Drazen_

Elementary 10-Step Evaluation Of United Leases Well being & Valuation

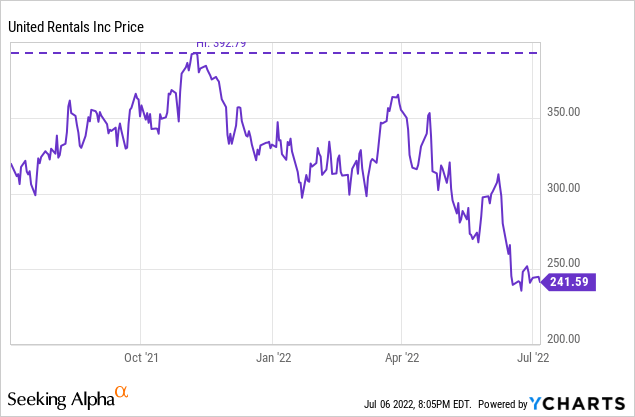

It has been one 12 months since we final checked out United Leases, Inc. (NYSE:URI), which, on the time, was sitting at $304 per share in early July 2021. Having surged over 100% from the prior twelve months in 2021, the valuation and fundamentals nonetheless regarded interesting – and now the practically $22B market cap has declined to a $17.3B market cap. Is the pullback in step with total market weak point in 2022 or has there been a change within the fundamentals that warrant concern with the fairness? Let’s check out the present share value’s justification by valuation metrics and the basics over the previous 5 years.

With a $17.3B market cap as of July 6, 2022, United Leases sits simply over 38.5% off from its 52-week excessive of $392.79 – and is simply barely above its 52-week low at $241.59 at current. Administration, together with CEO Matthew Flannery, believes 2022 will present document demand for United Leases even regardless of considerations of a weakening economic system, and with a depressed share value, that is an interesting entry level at current. Let’s dig deeper.

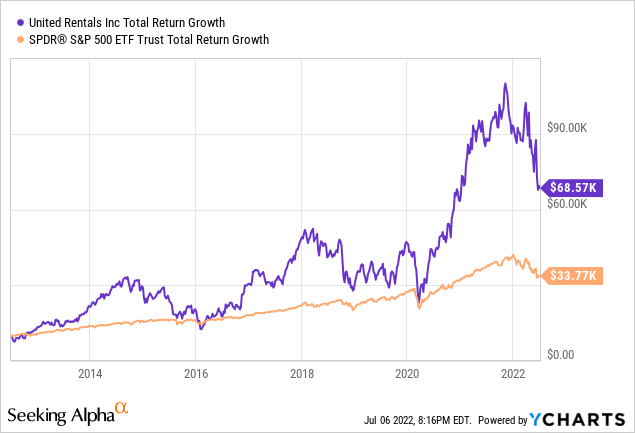

Because the graph under exhibits, buyers in United Leases have far exceeded the S&P 500 during the last 10 years even with the newest cool-off factored in, when accounting for value progress of $10,000. In truth, URI has greater than doubled the return, albeit with a a lot rockier experience as can be anticipated from a cyclical industrial. Does United Leases have the financial setup required for a protracted restoration ahead? Let’s have a look.

Utilizing a 10-Step Elementary Evaluation detailed additional right here, I’ll look at 10 necessary elements of United Leases and the way the corporate measures up on every metric, both assigning a 1/1, 0.5/1, or a 0/1 for every of the ten elements.

Income & Revenue Rising at Spectacular Charges, With Administration & Analysts Anticipating Continued Progress

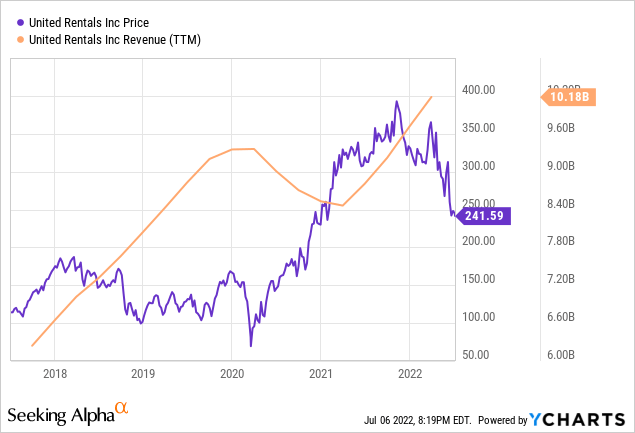

trailing 12-month numbers as of March 31, 2022, for working income over the previous 5 years, United Leases has elevated from $5.808B to $10.18B – representing an 11.86% CAGR. This income enhance has come from a wave of trade modifications that profit United Leases considerably – contractors and development corporations not personal gear in as nice of amount as earlier than and now discover it extra advantageous to hire gear for his or her jobs. This issue is an enormous profit to United Leases. In truth, the CEO particularly famous this issue with backhoes and different giant gear items within the April 2022 convention name.

What’s extra, as a result of vital quantity of share buyback exercise over the 5-year interval, on a per-share foundation the income will increase are much more dramatic – from $68.72/share in Q12017 to a staggering $142.15/share in Q12022: representing a formidable 15.65% CAGR in income over the 5-year stanza. That is the impact of share buybacks and the way they’ll even additional improve progress for the investor.

Wanting barely ahead, administration is guiding towards $11.1B to $11.5B for fiscal 2022 (Supply), which is up 16% from the $9.72B in fiscal 2021 – a rise from the previous 5 years of practically 12% compounded progress in revenues.

Income Progress: $5.808B -> $10.18B over 5 years / 11.86% CAGR with Spectacular 15.65% CAGR/share |

I’ve the utmost confidence in revenues going ahead and administration has steered the corporate impressively over the previous 5 years to double-digit compounded progress. Do not forget that the multibillion-dollar Infrastructure Funding and Jobs Acts (IIJA) shall be a serious catalyst starting in 2023, no matter any financial headwinds. Rating: 1/1

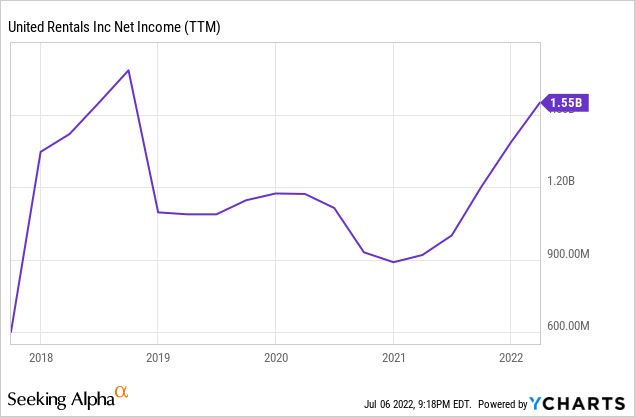

Internet earnings over the previous 5 years has grown from $583MM to $1.55B on a trailing twelve-month foundation representing an enormous 21.6% CAGR throughout the interval. This was achieved in two ways in which present not solely administration’s competence in rising the enterprise but additionally administration’s talent in working the enterprise effectively: first income progress got here in at practically 12% compounded throughout the 5-year interval after which bottom-line margins elevated from 10% in 2017 to over 15% within the trailing twelve months of 1st quarter 2022.

Whereas I think about free money circulate to be a extra measured and significant measure of well being, there’s nonetheless that means to be discovered within the earnings knowledge. The underside line earnings margin is particularly spectacular when contemplating the toll depreciation takes on earnings in a enterprise beset by excessive capital expenditures with gear.

On a per-share foundation over 5 years taking into consideration buybacks, earnings went from $6.90/share to $21.64/share, or a 25.68% CAGR throughout the interval. That is unbelievably spectacular and alone speaks extremely of administration’s capacity to not solely develop the enterprise but additionally shrink the share rely even in a enterprise that requires vital reinvestment into gear.

Revenue Progress: $583MM -> $1.55B over 5 years, 21.6% CAGR / Over 25% CAGR Per Share – Unbelievable! |

Once more, whereas I worth the impacts of free money circulate greater than GAAP earnings, there’s significance to this metric, and United Leases completely knocks it out of the park with margin growth and the flexibility to convey extra right down to the underside line for shareholders. Rating: 1/1

Stability Sheet Experiences Slight Bump in The Highway Gearing Up For Continued Progress

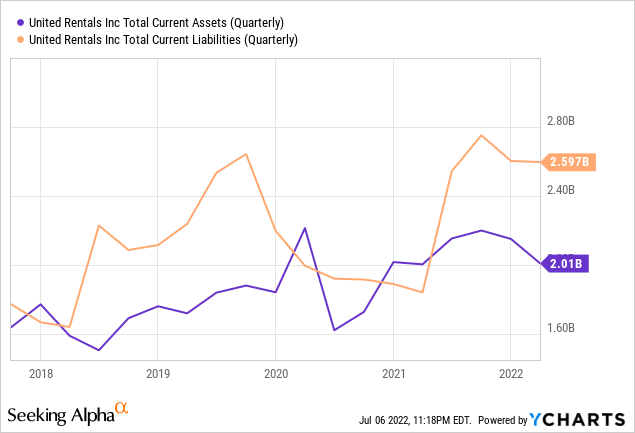

An necessary consider figuring out liquidity, United Leases, as a result of trade it operates in, has struggled to maintain present belongings above present liabilities for a few years and has let present liabilities balloon in the direction of their highest stage ever because the enterprise continues to develop quickly. Whereas this is not best, there are some industries the place the imbalance is extra regular and this trade of heavy gear purchases is one the place that is pretty normal.

Belongings vs. Liabilities: $2.01B present belongings v. $2.597B present liabilities / Not best, but additionally not sudden |

An anticipated, although not best scenario that doesn’t seem to massively hurt the corporate’s stability sheet. Rating: 0.5/1

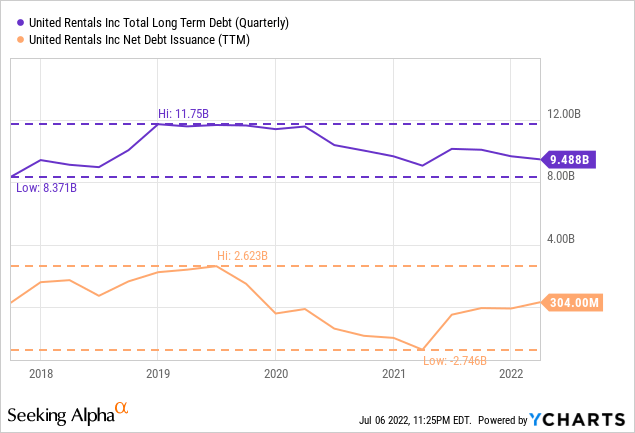

Once we final regarded on the debt scenario at United Leases one 12 months in the past, the scenario was very optimistic – let’s re-visit.

One of many greatest components representing administration’s robust concentrate on long run well being of the enterprise is the debt discount that has taken place previously 12 months. As of March 31, 2021 — United Leases complete long run debt stands at $9.082B, representing a virtually 23% discount from the debt highs of early 2020. United Leases has paid off practically $2.7B in debt in simply over 1 12 months, resulting in a a lot stronger stability sheet and decreased monetary leverage. — June 11, 2021 (Supply)

Sadly, this progress has not continued with gusto and has truly reversed with roughly $460MM extra long-term debt than one 12 months in the past representing web debt issuance throughout the 12 months. Whereas nowhere close to the debt issuance of mid-2019 at over $2.5B, it nonetheless represents a shift in progress and a reversion in the direction of issuing debt in a time when rates of interest are considerably larger than any level within the final 10 years, which can develop into a drag on web earnings. To be clear, nonetheless, the shift is small comparatively talking in comparison with total market capitalization + debt ratios and is probably going administration ramping up in the direction of anticipated progress and getting ready for alternatives.

Lengthy Time period Debt: Growing, However Nonetheless Extra Than Manageable With Regards to Debt Ratios |

Whereas I clearly would like to see debt discount persevering with to progress uninterrupted, particularly throughout larger rate of interest environments, progress is just not at all times a straight-line and administration is ramping up capital spending from a traditionally weak 2020 spending cycle (solely $4.16/share capital spending). That is the qualitative reasoning of investing – realizing the that means behind the numbers and why they’re occurring. Rating: 1/1

Nice Return On Capital Coupled With Robust Share Decreases = Lengthy Time period Successful Method for United Leases

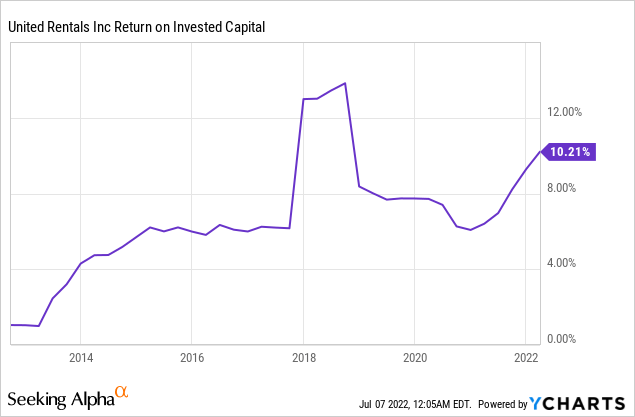

After noting the slight enhance of long-term debt just lately for United Leases, it appears a super alternative to look at administration’s returns from the capital invested again into the enterprise to see how this capital is being allotted – responsibly or in any other case. Return on invested capital is among the most dependable measures of an engaged and educated administration crew – how they make investments and allocate capital into the enterprise. The typical of all S&P 500 firms is roughly 7%. bettering upon the S&P’s common and in the direction of firms deploying capital into high-quality investments, I search for companies incomes greater than 10% return on invested capital.

Return on invested capital is a monetary metric favored by Charlie Munger, stating “It is apparent that if an organization generates excessive returns on capital and reinvests at excessive returns, it is going to do effectively.” (Supply). With a ten.21% return on invested capital at current, United Leases administration is deploying capital at charges above the market common. YCharts does present a slight discrepancy from ValueLine, which pegs the values as famous under at 12.2% for 2021, and projected larger for fiscal 2022 & 2023 at 14.5%.

ValueLine

This return on invested capital within the low-to-mid teenagers relying on supply is definitely above common, however is especially spectacular when contemplating simply how a lot capital is required to be spent on this trade of apparatus leases (over $2B in fiscal 2021 alone) – that is how practically 90% of revenues are earned is thru the rental of capital gear. Due to this fact, this determine of return on invested capital ought to seemingly mirror returns over time.

Funding Returns: 10.2%-14.5% ROIC avg. at current – Nice General, Notably in This Trade |

An necessary metric scores effectively for United Leases, particularly in such a capital-intensive trade. Rating: 1/1

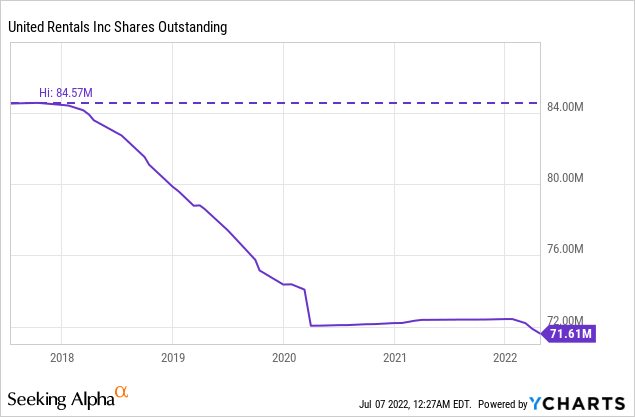

That is the one place on a chart the place seeing a precipitous decline ought to convey an investor full pleasure – the shares excellent. United Leases has managed to lower the shares of the corporate from 84.5MM at first of 2018 to 72MM by Q12020 simply earlier than the pandemic – a virtually 15% lower in simply over 2 years. Now, after rather less than 2 years of capital preservation and re-investment within the enterprise, the buybacks are starting once more with vigor. We noticed how this complete lower in share rely boosted per-share income and earnings figures, resulting in a compounding impact internally that results in larger share costs over time. With no dividend, share buybacks and capital reinvestment are the 2 elements of accelerating share value for shareholder return United Leases affords.

Buybacks: 84.57MM -> 71.61MM shares over 5 years, 15.3% discount total / Exceptional Progress |

Whereas repurchasing was halted for two years throughout the pandemic, the aggressive share buybacks did wonders for per share progress when it comes to all metrics. 15% is a really robust determine that seems to be re-starting, hopefully with vigor. Rating: 1/1

United Leases has by no means offered shareholders with a dividend, preferring to make the most of free money circulate in the direction of share buybacks, firm acquisitions, and re-investing in capital expenditures to gas additional progress and growth. This pro-shareholder selection by administration allowed most flexibility throughout the pandemic, versus shedding investor confidence by suspending a dividend. I additionally personally imagine {that a} lack of a dividend tends to encourage extra long-term holders of the enterprise, as shareholders have a tendency to understand the inner “snowball” compounding impact.

Dividend: $0 dividend annual, 0% yield / Allowed Nice Flexibility Throughout Pandemic & Most Buyback |

Rating: 1/1

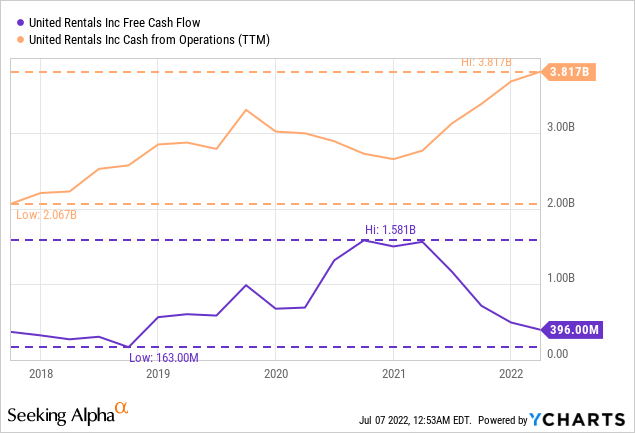

Very Robust Free Money Stream Will increase Sign Stability In The Future

From the standpoint of an organization’s operational energy and long-term stability, free money circulate represents a really significant metric and the first issue I look in the direction of when making a valuation metric and measuring long-term stability and progress. Fairly merely – this issue is of nice significance. On this trade specifically nonetheless, it is very important observe two distinctive components that play an necessary position in money circulate as effectively:

1) Usually free money circulate is calculated utilizing money from operations minus capital expenditures, however within the case of United Leases, utilizing money from operations minus NET capital expenditures (purchases much less inclinations or gross sales of property plant and gear or PPE) makes better sense on account of the truth that United Leases is regularly upgrading gear and promoting off outdated gear within the course of. I shall be utilizing NET capital expenditures in calculating free money circulate which isn’t mirrored within the “free money circulate” chart above, and

2) United Leases is ramping up purchases considerably in an effort to proceed growth and progress, which eats into free money circulate as a matter of capital expenditures into property, plant and gear. In an effort to present the well being of the enterprise from a money standpoint, I additionally wish to spotlight money from operations to point out how a lot money circulate the enterprise has to position in the direction of new gear & upgraded gear, in addition to money circulate for buybacks. In the end the money from operations is the impetus behind each of those facets which function the 2 major makes use of for money for the enterprise.

#1 Free Money Stream: This calculation of free money circulate contains web PPE, and has been rising slower than income and earnings as a result of fixed reinvestment required for progress. Wanting on the previous 5 years on a trailing twelve month foundation, United Leases has grown free money circulate from $1B in 2017 to $1.336B in 2022, at a roughly 6% CAGR. This was decrease than I anticipated upon first calculation, however is smart with the heavy reinvestment required to develop. In contrast to with different companies, the entire progress funding comes at a direct hit to free money circulate within the gear rental enterprise. On a per-share foundation, on account of share re-purchases, the numbers are enhanced: $11.83/share in 2017 to $18.66/share in 2022, or a 9.5% CAGR – a lot better!

#2 Money From Operations: This calculation exhibits the uncooked capacity for the corporate to funding in PPE and buyback shares. Wanting on the previous 5 years on a trailing twelve month foundation, United Leases has grown money from operations from $1.959B in 2017 to $3.817B in 2022, at a roughly 14.3% CAGR close to double. On a per-share foundation, on account of share re-purchases, the numbers are once more enhanced: $23.18/share in 2017 to $53.30/share in 2022, or a 18.1% CAGR. This inner compounding is actually unimaginable and permits for future progress, growth, and share buybacks.

That double in free money circulate translated properly into share value – 5 years in the past the shares had been at $112, right this moment they’re at $241 – a double. Take a look at that, the market is predicated on fundamentals generally.

Money Stream: $1B -> $1.336B in 5 yr & Money From Operations at 18% CAGR Over 5 Yrs Extra Than Double |

Over the previous 5 years, the money from operations on a per-share foundation assisted enormously by buybacks result in greater than a double within the share value. Rating: 1/1

Now for the element of valuation with reference to United Leases: Let’s take a look at a couple of strategies, earnings, free money circulate, and money from operations.

United Leases, primarily based on the $17.3B market cap, is promoting for 12.72 occasions free money circulate for the trailing twelve months – representing a 7.86% preliminary fee of return primarily based on free money circulate with a 6% CAGR free money circulate progress over the previous 5 years.

United Leases, primarily based on the $17.3B market cap, is promoting for 11.16 occasions earnings for the trailing twelve months – representing a 8.96% preliminary fee of return primarily based on earnings with a 21.6% CAGR earnings progress over the previous 5 years.

United Leases, primarily based on the $17.3B market cap, is promoting for 4.53 occasions money from operations for the trailing twelve months – representing a 22.07% preliminary fee of return primarily based on money from operations with a 14.3% CAGR money from operations progress over the previous 5 years.

By my normal metrics of in search of progress firms promoting for underneath 20 occasions free money circulate, the valuation of United Leases could be very interesting from all three facets famous above.

Valuation: 12.72x FCF; 11.16x Earnings; 8-9% implied preliminary return w/6% CAGR FCF and 21% CAGR Earnings |

Very interesting valuation on all three facets, with the free money circulate and earnings being extra closely weighted to the aggressive purchases required for upkeep, but additionally progress. Rating: 1/1

General United Leases Recap & Valuation

all of those metrics and making assumptions primarily based on the longer term is the important thing to creating assumptions on future returns and progress. We all know that administration is projecting double digit income will increase within the subsequent 12 months and we all know that the Infrastructure Invoice will spur continued progress in 2023 and past, in addition to the trade traits in development in the direction of leases and leases and never purchases. Let’s take a collection of assumptions primarily based on earnings over a 5 12 months interval:

– 14.5% annual compounded earnings will increase (under the current 5-year progress of 21%)

– 4% annual share rely discount (larger than the common 5 12 months fee, however keep in mind share buybacks did not happen for two years+ as a result of pandemic)

– 11.2 occasions earnings terminal a number of (precisely the place we’re proper now – no margin compression or growth)

What does this give buyers when it comes to returns over the following 5 years?

Roughly a 18% annual return for United Leases primarily based on the current share value. I strongly imagine administration will proceed progress spurred by trade tailwinds, resume shopping for again shares with vigor, and ship internally compounding outcomes to shareholders generously over the following 5 years — resulting in a 5 12 months share value of $585 by 2027.

Please see this weblog submit right here to know the methodology behind the 10-step evaluation.

Income Progress: $5.808B -> $10.18B over 5 years / 11.86% CAGR with Spectacular 15.65% CAGR/share |

Revenue Progress: $583MM -> $1.55B over 5 years, 21.6% CAGR / Over 25% CAGR Per Share – Unbelievable! |

Belongings vs. Liabilities: $2.01B present belongings v. $2.597B present liabilities / Not best, but additionally not sudden |

Lengthy Time period Debt: Growing, However Nonetheless Extra Than Manageable With Regards to Debt Ratios |

Funding Returns: 10.2%-14.5% ROIC avg. at current – Nice General, Notably in This Trade |

Buybacks: 84.57MM -> 71.61MM shares over 5 years, 15.3% discount total / Exceptional Progress |

Dividend: $0 dividend annual, 0% yield / Allowed Nice Flexibility Throughout Pandemic & Most Buyback |

Money Stream: $1B -> $1.336B in 5 yr & Money From Operations at 18% CAGR Over 5 Yrs Extra Than Double |

Valuation: 12.72x FCF; 11.16x Earnings; 8-9% implied preliminary return w/6% CAGR FCF and 21% CAGR Earnings |

Administration & Moat: Robust Management Has Grown All Metrics Impressively & Trade Tailwinds Help |

Primarily based on 10-Step Evaluation: 9.5 out of 10 |