Ticker seen at Charles Schwab headquarters positioned on 211 Predominant St. seen on Monday, Nov. 25, 2019, in San Francisco, Calif. (Photograph By Liz Hafalia/The San Francisco Chronicle through Getty Photos)

Liz Hafalia | The San Francisco Chronicle through Getty Photos

International inventory markets proceed to be unstable, influenced by the information round wavering tariffs and commerce tensions. Whereas the Trump administration’s rest of sure tariffs may present some reduction, the continued uncertainties and macro challenges would possibly proceed to weigh on investor sentiment.

Given this state of affairs, buyers can take cues from the suggestions of prime analysts and decide some enticing shares which have the power to thrive regardless of short-term headwinds.

With that in thoughts, listed here are three shares favored by the Road’s prime professionals, in line with TipRanks, a platform that ranks analysts primarily based on their previous efficiency.

Charles Schwab

First on this week’s record is monetary providers firm Charles Schwab (SCHW), which presents a variety of brokerage, banking, and advisory providers by means of its working subsidiaries. On April 17, the corporate introduced better-than-expected income and earnings for the primary quarter of 2025.

Following the upbeat outcomes and a optimistic convention name, TD Cowen analyst William Katz raised his 2024-2026 earnings estimates. He additionally reaffirmed a purchase ranking on Charles Schwab inventory and elevated his value goal to $95 from $88, saying, “SCHW stays our prime decide.”

Katz famous that administration’s commentary was primarily bullish, highlighting positives like stable momentum in new enterprise traits/demographics and working leverage. He added that April began on a strong be aware for the corporate, because of robust buying and selling, continued rise in consumer money, comparatively sturdy consumer margin balances, and sure stable web new belongings (NNAs).

The analyst believes that regardless of optimistic EPS revisions and ongoing market volatility, his mannequin continues to be conservative with regards to key drivers like NNAs/consumer money.

Katz sees the chance for extra P/E a number of enlargement, pushed by strong/extra constant administration execution, favorable natural progress dynamics, notable working leverage, and speedy enchancment in stability sheet flexibility.

Katz ranks No. 323 amongst greater than 9,400 analysts tracked by TipRanks. His scores have been worthwhile 58% of the time, delivering a median return of 10.2%. See Charles Schwab Financials on TipRanks.

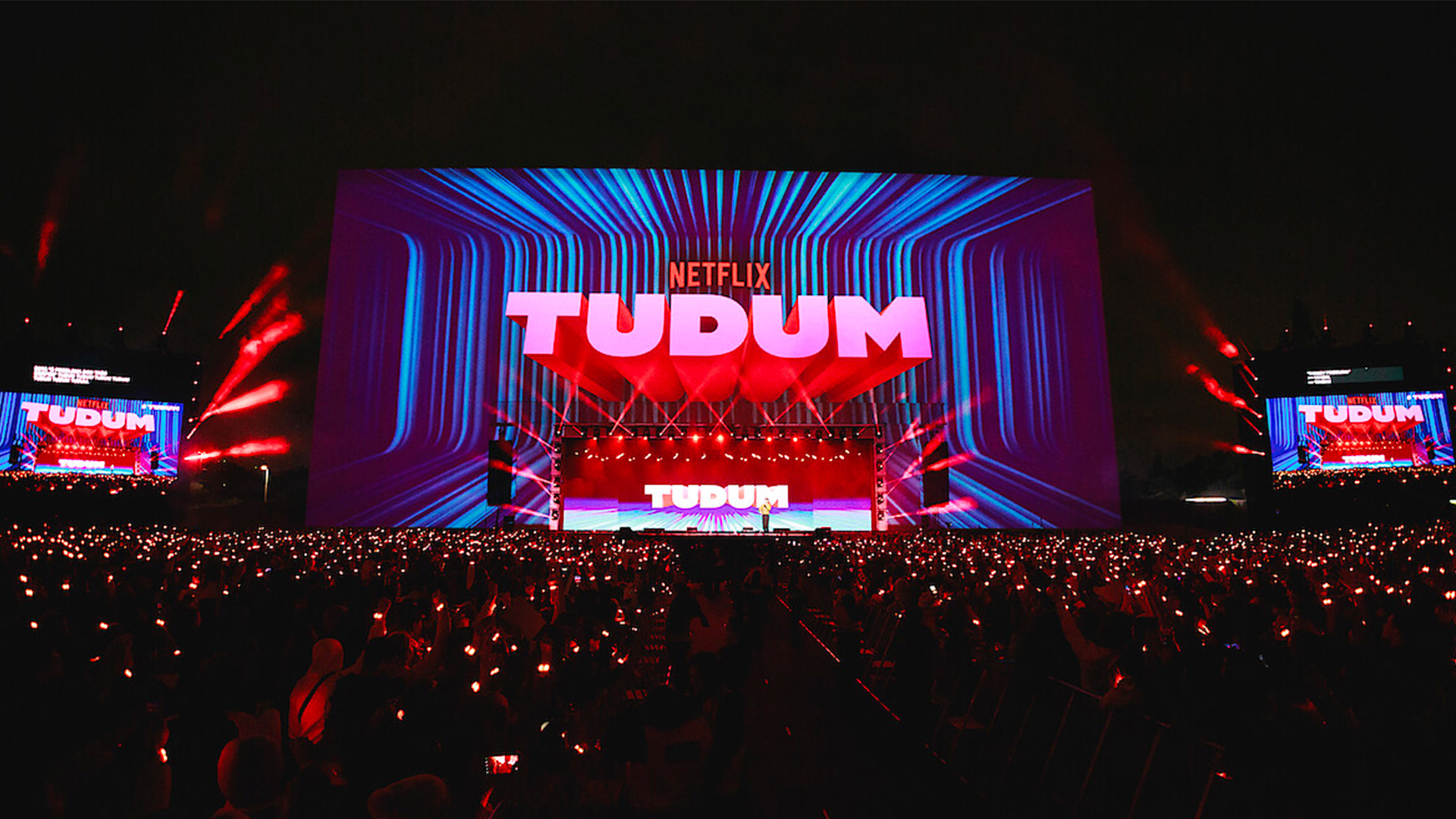

Netflix

Subsequent up is streaming big Netflix (NFLX), which lately posted a major earnings beat for the primary quarter of 2025. Greater-than-expected subscriptions and advert {dollars} helped enhance income and earnings within the quarter.

Impressed by the Q1 print, JPMorgan analyst Doug Anmuth reiterated a purchase ranking on NFLX inventory and raised the value goal to $1,150 from $1,025. “NFLX continues to play offense in its enterprise, whereas the inventory stays defensive within the unsure surroundings,” mentioned the analyst.

Anmuth famous that on the offensive aspect, Netflix supplied stable content material in Q1 2025, with “Adolescence” and three movies breaking into the streaming platform’s all-time hottest record. He added that the corporate is strategically elevating costs, together with the lately introduced enhance in France and the upcoming hikes within the U.S. and U.Ok. One other optimistic highlighted by Anmuth was the rise in Netflix’s promoting enterprise, supported by rising person scale and monetization.

On the defensive aspect, the analyst identified Netflix’s subscription-based mannequin, low churn, robust engagement and excessive leisure worth. Its low-priced advert tier ($7.99/month within the U.S.) additionally makes the service very accessible. Whereas Netflix will not be straight hit by tariffs, Anmuth famous that the corporate’s shareholder letter and interview highlighted its dedication to worldwide programming and manufacturing in Latin America, Asia, Europe, and the U.Ok.

Total, Anmuth is bullish on Netflix inventory because of a number of positives, together with the expectation of double-digit income progress in 2025 and 2026, a continued rise in working margin regardless of progress investments, and a dominant place within the streaming house.

Anmuth ranks No. 81 amongst greater than 9,400 analysts tracked by TipRanks. His scores have been profitable 59% of the time, delivering a median return of 18.3%. See Netflix Hedge Fund Buying and selling Exercise on TipRanks.

Verra Mobility

Lastly, let’s take a look at Verra Mobility (VRRM), a supplier of sensible transportation options like built-in expertise to assist prospects handle tolls, violations, and automobile registrations and faculty zone visitors cameras.

Lately, Baird analyst David Koning upgraded Verra Mobility inventory to purchase from maintain with a value goal of $27. The analyst highlighted the corporate’s stable market place. He finds a troublesome macro surroundings as time to improve the inventory, as a result of he views “high-quality corporations as much less pressured by buyers throughout harder/unsure occasions.”

Whereas Koning acknowledged the potential influence of macro pressures on journey volumes, he’s bullish on Verra Mobility because of its robust moat. Particularly, the analyst famous the stable place of the corporate’s Industrial unit through its rental automobile toll transponders and the moat in its Authorities unit by means of merchandise like velocity/purple gentle/faculty zone cameras.

Moreover, Koning emphasised the renewal of the New York Metropolis (NYC) contract, which accounts for almost 16% of Verra Mobility’s whole income. The analyst additionally thinks that states/municipalities might require extra cameras throughout a difficult macro surroundings to drive extra ticket income.

Koning expects Verra’s EPS estimates to be largely intact in a market the place the earnings estimates of many corporations may very well be lowered. At a valuation of 15x the 2026 EPS estimate, the analyst finds Verra inventory enticing, provided that it’s a high-moat enterprise.

Koning ranks No. 232 amongst greater than 9,400 analysts tracked by TipRanks. His scores have been worthwhile 55% of the time, delivering a median return of 13.2%. See Verra Mobility Possession Construction on TipRanks.