shih-wei

A revised long-term efficiency forecast for the World Market Index (GMI) fell once more in August. The downshift marks a second straight decline in anticipated return for GMI, an unmanaged benchmark that holds all the key asset courses (besides money) in accordance to market weights through a set of ETF proxies.

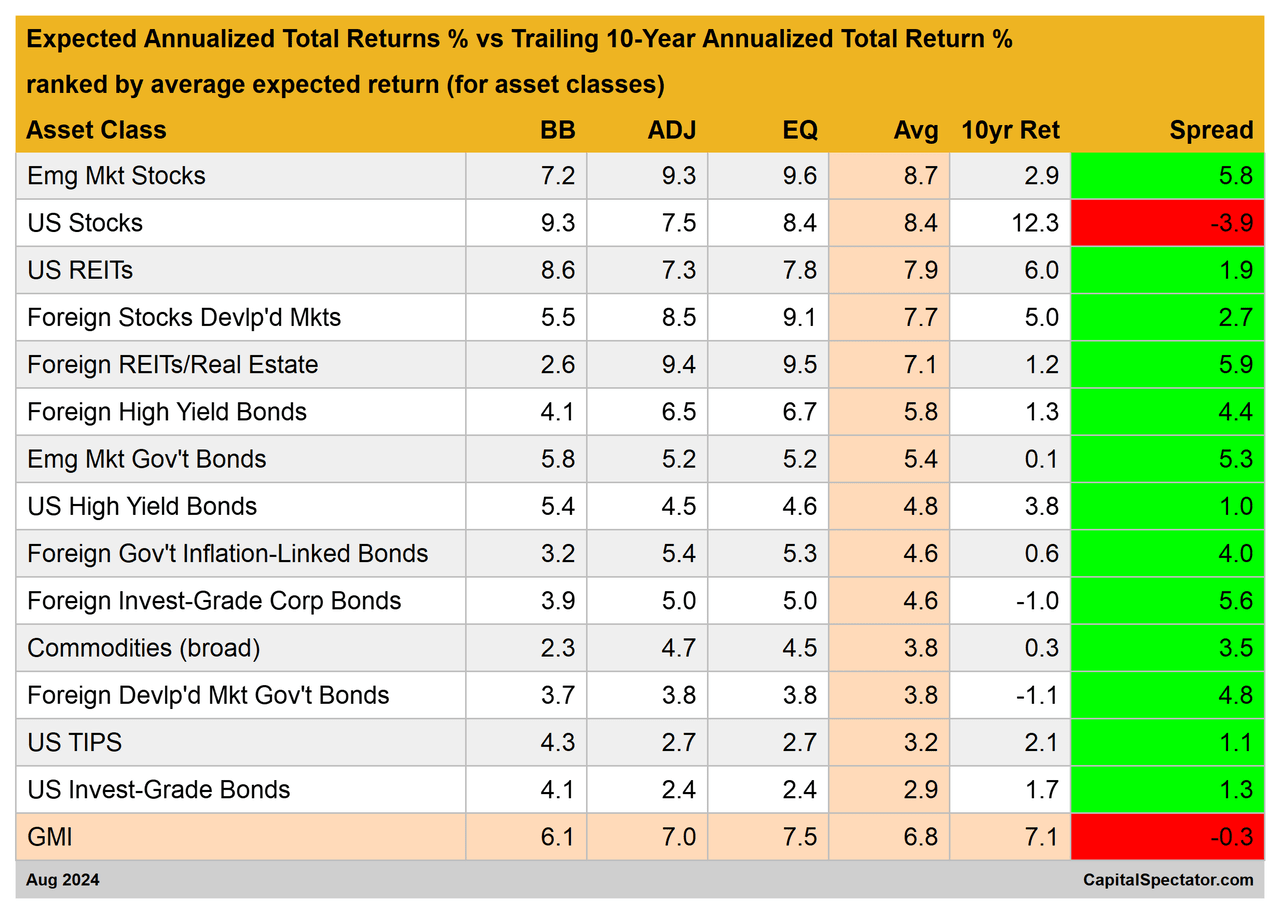

GMI’s long-term estimate eased to an annualized 6.8% efficiency, down from 7.0% within the earlier month, based mostly on the common of three fashions (outlined beneath).

Matching ends in latest historical past, US equities proceed to be the outlier for anticipated return relative to its historical past and the assorted asset courses that comprise GMI. The common forecast for American shares is printing nicely beneath its trailing 10-year efficiency. The implication: US shares are anticipated to earn lesser ends in the years forward vs. the market’s realized return over the previous decade. Against this, the remainder of the key asset courses proceed to publish return forecasts which are above their trailing 10-year information. The implied recommendation: the case for a globally diversified portfolio seems to be extra enticing in comparison with the previous decade.

GMI represents a theoretical benchmark for the “optimum” portfolio that is fitted to the common investor with an infinite time horizon. On that foundation, GMI is beneficial as a start line for customizing asset allocation and portfolio design to match an investor’s expectations, goals, danger tolerance, and many others. GMI’s historical past means that this passive benchmark’s efficiency is aggressive with most energetic asset allocation methods, particularly after adjusting for danger, buying and selling prices and taxes.

It is possible that some, most or probably all the forecasts above will probably be broad of the mark in some extent. GMI’s projections, nevertheless, are anticipated to be considerably extra dependable vs. the estimates for its elements. Predictions for the precise markets (US shares, commodities, and many others.) are topic to larger volatility and monitoring error in contrast with aggregating the forecasts into the GMI estimate, a course of that will scale back a few of the errors by way of time.

One other method to view the projections above is to make use of the estimates as a baseline for refining expectations.

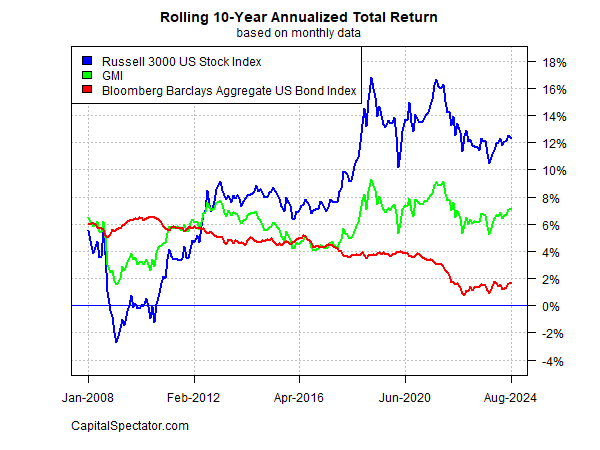

For context on how GMI’s realized complete return has advanced by way of time, take into account the benchmark’s observe report on a rolling 10-year annualized foundation. The chart beneath compares GMI’s efficiency vs. the equal for US shares and US bonds by way of final month. GMI’s present return for the previous ten years is 7.1%, which is middling relative to latest historical past.

This is a short abstract of how the forecasts are generated and definitions of the opposite metrics within the desk above:

BB: The Constructing Block mannequin makes use of historic returns as a proxy for estimating the longer term. The pattern interval used begins in January 1998 (the earliest out there date for all of the asset courses listed above). The process is to calculate the danger premium for every asset class, compute the annualized return after which add an anticipated risk-free fee to generate a complete return forecast. For the anticipated risk-free fee, we’re utilizing the most recent yield on the 10-year Treasury Inflation Protected Safety (TIPS). This yield is taken into account a market estimate of a risk-free, actual (inflation-adjusted) return for a “protected” asset – this “risk-free” fee can also be used for all of the fashions outlined beneath. Be aware that the BB mannequin used right here is (loosely) based mostly on a strategy initially outlined by Ibbotson Associates (a division of Morningstar).

EQ: The Equilibrium mannequin reverse engineers anticipated return by means of danger. Reasonably than attempting to foretell return straight, this mannequin depends on the considerably extra dependable framework of utilizing danger metrics to estimate future efficiency. The method is comparatively sturdy within the sense that forecasting danger is barely simpler than projecting return. The three inputs:

* An estimate of the general portfolio’s anticipated market value of danger, outlined because the Sharpe ratio, which is the ratio of danger premia to volatility (customary deviation). Be aware: the “portfolio” right here and all through is outlined as GMI

* The anticipated volatility (customary deviation) of every asset (GMI’s market elements)

* The anticipated correlation for every asset relative to the portfolio (GMI)

This mannequin for estimating equilibrium returns was initially outlined in a 1974 paper by Professor Invoice Sharpe. For a abstract, see Gary Brinson’s rationalization in Chapter 3 of The Transportable MBA in Funding. I additionally evaluation the mannequin in my ebook Dynamic Asset Allocation. Be aware that this system initially estimates a danger premium after which provides an anticipated risk-free fee to reach at complete return forecasts. The anticipated risk-free fee is printed in BB above.

ADJ: This system is similar to the Equilibrium mannequin (EQ) outlined above, with one exception: the forecasts are adjusted based mostly on short-term momentum and longer-term imply reversion elements. Momentum is outlined as the present value relative to the trailing 12-month transferring common. The imply reversion issue is estimated as the present value relative to the trailing 60-month (5-year) transferring common. The equilibrium forecasts are adjusted based mostly on present costs relative to the 12-month and 60-month transferring averages. If present costs are above (beneath) the transferring averages, the unadjusted danger premia estimates are decreased (elevated). The components for adjustment is just taking the inverse of the common of the present value to the 2 transferring averages. For instance: if an asset class’s present value is 10% above its 12-month transferring common and 20% over its 60-month transferring common, the unadjusted forecast is lowered by 15% (the common of 10% and 20%). The logic right here is that when costs are comparatively excessive vs. latest historical past, the equilibrium forecasts are lowered. On the flip aspect, when costs are comparatively low vs. latest historical past, the equilibrium forecasts are elevated.

Avg: This column is a straightforward common of the three forecasts for every row (asset class)

10yr Ret: For perspective on precise returns, this column exhibits the trailing 10-year annualized complete return for the asset courses by way of the present goal month.

Unfold: Common-model forecast much less trailing 10-year return.

Authentic Submit

Editor’s Be aware: The abstract bullets for this text have been chosen by Looking for Alpha editors.