Everyone wants to trade Treasuries. Big banks hold them for liquidity management, pension funds own them for long-term yields, hedge funds use them to bet on the economy, individuals’ savings are stored in them and central banks use them to manage foreign-exchange reserves. The market for Treasuries, most of the time, is deep and liquid. Some $640bn of government bonds change hands each day, at prices that become the benchmark risk-free rate by which all financial instruments are valued and lending rates set.

Your browser does not support the <audio> element.

Save time by listening to our audio articles as you multitask

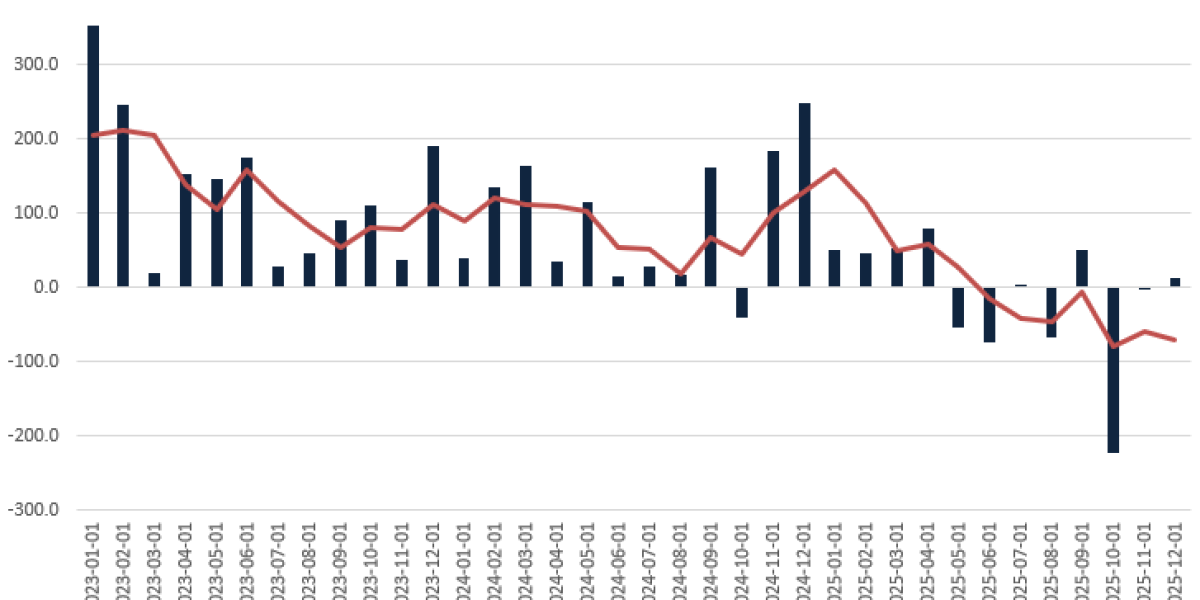

So why do they sometimes not change hands? Several times in the recent past the market has broken down. In 2014 a “flash rally” led to wild swings in prices, for no clear reason. In 2019 rates spiked in the “repo” market, in which Treasuries can be swapped for cash overnight. In March 2020 extreme illiquidity led yields to spike, even though in times of panic they usually fall as investors rush to safe assets. Now issues are cropping up again: measures of volatility have jumped to levels last seen in 2020 and bid-ask spreads are widening.

The problem stems from the fact that the Treasury market has doubled in size over the past decade, even as its infrastructure has shrunk. Trading is carried out by primary dealers, designated institutions which are mostly big banks—and regulatory requirements now constrain them. The leverage ratio, which limits the value of assets banks can hold relative to their capital, does not care whether the asset is super-safe Treasuries or subprime mortgage debt. Thus when a client calls asking to sell a bond, banks must find a client who wants to buy it, rather than holding it as inventory for when another client calls. In times of stress, this system gets overwhelmed.

The fixes fall into three buckets: let the banks trade more bonds with investors, let investors trade more bonds with each other, or let investors trade or swap more bonds with the Federal Reserve.

Start with letting the banks do more. The solution would be to exempt Treasuries and other safe assets, like bank reserves, from inclusion in leverage ratios. The Fed and other bank regulators did this for a year from March 2020 to help ease market chaos. The logic behind the move was sound enough. Treasuries are not risky assets, likely to default, and so they do not require much capital to be held against them. Still, the leverage ratio is appealing because it is simple to administer and cannot be gamed. And with Democratic bank regulators in charge, who do not want to appear to be undoing financial regulation, the idea is a non-starter.

How about letting investors deal more with one another? Portfolio managers at pimco, a large bond investment firm, have proposed that investors should trade on a platform where asset managers, dealers and non-bank liquidity providers can trade on a “level playing field, with equal access to information”, akin to how stocks are traded. This could be good, if it is actually possible. Matching buyers and sellers of Treasuries is harder than matching buyers and sellers of stocks. All shares in Microsoft are the same; there are dozens of Treasuries that have roughly five years to maturity.

A final fix would be to let investors do more with the Fed. Last year the central bank created a standing repo facility, which allows a Treasury to be swapped overnight for cash. But the facility is only for primary dealers, which do not always pass on the liquidity. Opening it to more participants would address this problem. It would also expose the Fed to a range of riskier counterparties—but that could be mitigated by requiring firms to swap a greater value in Treasuries than the central bank gives out in cash.

The problem is not a shortage of plausible reforms. It is that none of them have been implemented. The heady bull market has collided with the reality of high inflation and much higher interest rates. Financial markets have already entered a new phase in which volatility, stress and fear have returned. Any grand plans to overhaul the Treasury market cannot be implemented on the fly, in the midst of a burgeoning crisis.

If the Treasury market seizes up again—as the market for British government bonds did after ministers announced a package of unfunded tax cuts on September 23rd—the task of fixing it will fall on the Fed and its bond-buying schemes. Relaunching asset purchases at the same time as raising rates to combat inflation would be very uncomfortable. Since regulators failed to fix the Treasury market when they had the chance, they may end up with little choice.■

Read more from Buttonwood, our columnist on financial markets:

Investment banks are sharpening the axe (Sep 29th)

How to rebrand stockmarket indices (Sep 22nd)

Why investors should forget about delayed gratification (Sep 15th)

For more expert analysis of the biggest stories in economics, business and markets, sign up to Money Talks, our weekly newsletter.