FiledIMAGE/iStock Editorial by way of Getty Photographs

Union Pacific As soon as Once more Interesting

Union Pacific (NYSE:UNP) is heading north and its ATHs will not be far-off. After a few tough years with buyers fearing the high-interest atmosphere and the rail site visitors lower (particularly attributable to intermodal), the corporate appears to be switching gears due to Mr. Jim Vena, the brand new CEO ranked among the many greatest executives within the business. Due to the weekly replace on rail site visitors, we will observe these shares with thorough consideration with no need to attend from one quarter to the subsequent with none replace. So, let’s examine how issues are evolving for railroads and Union Pacific. Spoiler alert: buyers could also be comfortable.

Due to its final report, I lastly turned as soon as once more bullish on the corporate and its inventory. Previously, in actual fact, I used to be on one aspect bullish on railroads and Union Pacific’s publicity to the richest states within the U.S. and to intermodal site visitors coming from Asia; on the opposite, I couldn’t assist however specific my disappointment for low efficiency-metrics and uncautious buybacks which have been increasing Union Pacific’s debt past sustainability. Not by probability, the corporate needed to droop its buybacks as soon as rates of interest rose.

However earlier than we transfer on, permit me to shortly clarify my particular view on railroads.

Investing In Railoards After Warren Buffett

One of the crucial in depth analysis research I’ve executed on my journey towards changing into a profitable investor offers with North American Class 1 railroads. Particularly, I used to be impressed by Warren Buffett’s funding in BNSF. This has been the case examine the place I realized the factors the Oracle of Omaha used again in 2009 to speculate on this capital-intensive enterprise. As I reversed-engineered Buffett’s strikes and ideas to raised grasp what made him step in and purchase the most important Class 1 railroad, I discovered the next metrics. As we’ll see, they do not at all times match the usual KPIs we usually use for this business. The core thought hinges on why a capital-intensive enterprise could be a good funding: it has to yield a good return on capital employed.

Railroads are certainly regulated, however the regulators permit them to have a return above 10%. Buffett is understood for investing in enterprise with a moat. Railroads have a relatively robust one: their bodily belongings (tracks, hubs, fleets) are laborious to copy with no large use of capital. Since these firms use loads of capital for upkeep and gear enhancement or alternative, they tackle debt. What issues right here is their incomes energy, calculated as pre-tax earnings on curiosity bills. So long as curiosity bills are well-covered (railroads normally rating a 6 or extra), we could be positive railroads will be capable of meet their obligations and refinance the debt that has come to maturity with no actual danger of going bankrupt.

Railroads cannot actually develop their high line by constructing new tracks and routes. They do, after all, however to a really minor extent given the maturity of the business. So, they develop income by taking extra market share and by flexing their pricing energy. Gasoline surcharges can increase revenues, however they’ll additionally affect it negatively when costs go down. So, when the obtainable information permits us to take action, we solely have a look at revenues web of the gasoline surcharge applications every railroad implements. This explains why effectivity is especially in focus when contemplating railroads. Buffett normally seems to be at gasoline effectivity as an general proxy for the effectivity of operations. Final, however strictly associated to what we’ve simply summarized, Buffett desires to know the general use of capital the corporate desires to have. In the beginning, a railroad must deal with its belongings. Dividends and share repurchases needs to be executed solely with extra money. In fact, we’ve then seen how, in actuality, Buffett made BNSF take loads of debt from 2009 to 2015 to fund excessive distributions in direction of Berkshire. On this method, BNSF’s father or mother firm made shortly again its preliminary funding. However this is sensible as a result of Berkshire can deploy its capital at a better price of return, so shifting a few of Berkshire’s debt away from its stability sheet into BNSF’s was a strategic alternative.

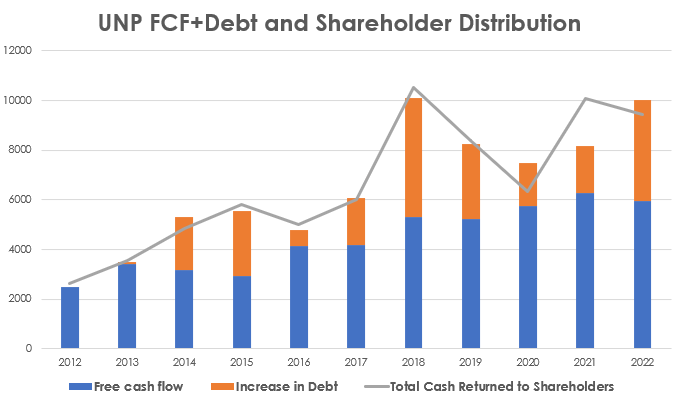

In Union Pacific’s case, nevertheless, I confirmed how from 2012 to 2022, the corporate recurrently elevated its debt to fund shareholder distributions.

Creator, with information from UNP Sec Filings

Whereas this absolutely helped the inventory’s efficiency, it left the corporate and its shareholders aghast as soon as the Fed elevated rates of interest.

In Q1 2024, Union Pacific reported an +1% enhance in volumes, which was significantly significant because it was a countertrend end result versus the business. Furthermore, the corporate’s working revenue grew by 3%, and we noticed the corporate making nice strides towards enhanced profitability. The stability sheet had improved to an adj. debt/EBITDA ratio lastly under 3x, though new properties weren’t bought, hinting {that a} pull-backward impact could happen due to a delay in property purchases.

Union Pacific’s Latest Developments

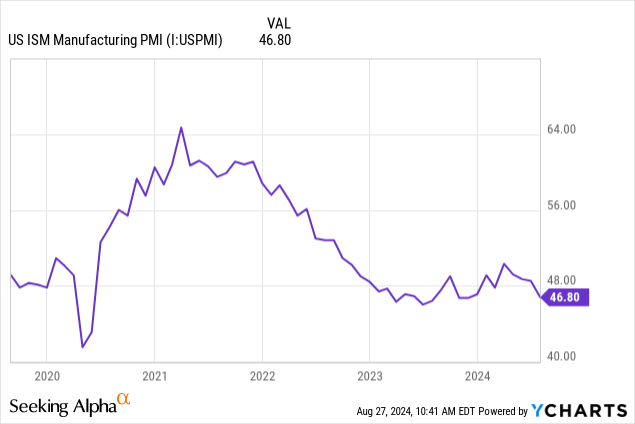

Manufacturing exercise has not been nice, and we are literally in a producing recession since late 2022.

This creates a troublesome atmosphere for railroads, since they transfer throughout North America many commodities required by manufacturing and industrial actions. Nonetheless, a number of strategists imagine the economic sector has grow to be as soon as once more engaging as manufacturing exercise appears to have discovered a backside, and easing rates of interest could drive new demand for equipment, gear, and industrial merchandise.

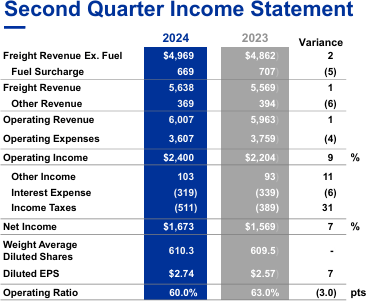

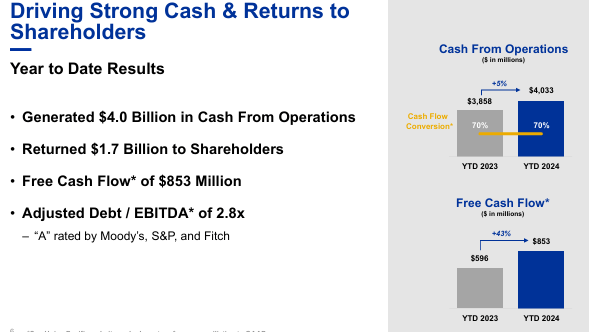

Now, Union Pacific’s Q2 report was blended, with working revenues of $6B, lacking estimates by simply $60M, and quarterly EPS of $2.74 beating consensus estimate by $0.03. Debt declined by 2.1% and the adj. debt/EBITDA ratio was diminished to 2.8x, confirming the deleveraging path Mr. Vena desires to undertake. Surprisingly, the corporate resumed buybacks, with $100M spent within the quarter.

Union Pacific was capable of report a income enhance due to pricing beneficial properties and elevated quantity, though the enterprise combine was partially unfavorable. However income carloads have been up, too, which is an effective signal. Most significantly, the corporate achieved a 60% working ratio, which, on this atmosphere with excessive enter prices and mushy demand, is unbelievable. Normally, 60% is the goal each railroad desires to realize. Proper now, nobody is shut. Because of this, working revenue elevated 9% to $2.4 billion. Now, that is one thing we wish to see from a railroad: income up low-single digits and OI up within the high-single digits.

UNP Q2 2024 Earnings Presentation

Gasoline effectivity improved by 1% to 1.08 gasoline per 1,000 GTMs.

Let’s look a bit extra intimately on the income combine.

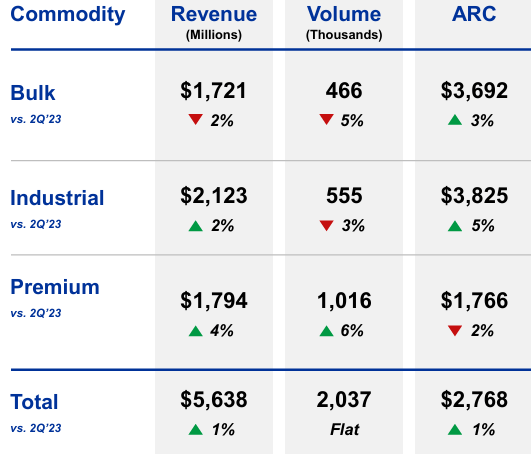

UNP Q2 2024 Earnings Presentation

Bulk, which includes grain, fertilizers, meals, and coal, noticed income and quantity lower, although this was primarily attributable to coal being down 21% YoY. Fertilizers, for instance, are up 9%, meals is up 9% and grain is up 1% YoY. General, we see a phase in fine condition. Coal, in spite of everything, noticed an enormous demand surge due to excessive gasoline costs in 2022 and 2023. However with gasoline now being low-cost as soon as once more, coal is returning to extra normalized ranges. Personally, I’d by no means spend money on a railroad anticipating coal volumes to extend in the long run. Nonetheless, the common income per automobile (ARC) was up 2% for coal, whereas fertilizers noticed a 14% lower. This helps us perceive why Union Pacific nonetheless talks a couple of blended atmosphere with low visibility. Demand shouldn’t be as robust as the corporate would want to guarantee buyers about its pricing beneficial properties down the highway.

Industrial was up 2%, due to chemical compounds and plastics contributing with a 9% enhance, whereas metals and minerals have been down 6%. Now, pay shut consideration. Chemical compounds is normally the commodity many economists contemplate understanding when the financial cycle is choosing up power as soon as once more. When demand for chemical compounds will increase, it means that we are going to quickly see extra industrial output down the manufacturing provide chain. So, this can be a significantly necessary quantity to contemplate, which absolutely bodes nicely for the subsequent manufacturing cycle to begin quickly.

Union Pacific’s premium phase is made up of automotive and intermodal. Effectively, each are up 5% and three% respectively. Now, automotive is slowly decelerating, and I do not anticipate it to extend in 2025 vs. 2024 as automakers are actually scuffling with volumes. Intermodal, alternatively, reveals some renewed power which might hold gaining traction as worldwide site visitors will increase. Nonetheless, the ARC was down 3% QoQ which nonetheless reveals some issue in exercising pricing energy.

Wanting on the firm’s quarterly revenue assertion, we see extra proof of enhanced efficiency. Working bills decreased 4% YoY. That is web of wage will increase and different enter prices, which put stress on margins. There is just one method to have a look at this end result: Mr. Vena is taking motion and the corporate is shortly eliminating pointless prices.

UNP Q2 2024 Earnings Presentation

Union Pacific’s outlook was considerably blended, which is cheap given the present scenario. Second-half quantity is seen as unsure, although the corporate expects to extend its profitability as much as the purpose it dedicated to a $1.5B share repurchase program to be ended by 2024 (1% of the present market cap). True, its earnings energy continues to be low round 5x, however by paying down debt we should always quickly see curiosity expense happening whereas pre-tax earnings ought to enhance.

UNP Q2 2024 Earnings Presentation

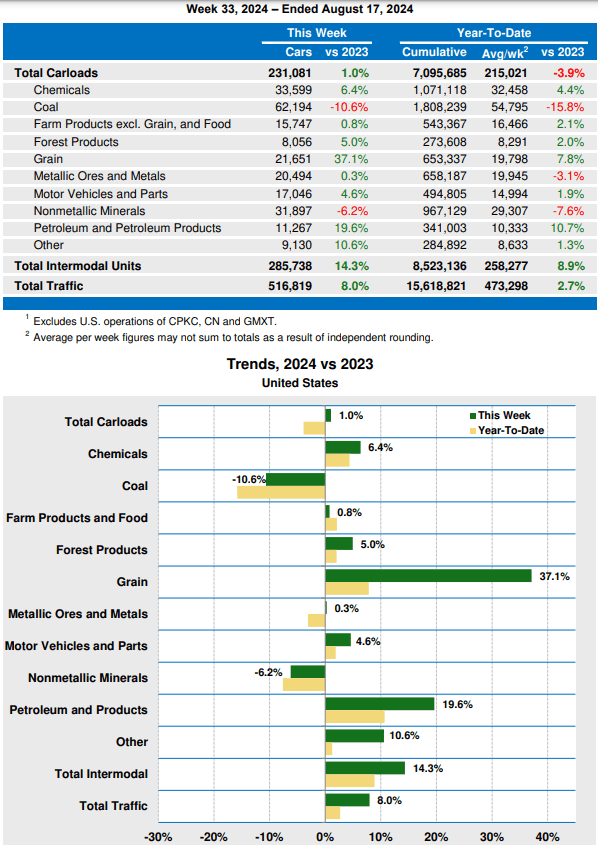

Since Union Pacific launched its Q2 earnings, nevertheless, extra optimistic information about rail site visitors has been launched. On the finish of July, the Affiliation of American Railroads (AAR) reported U.S. rail site visitors up 5.3% YoY, with intermodal quantity rising 10.5%. Grain, farm merchandise, forest merchandise, and meals all have been up throughout the board, whereas coal saved reducing in addition to minerals and metals.

The final obtainable report for the week ending August seventeenth, 2024, reveals weekly site visitors up 8% YoY, with 8 out of 10 commodity teams reporting YoY will increase. YTD, quantity continues to be down 3.9%, however intermodal is up 8.9%, which implies that general, site visitors is up 2.7% YoY.

Wanting on the report under, we see the breakdown by commodity. What issues, as soon as once more, is the convincing efficiency of chemical compounds (up 4.4% YTD), petroleum (up 10.7% YTD) and intermodal models. This makes me suppose industrials usually could be a good guess for 2025.

AAR

Union Pacific’s Valuation

Is Union Pacific a purchase? Sure. Let me present you why. The corporate trades at a fwd PE of twenty-two.2. At present, the S&P 500 trades at a PE near 27.5. Utilizing consensus earnings estimates, the inventory is buying and selling at a fwd 2025 PE of 19.7, and a fwd 2026 PE of 17.9. Nonetheless, although these estimates anticipate Union Pacific to develop EPS by 10-12% per 12 months, they nonetheless do not issue within the affect of buybacks or an enchancment of financial situations attributable to decrease rates of interest.

So, Union Pacific is undervalued in comparison with the remainder of the market, which can be a bit stretched in its valuation.

However what issues extra is that Union Pacific – beneath Vena’s tenure – could possibly develop its backside line by 10-12% per 12 months. If this goes together with a dividend yield of two.2% (supported by a FCF yield of three.9%) and share buybacks that return 1% or extra, we’ve the recipe for a 15+% annual return, which can most likely be mirrored within the inventory worth. This implies we should always see Union Pacific commerce above $310 by 2026. I feel Union Pacific will likely be above that in two years.

All of this goes together with a inventory scoring an A+ as its profitability metric.

So, a really attention-grabbing setup is developing. Now we have an inexpensive valuation for a enterprise that will not go away anytime quickly. Its inner operations are enhancing, leaving ample room for expense moderation and profitability enchancment. A producing recession appears to be near its trough, with indicators of recent financial exercise being already identifiable.