By Egon von Greyerz

The large cash creation within the 2000s has led to a debt and asset bubble, which is about to burst. Buyers shall be shocked by the velocity of the decline and received’t react earlier than it’s too late.

The large cash creation by central and industrial banks on this century has resulted in a progress of worldwide property from $450 trillion in 2000 to $1,540 trillion in 2020.

DEBT TO GDP GROWTH

Because the chart under exhibits US debt to GDP held properly under 25% from 1790 to the Thirties, a interval of just about 150 years. The despair with the New Deal adopted by WWII pushed debt to GDP as much as 125%. Then after the conflict, the debt got here right down to round 30% within the early Seventies.

The closing of the gold window in 1971 ended all fiscal and financial self-discipline. Since then, the US and far of the Western world has seen debt to GDP surge to properly over 100%. Within the US, Public Debt to GDP is now 125%. Again in 2000 it was solely 54% however since then we’ve seen a vote shopping for system with a cash printing bonanza and an exponential improve in debt to 125%.

A significant a part of the debt improve has gone to finance the speedy progress in property values.

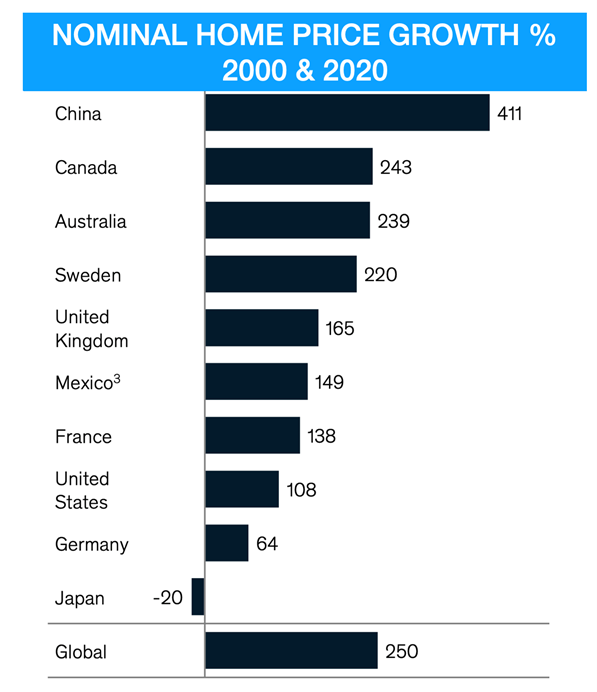

The desk under exhibits that property has grown on common by 250% between 2000 and 2020. So people are creating wealth by swapping properties with one another. Hardly a sustainable type of wealth creation.

The exponential progress in property costs has been international though international locations like China, Canada, Australia and Sweden stand out with over 200% good points since 2000. Many of the properties purchased within the final 20+ years contain large leverage. When the property bubble quickly bursts, many property house owners can have damaging fairness and will simply lose their properties.

So each personal and authorities debt is continuous to develop quickly. However no person ought to consider that it’s going to cease right here. The Fed’s intention to cut back the stability sheet isn’t working and the debt is at greatest going sideways at the moment.

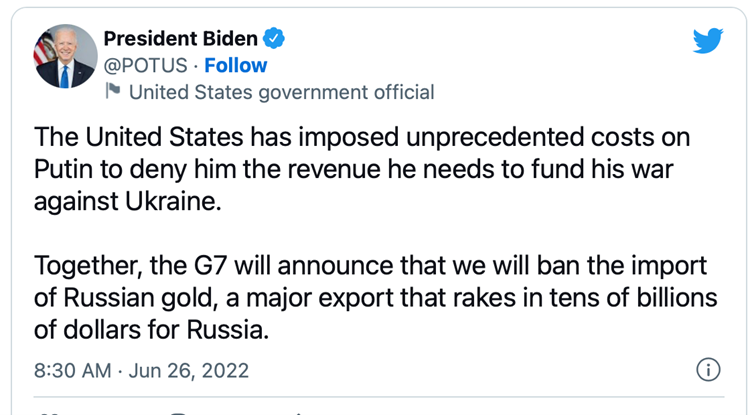

BIDEN BANS RUSSIAN GOLD

So it’s occurring once more. The US has determined to ban imports of Russian gold and advised the entire G7 to observe swimsuit. President Biden despatched the next Tweet final week:

So what’s going to the results be?

Russia is the second greatest gold producer on the planet after China. Identical to with oil, gasoline and plenty of different commodities, the impact shall be larger gold costs over time. The gold commerce is worldwide and the foremost patrons of gold are China and India. So Russia can proceed to promote gold to the Far East, the center East and South America.

Additionally, when the EU sanctions began, the LBMA (London Bullion Market Affiliation) determined to not settle for gold that had been refined in Russia.

So the impact of the G7 ban shall be minimal since gold deliveries from Russian refiners to the bullion banks already stopped in early March.

SANCTIONS ARE COUNTER PRODUCTIVE

Biden additionally signed an govt order on 15 March this yr, prohibiting US individuals to be concerned with gold buying and selling with Russian events.

Nonetheless, extra sanctions by the US and Europe will over time create shortages in gold simply because it has in different commodities. So Russia will have the ability to promote its commodities together with gold to different markets at larger costs.

However since Russia by far has the best commodity reserves on the planet at $75 trillion, the worth of those reserves are going to understand for years as we at the moment are at the start of a serious bull market in commodities.

The US and EU sanctions of Russia have an effect on round 15% of the world inhabitants so there are nonetheless loads of markets the place Russia can commerce.

The Roman Empire managed components of Europe, North Africa and the Center East. The Empire prospered primarily on account of free commerce inside the entire space with no sanctions. Sanctions damage all events concerned. And since Russia is such a serious commodity nation that may proceed to commerce with main nations, they are going to over time endure lower than the sanctioning international locations.

The implications of those sanctions particularly for Europe the place many international locations are depending on Russian oil and gasoline shall be completely devastating. So the US and Europe have actually shot themselves within the foot.

GOLD, THE US DOLLAR & STOCK MARKETS

Coming again to gold, the US and G7 transfer is extra more likely to have a useful impact on gold over time with demand rising and provide being restricted.

Gold began an uptrend in yr 2001 that lasted for 10 years to 2011 when gold reached $1,920. After a serious correction for 3 years till 2016, to $1,060, gold has resumed its exponential uptrend as may be seen within the chart under.

Though gold has not but made sustained new highs in {dollars}, we’ve seen a lot larger highs in gold in opposition to most currencies. The quickly robust greenback is making gold look weak measured within the US forex however that’s unlikely to final for lengthy.

MAJOR GOLD MOVE COMING

Because the chart under exhibits, gold is ending a Cup and Deal with technical sample. It does permit for a barely cheaper price earlier than the following transfer up though that’s not sure. Regardless, the foremost pattern for gold is substantial and I anticipate a sustained transfer as much as not less than 2026 however most likely for for much longer. Clearly there shall be main corrections on the way in which.

DOLLAR FALL NEXT

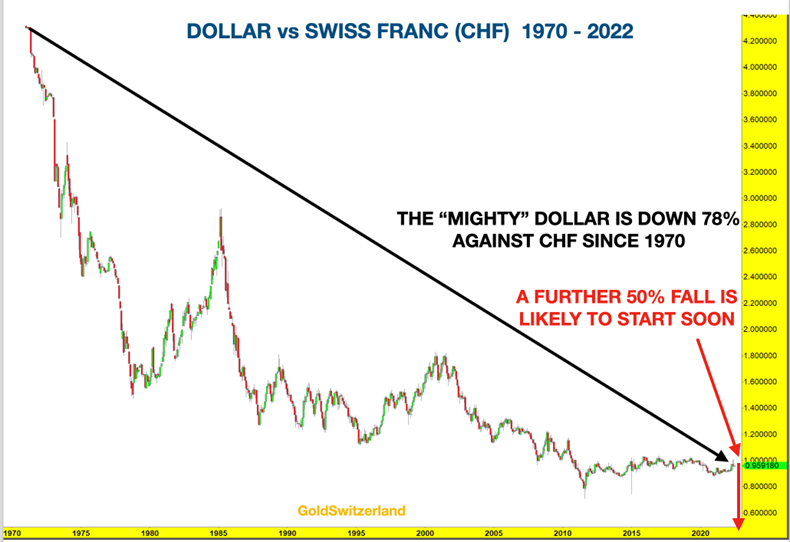

If we take a look at the chart of the greenback in opposition to the Swiss franc since 1970, we will see that the 78% fall up to now has gone sideways for 10 years.

The following transfer down is more likely to be one other 50% to 0.45-0.50 not less than.

So the feeble and non permanent greenback correction up is more likely to finish quickly with a powerful down transfer subsequent.

MAJOR STOCK MARKET FALL AHEAD

Shares globally are down round 20% this yr.

The following transfer down in shares is might occur throughout the subsequent few weeks. That is possible be a stunning transfer which is able to paralyse traders as they received’t have time to react.

So we might see shares and greenback strongly down on the similar time with the metals up. Even when gold and silver comes down initially, that transfer won’t final. The uptrend within the metals is quickly about to renew.

Wealth preservation

Our firm made substantial purchases of bodily gold at the start of 2002 for our traders and ourselves. The value was then $300. We now have by no means offered an oz since then however added at opportune moments.

There was, because the gold chart above exhibits, a serious transfer till 2011 after which a vicious 3 yr correction to $1,060 earlier than the bull pattern resumed. As I discussed above, gold has made a lot larger highs above the 2011-12 highs in Euros, Kilos,Yen, Swedish kronor, Australian {dollars} and many others.

US greenback highs are simply across the nook.

As we purchased gold for wealth preservation functions, it was important that it was bodily with direct possession and management for the investor. To have the ability to examine your personal gold can be a requirement.

It is usually crucial to retailer the gold exterior an more and more fragile monetary system. In the event you purchase gold as insurance coverage in opposition to such an over-leveraged and weak system, it clearly serves no function to retailer it inside that system.

To retailer your insurance coverage asset in a protected jurisdiction is clearly essential. Particularly with the present geopolitical unrest it’s important to take recommendation on location. Additionally necessary is to have the ability to transfer the gold shortly if vital.

The popularity and values of the corporate that assists you along with your gold investments have to be impeccable.

It serves no function to make your selection primarily based on the bottom value of storage, insurance coverage and dealing with when you find yourself defending when of your most necessary property.

BE CAREFUL

So there are more likely to be main strikes in markets subsequent.

Nobody can after all time these strikes precisely. However what’s essential to grasp is that threat is now extraordinarily excessive and traders aren’t going to be saved by central banks.

Assist Assist Unbiased Media, Please Donate or Subscribe:

Trending:

Views:

122