At its core, economics is about making selections. We face trade-offs. If you’d like extra of this, it’s essential to surrender a few of that.

Non-economists usually ignore the trade-offs. For instance, protectionists argue tariffs will assist American industries compete with their international rivals whereas elevating quite a lot of income for the American individuals.

Not so quick, say the economists. If tariff charges are low, most individuals will carry on importing. The federal government will gather tariff revenues on these imports, however the coverage is not going to do a lot to guard American industries. If tariff charges are excessive, most individuals will cease importing. This will assist these American industries that will in any other case face international competitors, nevertheless it is not going to lead to a lot income since so little will get imported.

Tariff Revenues

In a 2019 Journal of Financial Views article, Mary Amiti, Stephen J. Redding, and David E. Weinstein thought-about the preliminary results of the tariffs imposed by the Trump administration in 2018. The six waves of tariffs elevated the common tariff charge by round 1.7 proportion factors and lowered imports by 1.3 to five.9 p.c.

The month-to-month and cumulative tariff revenues estimated by Amiti, Redding, and Weinstein are introduced in Determine 1. The authors estimate the extra income raised by the newly-imposed tariffs at round $15.6 billion in 2018. Moreover, they discover that “the US import tariffs have been nearly fully handed by way of into US home costs in 2018, in order that the whole incidence of the tariffs fell on home customers and importers to date, with no impression thus far on the costs obtained by international exporters.” The 2018 tariffs raised some income for the American individuals, however the income raised got here nearly fully (and maybe fully) from the American individuals.

In fact, not one of the tariffs imposed in 2018 have been in place for the complete yr. Certainly, a lot of the rise in tariff charges occurred within the again half of the yr. Since the entire tariffs have been in impact by December 2018, we are able to multiply the December 2018 tariff revenues estimated by Amiti, Redding, and Weinstein ($3.2 billion) by twelve to get a tough estimate of how a lot these tariffs may be anticipated to lift per yr going ahead. Assuming no further efforts to scale back one’s publicity to tariffs happen in subsequent years, the 2018 tariffs will be anticipated to lift round $38.4 billion per yr — or, $46.8 billion per yr in in the present day’s {dollars}. For comparability, the federal authorities spent round $6,900 billion in 2024.

The estimated income raised by the 2018 tariffs is comparatively small at round 0.7 p.c of federal spending. Furthermore, the income raised is essentially (and maybe fully) paid by People. Larger tariff charges have a direct impact of elevating tariff income. However greater tariff charges additionally discourage imports, which reduces tariff income. In some unspecified time in the future, the latter impact dominates: greater tariff charges cut back tariff income.

Deadweight Lack of Tariffs

Economists are eager to quote one other tariff trade-off, as nicely. Suppose the target is to guard American industries. The upper the tariff, the larger the disincentive to import. Nevertheless, a better tariff additionally raises the worth prevailing on the home market — and the upper value will discourage some transactions from going down. Economists use the time period deadweight loss to indicate the misplaced positive factors from commerce that consequence when tariffs push up costs. You may improve safety for American industries, however solely if you’re prepared to simply accept a much bigger deadweight loss.

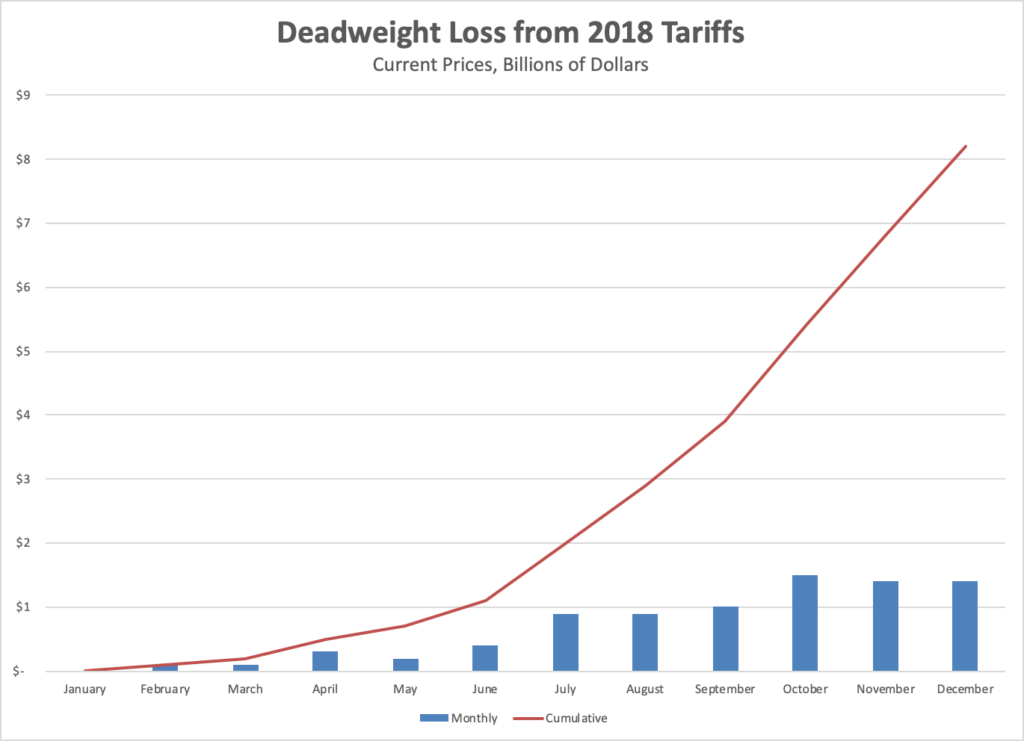

Amiti, Redding, and Weinstein additionally estimate the deadweight lack of the 2018 tariffs. Their month-to-month and cumulative estimates are introduced in Determine 2. In complete, they discover that the six tariff waves lowered the positive factors from commerce People realized by round $8.2 billion. As with revenues, we are able to get a tough estimate of the annual deadweight loss these tariffs may be anticipated to generate going ahead by multiplying the December 2018 deadweight loss estimated by Amiti, Redding, and Weinstein ($1.4 billion) by twelve. Therefore, the 2018 tariffs will be anticipated to scale back positive factors from commerce by round $16.8 billion per yr — or, $20.5 billion per yr in in the present day’s {dollars}.

The deadweight losses related to the 2018 tariffs have been comparatively small: every US family loses roughly $156 per yr. Larger tariffs would provide extra safety for American industries however at a better value to People.

Tariffs and Earnings Taxes

Curiously, there’s one tariff trade-off many economists appear to miss. Suppose the target is to lift a given quantity of income. You may impose a tariff. Or, you might impose a tax on revenue. The much less you depend on tariffs, the extra income you have to to lift from different taxes and costs, notably revenue taxes, which account for the majority of federal revenues. That’s how trade-offs work.

America spends far an excessive amount of in the present day to rely solely on tariffs, in fact. A 100% tariff on current imports — that’s, implausibly assuming nobody was dissuaded from buying and selling by the sky-high tariff charge — would generate simply $4,110 billion (and far, a lot much less beneath extra practical assumptions). Recall that the federal finances was round $6,900 billion in 2024. Nonetheless, there’s a trade-off on the margin. We may rely slightly extra on tariffs and rather less on revenue taxes, or rather less on tariffs and slightly extra on revenue taxes.

Economists who oppose tariffs on the grounds that they generate a deadweight loss are ignoring an necessary trade-off. Earnings taxes additionally generate a deadweight loss. The related query is whether or not the marginal deadweight loss related to the tariff is larger than the marginal deadweight loss related to the revenue tax. It’s not less than conceivable that, given the comparatively low tariff charge and the comparatively excessive marginal revenue tax charges, the deadweight loss brought on by a touch greater tariff charge can be greater than offset by the positive factors from commerce brought on by a touch decrease revenue tax charge.

The estimates from Amiti, Redding, and Weinstein suggest that the 2018 tariffs generated round 44 cents in deadweight loss for each greenback raised, along with the greenback transferred (nearly fully or fully) from People to their authorities. For comparability, Martin Feldstein estimated {that a} one-percent improve in all marginal revenue tax charges (e.g., from 15 p.c to fifteen.15 p.c, 25 p.c charge to 25.25, and so forth) would have elevated the deadweight lack of taxation in 2001 by round 76 cents per greenback raised.

Earlier than concluding that tariffs are a extra environment friendly revenue-raising system on the margin, not less than two caveats are so as. First, the marginal deadweight lack of tariffs and revenue taxes rise with the corresponding charges. That suggests that the marginal deadweight lack of further tariffs would exceed these estimated for the 2018 tariffs. Likewise, the estimates of the marginal deadweight loss from Feldstein ought to be up to date to replicate potential modifications from the established order (e.g., expiration of the Tax Lower and Jobs Act) slightly than an across-the-board improve from the 2001 revenue tax charge schedule.

Second, the marginal deadweight lack of tariffs estimated above doesn’t embrace any prices related to retaliatory tariffs levied by different international locations. Amiti, Redding, and Weinstein discover full pass-through of international tariffs as nicely, indicating that retaliatory tariffs have been equally paid by these within the nation imposing them. They don’t estimate the deadweight lack of retaliatory tariffs in 2018, however notice that “international retaliatory tariffs have been additionally costing US exporters roughly $2.4 billion per 30 days in misplaced exports” by the tip of 2018. Because the corresponding deadweight loss would subtract the chance value of misplaced exports from the worth of misplaced exports, $2.4 billion per 30 days will be regarded as an upper-bound estimate. Therefore, the deadweight lack of retaliatory tariffs realized by People might be substantial — notably in circumstances the place the US imposes greater tariffs on many international locations. If the chance value was lower than 57 p.c of the worth of imports, the deadweight lack of the 2018 tariffs per greenback raised exceeded the marginal deadweight lack of the revenue tax as estimated by Feldstein.

The aforementioned estimates shouldn’t be mistaken for rigorous coverage evaluation. They’re rough-and-ready back-of-the-envelope calculations. That they forged doubt on the traditional view amongst economists ought to give one pause, although — and immediate economists working in public finance to take a better look.

Economists normally have a eager eye for tradeoffs. They perceive you can’t have your cake and eat it, too. It’s shocking, subsequently, that they’ve largely missed the tradeoff between tariffs and revenue taxes. It’s not sufficient to say that tariffs are dangerous. One should additionally present that tariffs are worse than the out there options.

US authorities debt is rising sooner than the financial system. That isn’t sustainable. The federal government should get its finances deficit beneath management, however the political will to scale back spending is restricted. Which means the federal government might want to elevate further income. How ought to it go about doing that? Some wish to let the Tax Lower and Jobs Act expire. Others need greater tariff charges. To be able to determine which method is finest, we should take into account the tradeoffs.