EasyBuy4u/E+ via Getty Images

Given these uncertain times, you might not think that a company that deals in the food space would be faring all that well. But that’s not necessarily the case. One player that has performed exceptionally well as of late is TreeHouse Foods (NYSE:THS). This producer and distributor of private-label packaged foods and beverages focuses on a wide variety of offerings such as hot cereals, jams, skillet dinners, syrups, crackers, cookies, and so much more. Recently, the financial performance of the company has been rather mixed. Although revenue is rising nicely, profit figures have been less than ideal. But what likely has been the main driver for the company’s outperformance relative to the broader market has been the firm’s decision to divest of itself some major operations that will lead to a significant reduction in debt for shareholders. Although the company will not be the cheapest prospect on the market, it does seem to be cheap enough now and healthy enough now to warrant the ‘buy’ rating I once had on it.

Getting tastier again

The last time I wrote an article on TreeHouse Foods was in early June of this year. In that article, I talked about the company’s impressive performance, both from a fundamental perspective and a share price perspective. I felt as though the long-term picture for the company looked positive. But in that article, I also pointed to some headwinds that shareholders would have to contend with. Yes, shares of the company were still cheap. But given the volatility, I felt as though it would make a more appropriate ‘hold’ to reflect my view that it should generate returns from that point on that would more or less match the broader market. This was down from the ‘buy’ rating that I assigned to the company back in November of 2021. Unfortunately, it looks as though I left some money on the table when it comes to this particular play. Although shares of the company are up 33.3% at a time when the broader market has been down 11.4% from the time I initially rated the company a ‘buy’, they did see upside of 20.3% compared to the 1.7% decline experienced by the S&P 500 since I changed that rating to a ‘hold’.

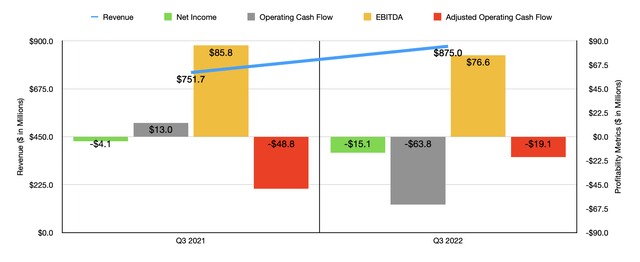

Author – SEC EDGAR Data

Interestingly, I don’t believe that all of this share price appreciation has been due to the company’s fundamental picture. To see what I mean, I would like to point to the most recent financial performance achieved by the firm. As a quick note, all performance data moving forward in this article is in reference to performance from continuing operations, not from operations that have since been labeled discontinued. In the third quarter of 2022 alone, sales came in at $875 million. This represents a nice increase over the $751.7 million the company generated the same time last year. According to management, this 16.4% rise was driven primarily by the company’s pricing actions aimed at recovering commodity and freight cost inflation. This is not to say the company did not benefit from increased demand when it came to its private-label food and beverage products. According to management, demand has been strong, but labor and supply chain disruptions have made it more difficult for them to meet this demand.

Although management believes that strong demand is the case, I’m not so sure I believe that. If it were, I would like to imagine that the company could at least keep its bottom line results from worsening year over year. In the latest quarter, the firm generated a net loss of $15.1 million. That’s over triple the $4.1 million loss generated the same time last year. Operating cash flow went from $13 million to negative $63.8 million. Though if we adjust for changes in working capital, it would have gone from negative $48.8 million to negative $19.1 million. Meanwhile, EBITDA for the company turned from $85.8 million to $76.6 million over the same window of time.

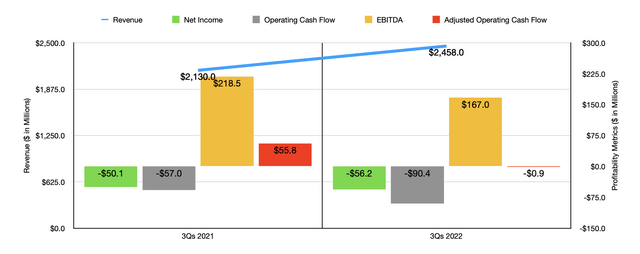

Author – SEC EDGAR Data

This kind of performance disparity between the top line and bottom line was not an occurrence experienced only in the latest quarter. For the first nine months of the firm’s 2022 fiscal year in its entirety, sales came in strong at $2.46 billion. That’s a nice improvement over the $2.13 billion generated the same time last year. Even so, the companies in that loss went from $50.1 million to $56.2 million. Operating cash flow nearly doubled from negative $57 million to negative $90.4 million. Even if we adjust for changes in working capital, it would have gone from $55.8 million to negative $0.9 million. Over that same window of time, we also saw EBITDA worsen during this time, declining from $218.5 million to $167 million.

Normally when you see something like this take place, particularly in a volatile market like what we are experiencing today, shares would experience a meaningful amount of pain. But what has stopped this from transpiring, I believe, is the fact that the company recently sold off a sizable portion of its Meal Preparation business to another party in exchange for $950 million. This deal took the form of $530 million in cash and $420 million in senior secured debt. The notes, due in 2027, carry an initial interest rate of 10%, with that number eventually rising to 13% over a few years. Overall sales associated with this part of the company totaled $1.6 billion, while EBITDA came in at $70 million. If we consider the entire transaction as a reduction in net debt, then total net debt for the company should have fallen from $1.82 billion to $866 million.

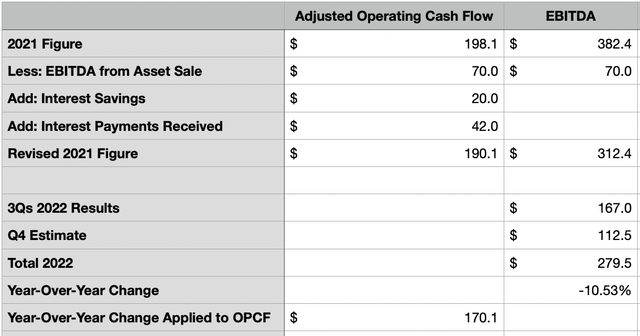

Author – SEC EDGAR Data

If we make certain adjustments to the company’s financial data for both 2021 and projected for 2022, with the latter based on fourth-quarter revenue growth of between 22% and 24%, with EBITDA from continuing operations up between $105 million and $120 million, we can have a rough approximation for how profitable the new business is without the divested assets. This can be seen in the table above, which for this year really just involves annualizing EBITDA and applying that year-over-year change from data last year onto this year for both it and adjusted operating cash flow. In short, for this year, the company should generate adjusted operating cash flow of $170.1 million and EBITDA of $279.5 million.

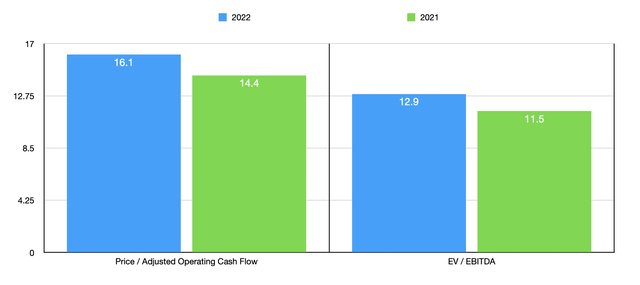

Author – SEC EDGAR Data

Based on these figures, the company is trading at a forward price to adjusted operating cash flow multiple of 16.1 and at a forward EV to EBITDA multiple of 12.9. By comparison, as the chart above illustrates, these numbers using data from 2021 would be 14.4 and 11.5, respectively. As part of my analysis, I also compared TreeHouse Foods to five similar businesses. On a price to operating cash flow basis, these companies ranged from a low of 8.7 to a high of 35.6. Only one of the five companies was cheaper than our prospect. Meanwhile, using the EV to EBITDA approach, the range was from 5.8 to 36.4. In this scenario, only two of the five companies were cheaper than our prospect.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| TreeHouse Foods | 16.1 | 12.9 |

| Utz Brands (UTZ) | 28.9 | 36.4 |

| Hostess Brands (TWNK) | 16.3 | 14.3 |

| The Simply Good Foods Company (SMPL) | 35.6 | 20.7 |

| Cal-Maine Foods (CALM) | 8.7 | 5.8 |

| Whole Earth Brands (FREE) | 23.4 | 10.1 |

Takeaway

Based on what data we have today, I still do believe that there is some uncertainty regarding TreeHouse Foods and its prospects moving forward. Long term though, things are unlikely to be horrible, especially once inflation gets under control. Shares are not as cheap as I would normally prefer them to be given this uncertainty. But considering the massive asset monetization the company just went through and the ultimate impact that has in the form of reduced risk for investors, I do think changing my rating from the ‘hold’ I had it at previously to a soft ‘buy’ makes sense.