A number of years in the past, I went to log in to my Fb account for the primary time in a couple of months.

I used to be an early consumer of Fb and joined shortly after they opened it as much as the general public in 2006. Through the years, it has turn into a strategy to keep linked with mates all over the world.

However one thing unusual occurred that morning. My account not existed. I assumed this have to be a password error, however there was no strategy to reset my password.

That meant 15 years of photographs, milestones, check-ins, connections and random ideas have been gone! They vanished into the cybersphere just like the waves washing away a seaside sandcastle.

I reached out to Fb however there was no recourse. Apparently, they’d despatched me an e mail a couple of months again to confirm my account as a result of another person was impersonating me.

Once I didn’t reply in a well timed method, they deleted my account as if I have been the impersonator!

This made me notice (and I’ve been warning readers of this hazard) that the info we publish on-line isn’t actually ours.

When you ship one thing into our on-line world, it’s now within the area and management of Google, Fb, Apple, Pinterest, Snapchat, and many others.

That’s why the following largest factor in cryptocurrencies is so very important.

It’s an opportunity to reclaim our non-public knowledge.

Proudly owning a Distinctive Digital Asset

Learn Write Personal is the title of famed enterprise capitalist Chris Dixon’s newest ebook.

In it, he talks in regards to the “three acts” of the web:

- Within the first act, the “learn period” (circa 1990-2005) early web protocol networks democratized data. Anybody may sort a couple of phrases into an internet browser and examine virtually any subject by means of web sites.

- Within the second act, the “read-write period” (roughly 2006-2020), company networks democratized publishing. Anybody may write and publish to mass audiences by means of posts on social networks and different providers.

- Now a brand new sort of structure is enabling the web’s third act. This structure represents a pure synthesis of the 2 prior varieties, and it’s democratizing possession. Within the dawning “read-write-own period,” anybody can turn into a community stakeholder — gaining energy and financial upside beforehand loved by solely a small variety of company associates, like stockholders and workers.

Individuals can learn and write on the web, however they’ll additionally now personal a digital asset.

What’s behind this motion? The blockchain. Some check with it as crypto (the native digital asset of the blockchain that makes them work), whereas others will name it web3.

On the finish of the day, it’s a strategy to create a novel digital asset that’s not managed or owned by a authorities or company. In the identical approach that Satoshi initially created bitcoin as a peer-to-peer digital foreign money.

All our digital knowledge — our digital selves — may be tokenized and saved similar to you possibly can retailer cryptocurrency.

The principle good thing about that is that social networks shall be constructed, permitting customers to choose in and switch their knowledge to a different one.

This can be a world the place Fb not hosts your knowledge, and you’ll simply transfer all of it to a different social community if you happen to don’t like the best way Fb is working issues.

And as soon as your digital selves are tokenized, it received’t be lengthy till all of your funds are tokenized as nicely.

Learn, write, now personal!

We are able to now tokenize something. We’re transferring to a world the place $867 trillion of economic devices may be tokens and freely traded all over the world 24 hours a day, twelve months a 12 months.

That is already beginning to occur, albeit slowly.

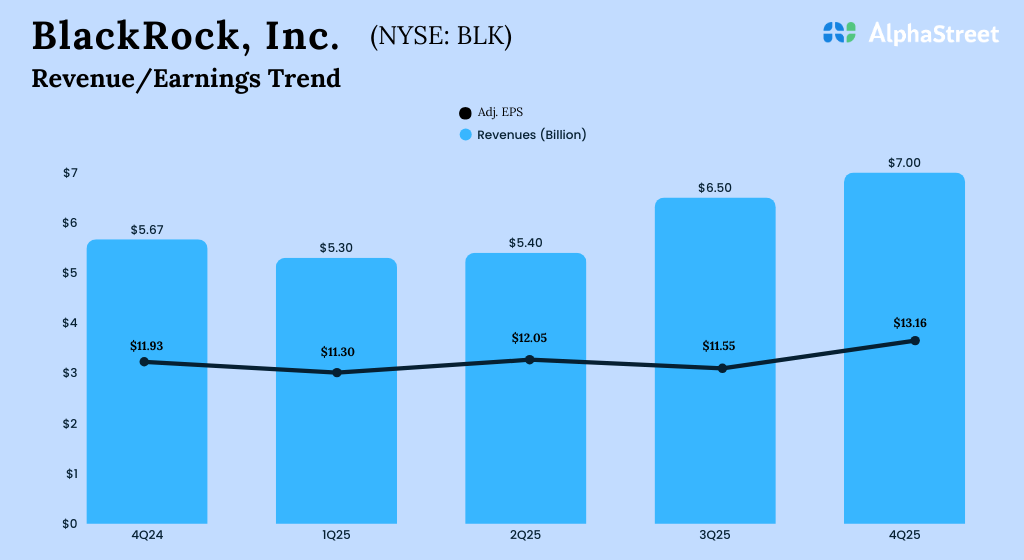

Larry Fink, CEO of BlackRock, thinks it’s “the following technology for markets.”

Fink mentioned that “[crypto] ETFs are the first step within the technological revolution within the monetary markets” and that “Step two goes to be the tokenization of each monetary asset.”

JPMorgan partnered with non-public fairness large Apollo World and is already testing tokenizing with Undertaking Guardian.

Constructing and managing discretionary portfolios for particular person traders is a $5.5 trillion enterprise that permits hundreds of thousands of traders to satisfy their monetary targets.

However present infrastructure and processes of the monetary system make it troublesome for wealth administration corporations to securely and effectively commerce monetary merchandise and develop their companies.

The target of Undertaking Guardian is to develop safe and environment friendly methods to combine digital belongings into the standard monetary system, making buying and selling straightforward and accessible by counting on blockchain infrastructure.

Even international monetary intermediaries are all for extra environment friendly infrastructure for the monetary system.

The Financial institution for Worldwide Settlements launched Undertaking Agora, which is experimenting with tokenized industrial financial institution deposits for fast fee settlements between giant banks throughout international locations.

The entities engaged on the venture embrace seven central banks and 41 international non-public banks.

And talking of personal banks, Goldman Sachs is planning to launch three tokenization initiatives by the top of the 12 months.

This comes as a part of the financial institution’s technique to make the most of the rising curiosity in digital belongings and tokenization.

And it is sensible. Goldman Sachs doesn’t wish to be left behind when its rivals are already providing tokenized treasury-based merchandise.

These are funds invested in authorities securities and associated devices that commerce as tokens on a blockchain as an alternative of shares on an alternate.

And the highest funds on this area at the moment are operated by two of the biggest asset managers on the earth.

BUIDL, with 22% of the market share, belongs to BlackRock and FOBXX, with 17% of the market share, belongs to Franklin Templeton.

These kinds of treasury-related merchandise are at present the most well-liked and fast-growing RWAs to be tokenized for buying and selling on blockchains.

The market cap of on-chain treasuries has surged by 216% in 2024 from simply $767.93 million at first of the 12 months to $2.43 billion at the moment.

And that’s simply tokenized treasuries. These asset managers haven’t even explored tokenized artwork, tokenized actual property or tokenized shares but.

We haven’t even scratched the floor of this pattern.

That is the beginning of an enormous transformation in what we will personal and the way we will switch that possession.

Till subsequent time,

Ian King

Editor, Strategic Fortunes