Actual property asset tokenization, powered by blockchain expertise, is opening doorways to unprecedented alternatives for traders and property house owners alike. Let’s dive into this transformative pattern and discover the way it’s set to redefine the way forward for actual property funding.

Actual property has lengthy been thought of a secure and profitable funding choice. Nonetheless, conventional actual property investments typically include important limitations to entry, together with excessive capital necessities and restricted liquidity. Enter actual property asset tokenization — a game-changing method that’s quickly gaining traction within the business.

As of early 2024, the market worth of tokenized real-world belongings, together with actual property, has reached a powerful $2.77 billion. This staggering determine underscores the rising confidence and funding in tokenization expertise throughout varied sectors, with actual property main the cost.

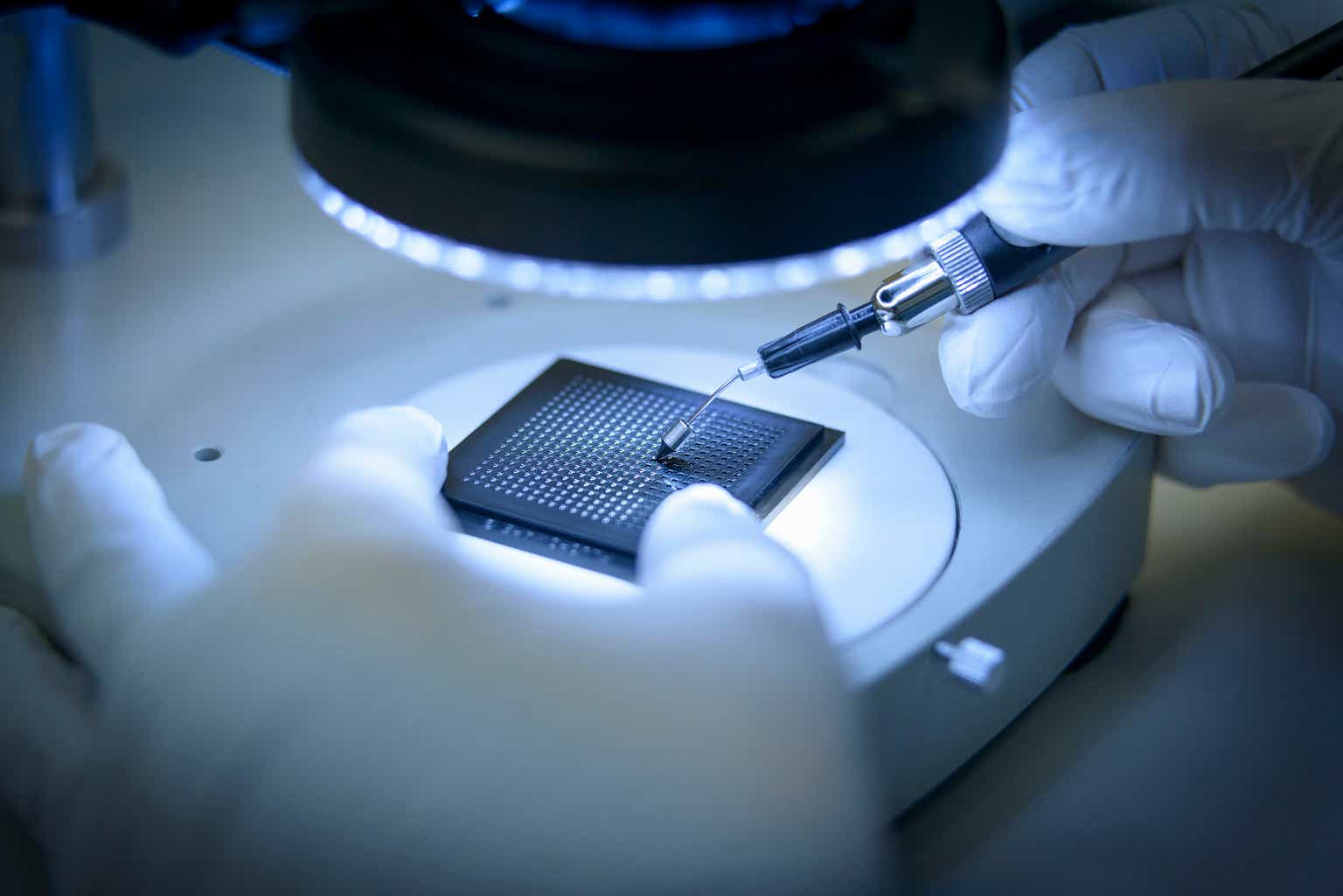

Actual property asset tokenization includes changing the possession rights of a property into digital tokens on a blockchain platform. These tokens signify fractional possession of the underlying actual property asset. By leveraging blockchain expertise, corresponding to Hyperledger Material, the method ensures transparency, safety, and immutability of possession data.

1. Enhanced Liquidity: Tokenization transforms historically illiquid actual property belongings into simply tradable digital tokens. This elevated liquidity permits traders to purchase or promote their property shares rapidly and effectively.

2. Decrease Barrier to Entry: By enabling fractional possession, tokenization opens up actual property funding alternatives to a broader vary of traders. You not want hundreds of thousands to put money into prime actual property — you can begin with a fraction of that quantity.

3. International Accessibility: Tokenized actual property belongings might be traded 24/7 on world platforms, eradicating geographical limitations and time zone restrictions.

4. Elevated Transparency: Blockchain expertise gives an immutable file of all transactions, guaranteeing transparency and lowering the chance of fraud.

5. Environment friendly Administration: Sensible contracts automate many points of property administration, from hire assortment to dividend distribution, streamlining operations and lowering prices.

With regards to actual property asset tokenization, safety and scalability are paramount. That is the place Hyperledger Material comes into play. As an open-source blockchain framework, Hyperledger Material gives a number of benefits that make it a perfect alternative for actual property tokenization:

1. Privateness and Permissioned Entry: Hyperledger Material permits for the creation of personal channels, guaranteeing that delicate actual property knowledge is simply accessible to approved events.

2. Scalability: With its modular structure, Hyperledger Material can deal with excessive transaction volumes, essential for large-scale actual property tokenization initiatives.

3. Sensible Contract Help: Hyperledger Material’s chaincode (good contracts) allows the automation of advanced actual property transactions and administration processes.

4. Interoperability: Its versatile design permits for seamless integration with present actual property administration programs and different blockchain networks.

The potential of actual property asset tokenization is not only theoretical — it’s already being realized in varied initiatives worldwide. As an example, in 2023, a luxurious condominium constructing in Manhattan was efficiently tokenized, permitting traders to buy shares for as little as $1,000. This mission attracted over 5,000 traders from 30 completely different nations, showcasing the worldwide enchantment and accessibility of tokenized actual property.

One other notable instance is the tokenization of a $30 million resort in Aspen, Colorado. The mission raised $18 million by safety token choices, demonstrating how tokenization can be utilized to fund large-scale actual property developments.

As we glance towards the longer term, the potential for actual property asset tokenization seems boundless. Business consultants predict that by 2026, as much as 10% of worldwide GDP can be tokenized, with actual property enjoying a major position on this transformation.

Rising Tendencies to Watch

1. Tokenized REITs: Conventional Actual Property Funding Trusts (REITs) are embracing tokenization, providing traders extra versatile and accessible methods to put money into diversified actual property portfolios.

2. Cross-Border Investments: Tokenization is breaking down geographical limitations, making it simpler for worldwide traders to take part in actual property markets worldwide.

3. Sustainable Actual Property Tokens: As environmental considerations take middle stage, we’re seeing the emergence of tokenized inexperienced buildings and sustainable actual property initiatives.

4. Integration with DeFi: The mixing of tokenized actual property with Decentralized Finance (DeFi) platforms is opening up new potentialities for lending, borrowing, and yield farming utilizing actual estate-backed tokens.

Whereas the potential of actual property asset tokenization is gigantic, it’s necessary to acknowledge the challenges:

1. Regulatory Panorama: The regulatory framework for tokenized actual property remains to be evolving. Buyers and mission builders should navigate advanced and typically unsure authorized territories.

2. Know-how Adoption: Widespread adoption of blockchain expertise in the actual property sector faces hurdles, together with resistance to vary and the necessity for training.

3. Valuation Complexities: Precisely valuing fractional possession of actual property belongings presents new challenges that the business is working to deal with.

4. Safety Considerations: Whereas blockchain gives enhanced safety, the digital nature of tokens introduces new cybersecurity dangers that should be fastidiously managed.

Actual property asset tokenization, powered by modern applied sciences like Hyperledger Material, is ushering in a brand new period of property funding. By unlocking liquidity, enhancing accessibility, and enabling world funding alternatives, tokenization is democratizing actual property funding in unprecedented methods.

As we transfer ahead, the convergence of blockchain expertise and actual property is ready to reshape the business panorama. For traders, property house owners, and actual property professionals, staying knowledgeable and adaptable can be key to leveraging the immense alternatives that actual property asset tokenization presents.

The way forward for actual property funding is right here, and it’s tokenized. Are you able to be a part of this revolutionary change?