Secure As Homes?

Nice Ones, it’s time to speak about homes once more.

Do we actually must?

Sure. Sure, we do … and I don’t prefer it any greater than you do.

You see, there was a report on February U.S. current dwelling gross sales on Friday that actually acquired buried beneath a landslide of Russia/Ukraine and oil information.

And whereas I do know that the market can stay irrational longer than I can stay solvent, this newest housing information doesn’t bode properly for the market.

Simply what we wanted … one other crimson flag.

Sorry, Nice Ones. I name ‘em like I see ‘em.

That’s proper, ya acquired bother, people! Proper right here in River Metropolis. Hassle with a capital “T,” and that rhymes with “P,” and that stands for expensive!

Dude, it’s Monday. I ain’t acquired time for The Music Man proper now … get to the purpose!

Proper.

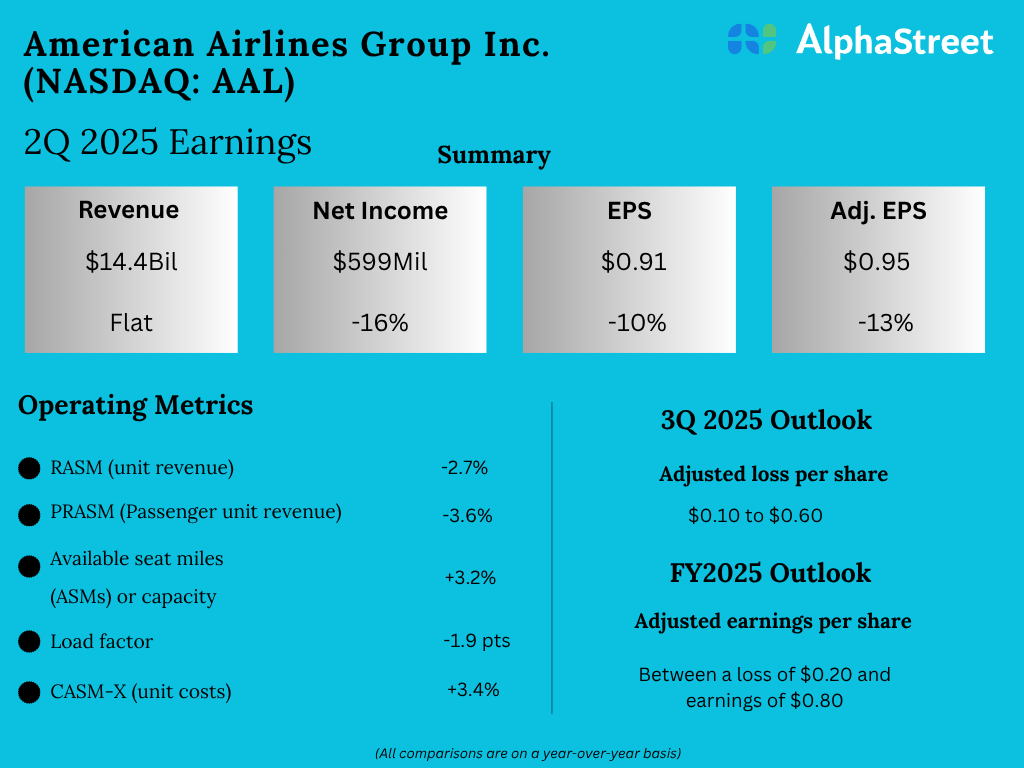

On Friday final week, the Nationwide Affiliation of Realtors (NAR) reported that February U.S. current dwelling gross sales plunged 7.2% from January and have been down 2.4% yr over yr. In reality, gross sales declined in every of the 4 main U.S. areas, with the Northeast and Midwest hit the toughest.

NAR Chief Economist Lawrence Yun famous that: “Housing affordability continues to be a serious problem, as patrons are getting a double whammy: rising mortgage charges and sustained worth will increase.”

However Yun additionally mentioned that he expects “the tempo of worth appreciation to sluggish as demand cools and as provide improves considerably because of extra dwelling building.”

I believe Yun is spot on, to a point. It’s vital to notice that dwelling gross sales and building all the time take successful in January and February … as a result of it’s freaking chilly within the winter. Duh. Too chilly to construct … too chilly to purchase for many.

So Yun has it proper that extra dwelling building later this yr will enhance the housing market state of affairs … however solely reasonably.

If we have been simply trying on the housing market in a vacuum, Yun and a plethora of different economists can be spot on. The factor is, it’s not nearly hovering dwelling costs and rents. It’s about hovering all the pieces.

Sure, I do know I used to be a type of “speaking heads” pushing the notion that inflation can be transitory. I nonetheless imagine that. However no one expects the Russian inquisition!

Issues occur. It’s what it’s. Name it what you’ll, however Russia actually threw a monkey wrench into the entire restoration narrative.

Due to Russia’s invasion of Ukraine, provide chains are nonetheless tousled. Commodities like oil, pure fuel, grain, neon, nickel, and so on. are all out of whack, once they ought to have began to normalize lastly.

Throw all of that on high of skyrocketing dwelling costs and rising mortgage charges … and y’all gonna have a foul time shopping for a home anytime quickly.

However what about extra homes being constructed later this yr, like Mr. Yun says?

Oh, there’ll be extra homes to promote later this yr. Homes with increased costs because of increased commodity costs, juiced by inflationary pressures. What’s extra, these homes will value extra to finance because of rising rates of interest.

My query is that this: How will Individuals spend extra on homes once we’re already spending extra all over the place else?

Inflation has already sucked up any private earnings good points Individuals made in the course of the Nice Resignation (which remains to be ongoing, by the way in which). The place’s the cash for a brand new dwelling going to return from?

Now, you would possibly argue that current owners may faucet into dwelling fairness or promote their properties for a revenue to purchase extra stuff. However with mortgage charges rising, the price of dwelling fairness loans and refinancing goes up too.

Moreover, it doesn’t matter how far more priceless your home is that if nobody can afford it.

After all, I could possibly be flawed. The U.S. economic system may climate all of this in stride, and there’ll be no main repercussions from the spikes in inflation, vitality costs, meals, dwelling costs, and so on. Be aware: I mentioned main repercussions … i.e., a recession.

However I don’t imagine that, and I don’t suppose any of you imagine that both.

In different phrases, ya acquired bother, people! Proper right here in River Metropolis. Hassle with a capital “T,” and that rhymes with “P,” and that stands for expensive!

Editor’s Be aware: A $30 Trillion Shock Wave Is About to Change America Without end

A radical new know-how could possibly be about to ship a $30 trillion shock wave throughout America. And in keeping with a high dealer and former World Financial institution economist, a tiny American firm — which trades for lower than $50 — holds the important thing to unleashing this know-how.

Proper now this little firm is just about unknown outdoors of tech circles — and a number of other high-profile billionaire traders. However that might quickly all change.

Click on right here to see why…

Going: Go Buffett Or Go House

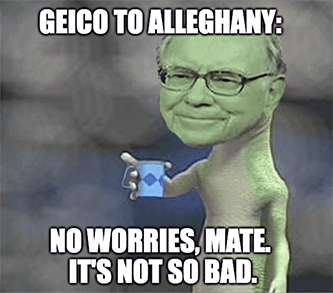

In what’s presumably essentially the most boring buyout within the historical past of buyouts … Warren Buffett’s Berkshire Hathaway (NYSE: BRK.A) has determined to buy insurance coverage firm Alleghany (NYSE: Y) for $11.6 billion.

When requested concerning the “daring” resolution to accumulate Alleghany, the Oracle of Omaha himself boasted: “Berkshire would be the excellent everlasting dwelling for Alleghany, an organization that I’ve intently noticed for 60 years.”

Is it simply me, or is that probably not a solution…

Nonetheless obscure Buffett’s beliefs could also be, the transfer does comply with Berkshire’s normal M.O. of shopping for bread-and-butter insurance coverage companies with good progress prospects, like Geico auto insurance coverage.

You could possibly save 15% or extra on automobile insurance coverage by shopping for us outright … or one thing like that.

Extra importantly, Buffett’s response begs the query: In case you haven’t researched your funding for 60 years … have you ever actually achieved your due diligence?

Let me know what you suppose: [email protected].

Going: GM’s Cruise Truce

This brand-new Chevy with a elevate package … it’d look lots higher with self-driving tech in it. So GM, you’re a tune, you make me wanna roll my portfolio down … and Cruise.

Is that … Florida Georgia Line? However Nice Stuff, I assumed you listened to, uhh, good nation?

You’ll must pardon the earworm in the present day, however Common Motors (NYSE: GM) is worming its manner again into Nice Stuff’s digital pages as soon as once more. The automaker simply introduced it’s shopping for Softbank’s stake in its self-driving Cruise subsidiary.

The value tag? $2.1 billion. Softbank was supposed to dump one other billion into Cruise to assist with industrial deployment, however GM’s stepping as much as the plate and nabbing full possession. However why?

Properly, with the corporate’s ever-growing push into electrical autos (EVs) comes the necessity to automate these autos. With Cruise remaining in-house — and never headed for the IPO highlight like Wall Road hoped for — GM can higher leverage the tech in its new EVs.

Or, as GM CEO Mary Barra places it, Cruise will assist GM “pursue essentially the most value-accretive path to commercializing and unlocking the complete potential of [automated vehicle] know-how.”

I like my phrasing higher, personally.

As for Softbank? Properly, I hope the tech funding agency doesn’t go and spend all that money in a single place… *cough WeWork cough*

However GM isn’t the one one spending huge wads of money on self-driving. Virtually each automobile firm is betting on this new tech: Audi alone is investing $16 billion … GM, $27 billion by way of 2025. BMW? $35 billion. In reality, Google, Amazon, Apple and even the U.S. Military are investing in it.

Click on right here to see why!

Gone: Beleaguered Boeing

In information that’s gone from unhealthy to Boeing (NYSE: BA), a 737-800 passenger airplane operated by China Jap Airways slammed into the facet of a mountain over the weekend after quickly dropping altitude over Southern China.

Whereas airline regulators nonetheless haven’t decided the reason for the crash, China is exercising warning and calling for all 737-800 jets to be grounded till additional discover.

Now, it will be straightforward on this state of affairs to begin pointing fingers at Boeing due to its previous issues with its 737 MAX planes. However the fact is that we don’t know whether or not Boeing’s manufacturing is guilty for the crash … and we received’t for a while.

The incident may have been the results of a design flaw, but it surely may have additionally come all the way down to poor upkeep practices. There’s additionally the chance that this was some random one-off occasion.

For that reason, I’m refusing to make a snap judgement name on Boeing earlier than we be taught the reason for the crash — and encourage Nice Stuff Picks traders to do the identical.

Does this look unhealthy for Boeing in the present day? Sure. It’s a tragic state of affairs for all concerned, particularly with Boeing already working double-time to get the 737 Max cleared for flights once more in China.

However, at this level, there’s no clear cause for traders to bail on Boeing inventory. In case you imagine in Boeing like I do and acquired into the corporate for its robust progress prospects, hold holding.

I hope you’re conscious and caffeinated, Nice Ones! It’s time for a lil’ thought experiment for in the present day’s Chart of the Week.

Aw, I used to be advised there’d be no pondering!

Don’t fret — there shall be no fretting on my watch. You would possibly’ve seen this chart earlier than, and in that case, nice! If not … even higher!

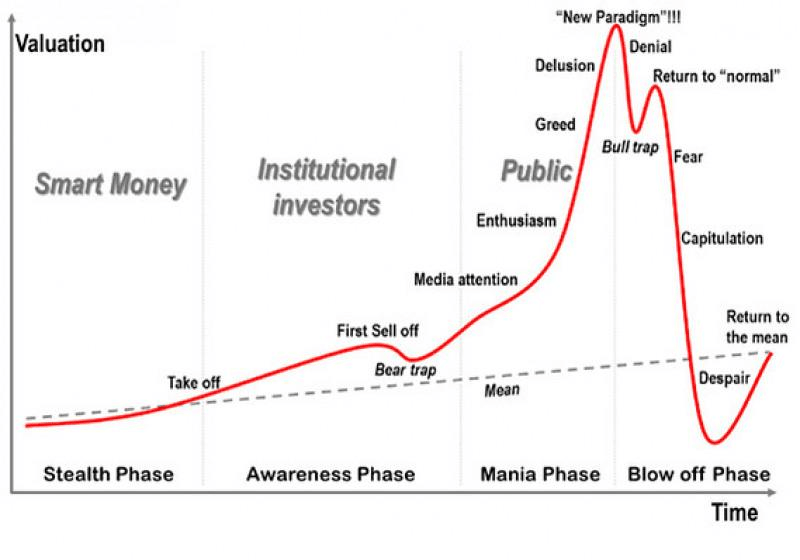

We speak a lot of commodity cycles, investing cycles and … ummm … Peloton’s stationary cycles, however when have we ever talked about emotional cycles?

Have a look under and inform me what your elf eyes see:

Take a second to soak up all that visualized Greatness.

This very chart can depict all the pieces from traders’ infatuation with the latest-and-greatest tech inventory, high-profile IPO hype, the housing market … even the broader market as an entire. Particularly the broader market.

Let’s face it, Nice Ones: As a lot as I remind you to separate your feelings out of your investments, most retail traders … simply … don’t. And the extra emotional a dealer will get, the extra inclined they’re to the large blooms of mania such as you see within the chart.

Keep in mind all of the occasions I’ve advised you over the previous two years that sentiment now guidelines the roost? That the market has grow to be indifferent from all semblance of actuality? Yeah … it seems like what you see above.

Now, I need you inform me which emotional stage of the investing cycle you suppose the market’s in now.

Like … truly inform me. Write in to [email protected] together with your reply! We’ll come again to this (and your responses) afterward within the week and focus on what’s what.

What? You’re not gonna give me the reply?

The place’s the enjoyable in that? I wish to know your ideas … your notion and evaluation of the present market malaise. So go on and rant away within the inbox!

[email protected] is the place you’ll be able to let your phrases fly like wind energy and let your smarts shine … or one thing like that.

In any other case, right here’s the place else yow will discover us:

Till subsequent time, keep Nice!

Regards,

Joseph Hargett

Editor, Nice Stuff