For American restaurant chains, the early months of the pandemic were a challenging period. But soon things changed for the better as people started ordering their favorite food items online during the lockdown, triggering a sales boom. Market leaders, including McDonald’s, Starbucks, and Chipotle Mexican Grill, ramped up their delivery, curbside pickup, and drive-thru services to cater to the spike in orders.

The companies’ resilience to headwinds like COVID-19 is a testament to the popularity of their affordable, quick-service meals and innovative menus. They look poised to capitalize on their ability to adapt to changes in operating conditions and customers’ cravings for tasty ready-to-eat meals. Those factors enable the companies to perform better than their ‘formal’ counterparts that depend on dine-in customers.

Customer is King

Come 2023, the scenario is different – market reopening has brought customers back to restaurants and the virus-induced home delivery boom waned. It would be interesting to analyze where the industry is headed this year as it faces new challenges like tightening consumer spending amid high inflation and rising interest rates.

The good thing about the multichannel shift is that restaurant operators can now leverage both their revamped delivery facilities as well as traditional dine-in services to serve customers better. The economic slump is unlikely to impact their businesses in the foreseeable future, thanks to competitive pricing and the fast-food culture ingrained in the minds of people.

The convenience brought about by on-the-go snacks and ready meals is irresistible to almost all categories of people, who would continue visiting fast food restaurants irrespective of their financial well-being. With market conditions becoming more and more conducive to the franchise business model, restaurant operators can now expand to new markets with ease.

Burger Giant

McDonald’s Corporation (NYSE: MCD), the largest snack chain in the US in terms of market capitalization, has maintained stable sales and earnings growth almost in every quarter since the onset of the pandemic, despite closing several restaurants, mainly in Russia. Last year, comparable sales bounced back from an initial slump, with sales picking up at both company-operated and franchised restaurants.

After peaking a few months ago, MCD is currently trading at a premium. The company is investing heavily in revamping its store network and adding new units, which would catalyze sales growth. This positive backdrop would allow the company to continue returning value to shareholders, which makes the stock a good bet.

The Perfect Brew

Coffee chain Starbucks Corporation (NASDAQ: SBUX) has constantly maintained its dominance in the highly competitive ready-to-drink market. The company had its share of problems soon after the pandemic outbreak, but the management took aggressive steps to align the business with new trends – like pushing more products through retail stores and e-commerce platforms like Amazon, so as to reach even those customers who might not be visiting its outlet.

In an effort to capitalize on the success of its partnership with Nestle, which helped expand the non-core Channel Development business, the company is extending the tie-up to new products and markets. It looks to beat inflation by raising prices and protecting margins but that is unlikely to affect sales volumes.

After entering 2023 on a high note, Starbucks’ stock pared a part of the gains and is currently trading below $100. The dip in valuation can be seen as a good entry point, given the coffee giant’s promising growth prospects. Going forward, reopening in China, one of the company’s key markets, would add to sales and margin growth. So, SBUX now has everything it takes to create strong shareholder value.

Mexican Cuisine

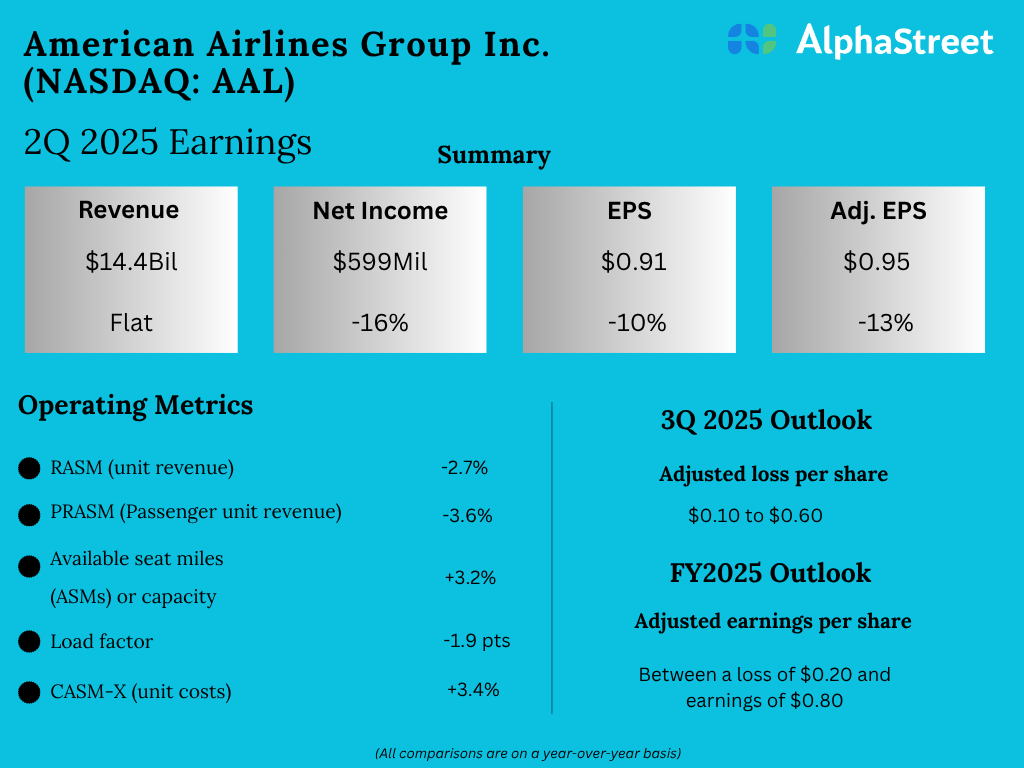

Chipotle Mexican Grill (NYSE: CMG) is a fast-casual restaurant chain specializing in made-to-order bowls, tacos, and burritos. Having successfully navigated the pandemic, the company hiked prices and has been able to grow sales and profit without affecting demand, supported by its highly loyal customers. Over the past five years, it delivered stronger-than-expected earnings in almost every quarter, while growing sales constantly.

Of late, Chipotle has been adding new units to its restaurant network at a fast pace. That has helped the company deliver double-digit sales growth in recent quarters, a trend that is expected to continue as the management is planning to open up to 285 restaurants this year. In the fourth quarter, adjusted earnings rose a whopping 50%. In the whole of FY22, operating margin climbed to 13.4%, showing that Chipotle is firing on all cylinders.

CMG is one of the most expensive fast-food stocks, with a 52-week average price of about $1,500. Yet, the current valuation is attractive from the long-term investment perspective because the stock is unlikely to become cheaper anytime soon.