bluebay2014

The rapid increase in interest rates around the world weighed on investment banking activity this year as central banks in many advanced economies took the punch bowl away. The higher cost of borrowing in 2022 put the kibosh on 2021’s boom times.

Equity capital markets issuance of $582B (as of Dec. 19) didn’t even surpass the $733B issued in H2 2021, according to Dealogic data. Debt capital market supply of $6.3T year-to-date slid 30% from a year ago. Global mergers & acquisition deal values of $3.6T dropped almost 39% from 2021.

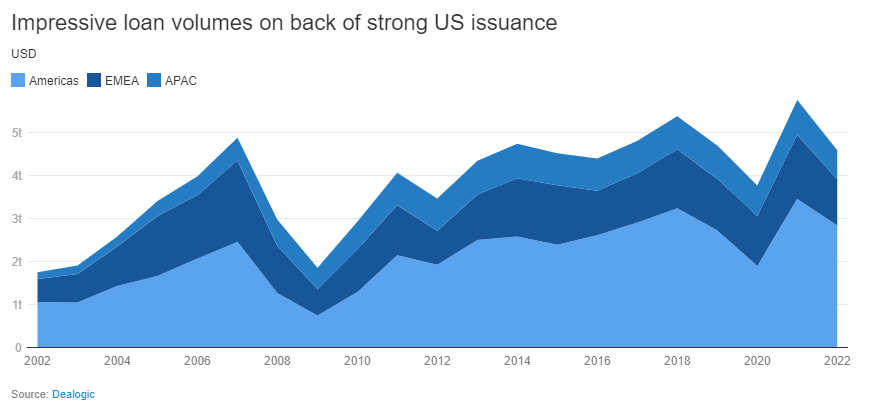

Leveraged finance issuance totaled $444B YTD vs. the record high $1.58T raised in 2021. Loan capital markets, though, held up for the year, raising $4.6T YTD, in line with the average over the past 10 years.

During the year, JPMorgan Chase (NYSE:JPM) pulled in the most investment banking revenue for the year at $5.86B, retaining its top position. It also stayed atop the league tables for debt capital markets, equity capital markets, and syndicated loan revenue. Wall Street rival Goldman Sachs (NYSE:GS) took the prime position in global M&A revenue, with just under $4B.

During the year, JPMorgan Chase (NYSE:JPM) pulled in the most investment banking revenue for the year at $5.86B, retaining its top position. It also stayed atop the league tables for debt capital markets, equity capital markets, and syndicated loan revenue. Wall Street rival Goldman Sachs (NYSE:GS) took the prime position in global M&A revenue, with just under $4B.

In the past year, the top five banks in the investment banking league table saw their stocks drop: JPMorgan (JPM), -17%, Goldman Sachs (GS) -9.9%, Morgan Stanley (NYSE:MS) -13%, Bank of America (NYSE:BAC) -27%, and Citigroup (NYSE:C) -26%. But Goldman and Morgan Stanley managed to fall less than the S&P 500’s 18% decline.

As for the outlook for 2023, here are some Dealogic observations:

For M&A, bankers report ample private equity dry powder and cash on corporate balance sheets could make for a rebound in deals in 2023. In addition, the persistent valuation gap that had been stifling activity in 2022 has been closing, Dealogic said. Due to the weakened valuations, “many companies are opting to sell a stake instead of the whole thing,” the company’s Insights team said.

The negative headlines in the cryptocurrency sector may trigger M&A activity as companies face depressed valuations and a difficult capital-raising environment, wrote Mergermarket’s Rachel Stone. “Companies have to transact right now,” Adam Sullivan, managing director at XMS Capital Partners told Mergermarket. “Companies are running out of cash.”

There is some hope for a rebound in equity issuances next year. “There are hopes that a period of investor engagement in ECM following on from a better-than-expected inflation print in the U.S. will continue into 2023 and that a global rate rising cycle will peak mid-way next year,” Dealogic said.

James Manson-Bhar, head of EMEA ECM syndicate at Morgan Stanley told

In leveraged finance, a flurry of deals in December may start off the year on positive note. Still, “uncertainties surrounding inflation, interest rates and the economy are still expected to pose challenges for leveraged finance markets next year,” Dealogic’s Jelena Cvejic wrote.

With a recession expected next year, global loan volumes will, in large part, depend on how well central banks “navigate these uncertain waters and their ability to guide their economies to as soft a landing as possible,” Dealogic’s Ben Watson wrote.

With many of the factors that hurt markets in 2022 (Russia-Ukraine war, Chinese property crisis, Covid) still a factor in 2023, markets are likely to stay volatile and defaults are expected to rise. Moody’s expects global default rates to rise to 4.9% from 2.6%. S&P, meanwhile, estimates U.S. default rates will climb to. 3.75% from 1.6% in 2022 and European default rates to increase to 3.25% from 1.4%.

As for equities, strategists expect little from the S&P in ’23, but SA readers still love stocks