phototechno

TriplePoint Venture Development (NYSE:TPVG) is a business development company, and its stock is currently trading at a significant discount to its net asset value.

The BDC primarily targets companies in the venture growth stage that generate significant revenue. Having said that, the portfolio has recently experienced a higher number of non-accruals, indicating deteriorating portfolio quality, which may worsen if the U.S. economy weakens.

Even though the stock is available at a discount to net asset value and currently pays a 13% dividend yield, I would not invest in TPVG at this time.

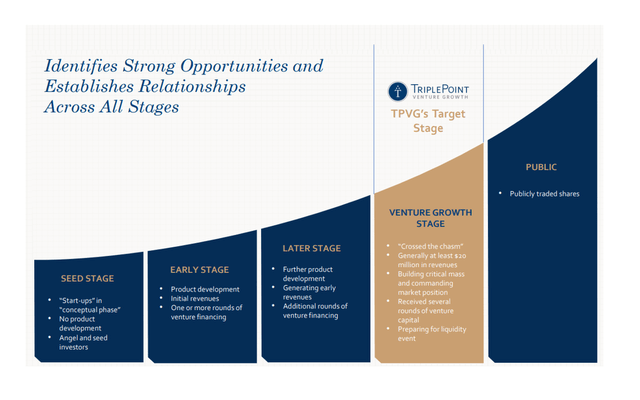

TriplePoint Venture Growth’s Portfolio Strategy

In contrast to many other business development firms that focus primarily on the lower middle market, the business development company focuses on making investments in the venture growth segment, which consists of fast-growing companies with at least $20 million in annual revenues.

Venture growth companies require capital to grow their businesses and have the potential to enter the public market successfully, for example, through an initial public offering.

Because TriplePoint Venture Growth also invests in venture growth companies, the BDC has the opportunity to increase its total returns, but the portfolio also has higher risks as a result.

Portfolio Strategy (TripePoint Venture Development BDC Corp)

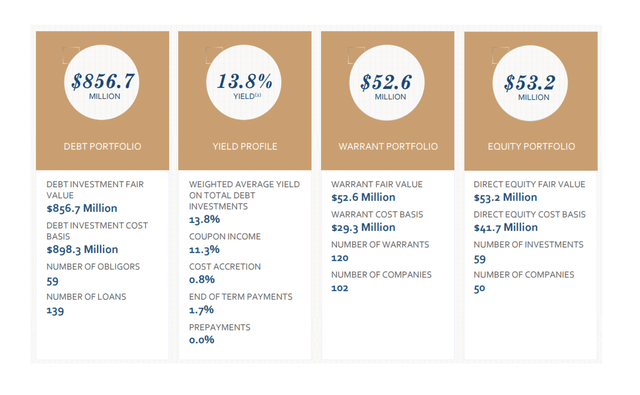

The venture growth stage focus is most likely what distinguishes the company from other business development firms. TriplePoint Venture Growth’s total portfolio (including debt, equity, and warrants) was valued at $962.5 million, with debt continuing to account for the majority of investments (89%) at $856.7 million. As of the end of the September quarter, the Debt portfolio contained 139 loans with a weighted-average debt yield of 13.8%.

Weighted Average Debt Yield (TriplePoint Venture Growth Development BDC Corp)

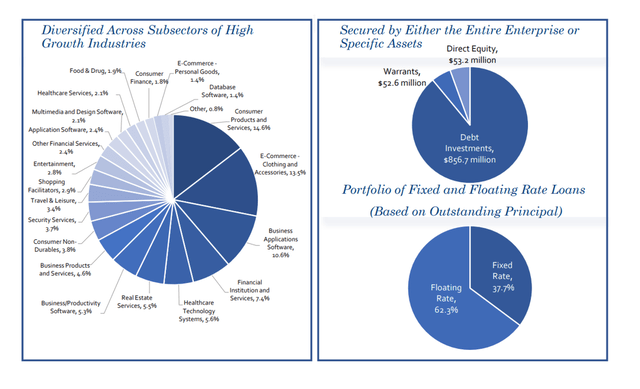

As previously stated, TriplePoint Venture Growth primarily consists of customized debt solutions for venture growth companies, but the company also takes Equity and Warrant positions totaling $105.8 million, representing approximately 11% of TriplePoint Venture Growth’s total portfolio value.

Only 62.3% of loans were attached to floating rates, indicating that TPVG is significantly less exposed to floating rates than most other business development companies.

Portfolio Overview (TriplePoint Venture Growth Development BDC Corp)

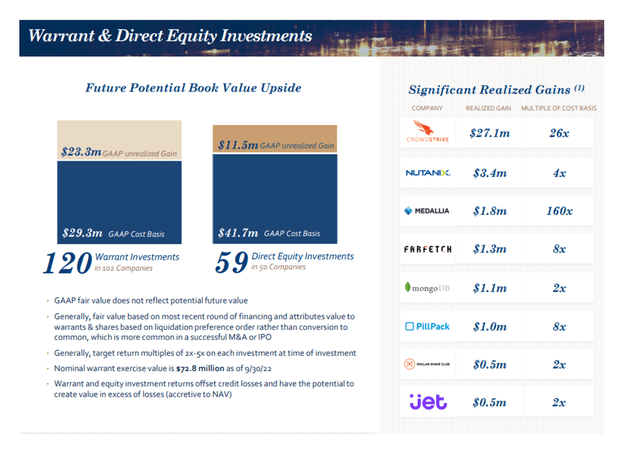

Equity/Warrant Exposure

TriplePoint Venture Growth has a track record of exiting equity investments at attractive multiples, potentially providing investors with the opportunity to profit from increased total return potential.

However, because the returns on equity investments are inherently difficult, if not impossible to forecast, passive income investors may view the equity exposure as a bonus if the capital markets as a whole perform well.

Warrant And Direct Equity Investments (TriplePoint Venture Growth Development BDC Corp)

TPVG’s Valuation

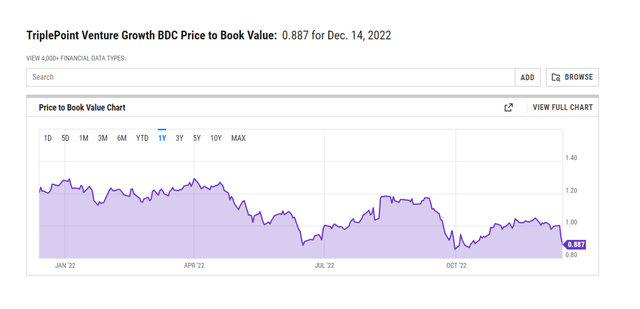

The stock of TriplePoint Venture Growth is trading at a P/B ratio of 0.89x, representing an 11% discount to net asset value. If the BDC’s portfolio quality continues to deteriorate, I expect the NAV discount to widen.

Price To Book Value (YCharts)

Risks With TriplePoint Venture Growth

The obvious risk is portfolio quality, which I believe will deteriorate if more borrowers face financial difficulties. A U.S. recession combined with higher interest rates, which makes loan servicing more expensive for corporations, including investment firms, could be the trigger.

In the event of a significant deterioration in portfolio quality, the discount to net asset value for TriplePoint Venture Growth could widen significantly in the future. A downturn in the U.S. economy and stock market could also obstruct exits from equity investments.

Alternative Investments to TPVG

There are two BDCs that I particularly enjoy. One shares the same strategic orientation as TriplePoint Venture Growth. Hercules Capital, Inc. (HTGC), which also invests in venture capital, but with a larger portfolio and much higher credit quality.

Another business development that I prefer is Oaktree Specialty Lending Corporation (OCSL), which also has excellent credit quality and is managed by a highly experienced and capable management team.

My Conclusion

TriplePoint Venture Growth has an appealing investment focus in the venture growth stage, but I believe the BDC’s portfolio’s high level of non-accruals speaks against making an investment here, despite the stock trading at a not insignificant discount to net asset value.

Given the current economic expansion’s late stage, it appears to me that the emphasis on venture growth capital may represent a risk that other companies do not have.

With that said, I am willing to revisit TPVG at a later date, but I currently believe the risk-reward tradeoff for TriplePoint Venture Growth is unappealing.