Brief-term rental investing isn’t what it was 5 years in the past—and that’s a good factor.

The market has lastly matured. What used to really feel like a Wild West of trial and error now comes with actual information, confirmed visitor conduct, and smarter underwriting.

For traders, which means we’re seeing one thing highly effective: steadiness. And when income turns into extra predictable, financing your subsequent deal turns into a lot simpler.

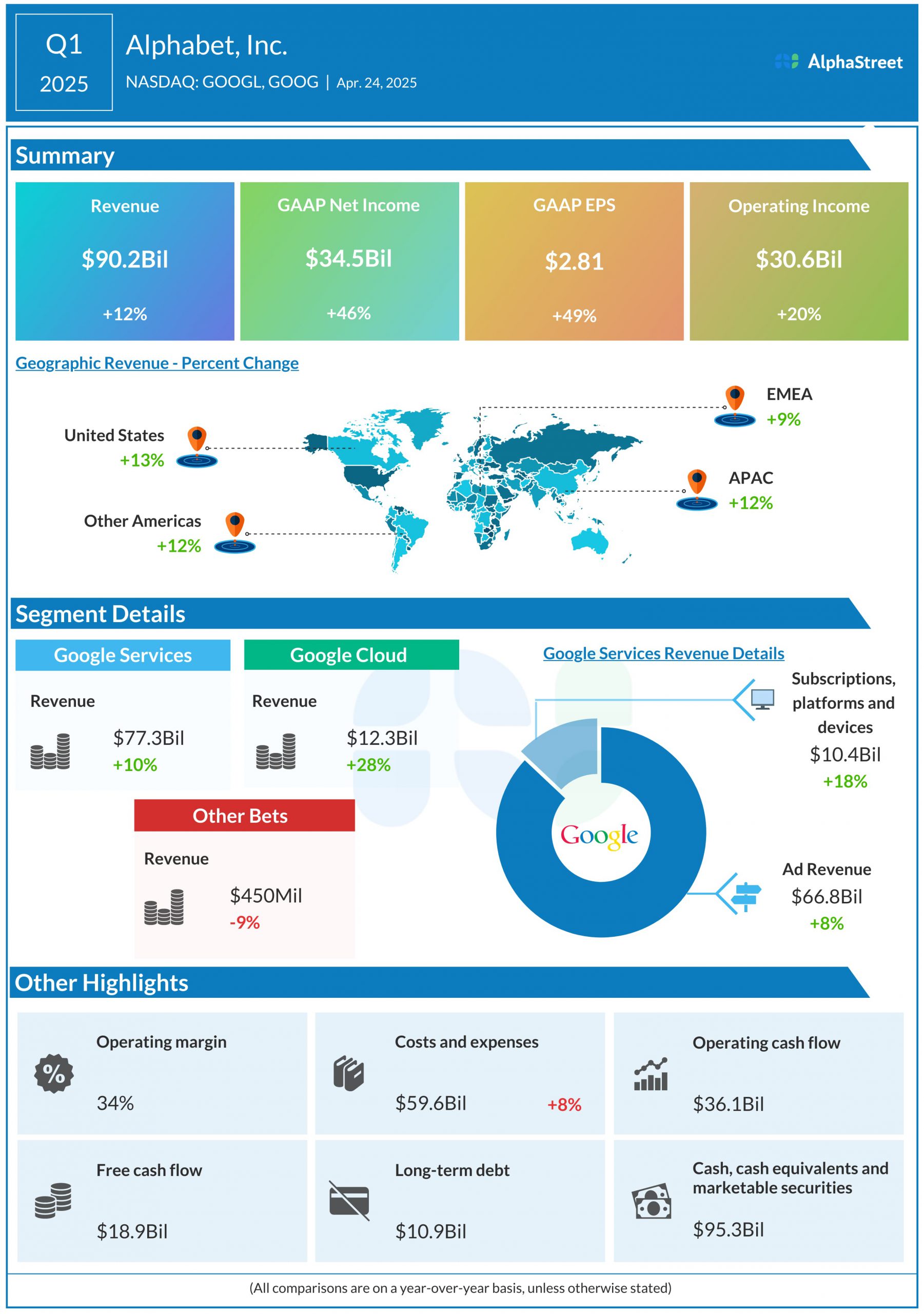

Trying on the Information

That’s exactly why I teamed up with Host Monetary (utilizing AirDNA and Zillow information) to spotlight 5 STR markets that present robust demand and progress and constantly outperform in gross rental yield (the upper the %, the higher).

Gross Rental Yield = (Annual Income / Median Dwelling Worth) × 100

It tells you ways a lot revenue you’re producing relative to the acquisition value. The upper the share, the extra revenue you’re getting for each greenback you spend money on shopping for the property.

Let’s say:

- The median house value in a market is $300,000.

- Annual STR income is $45,000.

Then:

Gross Rental Yield = ($45,000 ÷ $300,000) × 100 = 15%

Which means you’re incomes 15% of the property’s worth in rental revenue every year—earlier than bills. That’s a robust quantity, particularly for STRs.

These aren’t simply nice locations to take a position; they’re nice locations to get financed. With a DSCR (debt service protection ratio) mortgage, Host Monetary will help you qualify based mostly on what the property will earn as a short-term rental, not what it would carry as a long-term lease.

Whether or not you’re making an attempt so as to add a cash-flowing trip rental or scale into a brand new state, listed here are 5 markets to observe in 2025, and precisely how Host will help you make it occur.

1. Shenandoah, Virginia

- Market rating: 94

- Annual income: $42K

- ADR: $266.51

- RevPAR: $128.94

- Common home value: $255,593

- Yield: 16.4%

Shenandoah is essentially the most underrated short-term rental area within the U.S. With proximity to Shenandoah Nationwide Park and one of many highest income progress scores within the nation, this vacation spot is outperforming even with reasonable occupancy. Excessive ADRs, robust seasonality, and inexpensive property costs make it a win for nature-focused stays.

Financing tip

With regular RevPAR and favorable seasonality, Host will help you qualify utilizing STR-specific revenue projections, even in markets the place conventional rental comps fall brief.

2. Columbia, South Carolina

- Market rating: 98

- Annual income: $33.9K

- ADR: $201.50

- Occupancy: 57%

- Common home value: $232,153

- Yield: 14.6%

Columbia is delivering the most effective general AirDNA scores within the nation. With robust scores throughout income progress (+10%), seasonality, and occupancy, it’s a primary instance of a midsized metropolis STR market on the rise. Bonus: Columbia is a university city, a capital metropolis, and a enterprise hub multi function.

Financing tip

This is a “go large or go house” market. Giant houses are outperforming as a result of they appeal to households, sports activities journey teams, faculty reunion crews, and occasion company. If you may provide beds, bogs, and daring design, Columbia will reward you.

3. Poconos, Pennsylvania

- Market rating: 60

- Annual income: $53.2K

- ADR: $394.14

- RevPAR: $164.27

- Common home value: $246,669

- Yield: 21.5%

The Poconos show that seasonal demand doesn’t must imply seasonal revenue. Providing larger houses that may sleep massive teams and facilities like scorching tubs and sport rooms, you may command luxurious nightly charges, even when occupancy is barely decrease. Add a RevPAR of $164, and it’s nonetheless a high-yield machine.

Financing tip

Many properties right here fall into the large-home, high-income class. Host gives jumbo DSCR loans which are good for second houses which are producing $50K+ in annual income.

4. Tulsa, Oklahoma

- Market rating: 99

- Annual income: $28.3K

- ADR: $173.92

- RevPAR: $95.42

- Common home value: $205,014

- Yield: 13.8%

Tulsa continues to shock STR traders. It’s received city appeal, rising tourism, and a various journey base. Occupancy and RevPAR have each seen wholesome progress, and with a 91 Investability Rating, it’s primed for value-add STR traders who know how you can market effectively and furnish sensible.

Financing tip

Whether or not you’re planning a short-term rental or holding as a long-term, Host Monetary will help you qualify utilizing both mannequin. For STRs, you may get accepted based mostly on projected Airbnb income. For LTRs, you need to use normal hire comps. Tulsa is likely one of the few markets the place each financing paths make sense and provide substantial upside.

5. Destin, Florida

Market rating: 91

Annual income: $72.2K

ADR: $395.52

RevPAR: $245.60

Common home value:$577,366

Yield: 12.5%

Destin may not be “undiscovered,” but it surely’s nonetheless one of the worthwhile beachfront markets within the U.S. With income progress of 11% and a $72K common gross, this Emerald Coast scorching spot constantly rewards traders who play within the upper-mid or luxurious tiers. Jumbo DSCR loans permit traders to interrupt into luxurious short-term rental markets without having conventional revenue verification.

As an alternative of utilizing your private revenue, lenders qualify the mortgage based mostly on the property’s projected rental efficiency. If you may have robust liquidity and a strong credit score rating, you may qualify for properties that exceed conforming mortgage limits. This opens the door to high-end STR offers that the majority traders by no means assume are potential.

Financing tip

For a higher-price market like Destin, Host gives jumbo DSCR and second-home merchandise with versatile phrases—good for premium STRs in scorching places. Prequalifying early is vital, particularly throughout aggressive seasons.

Why STR Financing Isn’t One-Measurement-Suits-All

Every market has completely different guidelines—some require allow approvals, others require STR revenue documentation, and lots of push for LLC vesting, relying in your mortgage sort. That’s why working with a lender specializing in trip leases makes all of the distinction.

Host Monetary helps you:

- Construction your mortgage with the right entity.

- Use STR projections as a substitute of LTR comps.

- Get prequalified rapidly, with minimal crimson tape.

- Shut with confidence, even in permit-restricted areas.

Setting Your self Up for Success

When shopping for in rising short-term rental markets, just a few key methods separate profitable traders from the remainder.

First, at all times get prequalified by speaking with Host Monetary. Use projected STR revenue instruments to safe higher mortgage phrases and strengthen, sooner gives. Discuss all the main points that associate with their completely different sort of mortgage merchandise. Lastly, understanding native zoning legal guidelines is essential, as not each metropolis welcomes STRs equally, and figuring out the native legal guidelines means you may keep compliant from day one.

When you personal the property, design with the visitor expertise in thoughts since excessive ADRs typically come from distinctive touches, revolutionary layouts, and nice aesthetics.

Lastly, construct a community of native STR professionals, together with cleaners, allow places of work, and property managers, to maintain operations working easily and company returning.

Remaining Ideas

The short-term rental business has grown, and so have the methods that drive the most effective returns. We’re not in an period of guesswork. Because of extra constant visitor demand, stronger seasonality information, and smarter monetary merchandise, as we speak’s STR traders have the chance to construct actual, scalable portfolios in worthwhile, sustainable markets.

These 5 markets stand out as a result of they mix dependable income with favorable property pricing, producing gross rental yields that outpace many of the nation. Extra importantly, they provide room to develop.

What makes these alternatives much more accessible is the financing. With a DSCR mortgage from Host Monetary, you may qualify based mostly on what your property will earn as a short-term rental, not simply what it will carry in as a long-term lease. Which means your income potential works in your favor, opening the door to raised investments, even in markets with larger value tags.

Whether or not you’re scaling into your second or tenth property, the formulation for fulfillment is similar: Perceive your market, design for the visitor, construct a strong native staff, and companion with a lender who really will get the STR sport.

If you’re able to get prequalified and begin making aggressive gives, Host Monetary is constructed for you. Let this be the 12 months you purchase smarter, scale sooner, and make investments with confidence.