan

Introduction

As a dividend growth investor, I constantly seek investment in income-producing assets. My goal is to supplement the income that my portfolio generates. Most of the time, I add to existing positions that I find attractive. However, I start new positions on other occasions to further diversify my holding. The current volatility may be a decent opportunity to buy the income for less money.

My dividend growth portfolio consists of more than 70 companies. All the holdings are single stocks in companies that increase their FCF over the long term, and almost all pay an increasing dividend. ETFs are mostly overlooked by dividend growth investors, as investors have less control over their portfolios. Yet, sometimes, they can offer an easy solution that suits some investors.

In the past, I was not too fond of using ETFs as a substitute for single stocks. Yet, I understand that smaller portfolios may find it beneficial to gain diversification from the beginning. However, in a previous article, I analyzed Schwab Strategic Trust – Schwab U.S. Dividend Equity ETF (SCHD) and found it attractive to some investors. In this article, I will look into another prominent ETF: Vanguard High Dividend Yield ETF (NYSEARCA:VYM).

Seeking Alpha’s company overview shows that:

Vanguard Whitehall Funds – Vanguard High Dividend Yield ETF is an exchange-traded fund launched and managed by The Vanguard Group. It invests in public equity markets in the United States. The fund invests in growth and value stocks of companies across diversified market capitalization and sectors. The fund invests in dividend-paying stocks of companies, seeking to track the performance of the FTSE High Dividend Yield Index.

Fundamentals

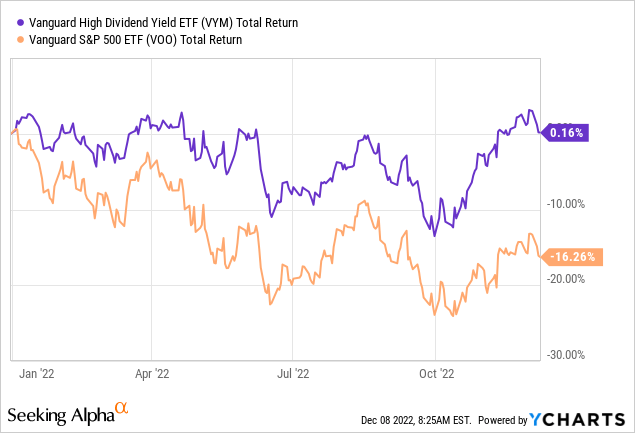

The Vanguard High Dividend Yield ETF is an excellent investment. It started trading in 2006. Therefore, it has a track record that covers the 2008 financial crisis. The fund holds 445 stocks in different sectors, which means investors have significant diversification. The fund’s current dividend yield is almost 3% using the distributions in the trailing twelve months. The dividend grew at 9% annually over the last decade. The growth came with less volatility, and as the graph below shows, the ETF is breaking even year to date, unlike the S&P 500 (VOO), which is down 16%.

The ETF has a track record of 12 years of dividend increases. Since 2010, the distribution has grown every year. However, during the financial crisis of 2008, the companies in the ETF lowered their dividend. Thus, the payments were lower. Therefore, investors should take into account that not every company held is a dividend aristocrat, so the dividend, while growing in the long term, may be somewhat volatile when the business environment is harsh. It is similar to what we see with an investment in the S&P 500.

The ETF grows its dividend erratically and pays every quarter the accumulated dividends. Over the last twelve months, the dividend increased by 7%, which is almost in line with inflation. Therefore, the ETF outperformed the index, and the income almost didn’t erode. Over the last decade, the dividend increased by 9% annually, which means that investors got real income increases that were much higher than the inflation over that decade.

The ETF follows the FTSE High Dividend Yield Index and invests in almost 450 stocks across different sectors and industries. The largest sectors are the financial sector (20% of the assets), healthcare (16% of the assets), and consumer staples (14% of the assets). Therefore, investors can gain with $110 an exposure to a diversified portfolio that requires almost no maintenance.

Pros

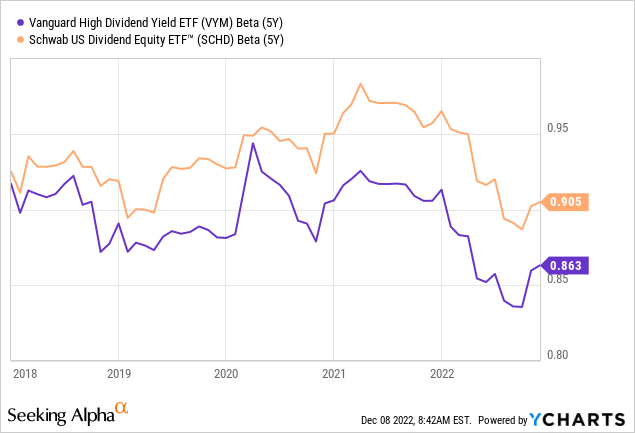

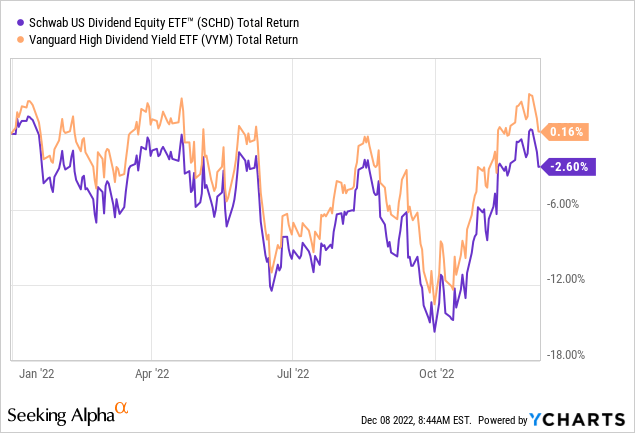

The Vanguard High Dividend Yield ETF is a highly stable investment. It is true not only when comparing to the S&P 500 but also to Schwab U.S. Dividend Equity ETF. Vanguard’s ETF offers a significantly lower beta compared to its peer. Therefore, during these volatile times, it has outperformed its peer. While SCHD had a negative total return in 2022, VYM managed to beat it as it offered a positive return.

Vanguard High Dividend Yield ETF has another advantage over Schwab U.S. Dividend Equity ETF, and that’s the longer track record. SCHD has a decent track record of more than ten years. However, the ETF never had to deal with a significant market downturn like the one we saw in 2008. VYM, on the other hand, has a longer track record, and investors can see that it performed well during the 2008 recession.

Another advantage of the Vanguard ETF over its Schwab peer is that it is more diversified. The Vanguard ETF invests in 445 compared to the 103 companies in which the Schwab ETF invests. Diversification helps to lower the beta, and it is one of the reasons why the VYM is less volatile. It means that Vanguard offers an exposure that is more fragmented than Schwab.

Cons

The ETF’s name may be a little bit misleading. The fund’s name is Vanguard High Dividend Yield ETF. However, the current dividend yield is 2.93%. That is not what most investors call a high yield, especially in the current business environment when 10-year Treasury yields more. The yield is still lower when comparing the ETF to Schwab U.S. Dividend Equity ETF, as SCHD offers a dividend yield of 3.4%.

While Vanguard High Dividend Yield ETF offers a lower yield than Schwab U.S. Dividend Equity ETF, it also provides slower dividend growth. Over the last five years, VYM increased its payments by 7% annually compared to 12% of SCHD. The faster growth is the result of the stocks in the indices. SCHD has higher exposure to companies that offer high dividend growth, like Amgen (AMGN) and Broadcom (AVGO).

Another risk for investors in Vanguard High Dividend Yield ETF is its exposure to the energy and basic materials sectors. The ETF has a 15% exposure to these two sectors. On the other hand, Schwab U.S. Dividend Equity ETF has a 7.5% exposure. During 2022, it paid off for VYM as inflation was high due to the increase in the prices of commodities. However, during a recession, the demand may decrease, and this high exposure may drag VYM compared to SCHD.

Conclusions

I love both ETFs, and I believe both have room in the portfolios of conservative investors who prefer a low-maintenance option. These investors may be investing in both ETFs as they hold blue chip companies with limited risks and provide investors with a growing income. Therefore, as both are defensive during this volatile era, they are both BUY.

If I have to choose between the two, I prefer Schwab U.S. Dividend Equity ETF. Despite the higher volatility, I like the higher yield and the higher dividend growth. The reason is that I invest for the long run, so volatility doesn’t play a significant role in my investment decisions. Investors with a shorter investment period may prefer Vanguard for that exact reason.