‘The financial institution of mum and pop’ is considerably impacting the UK housing market, enabling first-time consumers to buy properties a lot earlier and at larger value factors, in keeping with a brand new evaluation by UK Finance. The rising development can be elevating issues about deepening inequalities in homeownership.

The evaluation in contrast “assisted” first-time consumers – these seemingly receiving monetary assist from household – with “unassisted” consumers in 2024.

UK Finance used mortgage knowledge modelling to estimate which consumers had deposits realistically saved from their revenue, and which had deposits probably boosted by household contributions.

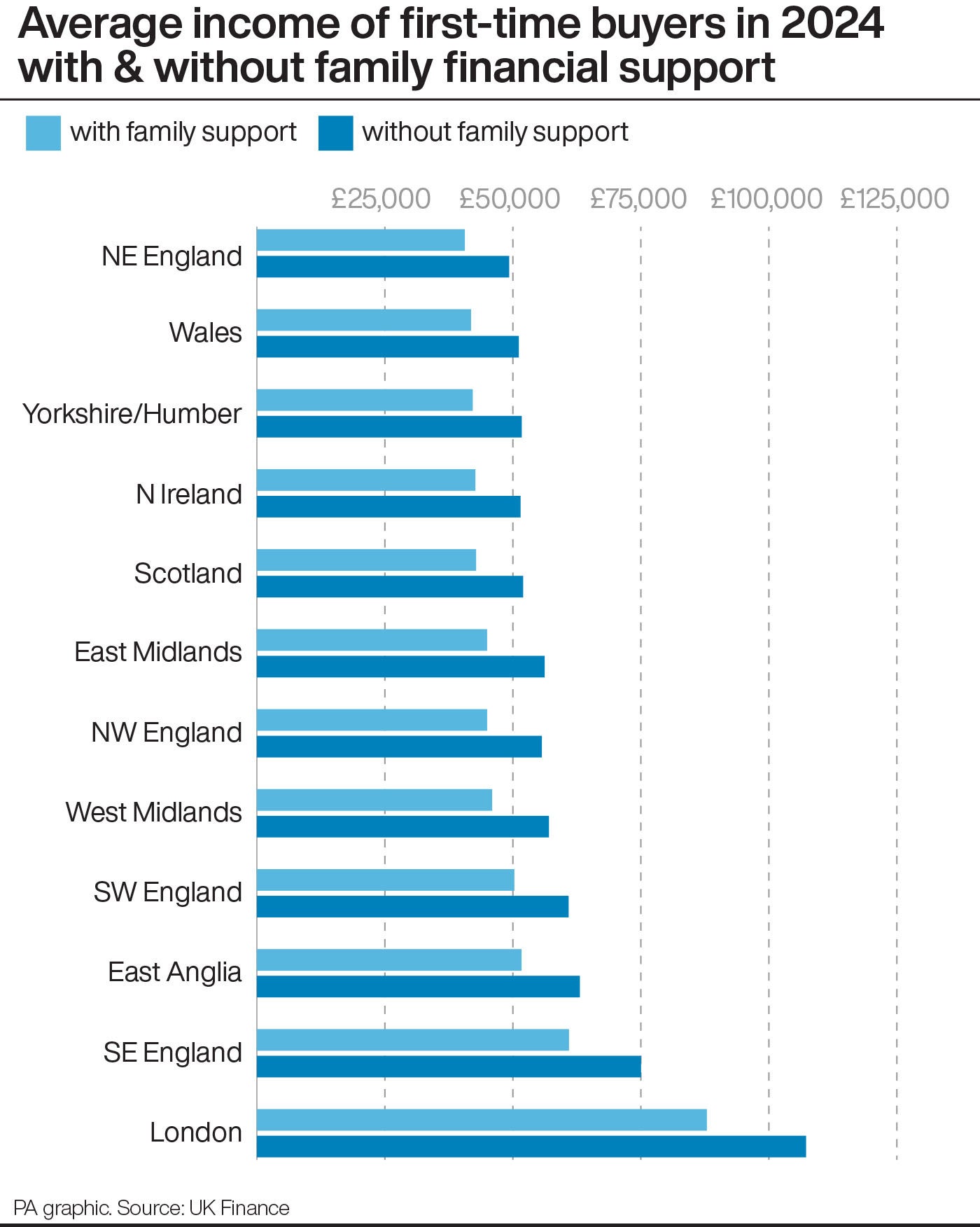

The findings reveal a stark distinction in buy energy. Assisted consumers enter the market round age 30, with a mean family revenue of £56,000.

They sometimes buy houses value almost £40,000 greater than their unassisted counterparts. Unassisted consumers, regardless of having the next common family revenue of £65,000, have a tendency to purchase later, at round age 32.5.

This distinction highlights the numerous benefit conferred by household assist, permitting youthful consumers to beat affordability hurdles and entry higher-value properties, regardless of decrease earnings.

UK Finance warns that this rising reliance on household assist dangers exacerbating current inequalities throughout the housing market.

The common deposit put down by consumers with household assistance is £118,073 and the common quantity put down by unassisted first-time consumers is £60,741.

Throughout the UK, the common buy value for consumers who’ve household help is £317,846 and the common value paid for these with out this further assist is £279,381.

The distinction in deposit quantities is especially pronounced in London, the evaluation discovered.

In 2024, a first-time purchaser buying a house in London with out household assist sometimes put down a deposit of £145,133. However amongst these receiving household help, the common deposit was £224,054.

UK Finance additionally regarded on the impression of a brief stamp responsibility vacation, launched in the course of the coronavirus pandemic.

It seems to have had uneven results, significantly serving to those that might additionally get assist from the financial institution of mum and pop, UK Finance stated.

It discovered a disproportionate enhance within the variety of assisted first-time consumers.

The coverage additionally coincided with a notable enhance in debtors withdrawing sizeable quantities of fairness when remortgaging, suggesting that some households had been drawing on their very own property wealth to assist household get on the housing ladder, UK Finance stated.

On Thursday this week, the Financial institution of England diminished the bottom price to 4.25%, from 4.5%.

Housing market consultants have prompt the speed lower might assist to inject extra purchaser curiosity into the housing market, with a number of lenders having already launched extra mortgages with sub-4% charges.

James Tatch, UK Finance’s head of analytics, stated: “First-time consumers are important to the UK housing market, serving to to unlock transactions additional up the chain and preserve general liquidity.

“Whereas the vast majority of first-time consumers are nonetheless managing to buy with out assist, the rising reliance on household assist dangers deepening inequality within the housing market. A balanced method which addresses each provide and affordability points is crucial to make sure the door to residence possession stays open to all.”

Toby Leek, NAEA (Nationwide Affiliation of Property Brokers) Propertymark president, stated: “These figures exhibit that there’s nonetheless a lot work to be carried out to assist first-time consumers get onto the property ladder, and that for many individuals beneath the age of 30, homeownership shouldn’t be a practical aspiration with out monetary assist from dad and mom.”

Henry Jordan, Nationwide Constructing Society’s director of residence, stated: “First-time consumers are very important to the housing market and financial system, however residence possession stays a problem for a lot of with out extra assist.

“Alongside constructing a deposit, many additionally wrestle to borrow sufficient.”

He stated Nationwide’s Serving to Hand deal, which provides first-time consumers the flexibility to borrow as much as six occasions revenue at as much as 95% loan-to-value, has helped greater than 55,000 clients since its launch in 2021.

Listed below are residence buy costs, deposit sizes and ages for first-time consumers with and with out help, in keeping with UK Finance:

East Anglia

Assisted consumers: £286,957 worth, £102,340 deposit, age 30.0

Unassisted consumers: £273,723 worth, £56,060 deposit, age 32.4

East Midlands

Assisted: £237,872, £80,486, 29.5

Unassisted: £229,565, £41,788, 32.3

London

Assisted: £546,972, £224,054, 31.7

Unassisted: £145,133, 33.9

North East

Assisted: £189,455, £66,176, 28.7

Unassisted: £167,161, £29,918, 31.3

North West

Assisted: £231,697, £82,579, 29.8

Unassisted: £212,871, £40,262, 32.2

Northern Eire

Assisted: £205,514, £87,177, 29.9

Unassisted: £183,571, £40,165, 32.3

Scotland

Assisted: £203,450, £72,267, 28.5

Unassisted: £182,442, £36,882, 31.6

South East

Assisted: £359,719, £127,833, 30.7

Unassisted: £347,481, £71,951, 33.2

South West

Assisted: £288,601, £104,071, 30.3

Unassisted: £275,911, £58,882, 32.5

Wales

Assisted: £212,558, £75,985, 29.7

Unassisted: £193,640, £35,551, 31.8

West Midlands

Assisted: £248,705, £87,239, 30.2

Unassisted: £235,819, £45,037, 32.6

Yorkshire and the Humber

Assisted: £214,354, £75,357, 29.2

Unassisted: £196,711, £37,809, 31.5

UK Common

Assisted: £317,846, £118,073, 30.2

Unassisted: £279,381, £60,741, 32.5