naphtalina/iStock by way of Getty Pictures

My View: Market Is Costly, Even Worth

Over the previous 12 months I’ve written numerous articles for Searching for Alpha about market and particular person fairness valuations. The final theme: Market is dear.

Immediately’s write-up builds off these previous articles:

- ‘Epic Bubble’ 3.0 – Placing 70 Worth Shares Below the Valuation Microscope, February 2021

- Time to De-Threat, July 2021

- Time To De-Threat 2.0: Not Time to Be Daring, Correction Creates Alternatives, Might 2022

Worth Funds Outperforming However Not Low cost

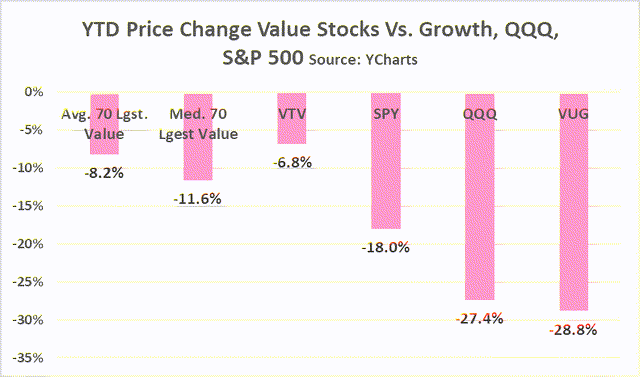

Giant Cap Worth funds have outperformed the market as this chart exhibits. Nevertheless, value change year-to-day (Might 20) is -8.2% for the Vanguard Worth ETF (VTV).

In distinction, the Vanguard Development ETF (VUG) and the SPDR S&P 500 Belief ETF (SPY) are down 29% and 27%, respectively.

Value Change YTD (Ycharts)

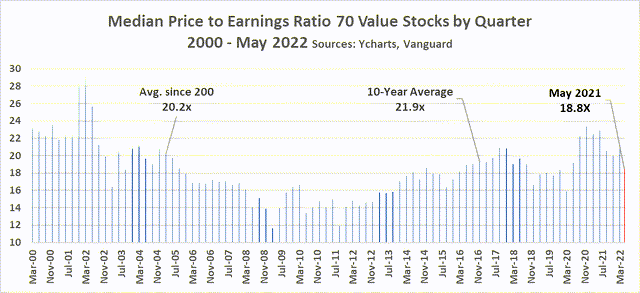

The histogram under exhibits the median quarterly PE for the 70 largest corporations within the Vanguard Worth ETF from 2000 to Might 2022. The present median PE is favorable to each the ten-year common PE in addition to the typical since 2000.

Whereas 18.8x median PE is favorable to historical past, the present PE just isn’t low cost and never signaling a “purchase” given financial uncertainty.

PE Historical past Giant Cap Worth (Ycharts, Vanguard)

Not A Market Timer

At any time when I write articles about market valuations, I invariably hear a refrain of warnings from buyers to “not time the market.”

I agree.

But, market turmoil creates a time for tweaks.

I’m a buy-and-hold investor with a large-cap Worth tilt. My present portfolios embrace 29 of the Vanguard Worth ETF’s largest 70 holdings.

My prime ten Worth holdings are in corporations owned for greater than a decade. These are: Exxon Mobil Company (XOM), Johnson & Johnson (JNJ), The Procter & Gamble Firm (PG), CVS Well being Company (CVS), Walmart Inc. (WMT), BlackRock Inc. (BLK), PepsiCo, Inc. (PEP), Berkshire Hathaway Inc. (BRK.B), Abbott Laboratories (ABT), and Cisco Techniques, Inc. (CSCO).

Knowledge Search: Wanting For Worth, Security, Dividends From Giant-Cap Worth

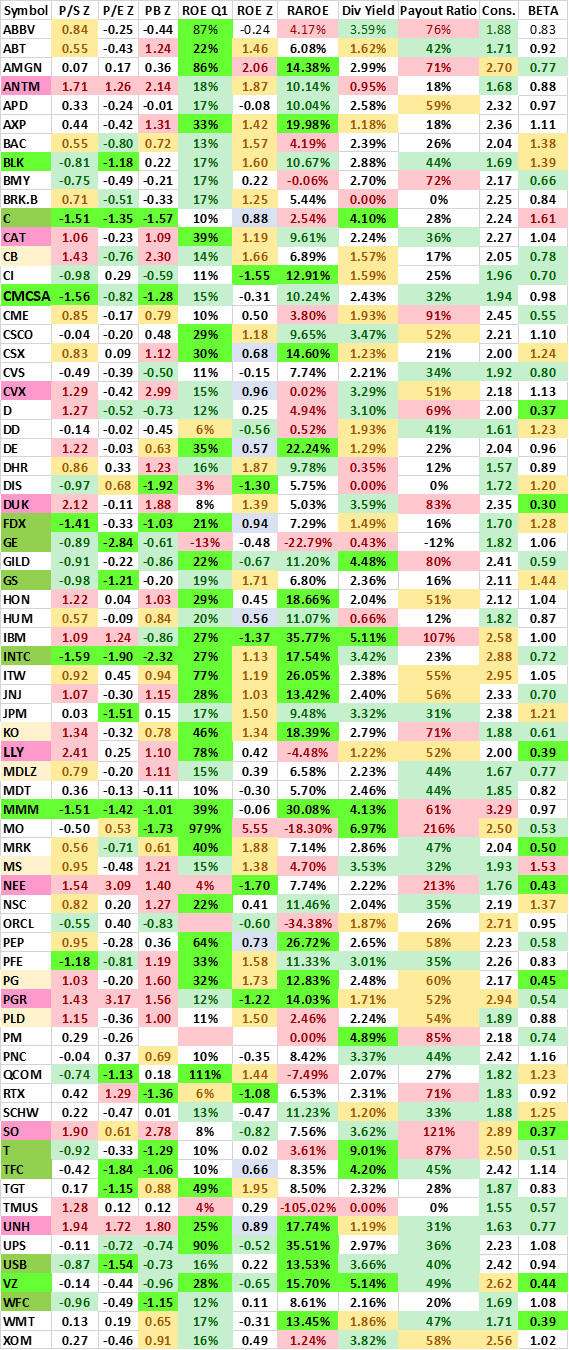

The Warmth Map desk under exhibits my favourite information for the 70 largest Vanguard Worth holdings.

There are ten columns along with the primary column which exhibits symbols.

- PS (Value to Gross sales) Z = z-score for present PS in comparison with ten-year P/S.

- PE (Value to Earnings) Z = z-score for present PE in comparison with ten-year P/E.

- PB (Value to Ebook) Z = z-score for present PB in comparison with ten-year P/B.

- ROE Q1 = Most up-to-date Return on Fairness

- ROE Z = Most up-to-date ROE to ten-year ROE.

- RAROE = Ten-year common ROE minus the usual deviation of ten-year ROE

- Div. Yield = Might 20 dividend yield TTM.

- Payout Ratio = Most up-to-date dividend payout ratio.

- Cons. = Consensus analyst Purchase/Maintain/Promote score.

- Beta = ten-year Beta.

Shade coding is subjective. Brilliant inexperienced displays statistically vital constructive variance. Gentle inexperienced = constructive variance. Yellow = average variance. Pink = vital unfavourable variance.

Warmth Map (Ycharts)

Value Change YTD

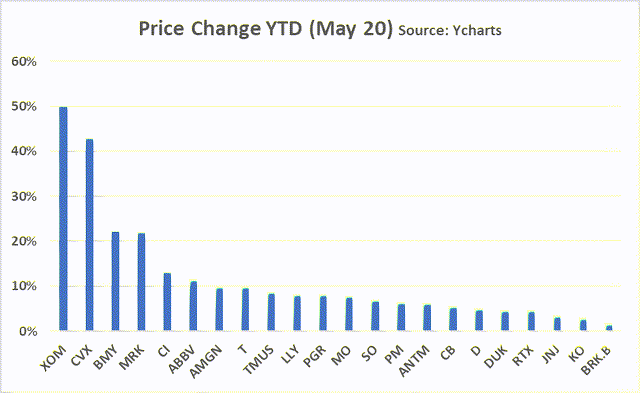

The chart under exhibits the YTD value change for the 22 large-cap Worth corporations exhibiting share value appreciation in 2022.

Vitality, Prescription drugs, Tobacco, and Public Utilities are the massive drivers of the relative outperformance of large-cap Worth YTD. Listed here are the massive cap Worth corporations with constructive inventory value change this 12 months.

Share Value Change YTD (Ycharts)

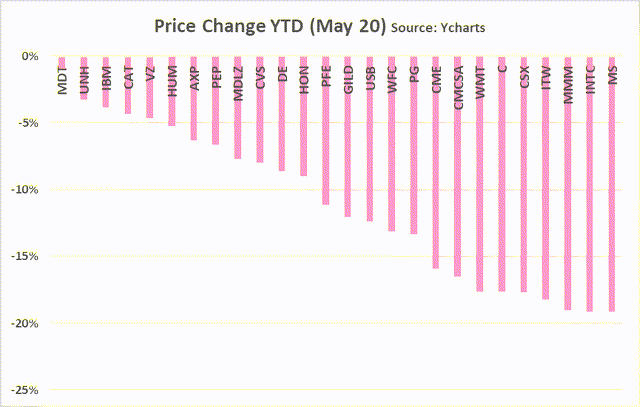

The subsequent chart exhibits the YTD value change for the 26 large-cap Worth corporations with value adjustments starting from -2% to -19%. Banks, Information Expertise, and Industrials are among the many decliners.

Share Value Change YTD (Ycharts)

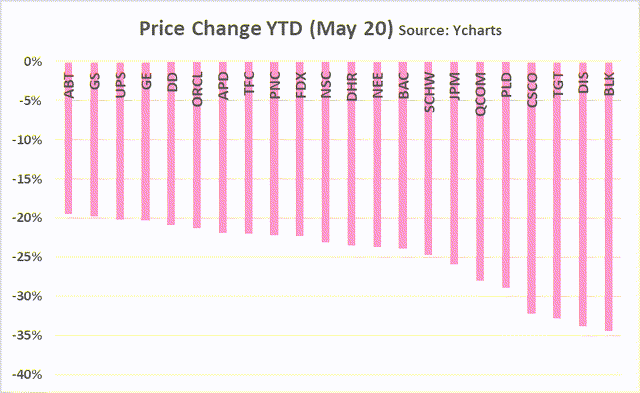

Listed here are the worst performing large-cap Worth corporations YTD, all with whole returns worse than -20%.

Share Value Change YTD (Ycharts)

Motion Plan

My present plan is to build up shares within the 4 corporations famous in brilliant inexperienced:

- BlackRock

- Comcast Company (CMCSA)

- 3M Firm (MMM)

- Verizon Communications Inc. (VZ)

Here’s a thumbnail sketch of key information, observations, and dangers related to every:

BlackRock (Including to present place. Dividend reinvesting.)

- CFRA (S&P) High quality Ranking: A

- PE, PS, PB: statistically favorable to historical past.

- Wonderful long-term ROE.

- Div. Yield: 2.88% TTM, 3.25% ahead. Quarterly dividend ($4.88) up 18% Y/Y.

- Share Buybacks: Shares O/S 151.5 million April 2022 vs. 155.2 million YE 2019.

- CFRA income forecast progress of 8-12% in 2022 with margin forecast consistent with 2021.

- YTD value change is -34%, the worst performer among the many 70 large-cap Worth.

- Web influx of $11.48 billion in Q1.

- Fan of their unleveraged closed-end funds.

- Seven of the final ten Searching for Alpha articles on BlackRock are Buys (three Holds). This Maintain suggestion article says that $476 is the “value to think about shopping for BlackRock.”

- Negatives/Dangers:

- Sturdy Consensus: 1.69. Merrill, CFRA, Morningstar every have BUY score with common 12-month goal value of $917 (present value $600), indicating 52% potential upside.

- Merrill just lately lowered EPS estimates due to “barely softer-than-expected core earnings” and have to put money into expertise and know-how.

- Morningstar worries about BlackRock’s “sheer measurement and scale” as “obstacle to… progress.”

- S&P notes that shrinking fairness and bond valuations will cut back AUM.

Comcast (New place)

- Seven of the final ten Searching for Alpha articles present Comcast as a Purchase or Sturdy Purchase (three Holds). Right here is the latest.

- CFRA High quality Ranking: A

- Reasonably Sturdy Consensus: 1.94. Purchase rankings from CFRA, Morningstar. Merrill: Impartial. Common 12-month goal value of $55 (present value $42), indicating 31% potential upside.

- PE statistically favorable to historical past.

- Div. Yield: 2.43% TTM, 2.57% ahead. Quarterly dividend ($.27) elevated 8% in January.

- Share Buybacks: Shares O/S 4.48 billion April 2022 vs. 4.55 billion YE 2019. January 2022 introduced $10 billion buyback.

- S&P income forecast progress of three.8% in 2022 with EBITDA forecast in line barely favorable to 2021.

- YTD value change is -16.5%.

- Negatives/Dangers

- Regulatory.

- Growing broadband competitors.

- Theme parks pandemic.

- Popularity for poor customer support (important purpose I’ve not owned in previous).

- Debt so excessive that acquisitions unlikely at the same time as market valuations of enticing acquisition candidates decline.

3M (Including to present small place. Dividend reinvesting. Contrarian name.)

- Eight of the final ten Searching for Alpha articles on 3M are Buys (two Holds). This Might 22 article calls 3M a “dividend dream inventory.”

- CFRA High quality Ranking: A

- PE, PS, PB: statistically favorable to historical past.

- Div. Yield: 4.13% TTM, 4.14% ahead. Quarterly dividend ($1.49) elevated <1% ($.01) in February.

- Extremely diversified industrial agency.

- Shares Excellent: Shares O/S 569 million April 2022 vs. 575 million YE 2019.

- YTD value change is -19%.

- Negatives/Dangers

- Leveraged to financial system.

- Litigation threat is excessive.

- Weak Consensus: 3.29. Purchase rankings from Morningstar. Merrill: Promote. Common 12-month goal value for 21 analysts is $161.17 (vary $140 to $207) (present value $143.82), indicating 12% potential upside.

- Dividend yield and dividend progress fee anemic, reflecting financial uncertainty and litigation threat.

- Payout ratio excessive: 61%.

- Income progress flat regardless of nominal GDP within the US

- Inflation hurting margins as price of gross sales up 7% Y/Y.

Verizon (Including to present moderate-sized place.)

- The final eight Searching for Alpha articles on Verizon present seven Buys and one Sturdy Purchase.

- CFRA High quality Ranking: B (I want A+, A, A-, with a small publicity to B+ and even smaller to B.)

- Low Beta (.44).

- Constant, enticing ROE that exceeds price of capital.

- Div. Yield: 5.14% TTM, 5.17% ahead. Quarterly dividend ($.64) elevated solely 2% ($.0125) in Sept. 2021.

- Shares Excellent: Shares O/S 4.20 billion April 2022 vs. 4.16 billion YE 2019.

- YTD value change is -5%

- Use their merchandise and see share possession as dividends as inflation hedge.

- Main community availability, sturdy funding in 5G, scale, effectivity.

- Largest buyer base within the US.

- Negatives/Dangers

- Berkshire Hathaway exit of Verizon in Q1 signifies Buffett just isn’t a believer.

- Consensus reasonably weak at 2.62. CFRA has promote. Merrill and Morningstar: Purchase. Consensus 12-month value $58.35 (present value $49.53), indicating 18% upside.

- Income progress not protecting tempo with inflation.

- Largest buyer base within the US, slowing wi-fi progress reflecting intense retail competitors.

- Leveraged to financial system prone to recession.

- Debt overhang.

Funding Share Buy With Three Gross sales

Over the previous six weeks, I’ve bought shares in three long-held positions: Oracle Company (ORCL), The Walt Disney Company (DIS), and The Southern Firm (SO).

Oracle (promoting shares)

- Share buybacks have fueled sturdy inventory value appreciation: 2.67 billion March 2022 versus 3.21 billion YE 2019.

- Reasonably weak consensus.

- Income sluggish progress, margins narrowing.

- Weak dividend, weak dividend progress.

Disney (promoting shares)

- Sturdy consensus at 1.72.

- No dividend: ought to have bought when Disney eradicated dividend.

- Considerations about management.

- Considerations about mission/goal confusion.

- Considerations that firm just isn’t shareholder pleasant.

Southern (promoting short-dated calls)

- Stellar performer as have all utilities.

- Been a terrific trip, however utilities relative efficiency out-of-line with historical past.

- PE, PS, PB statistically unfavorable to historical past as is case with Duke Vitality Company (DUK) which I just lately exited.

- Present dividend yield at 20+ 12 months low.

Closing Remark: Not Going Hog Wild

Gradual-and-steady wins the race.

I like dividends from prime quality corporations.

Present acquisition plan:

- Verizon: Highest precedence for brand new share purchases. Have bought June 3 Places ($48) at $1.20. Will promote extra Places over time on weak spot with intention of including shares to present place. Goes x-dividend in early July.

- BlackRock: 2nd highest precedence for share purchases. Will purchase new shares over time. $600 enticing value for long-term maintain. X-dividend early June. Reinvesting shares.

- Comcast: Average purchaser at $42. No rush to purchase so will begin sluggish. X-dividend early July.

- MMM: Cautious. Will add small place (+10% to present holdings) this week if value falls <$140. Went x-dividend Might 19. Reinvesting shares.

Caveat

Buyers want to know targets and urge for food for threat. Having a perspective on market valuations is only one ingredient of an investor’s threat urge for food.

My Threat Profile is such that I’m not making an attempt to beat the market. Capital preservation is essential. I’m prepared to commerce excessive facet alternative for low facet safety.

Diversification is my finest safety in opposition to out-sized threat, but it surely doesn’t present excellent safety in opposition to worldwide fairness weak spot.

My “home rule” is that nobody particular person fairness ought to characterize greater than 4-5% of my investable belongings. Sure, I do know that’s conservative.

My long-held view is that buy-and-hold, and dividend reinvestment, are sound means to constructing and defending significant wealth over time. Zigging out and in of the market takes distinctive talent.

Buyers have to do their very own due diligence earlier than investing.