Updated on December 27th, 2022, by Nikolaos Sismanis

The book publishing industry is undergoing rapid changes. The business model that remained relatively unchanged for decades is rapidly moving toward new technologies such as e-books, while traditional books lose market share. The distribution channels through which the publishers sell books are shifting as well.

Traditional book stores are increasingly closing down, whereas sales of books via e-commerce platforms are growing. Amazon (AMZN), which started out as an online book store and expanded into many other product categories since, is the largest online book seller. Amazon is not only selling books, it has also moved into publishing books itself, which puts some pressure on traditional publishers.

These challenges were once again illustrated in unit sales of print books falling 4.8% through the first nine months of 2022 to 570 million, compared to the same period in 2021.

In this article, we will look at the three biggest publicly traded book publishing stocks: Scholastic (SCHL), John-Wiley & Sons (WLY), and Pearson plc (PSO), which is the parent company of Random House.

All three of these companies pay dividends to shareholders, and are included in our list of all consumer cyclical stocks.

One way for investors to find great dividend stocks is to focus on those with the longest histories of raising dividends.

With this in mind, we created a downloadable list of all 148 Dividend Champions.

You can download your free copy of the Dividend Champions list, along with relevant financial metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the link below:

The three stocks are ranked by estimated total returns over the coming five years. More data on each company is available through the Sure Analysis Research Database.

Book Publishing Stock #3: Pearson plc (PSO)

- 5-year expected annual returns: -0.7%

Pearson plc is the biggest book publishing company in the world, with annual sales of ~$3.4 billion and a market capitalization of $8.1 billion. Pearson is headquartered in the U.K., and the company was founded in 1944.

Pearson is active in consumer publishing, education content, and business information markets.

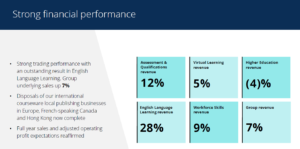

Pearson reported its Q3/9M trading update on October 24th. The company announced that its revenue grew by 7% versus the previous year on an adjusted basis, which backs out currency rate changes and the impact of acquisitions and divestitures.

Global Online Learning remained a bright spot for the company, and assessment and qualification was another well-performing business unit, showcasing 12% revenue growth versus the previous year. U.S. student assessment revenue grew by an attractive 32% year over year.

Source: Investor Presentation

Pearson established a cost-cutting strategy that aims at increasing the company’s margins, which seems like a good idea, as declining profits during the last couple of years were primarily based on margin pressures. If Pearson could hit that target, its profitability would grow significantly in a vacuum, but it looks like most of those cost-cutting benefits will be offset by headwinds such as gross margin pressures,

Based on current earnings-per-share estimates for this year, Pearson is trading at around 20.5 times net profits. Pearson traded at a price-to-earnings multiple of up to the low 20s at times during the last decade as well, which is somewhat surprising when we account for the quite weak growth performance that Pearson delivered during the last 10 years.

Right now, shares seem overvalued, we believe, based on a 15x earnings multiple that we would deem fair for its shares. We thus see considerable downside potential for shares from the current level.

Click here to download our most recent Sure Analysis report on Pearson (preview of page 1 of 3 shown below):

Book Publishing Stock #2: Scholastic (SCHL)

- 5-year expected annual returns: 0.3%

Scholastic Corporation is a publishing corporation that markets children’s books, magazines, and teaching materials. The company operates through three divisions: Children’s Book Publishing and Distribution, Educational, and International.

Scholastic reported its fiscal 2023 first-quarter earnings results in late September. Scholastic recorded revenue of $260 million during the quarter, which represents an increase of 1% versus the prior year’s quarter. Scholastic’s Education segment continued to perform well, which includes growth from digital subscriptions.

Scholastic’s revenue growth was, overall, negatively impacted by the fact that the comparison to the previous year’s quarter was tougher than during some of the recent quarters, during which Scholastic recorded stronger year-over-year revenue growth rates.

Scholastic generated a loss-per-share of $1.33 during the first quarter. Due to the seasonality of the business, the loss during Scholastic’s Q1 was not an irregularity – the same has happened repeatedly in the past

Click here to download our most recent Sure Analysis report on Scholastic (preview of page 1 of 3 shown below):

Book Publishing Stock #1: John Wiley & Sons (WLY)

- 5-year expected annual returns: 11.6%

John Wiley & Sons is a publishing company with a strong focus on the professional and scientific community. Its products include research journals (scientific, technical, medical and scholarly), reference books, manuals, databases, scientific and education books, test preparation services, and more.

The company also offers services such as development and assessment services for businesses and services for higher education institutions. John Wiley & Sons was founded in 1807.

Source: Investor Presentation

John Wiley & Sons reported its second quarter (fiscal 2022) earnings results on December 9th. The company announced that its revenue totaled $515 million during the quarter, which represents a decline of 3.4% versus the prior year’s quarter.

Earnings–per–share came in at $1.20, down 13% year-over-year. The company lowered its guidance, now expecting revenues to be in the range of $2.11 billion to $2.15 billion, down from the prior outlook of $2.175 billion to $2.215 billion. Nevertheless, management reaffirmed their adjusted EPS guidance of $3.70 to $4.05.

John Wiley & Sons’ dividend payout ratio was never especially high. Most of the time, it remained below 50%. John Wiley & Sons raised its dividend continually throughout the last decade, making it a blue chip stock.

We believe that the dividend is relatively safe, especially as John Wiley’s dividend was not in danger during the Great Recession.

There is little risk to John Wiley & Sons’ business model thanks to:

- The company’s successful ongoing transformation

- Its strong position in the non-cyclical scientific and professional market

John Wiley has increased its dividend for over 25 years. It is a Dividend Champion.

Click here to download our most recent Sure Analysis report on John Wiley & Sons (preview of page 1 of 3 shown below):

Final Thoughts

Book publishing stocks have experienced a number of challenges in recent years. Not only did the industry suffer from the coronavirus pandemic, but it was already dealing with the rise of e-readers and online education. Book publishing stocks have had to adapt to these challenges, with varying levels of success thus far.

Because the industry remains in a challenged state heading into 2023, investors should be selective when it comes to book publishing stocks. Not all book publishers will succeed going forward.

Due to the company’s earnings growth outlook, solid dividend yield, and reasonable valuation, we view John Wiley & Sons as the top book publishing stock today.

We view both Pearson and Scholastic as a sell due to their negative/marginal expected returns.

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].