The U.S. inflation price is hovering at its quickest tempo in additional than 40 years, with prices for meals, gasoline, housing and different requirements squeezing customers and wiping out the pay raises that many individuals have acquired.

The Labour Division stated Tuesday that its client worth index jumped 8.5 per cent in March from 12 months earlier — the largest year-over-year enhance since December 1981.

Costs have been pushed up by bottlenecked provide chains, sturdy client demand and disruptions to international meals and vitality markets worsened by Russia’s struggle in opposition to Ukraine.

Inflation elevated by 1.2 per cent within the month of March alone from February’s stage. That is the largest one month enhance since 2005 and an uptick from the 0.8 per cent enhance from January to February.

The March inflation numbers had been the primary to seize the total surge in gasoline costs that adopted Russia’s invasion of Ukraine on Feb. 24. Moscow’s brutal assaults have triggered far-reaching Western sanctions in opposition to the Russian financial system and have disrupted international meals and vitality markets. The typical worth of a gallon of gasoline within the U.S. presently prices $4.10 US, a determine that has elevated by 43 per cent from a yr in the past.

“The struggle in Ukraine has difficult the inflation outlook,” famous Luke Tilley, chief economist at Wilmington Belief.

That enhance within the worth to replenish a tank has added bills to the price of nearly the whole lot that depends on delivery to get to a client’s door.

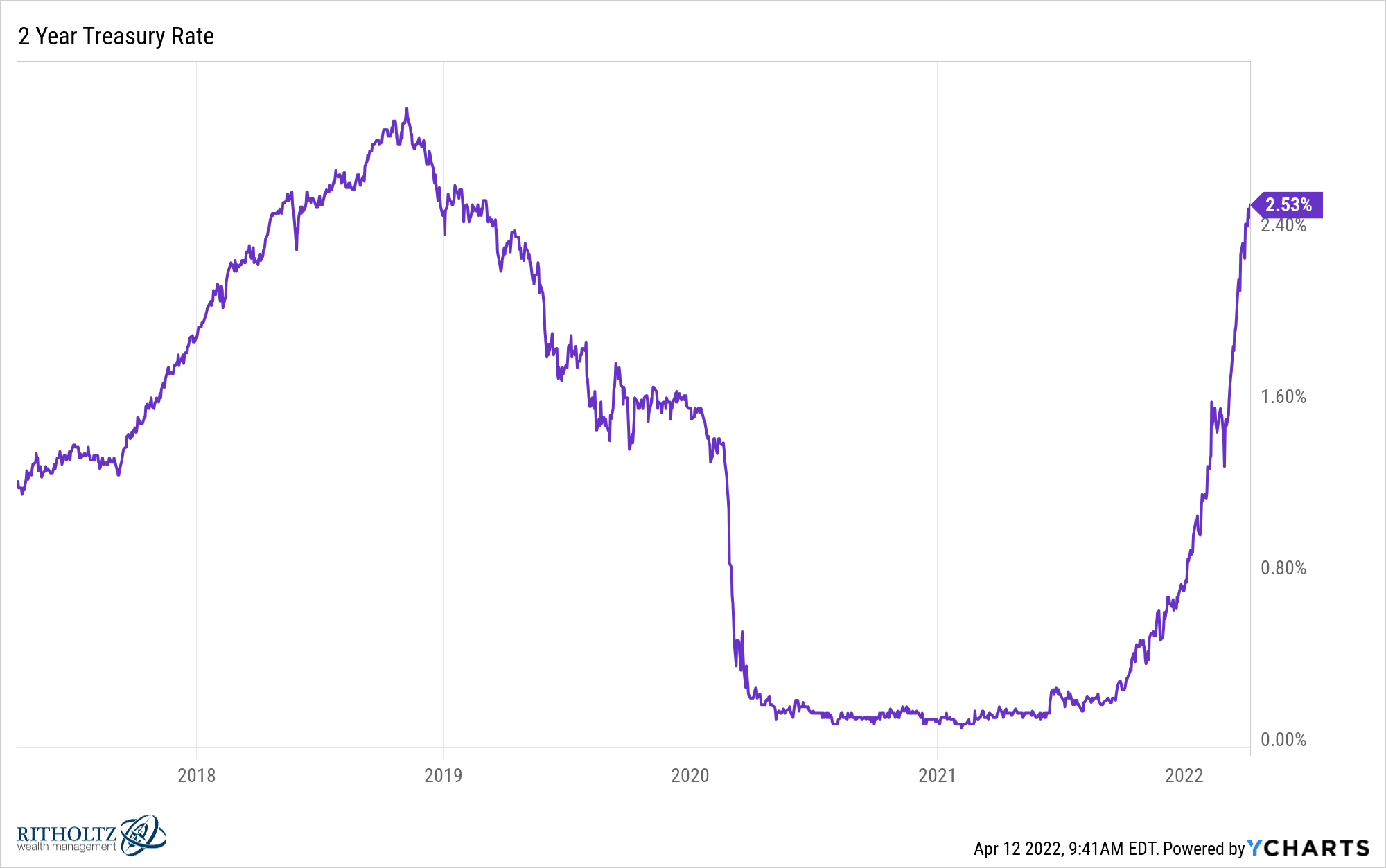

The attention-popping determine will increase the chance that the U.S. central financial institution will likely be much more aggressive in elevating its rate of interest for the remainder of the yr to attempt to gradual borrowing and spending, and tame inflation.

Inflation, which had been largely below management for 4 many years, started to speed up within the U.S., Canada and all over the world as economies rebounded with surprising velocity and energy from the temporary however devastating coronavirus recession that started within the spring of 2020.

The restoration, fuelled by enormous infusions of presidency spending and super-low rates of interest, caught companies abruptly, forcing them to scramble to satisfy surging buyer demand. Factories, ports and freight yards struggled to maintain up, resulting in persistent delivery delays and worth spikes.

Whereas an eye fixed popping determine by any metric, some economists are beginning to suppose that March could show to be the excessive water mark for inflation, because the quantity will slowly begin to inch down to any extent further.

“March will doubtless be the height for inflation because the indices will likely be lapping some robust year-ago readings beginning in April, whereas gasoline costs have eased off currently,” CIBC economist Katherine Choose stated.