by visualcapitalist

In line with the Federal Reserve (Fed), U.S. shopper debt is approaching a record-breaking $16 trillion. Critically, the speed of improve in shopper debt for the fourth quarter of 2021 was additionally the very best seen since 2007.

This graphic offers context into the patron debt state of affairs utilizing information from the tip of 2021.

Housing Vs. Non-Housing Debt

The next desk consists of the info used within the above graphic. Housing debt covers mortgages, whereas non-housing debt covers auto loans, pupil loans, and bank card balances.

Supply: Federal Reserve

Tendencies in Housing Debt

Dwelling costs have skilled upward strain for the reason that starting of the COVID-19 pandemic. That is evidenced by the Case-Shiller U.S. Nationwide Dwelling Value Index, which has elevated by 34% for the reason that begin of the pandemic.

Driving this development are numerous pandemic-related impacts. For instance, the price of supplies resembling lumber have seen huge spikes. We’ve coated this story in a earlier graphic, which confirmed what number of properties may very well be constructed with $50,000 value of lumber. Most often, these greater prices are handed on to the patron.

One other key issue right here is mortgage charges, which fell to all-time lows in 2020. When charges are low, customers are capable of borrow in bigger portions. This will increase the demand for properties, which in flip inflates costs.

In the end, greater dwelling costs translate to extra mortgage debt being incurred by households.

No Have to Fear, Although

Economists consider that immediately’s housing debt isn’t a trigger for concern. It is because the standard of debtors is way stronger than it was between 2003 and 2007, within the years main as much as the monetary disaster and subsequent housing crash.

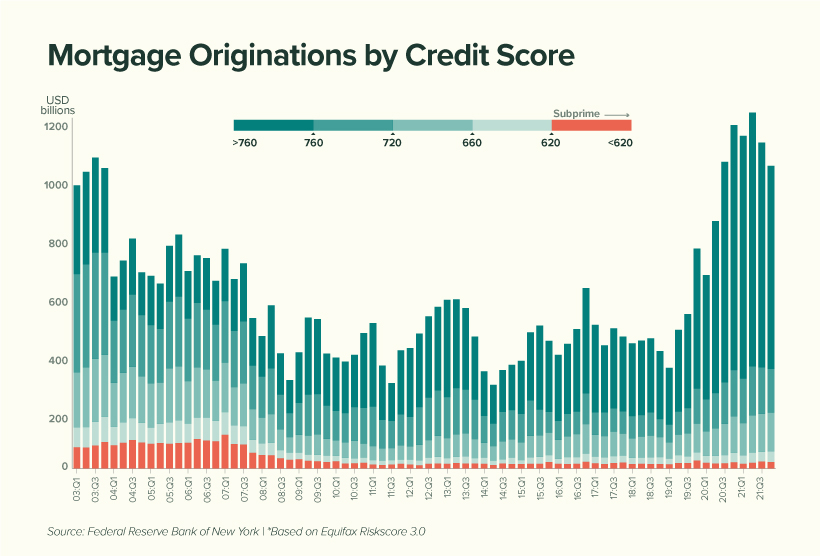

Within the chart beneath, subprime debtors (these with a credit score rating of 620 and beneath) are represented by the red-shaded bars:

We are able to see that subprime debtors characterize little or no (2%) of immediately’s whole originations in comparison with the interval between 2003 to 2007 (12%). This implies that American owners are, on common, much less prone to default on their mortgage.

Economists have additionally famous a decline within the family debt service ratio, which measures the proportion of disposable revenue that goes in direction of a mortgage. That is proven within the desk beneath, together with the common 30-year mounted mortgage price.

| Yr | Mortgage Funds as a % of Disposable Earnings | Common 30-Yr Mounted Mortgage Fee |

|---|---|---|

| 2000 | 12.0% | 8.2% |

| 2004 | 12.2% | 5.4% |

| 2008 | 12.8% | 5.8% |

| 2012 | 9.8% | 3.9% |

| 2016 | 9.9% | 3.7% |

| 2020 | 9.4% | 3.5% |

| 2021 | 9.3% | 3.2% |

Supply: Federal Reserve

Whereas it’s true that Individuals are much less burdened by their mortgages, we should acknowledge the lower in mortgage charges that happened over the identical interval.

With the Fed now rising charges to calm inflation, Individuals might see their mortgages start to eat up a bigger chunk of their paycheck. Actually, mortgage charges have already risen for seven consecutive weeks.

Tendencies in Non-Housing Client Debt

The important thing tales in non-housing shopper debt are pupil loans and auto loans.

The previous class of debt has grown considerably over the previous 20 years, with development petering out through the pandemic. This may be attributed to COVID aid measures which have quickly lowered the rate of interest on direct federal pupil loans to 0%.

Moreover, these loans had been positioned into forbearance, that means 37 million debtors haven’t been required to make funds. As of April 2022, the worth of those waived funds has reached $195 billion.

Over the course of the pandemic, only a few direct federal debtors have made voluntary funds to cut back their mortgage principal. When funds finally resume, and the 0% rate of interest is reverted, economists consider that delinquencies might rise considerably.

Auto loans, alternatively, are following an identical trajectory as mortgages. Each new and used automobile costs have risen as a result of international chip scarcity, which is hampering manufacturing throughout the whole trade.

To place this in numbers, the common value of a brand new automobile has climbed from $35,600 in 2019, to over $47,000 immediately. Over an identical timeframe, the common value of a used automobile has grown from $19,800, to over $28,000.

Assist Help Unbiased Media, Please Donate or Subscribe:

Trending:

Views:

40