Khaosai Wongnatthakan

The next knowledge is derived from buying and selling exercise on the Tradeweb Markets institutional European- and U.S.-listed ETF platforms.

European-Listed ETFs

Whole traded quantity

All through June, buying and selling exercise on the Tradeweb European ETF market reached EUR 55.1 billion, whereas the proportion of transactions processed by way of Tradeweb’s Automated Clever Execution (AiEX) software was 82.8%.

Adam Gould, head of equities at Tradeweb, stated: “June was one other extraordinarily turbulent month for equities. Elevated oil costs, lack of readability from the Fed and a few key earnings misses have been just a few of the various components that contributed to the broad-based unload. Throughout turbulent durations, we proceed to see shoppers use ETFs as a beneficial software to switch threat and tactically place portfolios.”

Quantity breakdown

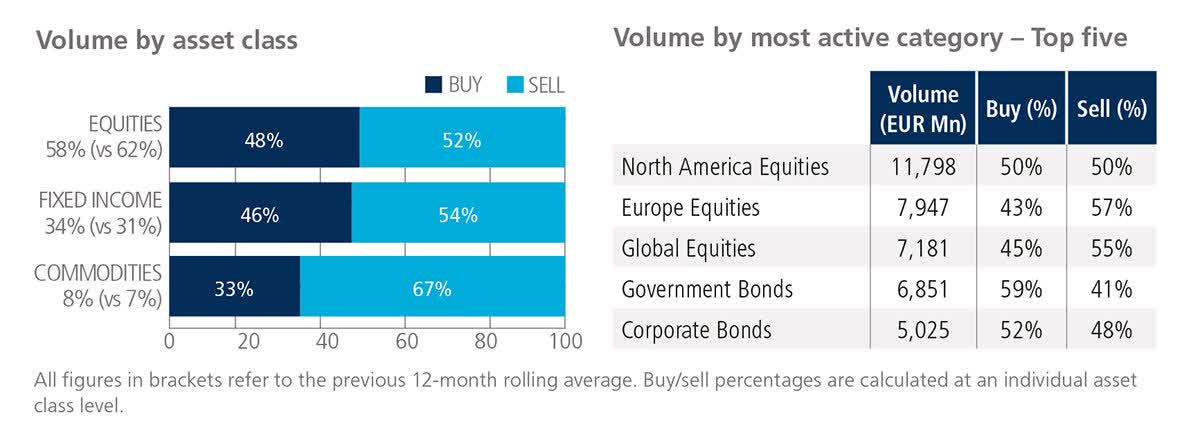

All asset courses noticed internet promoting for the second consecutive month. Exercise in commodity ETFs, the place ‘sells’ outstripped ‘buys’ by 34 share factors, elevated to eight% of the full platform move in June. North America Equities was probably the most actively-traded class, with practically EUR 11.8 billion in whole notional quantity.

High ten by traded notional quantity

The iShares Core S&P 500 UCITS ETF (CSTNL) held on to the highest spot for an additional month. In second place, the Lyxor Commodities Refinitiv/CoreCommodity CRB TR UCITS ETF is benchmarked in opposition to an index monitoring the modifications within the costs of the futures contracts on power, metals and agricultural merchandise.

U.S.-Listed ETFs

Whole traded quantity

Whole consolidated U.S. ETF notional worth traded in June 2022 was USD 58.7 billion, the platform’s third greatest month-to-month efficiency on report.

Quantity breakdown

As a share of whole notional worth, equities accounted for 49% and stuck revenue for 45%, with the rest comprising commodity and specialty ETFs. Adam Gould, head of equities at Tradeweb, stated: “As ETFs more and more turn out to be a staple within the toolkits of traders, we have seen many proceed to embrace digital RFQ as their most popular execution methodology. Yr over 12 months, month-to-month U.S. ETF exercise on Tradeweb was up 135% and for the primary half of 2022, volumes rose 125%.”

Adam Gould, head of equities at Tradeweb, stated: “As ETFs more and more turn out to be a staple within the toolkits of traders, we have seen many proceed to embrace digital RFQ as their most popular execution methodology. Yr over 12 months, month-to-month U.S. ETF exercise on Tradeweb was up 135% and for the primary half of 2022, volumes rose 125%.”

High ten by traded notional quantity

Throughout the month, 2,027 distinctive tickers traded on the Tradeweb U.S. ETF market. Fastened revenue merchandise dominated June’s high ten listing by traded notional quantity, with the Vanguard Brief-Time period Bond Index Fund ETF shifting up 5 locations from Might to be ranked first.

Unique Put up

Editor’s Observe: The abstract bullets for this text have been chosen by Looking for Alpha editors.