Revealed on December fifteenth, 2025 by Bob Ciura

The target of rational merchants is to maximize full return under a given set of constraints. Dividends contribute a superb portion of a stock’s full return.

In addition to, shares that elevate their dividends yearly, even all through recessions, can current extreme returns to shareholders over the long run.

That’s the reason we think about that merchants must take care of proudly proudly owning high-quality dividend-paying shares such as a result of the Dividend Aristocrats, which can be these companies which have raised their dividends for on the very least 25 consecutive years.

Membership on this group is so distinctive that merely 69 companies qualify as Dividend Aristocrat. We’ve obtained compiled a listing of all Dividend Aristocrats and associated financial metrics like dividend yield and P/E ratios.

You presumably can receive the entire itemizing of Dividend Aristocrats by clicking on the hyperlink beneath:

Disclaimer: Sure Dividend won’t be affiliated with S&P Worldwide in any method. S&P Worldwide owns and maintains The Dividend Aristocrats Index. The info on this text and downloadable spreadsheet is based on Sure Dividend’s private evaluation, summary, and analysis of the S&P 500 Dividend Aristocrats ETF (NOBL) and totally different sources, and is meant to help specific particular person merchants increased understand this ETF and the index upon which it’s based. Not one of many information on this text or spreadsheet is official information from S&P Worldwide. Search the recommendation of S&P Worldwide for official information.

Whereas earlier effectivity won’t be a guarantee of future outcomes, it might be useful to look once more to see which Dividend Aristocrats carried out the proper.

On account of this reality, this article will give attention to the ten best-performing Dividend Aristocrats over the earlier 10 years.

Desk of Contents

The desk of contents beneath permits for easy navigation. The shares are listed by annualized full returns over the earlier 10 years, in ascending order.

Best Performing Dividend Aristocrat #10: Linde plc (LIN)

- 10-year annualized full returns: 16.8%

Linde plc, which was created through the merger of Germany-based industrial gases agency Linde AG and US-based industrial gases agency Praxair, is the world’s largest industrial gasoline firm.

The company produces, sells, and distributes atmospheric, course of, and specialty gases, along with high-performance ground coatings. It’s headquartered in Guildford, United Kingdom.

Linde plc launched its third quarter earnings results in November. The company launched that its revenues totaled $8.6 billion all through the quarter, which was up 2% versus the prior 12 months’s quarter.

Linde was able to develop its margins over the past 12 months, as its adjusted working margin expanded by 10 basis elements year-over-year.

Earnings-per-share all through the third quarter totaled $4.21, which suggests that the company’s earnings-per-share progress obtained right here in at 7% versus the sooner 12 months’s quarter.

Administration has a constructive view regarding the foreseeable future, forecasting earnings-per-share in a ramification of $16.35 to $16.45 for fiscal 2025, which represents a steady progress cost of spherical 6% compared with 2024.

Click on on proper right here to acquire our most modern Sure Analysis report on LIN (preview of net web page 1 of three confirmed beneath):

Best Performing Dividend Aristocrat #9: Dover Corp. (DOV)

- 10-year annualized full returns: 15.4%

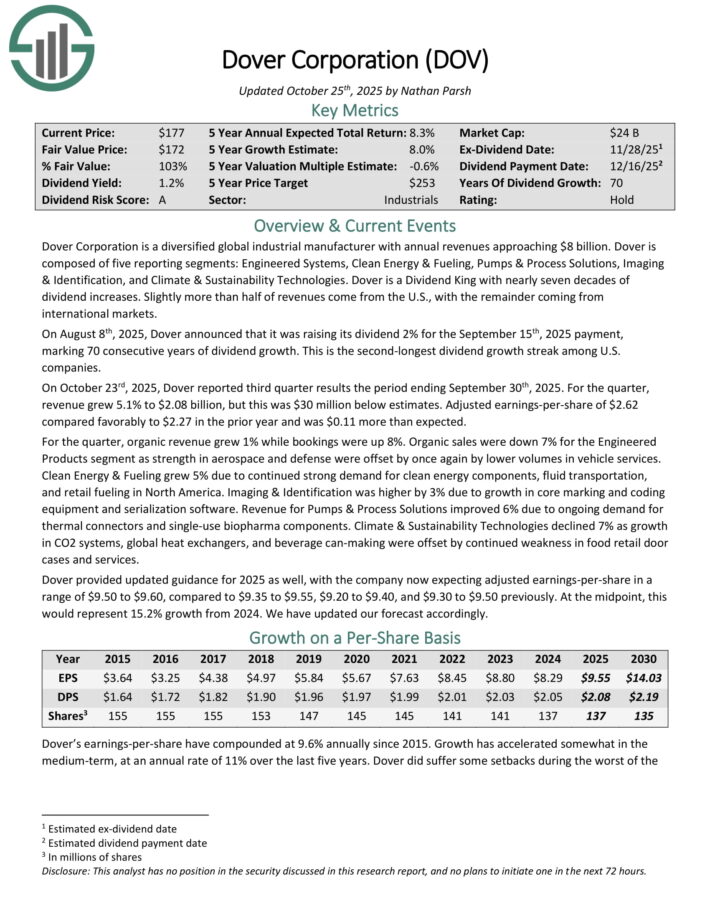

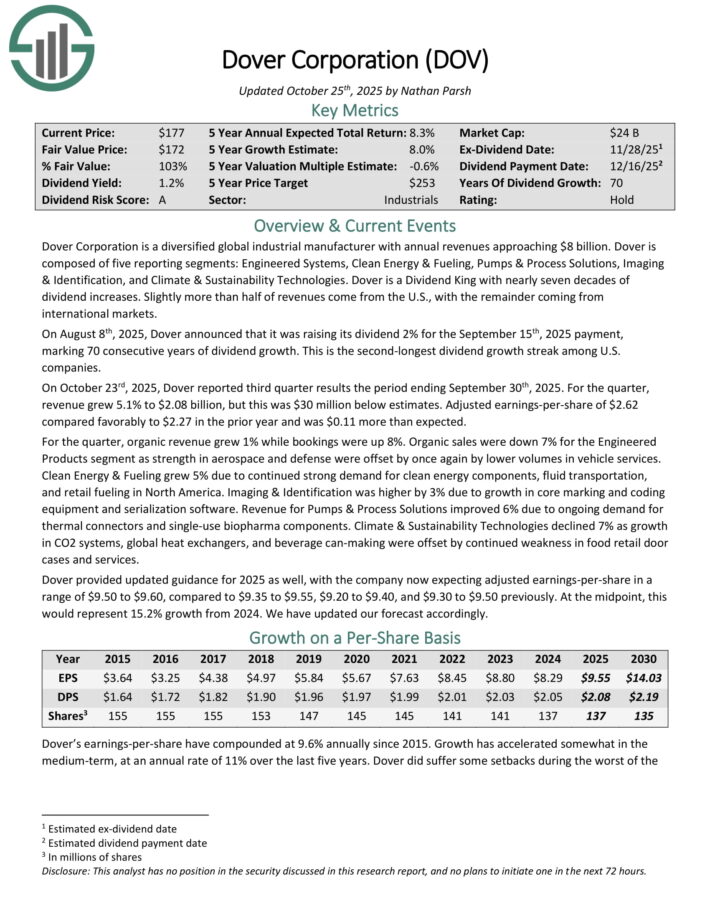

Dover Firm is a diversified world industrial producer with annual revenue approaching $8 billion. Dover consists of 5 reporting segments: Engineered Strategies, Clear Energy & Fueling, Pumps & Course of Choices, Imaging & Identification, and Native climate & Sustainability Utilized sciences.

On August eighth, 2025, Dover launched that it was elevating its dividend 2% for the September fifteenth, 2025 payment, marking 70 consecutive years of dividend progress. That’s the second-longest dividend progress streak amongst U.S. companies.

On October twenty third, 2025, Dover reported third quarter outcomes the interval ending September thirtieth, 2025. For the quarter, revenue grew 5.1% to $2.08 billion, nevertheless this was $30 million beneath estimates. Adjusted earnings-per-share of $2.62 in distinction favorably to $2.27 throughout the prior 12 months and was $0.11 higher than anticipated.

For the quarter, pure revenue grew 1% whereas bookings had been up 8%. Pure product sales had been down 7% for the Engineered Merchandise part as energy in aerospace and safety had been offset by as quickly as as soon as extra by lower volumes in vehicle corporations.

Clear Energy & Fueling grew 5% because of continued sturdy demand for clear vitality parts, fluid transportation, and retail fueling in North America. Imaging & Identification was bigger by 3% because of progress in core marking and coding gear and serialization software program program.

Native climate & Sustainability Utilized sciences declined 7% as progress in CO2 applications, world heat exchangers, and beverage can-making had been offset by continued weak level in meals retail door circumstances and firms.

Dover provided updated steering for 2025 as correctly, with the company now anticipating adjusted earnings-per-share in a ramification of $9.50 to $9.60. On the midpoint, this might characterize 15.2% progress from 2024.

Click on on proper right here to acquire our most modern Sure Analysis report on DOV (preview of net web page 1 of three confirmed beneath):

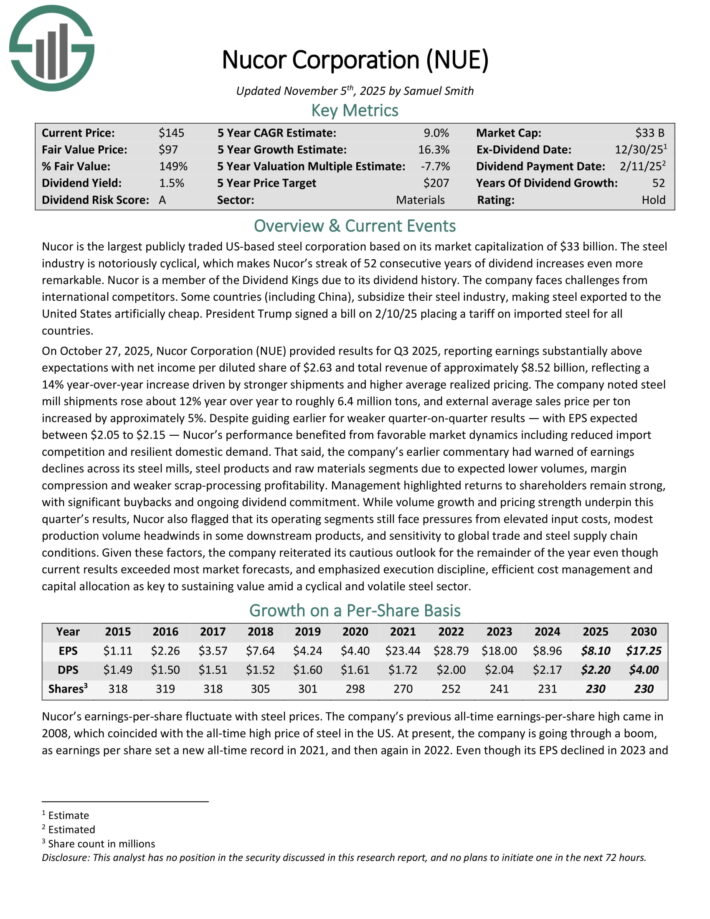

Best Performing Dividend Aristocrat #8: Nucor Corp. (NUE)

- 10-year annualized full returns: 16.8%

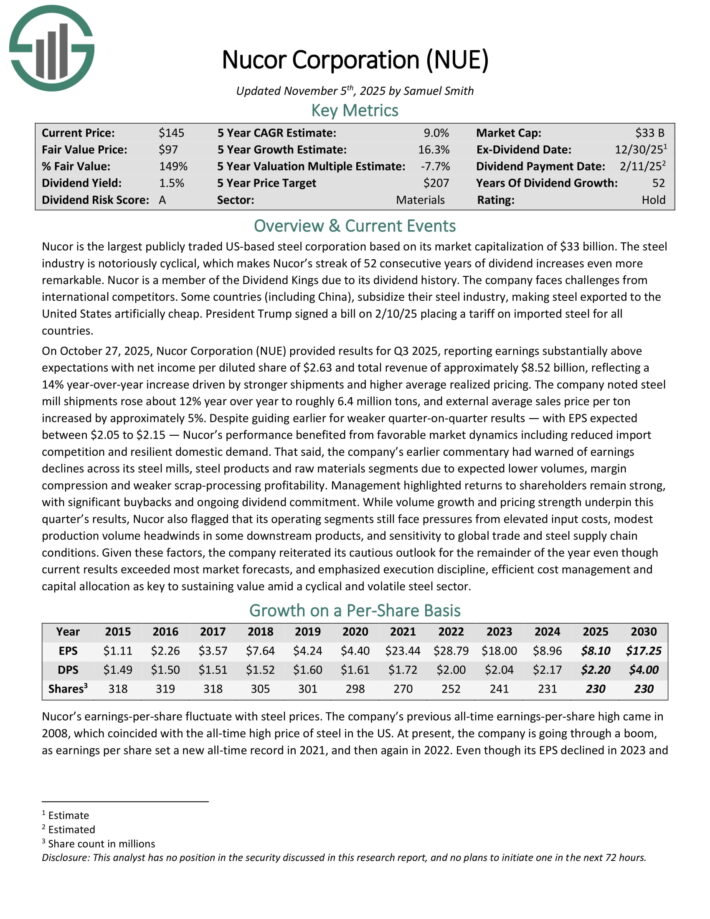

Nucor is crucial publicly traded US-based steel firm based on its market capitalization. The steel enterprise is notoriously cyclical, which makes Nucor’s streak of 52 consecutive years of dividend will improve rather more distinctive. Nucor is a member of the Dividend Kings because of its dividend historic previous.

On October 27, 2025, Nucor Firm (NUE) provided outcomes for Q3 2025, reporting earnings significantly above expectations with web income per diluted share of $2.63 and full revenue of roughly $8.52 billion, reflecting a 14% year-over-year enhance pushed by stronger shipments and higher widespread realized pricing.

The company well-known steel mill shipments rose about 12% 12 months over 12 months to roughly 6.4 million tons, and exterior widespread product sales price per ton elevated by roughly 5%.

No matter guiding earlier for weaker quarter-on-quarter outcomes — with EPS anticipated between $2.05 to $2.15 — Nucor’s effectivity benefited from favorable market dynamics along with decreased import rivals and resilient dwelling demand.

Click on on proper right here to acquire our most modern Sure Analysis report on NUE (preview of net web page 1 of three confirmed beneath):

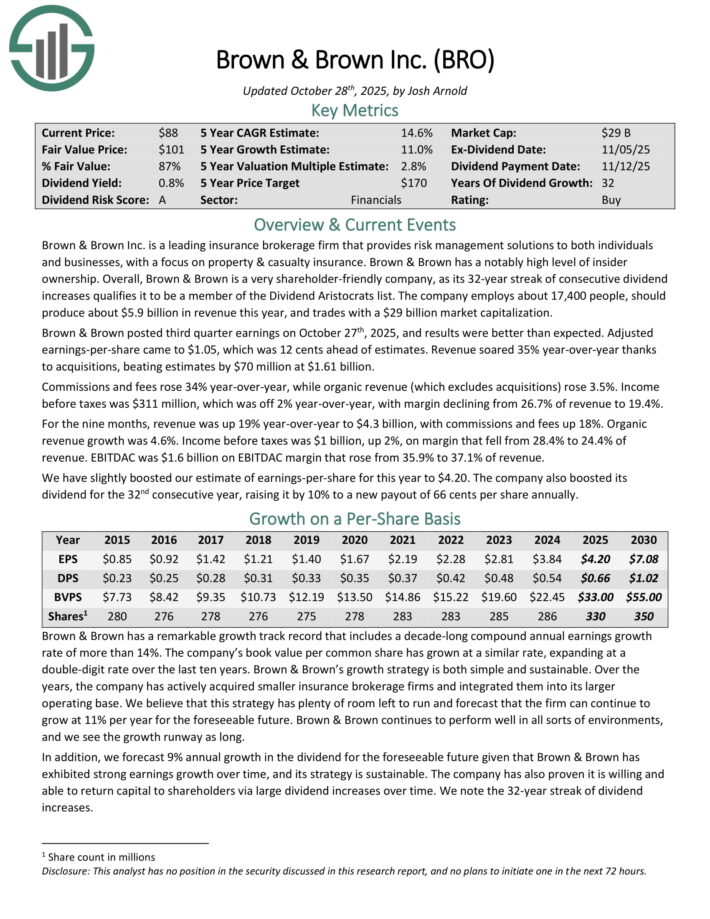

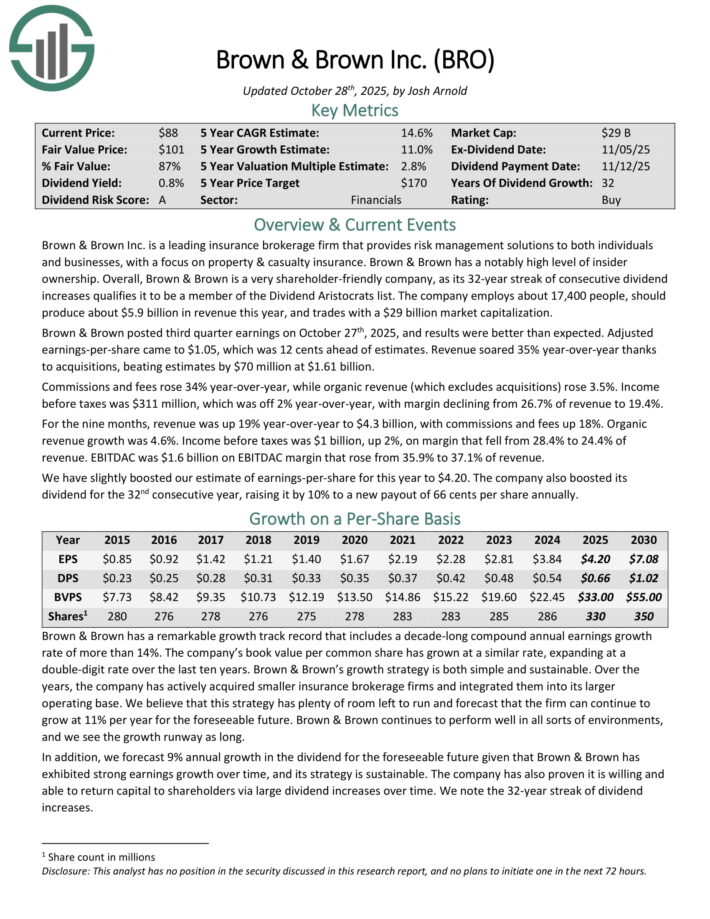

Best Performing Dividend Aristocrat #7: Brown & Brown (BRO)

- 10-year annualized full returns: 18.2%

Brown & Brown Inc. is a primary insurance coverage protection brokerage company that provides risk administration choices to every folks and firms, with a take care of property & casualty insurance coverage protection. Brown & Brown has a notably extreme stage of insider possession.

Brown & Brown posted third quarter earnings on October twenty seventh, 2025, and outcomes had been increased than anticipated. Adjusted earnings-per-share obtained right here to $1.05, which was 12 cents ahead of estimates. Earnings soared 35% year-over-year on account of acquisitions, beating estimates by $70 million at $1.61 billion.

Commissions and prices rose 34% year-over-year, whereas pure revenue (which excludes acquisitions) rose 3.5%. Income sooner than taxes was $311 million, which was off 2% year-over-year, with margin declining from 26.7% of revenue to 19.4%.

For the 9 months, revenue was up 19% year-over-year to $4.3 billion, with commissions and prices up 18%. Pure revenue progress was 4.6%. Income sooner than taxes was $1 billion, up 2%, on margin that fell from 28.4% to 24.4% of revenue. EBITDAC was $1.6 billion on EBITDAC margin that rose from 35.9% to 37.1% of revenue.

We’ve obtained barely boosted our estimate of earnings-per-share for this 12 months to $4.20. The company moreover boosted its dividend for the thirty second consecutive 12 months, elevating it by 10% to a model new payout of 66 cents per share yearly.

Click on on proper right here to acquire our most modern Sure Analysis report on BRO (preview of net web page 1 of three confirmed beneath):

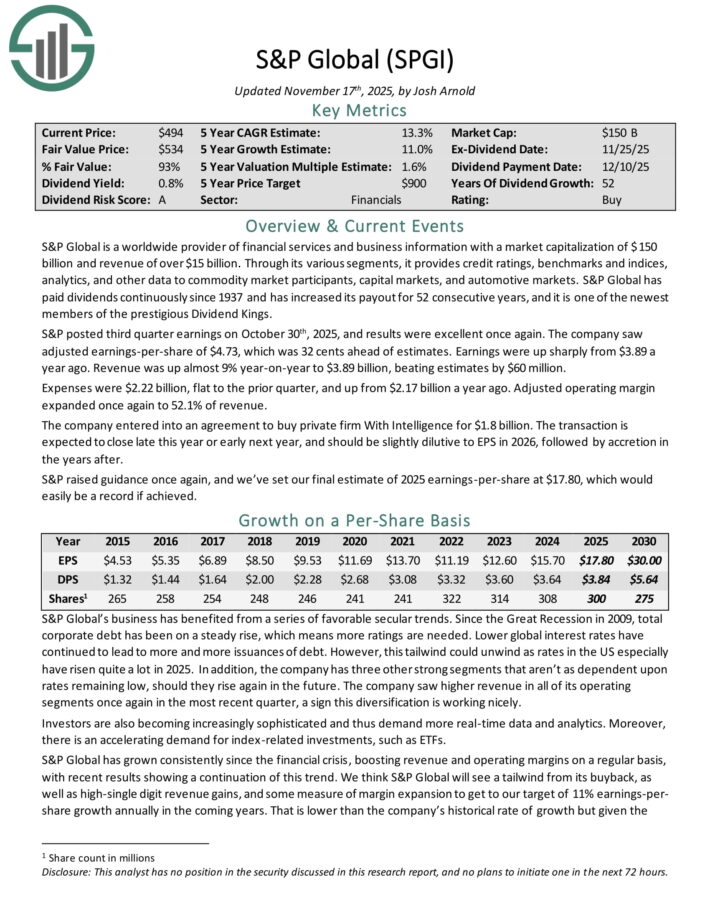

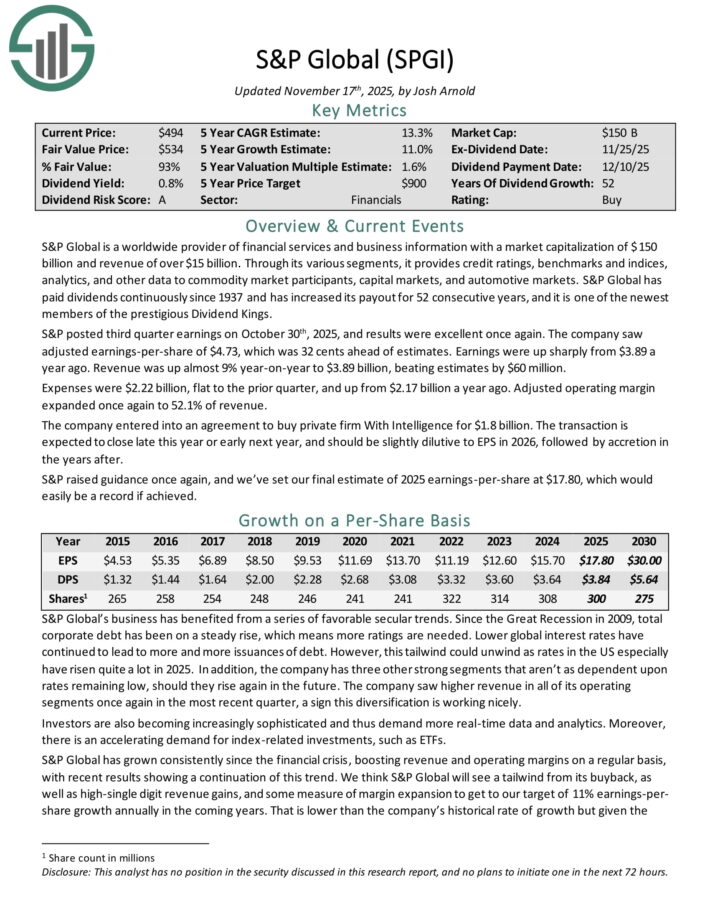

Best Performing Dividend Aristocrat #6: S&P Worldwide (SPGI)

- 10-year annualized full returns: 19.5%

S&P Worldwide is a worldwide provider of financial corporations and enterprise information with revenue of over $15 billion. By way of its assorted segments, it provides credit score rating scores, benchmarks and indices, analytics, and totally different information to commodity market members, capital markets, and automotive markets.

S&P Worldwide has paid dividends repeatedly since 1937 and has elevated its payout for 52 consecutive years, and it’s among the many newest members of the celebrated Dividend Kings.

S&P posted third quarter earnings on October thirtieth, 2025. The company observed adjusted earnings-per-share of $4.73, which was 32 cents ahead of estimates.

Earnings had been up sharply from $3.89 a 12 months up to now. Earnings was up nearly 9% year-on-year to $3.89 billion, beating estimates by $60 million.

Payments had been $2.22 billion, flat to the prior quarter, and up from $2.17 billion a 12 months up to now. Adjusted working margin expanded as quickly as as soon as extra to 52.1% of revenue.

The company entered into an settlement to buy private company With Intelligence for $1.8 billion. The transaction is predicted to close late this 12 months or early subsequent 12 months, and must be barely dilutive to EPS in 2026, adopted by accretion throughout the years after.

Click on on proper right here to acquire our most modern Sure Analysis report on SPGI (preview of net web page 1 of three confirmed beneath):

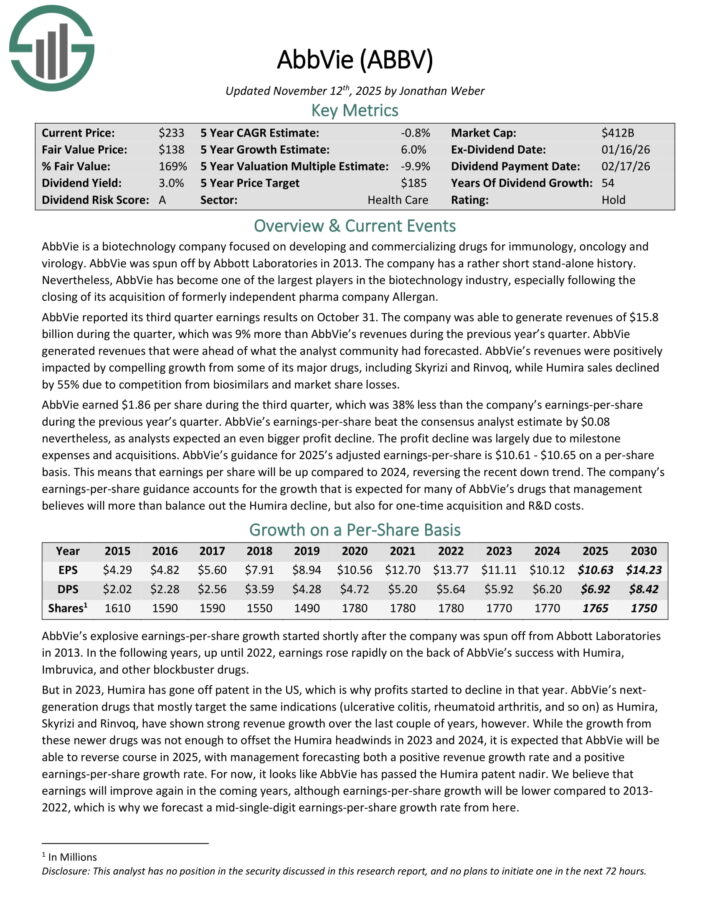

Best Performing Dividend Aristocrat #5: AbbVie Inc. (ABBV)

- 10-year annualized full returns: 20.1%

AbbVie is a biotechnology agency focused on rising and commercializing drugs for immunology, oncology and virology. It was spun off by Abbott Laboratories in 2013 and has flip into one in every of many largest players throughout the biotechnology enterprise.

AbbVie reported its third quarter earnings outcomes on October 31. The company was able to generate revenues of $15.8 billion all through the quarter, which was 9% year-over-year progress.

Earnings was positively impacted by compelling progress from a number of of its predominant drugs, along with Skyrizi and Rinvoq, whereas Humira product sales declined by 55% because of rivals from biosimilars and market share losses.

AbbVie earned $1.86 per share all through the third quarter, which was 38% decrease than the company’s earnings-per-share all through the sooner 12 months’s quarter.

Earnings-per-share beat the consensus analyst estimate by $0.08. Guidance for 2025 adjusted earnings-per-share is $10.61 – $10.65.

Click on on proper right here to acquire our most modern Sure Analysis report on ABBV (preview of net web page 1 of three confirmed beneath):

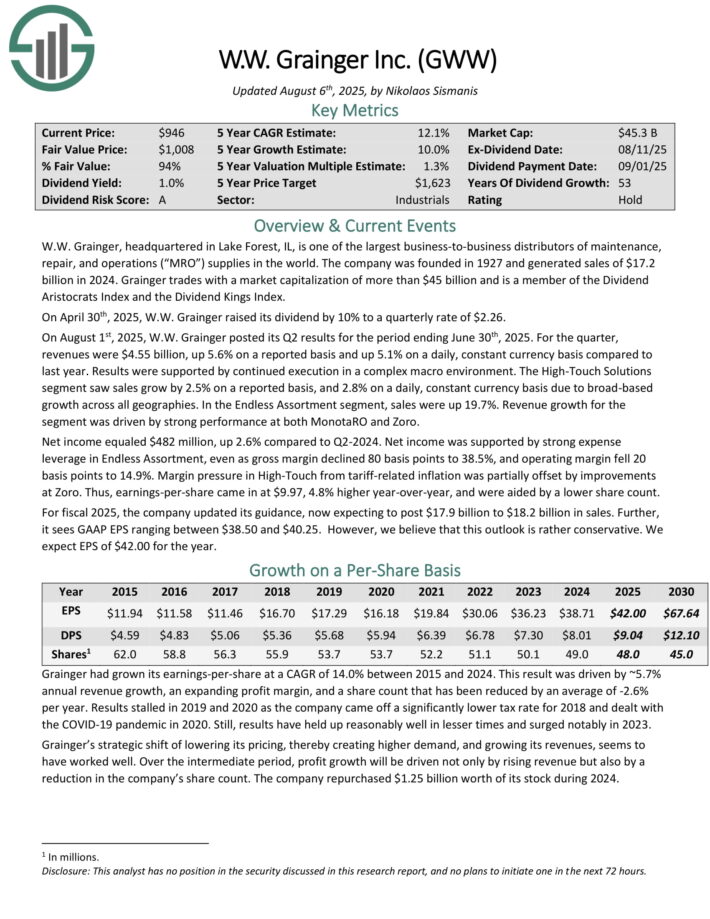

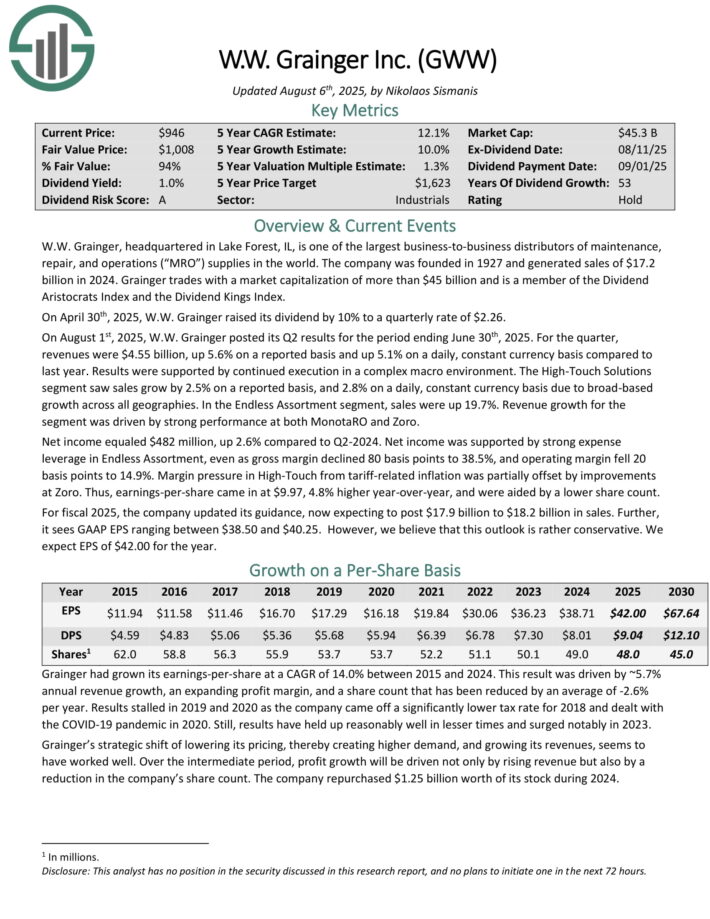

Best Performing Dividend Aristocrat #4: W.W. Grainger (GWW)

- 10-year annualized full returns: 20.2%

W.W. Grainger, headquartered in Lake Forest, IL, is among the many largest business-to-business distributors of repairs, restore, and operations (“MRO”) gives on this planet. The company was based mostly in 1927 and generated product sales of $17.2 billion in 2024.

On August 1st, 2025, W.W. Grainger posted its Q2 outcomes for the interval ending June thirtieth, 2025. For the quarter, revenues had been $4.55 billion, up 5.6% on a reported basis and up 5.1% on a day-to-day, mounted foreign exchange basis compared with closing 12 months.

The Extreme-Contact Choices part observed product sales develop by 2.5% on a reported basis, and a few.8% on a day-to-day, mounted foreign exchange basis because of broad-based progress all through all geographies.

Throughout the Limitless Assortment part, product sales had been up 19.7%. Earnings progress for the part was pushed by sturdy effectivity at every MonotaRO and Zoro.

Internet income equaled $482 million, up 2.6% compared with Q2-2024. Internet income was supported by sturdy expense leverage in Limitless Assortment, similtaneously gross margin declined 80 basis elements to 38.5%, and dealing margin fell 20 basis elements to 14.9%.

Margin stress in Extreme-Contact from tariff-related inflation was partially offset by enhancements at Zoro. Earnings-per-share obtained right here in at $9.97, 4.8% bigger year-over-year, and had been aided by a lower share rely.

Click on on proper right here to acquire our most modern Sure Analysis report on GWW (preview of net web page 1 of three confirmed beneath):

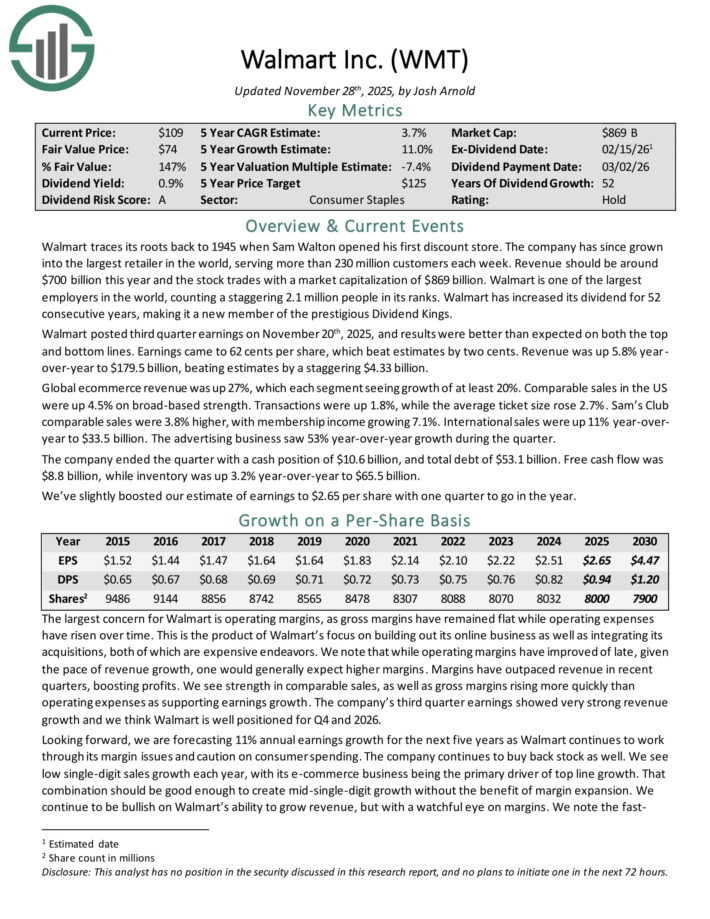

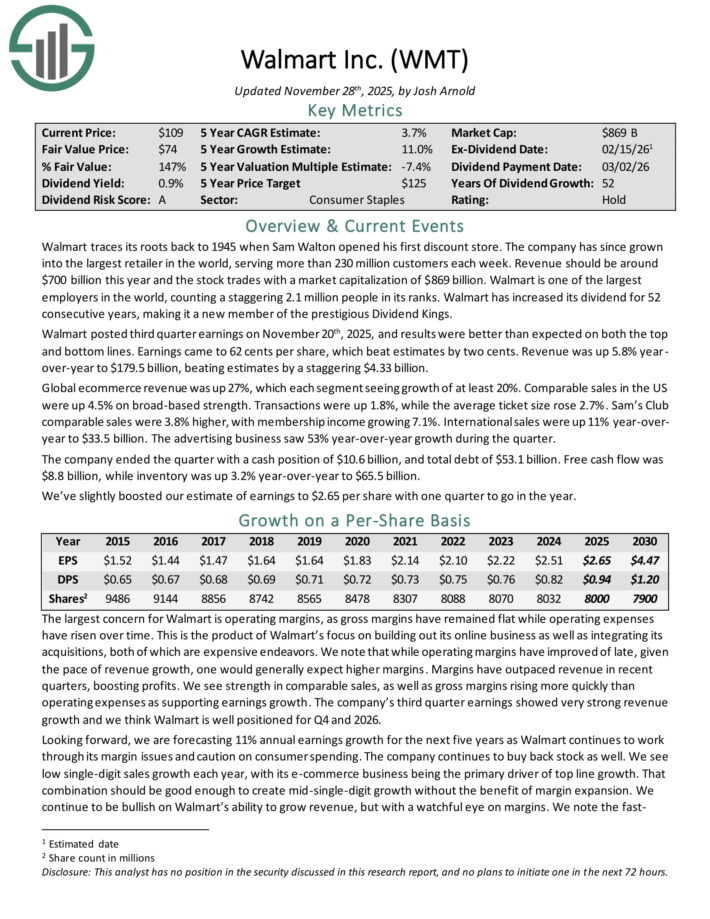

Best Performing Dividend Aristocrat #3: Walmart Inc. (WMT)

- 10-year annualized full returns: 21.6%

Walmart traces its roots once more to 1945 when Sam Walton opened his first low price retailer.

The company has since grown into crucial retailer on this planet, serving higher than 230 million shoppers each week. Earnings must be spherical $700 billion this 12 months.

Walmart posted third-quarter earnings on November twentieth, 2025, and outcomes had been increased than anticipated on every the best and bottom traces. Earnings obtained right here to 62 cents per share, which beat estimates by two cents.

Earnings was up 5.8% year-over-year to $179.5 billion, beating estimates by $4.33 billion. Worldwide e-commerce revenue was up 27%, which each and every part seeing progress of on the very least 20%.

Comparable product sales throughout the US had been up 4.5% on broad-based energy. Transactions had been up 1.8%, whereas the widespread ticket dimension rose 2.7%. Sam’s Membership comparable product sales had been 3.8% bigger, with membership income rising 7.1%.

Worldwide product sales had been up 11% year-over-year to $33.5 billion. The selling enterprise observed 53% year-over-year progress all through the quarter.

Click on on proper right here to acquire our most modern Sure Analysis report on WMT (preview of net web page 1 of three confirmed beneath):

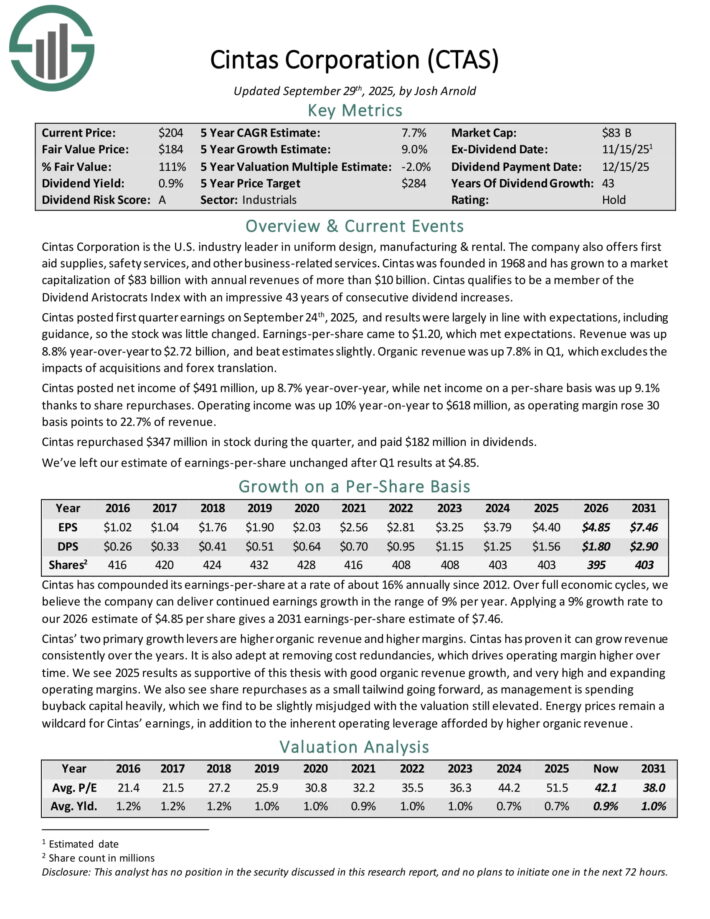

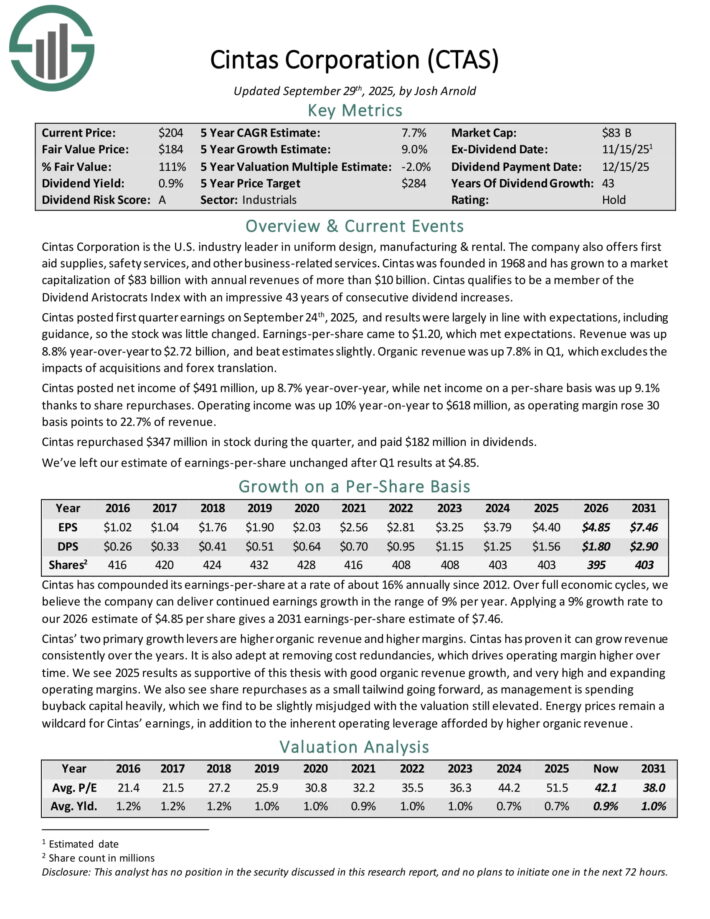

Best Performing Dividend Aristocrat #2: Cintas Corp. (CTAS)

- 10-year annualized full returns: 24.9%

Cintas Firm is the U.S. enterprise chief in uniform design, manufacturing & rental. The company moreover affords first assist gives, safety corporations, and totally different business-related corporations.

Cintas was based mostly in 1968 and has grown to generate annual revenues of higher than $10 billion. It qualifies to be a member of the Dividend Aristocrats Index with 43 years of consecutive dividend will improve.

Cintas posted first quarter earnings on September twenty fourth, 2025, and outcomes had been largely in line with expectations, along with steering, so the stock was little modified. Earnings-per-share obtained right here to $1.20, which met expectations.

Earnings was up 8.8% year-over-year to $2.72 billion, and beat estimates barely. Pure revenue was up 7.8% in Q1, which excludes the impacts of acquisitions and international change translation.

Cintas posted web income of $491 million, up 8.7% year-over-year, whereas web income on a per-share basis was up 9.1% on account of share repurchases. Working income was up 10% year-on-year to $618 million, as working margin rose 30 basis elements to 22.7% of revenue.

Cintas repurchased $347 million in stock all through the quarter, and paid $182 million in dividends.

Click on on proper right here to acquire our most modern Sure Analysis report on Cintas (preview of net web page 1 of three confirmed beneath):

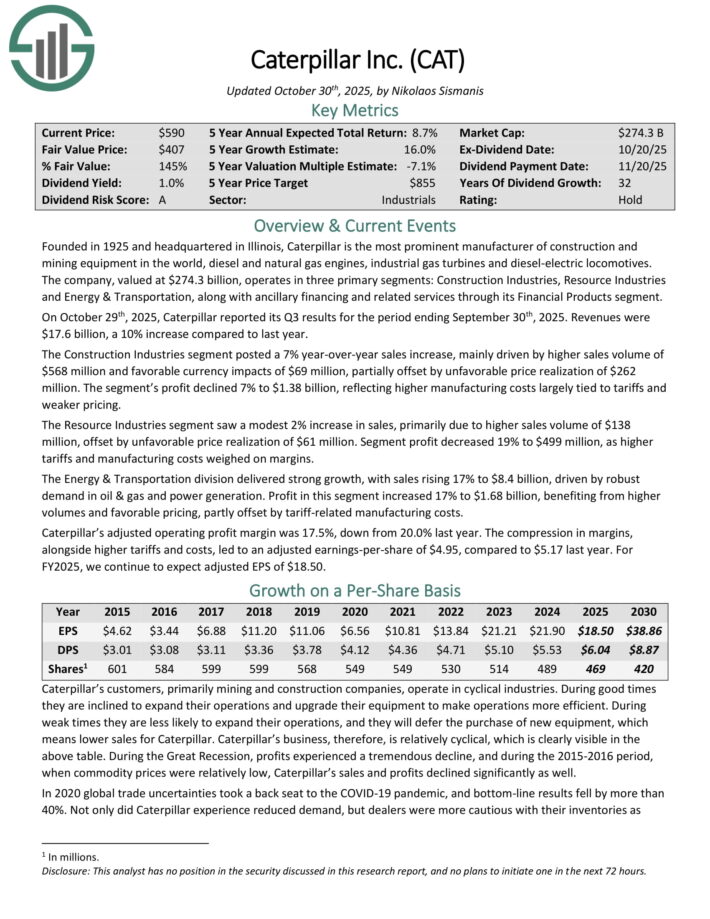

Best Performing Dividend Aristocrat #1: Caterpillar Inc. (CAT)

- 10-year annualized full returns: 27.9%

Caterpillar might be essentially the most excellent producer of growth and mining gear on this planet, diesel and pure gasoline engines, industrial gasoline turbines and diesel-electric locomotives.

It operates in three predominant segments: Growth Industries, Helpful useful resource Industries and Energy & Transportation, along with ancillary financing and related corporations through its Financial Merchandise part.

On October twenty ninth, 2025, Caterpillar reported its Q3 outcomes for the interval ending September thirtieth, 2025. Earnings was $17.6 billion, a ten% enhance compared with closing 12 months.

The Growth Industries part posted a 7% year-over-year product sales enhance, primarily pushed by bigger product sales amount of $568 million and favorable foreign exchange impacts of $69 million, partially offset by unfavorable price realization of $262

million.

The Helpful useful resource Industries part observed a modest 2% enhance in product sales, primarily because of bigger product sales amount of $138 million, offset by unfavorable price realization of $61 million.

The Energy & Transportation division delivered sturdy progress, with product sales rising 17% to $8.4 billion, pushed by robust demand in oil & gasoline and power period.

Income on this part elevated 17% to $1.68 billion, benefiting from bigger volumes and favorable pricing, partly offset by tariff-related manufacturing costs.

Caterpillar’s adjusted working income margin was 17.5%, down from 20.0% closing 12 months. The compression in margins, alongside bigger tariffs and costs, led to an adjusted earnings-per-share of $4.95, compared with $5.17 closing 12 months.

Click on on proper right here to acquire our most modern Sure Analysis report on CAT (preview of net web page 1 of three confirmed beneath):

Additional Learning

The subsequent Sure Dividend databases comprise in all probability essentially the most reliable dividend growers in our funding universe:

Thanks for learning this textual content. Please ship any ideas, corrections, or inquiries to [email protected].

rn

rn

Source link ","creator":{"@sort":"Particular person","title":"Index Investing Information","url":"https://indexinvestingnews.com/creator/projects666/","sameAs":["https://indexinvestingnews.com"]},"articleSection":["Investing"],"picture":{"@sort":"ImageObject","url":"https://www.suredividend.com/wp-content/uploads/2022/10/Dividend-Aristocrats-Picture-150x150.png","width":0,"top":0},"writer":{"@sort":"Group","title":"","url":"https://indexinvestingnews.com","brand":{"@sort":"ImageObject","url":""},"sameAs":["https://www.facebook.com/Index-Investing-News-102075432474739","https://twitter.com/IndexInvesting_"]}}

Source link