simpson33

The Commerce Desk’s 2Q22 earnings places the corporate in its personal league.

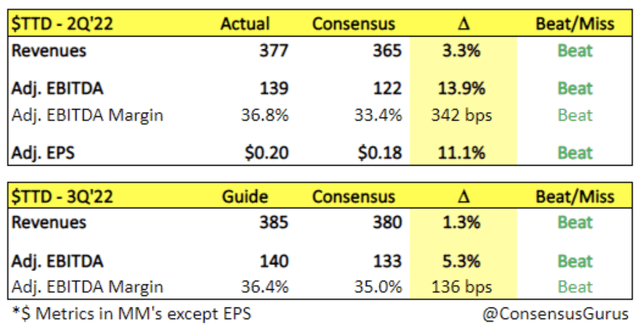

Simply when your complete world was satisfied that digital promoting has dramatically slowed down in a post-COVID world characterised by 40-year-high inflation, warfare and a looming recession, The Commerce Desk (NASDAQ:TTD) reported astonishingly optimistic 2Q22 outcomes the place each the highest and backside line shocked the Road to the upside. Having beforehand obtained such gloomy/unsure forward-looking statements from the likes of Snap (SNAP), Meta (META), Pinterest (PINS), Roku (ROKU) and Google (GOOG), markets have been mentally ready for one more man down going into Commerce Desk’s Q2 earnings. As an alternative, the impartial demand-side platform [DSP] reported income of $377 million (+35% YoY) on prime of an exceptionally sturdy 2Q21 the place income grew 101% and generated adjusted EBITDA of $139 million that beat consensus estimates by a large margin.

Consensus Guru

There’s so much to love about Commerce Desk’s top-line development in Q2. First, development was broad-based throughout all channels and verticals. In actual fact, all verticals that make up no less than 1% of platform advert spend grew double digits within the quarter, the place journey and pets greater than doubled, and meals & drink and know-how have been additionally sturdy. Once more, CTV was the most important development driver with sturdy efficiency in North America and spend additionally greater than doubled in Europe. Administration highlighted optimistic early outcomes from growing a ahead market product for CTV advert shopping for/promoting the place advertisers and publishers can each get the advantages of upper visibility.

In Q2, Video (incl. CTV) made up low 40’s % (vs. 40% beforehand) of whole platform advert spend in Q2; whereas Cell was within the excessive 30’s % (vs. 40% beforehand); Show 15%; and Audio 5%. 90% of spend was in North America, indicating a comparatively wholesome US digital advert market. This was fairly completely different from what many friends have been telling buyers.

The underside line did not disappoint analysts regardless of journey bills and dwell firm occasions are actually again. Although YoY OPEX development (ex-stock-based compensation) of 45% in Q2 was larger than earlier quarters, administration was capable of ship an adjusted EBITDA margin of 37%, a extremely enviable margin within the tech sector the place margins for many corporations are both not very significant or nearly nonexistent. Additional, Commerce Desk generated free money circulate of $86 million and completed the quarter with $1.2 billion in money and no debt.

Q3 steering shocked to the upside, whereas friends anticipate little/no/adverse development

Commerce Desk is normally the final digital promoting identify to report earnings so it is conceivable that each purchase/sell-side expectations for Q3 steering have been already low as friends who reported earlier painted a slightly gloomy image. To everybody’s shock, Commerce Desk truly guided to the upside with Q3 income of no less than $385 million vs. $380 million consensus, indicating YoY development of 28% on prime of 39% development in 3Q21. For perspective, this is what friends have for his or her Q3 outlook:

- Meta: income of $27 billion at midpoint (-6% YoY/flat ex-FX), 10% beneath $30 billion consensus (evaluation right here).

- Snap: pulled steering and mentioned in July that development had been flat to this point in Q3 (right here). Be aware that 2Q22 income development of 13% decelerated dramatically from 38% in 1Q22.

- Pinterest: income to develop mid-single digits YoY vs. 8.15% consensus.

- Roku: income of $700 million (+3% YoY), 22% beneath $903 million consensus. Pulled full yr 2022 steering.

- Google: no concrete steering as standard however used the phrase “uncertainty” a number of occasions to explain the outlook.

Evidently, Commerce Desk is in an enviable spot as it’s properly positioned to experience the CTV wave and is comparatively secure from the influence of Apple’s IDFA that, for instance, will value an estimated $10 billion in misplaced income for Meta in 2022. Whereas Google is set to do away with third social gathering cookies (delayed till 2H24), cookies solely have an effect on Commerce Desk’s Show enterprise which represents 15% of platform advert spend. In areas like cellular and CTV, cookies are nearly irrelevant as they’re solely used to trace consumer actions inside internet browsers. Moreover, UID2 (an trade various to cookies) has been gaining important traction with assist from behemoths like Amazon’s (AMZN) AWS, Oracle, Adobe, Salesforce, Nielsen, and a bunch of different supply-side platforms [SSP] and knowledge suppliers.

Final however not least, retail media is the brand new black as system IDs and cookies proceed to step into irrelevance. Up to now, Commerce Desk has partnered with main retailers together with Walmart (WMT), Albertsons (ACI), and Walgreens (WBA) to permit advertisers to leverage shopper knowledge to run focused adverts on the Commerce Desk platform (evaluation right here). Having witnessed what Amazon can do with on the promoting entrance with its personal buyer knowledge, retailers are more and more seeing the necessity to leverage their proprietary shopper knowledge to unlock their promoting capabilities. Per a research by BCG, retail media is a excessive margin enterprise with a gross margin of 70%-90%.

Solimar, AWS partnership, and MSFT+NFLX,

Solimar has reached 100% adoption the place administration famous common channel utilization was up 50% and AI/ML utilization was additionally up 50% towards the older platform. Not too way back, Commerce Desk introduced a partnership with AWS, which occurs to be one of many largest advertising and marketing knowledge aggregators on the planet. The partnership permits advertisers already utilizing AWS to create identifiers with UID2 with out leaving the AWS ecosystem.

CEO Jeff Inexperienced additionally touched on the partnership between Netflix (NFLX) and Microsoft (MSFT) with a optimistic tone, seeing the collaboration as an important step for the open Web. Microsoft’s Xandr will probably be the first advert tech platform behind Netflix promoting and features as each a SSP and a DSP. Nonetheless, Inexperienced famous that Xandr is primarily targeted on the provision aspect and has a really small publicity on the demand aspect (ranked #10 when it comes to DSP scale and captures <10% of demand), so Xandr will probably characterize Netflix as a SSP whereas advertisers can nonetheless buy stock within the open Web. Then again, Netflix has talked about it is nonetheless early days for its enterprise into promoting, so that is one thing to look at going ahead.

Valuation stretched following the 35% rally, threat/reward not engaging

Commerce Desk stays a beautiful story in digital promoting with one of the best stability between development and profitability. The corporate shocked the market to the upside and buyers are blissful sufficient to ship the replenish 35% in gentle of a below-expectation July CPI enhance (8.5% vs. 8.7% consensus) which proved optimistic for tech valuations. Nonetheless, shares are once more again in a comparatively speculative territory with NTM EV/Gross sales of 20x, a demanding a number of underneath the brand new rate of interest regime. Whereas the inventory may proceed to go up, it is tough to think about valuation crossing the 25x mark that markets have been so accustomed to seeing final yr when cash was free and pandemic advantages have been in full swing. As glorious as Commerce Desk is from a basic standpoint, I imagine as we speak’s huge worth rally represents an important alternative to take earnings and anticipate the subsequent practice.