Patcharapong Sriwichai/iStock via Getty Images

Tesla (NASDAQ:TSLA) is a long-time TechStockPros favorite. Still, we are moving the company to a sell. Tesla stock slipped 5% on Tuesday as the market rallied. While Tesla owns more than any other automotive company in the Electric Vehicle (EV) market, we expect this to change toward 2025. We believe the EV giant is gradually losing its stranglehold on the U.S. EV market as competition penetrates the market with more attractive pricing options. Tesla achieves the bulk of its revenue from its automotive segment, accounting for roughly 86% of total revenue. We expect Tesla’s stock to suffer as its market share in the EV segment shrinks.

Tesla’s 3Q22 report announced EPS ahead of expectations but fell short of revenue achieving $21.45B, slightly lower than the expected $21.96B. We don’t see Tesla making meaningful money in the near term until its valuation is compressed. Tesla stock dropped 60% YTD, and we expect the stock to drop further. We believe the stock is highly valued, at risk of multiple compression and stiff competition in its EV market. We like Tesla but believe entering the stock with current risks and no plans from management to handle the situation makes for an unfavorable investment. We recommend investors wait on the sidelines for valuation to get compressed before buying Tesla.

EV market share is not what it used to be

Just two years ago, in 2020, Tesla owned around 79% of the EV market share in the U.S. In the third quarter of 2022, we’re seeing this number slip to a notably lower 65%. Tesla’s shrinking market share is at the core of our bearish thesis. We believe Tesla is losing its first-mover advantage; S&P forecasts Tesla’s EV market share to decline to less than 20% by 2025. It is no surprise that Tesla is facing increased competition in the EV market, but the shock is how fast the company’s market share is declining. We expect the shrinking market share to drive Tesla’s stock down as the company achieves most of its revenue from its automotive revenue.

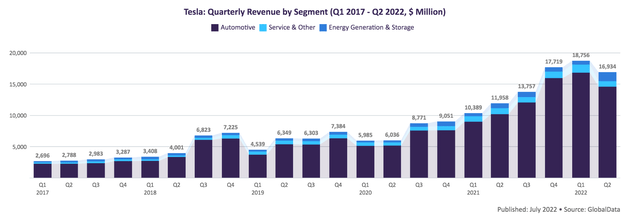

The following graph outlines Tesla’s revenue by segment between 1Q17-2Q22.

GlobalData

The automotive industry is rapidly transitioning to EVs, with the S&P reporting about 48 EV models selling in the U.S. and forecasting this number to grow to 159 by the end of 2025. We don’t expect Tesla to disappear but believe as competition penetrates the market, the company will take a smaller piece of the EV market pie.

Too expensive for the macroeconomic environment

We believe competition is chipping away at Tesla’s market share as they offer better pricing ranges for EVs. We expect it’ll be tough for Tesla to compete with the competition as they make share gains in the price range below $50,000. As inflation reaches a 40-year high, we expect more consumers will opt to buy cheaper EVs. Tesla’s entry-level Model 3 starts at $48,200, with their other vehicles selling for higher prices. Ford’s (F) Mustang Mach-E is ranked third in EV registrations. We believe more non-Tesla vehicles will make it to the top five ranked EVs, as Chevrolet Bolt (GM) and Bolt EUV, Hyundai Ioniq 5, Kira EV6, Volkswagen ID.4 (VOW3), and Nissan Leaf creep up the ranks. We believe the Tesla bulls are disregarding the impact of the current macroeconomic environment on consumer behavior and spending. We believe Tesla is lagging in reacting to the current macroeconomic environment and expect this to cost them a piece of their market share.

In terms of pricing, we believe General Motors and Ford are the best positioned to compete. We expect the upcoming Chevrolet Equinox to steal customers away from Tesla with a starting point in the $30,000 range. We believe the demand for cars north of the $50,000 to $55,000 price range is limited. Hence, we believe Tesla is going to have to succumb to the macroeconomic environment and look into lowering its price points if they are to leverage more customers.

Musk is distracted by Twitter

We believe Tesla CEO, Elon Musk, is distracted by the recent Twitter acquisition and is not giving Tesla the required attention. The company’s stock has dropped 28% since the Twitter acquisition on October 27th. In comparison, Tesla’s competition in the EV market has been slightly up since October. We’re worried about Tesla’s performance in the near term and expect the company to face pressure from the competition without solid counter-attack plans. We’re not the only ones worried; Leo Koguan, one of Tesla’s largest retail shareholders, called for the company to “perform shock therapy to resuscitate stock price.” We believe Tesla is well-positioned in the EV market for now, but we believe the company will now have to work harder to maintain its position as alternative EVs pile up.

Valuation – Risks of multiple compression

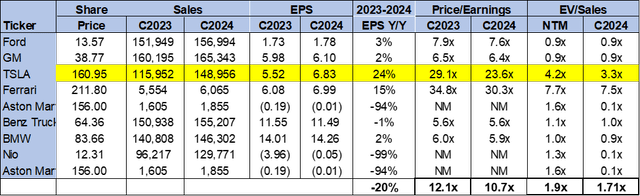

Tesla stock is not cheap. On a P/E basis, the stock is trading at 23.6x C2024 EPS $6.83 compared to the peer group average of 10.7x. The stock is trading at 3.3x EV/C2024 Sales versus the peer group average of 1.7x.

The following graph outlines Tesla’s valuation.

TechStockPros

We believe Tesla’s stock is at risk of multiple compression, an effect that occurs when a company’s reported earnings increase, but the stock does not react or respond. From a quantitative analysis point of view, we believe the market has valued Tesla for its future earnings and rewards preemptively. The following graphs outline Tesla’s P/E ratios- calculated by dividing the latest closing price by the most recent EPS. The following charts outline the discrepancies between the P/E ratio not responding to the earnings.