Amid rising requires the Federal Reserve to start reducing rates of interest, White Home officers (and the president himself) have adopted the tactic of pointing to the nominal coverage charges of international central banks as proof that the Fed is behind the curve.

At greatest, it’s a deceptive argument; at worst, it’s intellectually lazy. Evaluating nominal rates of interest throughout nations with out accounting for key variations ignores primary financial economics. Such claims could also be politically expedient, however they threat distorting public understanding of the Fed’s mandate and undermining its independence at a time of heightened macroeconomic complexity. In addition they invoke the reminiscence of latest makes an attempt to affect opinion by misciting, or oversimplifying, financial fundamentals.

Coverage charges are set within the context of home inflation dynamics, output gaps, and labor market situations. The US at the moment faces core inflation above goal, low unemployment, and elevated nominal wage development—situations not mirrored in Japan (which is rising from a long time of deflation), Switzerland (which has had persistently low inflation), or Costa Rica and Trinidad (which can be responding to totally different structural or commodity-related elements). Financial coverage should mirror native macroeconomic fundamentals, not international benchmarks.

Financial coverage can’t be in contrast throughout nations with out accounting for structural variations in regime and context. Japan’s yield curve management and Switzerland’s expertise with damaging rates of interest stem from persistent disinflationary forces and efforts to handle forex energy, not from latest inflation dynamics. Moreover, the credibility of central banks and the diploma to which inflation expectations are anchored fluctuate considerably throughout jurisdictions. Because the steward of the world’s dominant reserve forex, the Federal Reserve faces a definite obligation to take care of coverage readability and value stability with the intention to uphold each its institutional credibility and the worldwide standing of the greenback.

Rates of interest are additionally formed by long-run structural elements: demographic developments, productiveness development, and capital formation. Japan, for instance, has an growing old inhabitants and weak demand for credit score, which structurally suppresses impartial rates of interest. In distinction, the US has stronger demographic momentum and capital-intensive sectors that assist greater pure actual charges. Utilizing decrease rates of interest overseas to argue for US price cuts ignores divergent long-run impartial charges (“r^*,” “r-star”) throughout economies.

Many nations with decrease rates of interest have totally different alternate price regimes or weaker currencies and rely extra on capital inflows or export competitiveness. As an illustration, Trinidad and Costa Rica have narrower financial transmission mechanisms and extra fragile present accounts. The US runs persistent deficits and points the worldwide reserve forex, which means its charges carry a special weight in international capital flows and have to be managed to protect exterior stability and greenback demand. Decreasing US charges primarily based on international benchmarks might destabilize capital flows or re-ignite inflationary pressures.

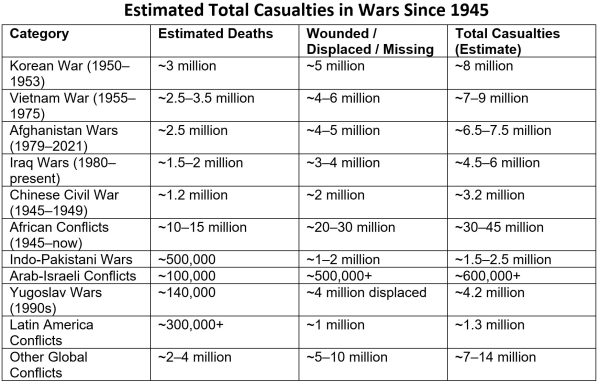

Cross-country comparisons of coverage rates of interest might provide superficial attraction, however they’re finally insufficient—and sometimes deceptive—when used to guage the stance of Federal Reserve coverage. Merely pointing to decrease nominal charges in nations like Trinidad and Tobago, Cambodia, or the United Arab Emirates overlooks the profound variations in underlying financial situations, institutional mandates, and financial frameworks. Inflation dynamics fluctuate broadly, as do ranges of debt, productiveness development, and labor market slack. Central banks additionally differ broadly within the diploma of independence they get pleasure from, the instruments they deploy, and the inflation expectations they have to handle.

This isn’t a protection of the Federal Reserve, or Fed Chair Jerome Powell, or of central banking as an financial establishment. It’s a protection of sound economics—of the significance of making use of constant analytical frameworks, respecting empirical nuance, and resisting the temptation to cherry-pick statistics for political expediency. It will be as smart to match the shoe sizes of runners to find out who’s quickest.

Analyzing financial coverage requires greater than headline comparisons and speaking factors; it calls for an understanding of actual versus nominal variables, institutional context, and the worldwide function of the US greenback. Stripping away that rigor weakens public discourse, distorts expectations, and finally undermines the very outcomes—value stability, sustainable development, and financial resilience—that sound insurance policies intention to attain.