[ad_1]

By now, you’re little doubt getting fairly anxious concerning the markets.

In any case, why wouldn’t you?

Russia has invaded Ukraine which has large implications for pure sources. Oil is over $120 a barrel. The inventory market is already down over 10% from its latest highs.

It’s sufficient to emphasize anybody out!

Properly, sadly we now want so as to add the next: the U.S. will probably enter a recession late this 12 months or early within the subsequent.

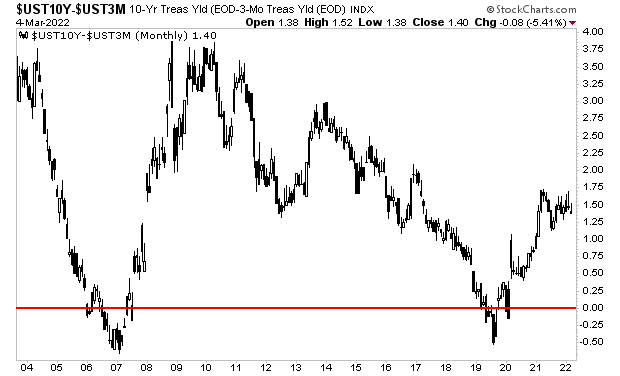

In accordance with the Fed’s analysis, essentially the most correct predictor of a recession is the 10-year/ 3 month U.S Treasury yield curve, or the distinction between the yield on the 10-Yr U.S. Treasury and the yield on the 3-month U.S. Treasury.

Each time this yield curve breaks under 0%, the U.S. has entered a recession. I’ve recognized this degree on the chart under.

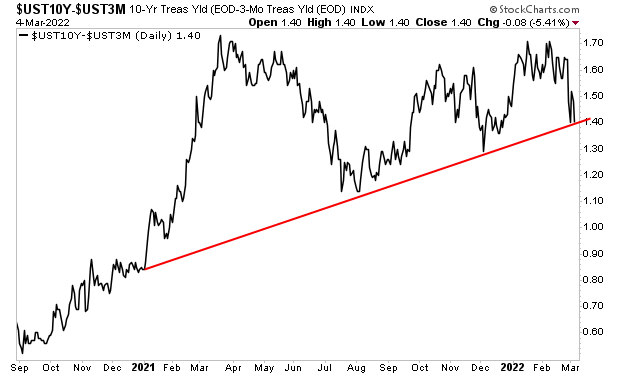

The unhealthy information at present is that this yield curve is presently rolling over in an enormous approach.

As I write this, it’s about to take out its upward trendline (pink line within the chart under). This is able to imply that the yield curve is not trending in a constructive method however is heading downwards to the dreaded ZERO that predicts a recession.

Put one other approach, a break of this degree would virtually assuredly set off a yield curve inversion… which might imply a recession is simply across the nook.

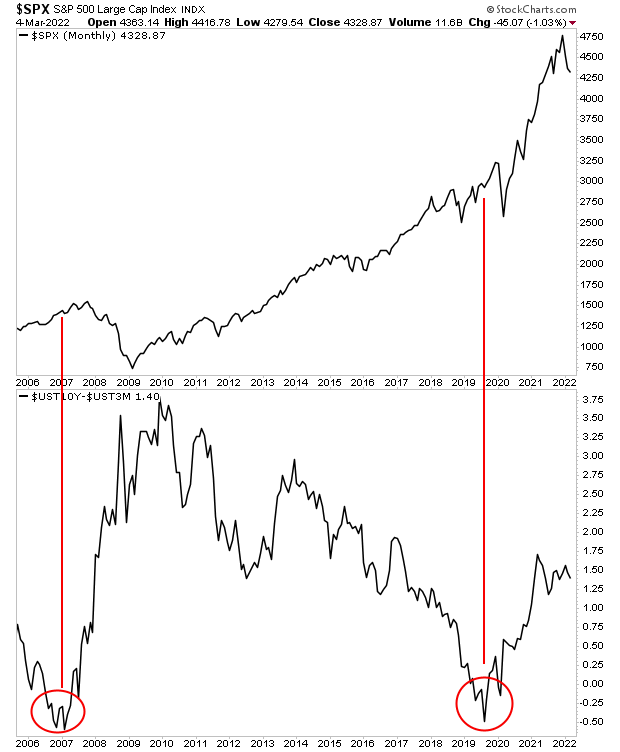

Please be aware, the final two recessions triggered inventory market crashes. The yield curve inverted a mere six to 9 months earlier than the crash hit. This implies we will anticipate a full blown crash a while later this 12 months or early within the subsequent

You’ve been warned.

[ad_2]

Source link