grandriver

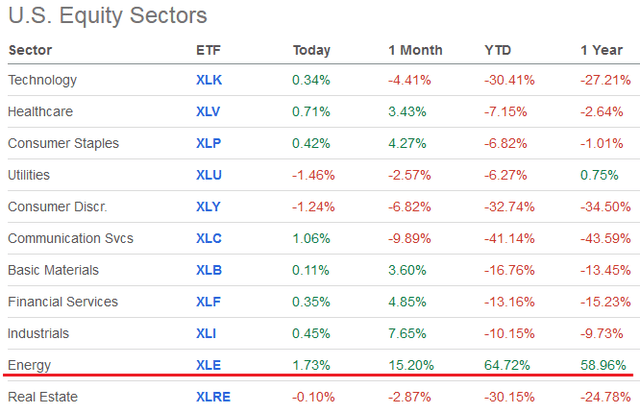

As most of you know, the energy sector has been, by far, the top-performing equity sector during the 2022 bear-market (see graphic below). Indeed, other than the Utilities Sector SPDR (XLU), it is the only sector in the green. Given the macro environment – Russia’s invasion of Ukraine and resulting actions that have effectively broken the global energy supply chain, the decision by OPEC+ to cut back on production and defend a higher price range for Brent (an estimated $85-$95/bbl), and the relatively new-found discipline of the domestic shale producers, as well as relative low global storage levels – the outlook going forward remains bullish, in my opinion. That being the case, the trend is your friend, and despite the over-sized returns this year, O&G stocks just might have much more upside. One option investors should consider is diversified exposure to the sector through the Invesco Dynamic Energy E&P ETF (NYSEARCA:PXE). Today, I’ll take a close look at this ETF and see if it may be a good fit in your portfolio.

Seeking Alpha

Investment Thesis

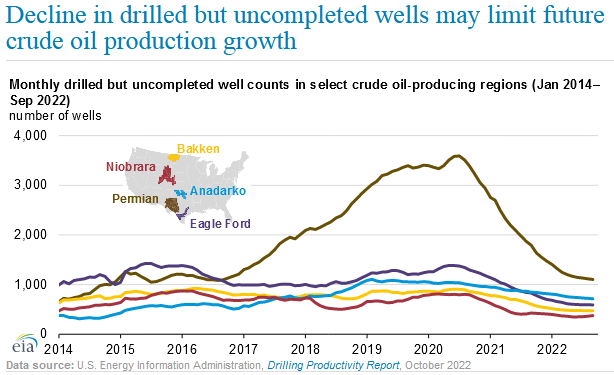

As stated earlier, the global petroleum macro-environment remains quite bullish in my opinion. Here in the U.S., note that drilled but uncompleted wells (“DUCs”) have dropped dramatically since demand and price destruction caused by the global pandemic forced E&P companies to stop drilling new wells and, instead, focus on completing existing DUCs:

EIA

Having a significantly lower DUC inventory, combined with surging inflation in the oil patch and new spending discipline by domestic E&P companies, means that growing oil production is facing some big headwinds. Even drawing down the strategic petroleum reserve (“SPR”) to the lowest level since the early 1980s has done little to bring down the price of oil and gasoline.

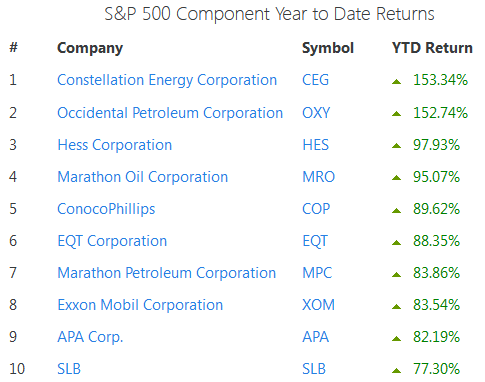

That being the case, inflation and high gas prices are likely to be a thorn in the side of consumers (and investors …) for some time to come. As a result, investors need to protect their portfolio with at least a market weighting in energy, or, in my opinion, an over-weight position. Note the current weight of the SPDR Energy ETF (XLE) in the S&P 500 is only 5.6%. Note also that the top-performing stocks in the S&P 500 this year have been dominated by E&P players:

SlickCharts.com

Now, let’s take a look at the PXE ETF to see how it has positioned investors for success moving forward.

Top 10 Holdings

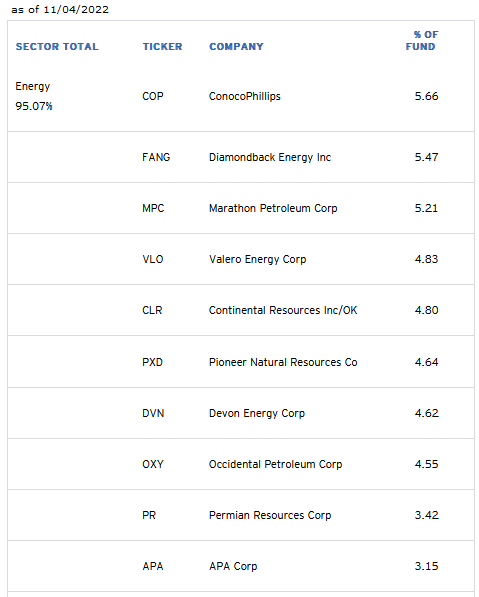

The top 10 holdings in the Invesco Dynamic Energy E&P ETF shown below were taken directly from Invesco’s PXE ETF webpage and equate to what I consider to be a moderately concentrated 46% of the entire 30-company portfolio:

Invesco

The first observation I have is that four of the top 10 holdings also can be found on the top-10 S&P500 performer list (i.e. the previous graphic).

The No. 1 holding with a 5.7% weight is ConocoPhillips (COP). Conoco has become a Permian powerhouse after buying Concho Resources and the majority of Shell’s Permian assets at the bottom of the cycle during the pandemic. COP also has excellent Brent-based production and global LNG assets. The company generated $4.7 billion (or an estimated $3.70/share) of free cash flow in Q3. That led to an 11% boost in the quarterly dividend and an additional $20 billion added to the existing buyback program – which now totals $45 billion – or 27% of the company’s current $164.8 billion market-cap. See COP Drills A Gusher In Q3 for more information on how the company performed in Q3. As explained in that piece, COP has a (base+variable) dividend policy and is estimated to yield 3.6%.

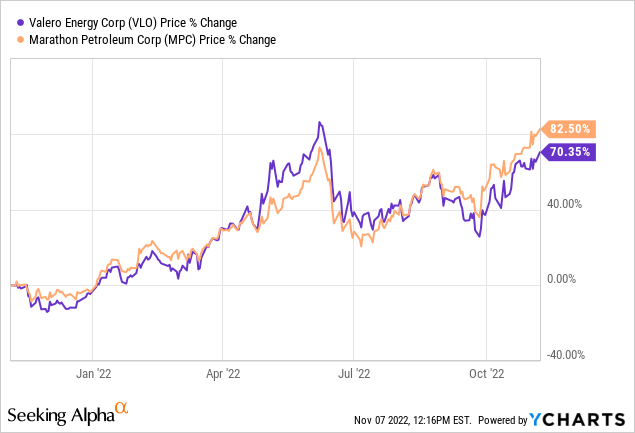

Refiner and midstream operator Marathon Petroleum Corp (MPC) is the #3 holding with a 5.2% weight. Along with No. 4 holding Valero (VLO), refiners equate to an allocation of ~10% within the top 10 holdings. As explained in my recent Seeking Alpha article on Phillips 66 (PSX), refiners have been killing it this year on higher margin (especially for diesel) due to a general lack of refining capacity, the spread between Brent & WTI, and the big discount of WCS feedstock imported from Canada (see PSX: The Spring Has Sprung):

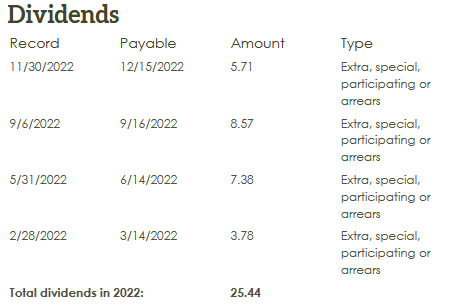

Pioneer Resources (PXD) is the No. 6 holding with a 4.6% weight. PXD has a very shareholder friendly management team and, unlike COP – a company that significantly over-emphasizes share buybacks – puts a priority on returning cash to shareholders in the form of dividends paying out a whopping $25.44/share in dividends this year:

Pioneer Natural Resources

Occidental Petroleum (OXY) is the No. 8 holding and a (the?) top-performing stock in the entire S&P 500 this year. As explained in my recent Seeking Alpha piece, OXY has been a primary beneficiary of Russia’s invasion of Ukraine – and the resulting jump in oil and gas prices – because it enabled the company to greatly accelerate its debt pay-down plan. Indeed, in the first two quarters of 2022 OXY was able to reduce long-term debt by a whopping $8.1 billion. The company was even able to significantly increase its dividend and begin buying back stock. See: Why OXY Is Among The Best Performing Stocks In The S&P500 This Year.

APA Corp (APA), the old Apache, rounds out the top 10 with a 3.2% weight. APA is generally considered to be a gassier play considering its massive Alpine discovery. APA is +71% this year and yields 2%.

Valuation Metrics

Despite the big gain in the fund this year, PXE still trades at a significant discount to the broad S&P 500:

| PXE ETF | S&P500 | |

| P/E Ratio | 5.32x | 19.66x |

| Forward P/E Ratio | 4.33x | 18.01x |

| Price-to-Book Ratio | 2.13x | 3.77x |

| ROE | 36.44% | 11.8% |

Performance

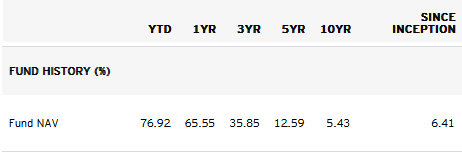

The long-term performance of the PXE ETF is shown below:

Invesco

As can be seen in the graphic, the three-year average – and even the five-year – average annual returns of the fund are excellent. However, note that the 10-year returns incorporate the “lost decade” when the energy sector was the worst performing sector of the entire market.

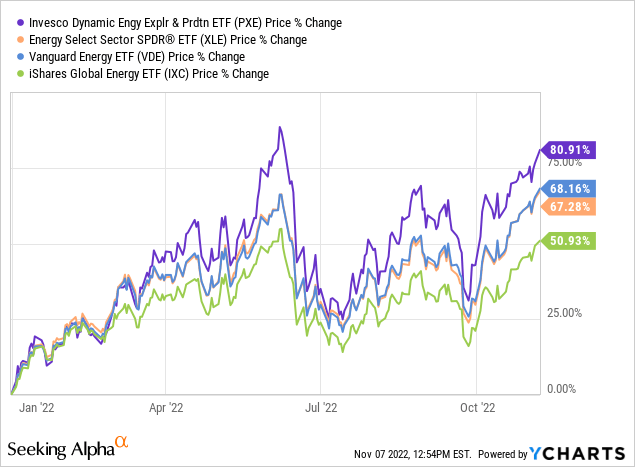

The following graphic compares PXE’s price performance with that of some of its peers during the 2022 bull-market in O&G stocks: The SPDR Energy ETF (XLE), the Vanguard Energy ETF (VDE), and the iShares Global Energy ETF (IXC):

PXE comes out on top of the chosen funds.

Risks

The primary risk of investing in the PXE ETF is that the prices of oil and gas and refined products could come down. That could be the result of increased production or due to demand destruction as a result of global economic contraction.

Note that the PXE does not hold the major integrated oil companies like Exxon and Chevron. That being the case, the portfolio is not nearly as exposed to the downstream (think chemicals and refining) as compared to many energy funds. That strategy works well during oil and gas price up-cycles, but not so well on down-cycles where downstream assets can help offset weakness in upstream.

While the 0.63% expense fee is quite stiff, you can’t argue with the fund’s out-performance.

Summary and Conclusion

Holding many of the top domestic O&G producer and refiners, the PXE ETF has been a great place to have had your money during the 2022 bear market. That said, it’s my belief that the macro-environment going forward is bullish and that the “trend is your friend.” Meantime, the ETF is still considerably undervalued in comparison to the S&P 500 and on an ROE basis.

Bottom line: Investors getting whacked by “pain at the pump” and inflationary pressures across the board, not to mention getting mauled by the 2022 bear-market – had better considering establishing – or increasing – exposure to the energy sector moving forward. PXE is a buy.