Key FactorsA number of market indicators mirror that of the dot-com bubble of late 1999.

When that tech bubble popped, the Nasdaq plunged 78% over three years.

This is what’s related about immediately’s AI-crazed market, what could also be completely different, and what buyers ought to do now.

- 10 shares we like higher than NASDAQ Composite Index ›

A number of market indicators mirror that of the dot-com bubble of late 1999.

When that tech bubble popped, the Nasdaq plunged 78% over three years.

This is what’s related about immediately’s AI-crazed market, what could also be completely different, and what buyers ought to do now.

Traders have ridden an unimaginable restoration from the April 2 “Liberation Day” tariff surprises. For the reason that April 8 low, the Nasdaq Composite (NASDAQINDEX: ^IXIC) has appreciated an unimaginable 40%. And naturally, that restoration has taken place amid a decade-long bull market in expertise progress shares.

It is easy to grasp why. Society is changing into extra digital and automatic. The final 10 years have seen the emergence of cloud computing, streaming video, digital promoting, the pandemic-era growth in digital gadgets and work-from-home, all topped off by the introduction of generative synthetic intelligence (AI) marked by the revealing of ChatGPT in late 2022.

The place to take a position $1,000 proper now? Our analyst group simply revealed what they consider are the 10 greatest shares to purchase proper now. Proceed »

Nevertheless, after a protracted tech bull market, expertise progress shares have reached a worrying valuation stage relative to different shares, and immediately’s relative overvaluation mirrors an notorious interval in inventory market historical past.

Echoes of the dot-com period?

In a number of methods, expertise inventory efficiency and valuations are at present mirroring the extremes of the dot-com growth of the late Nineteen Nineties. Sadly, everyone knows how that interval ended, with a horrible “bust” that despatched the Nasdaq tumbling three years in a row, ultimately culminating in a 78% drawdown from the March 10, 2000, peak.

QQQ knowledge by YCharts.

How frothy are tech shares?

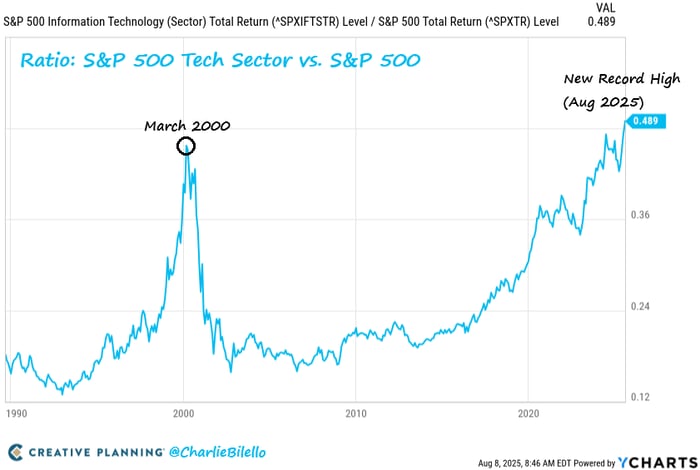

Know-how innovation may be very thrilling; nonetheless, that pleasure usually finds itself within the type of excessive valuations. In keeping with knowledge printed on Charlie Bilello’s State of the Markets weblog, the expertise sector’s current outperformance has now exceeded that of the peak of the dot-com bubble:

Picture supply: Charlie Bilello’s State of the Markets weblog.

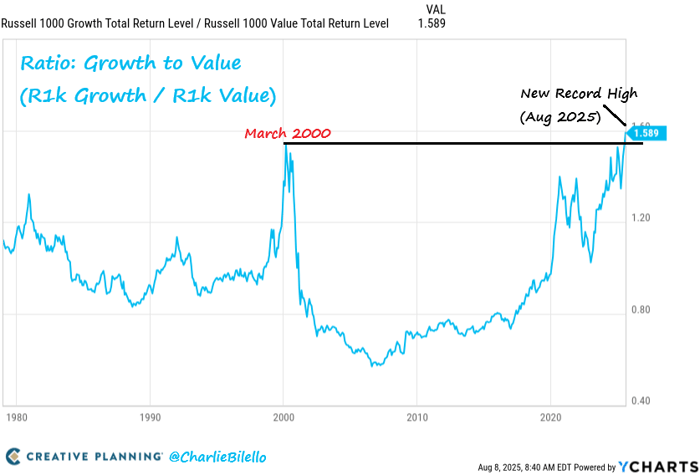

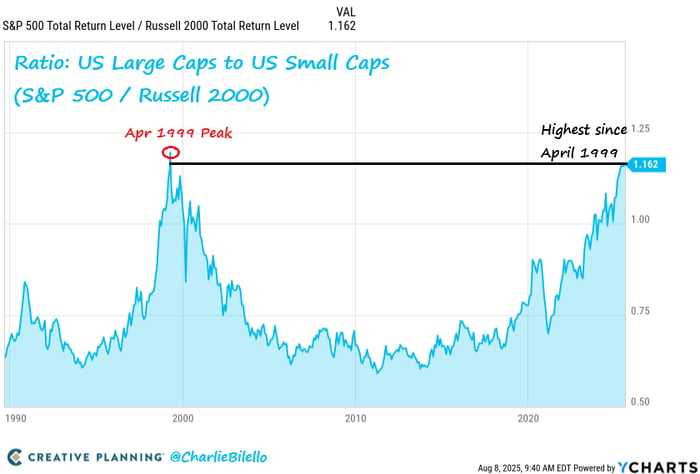

The relative outperformance is not the one mirror to the dot-com period. Again then, tech shares additionally grew to become very giant, resulting in an outperformance of enormous shares relative to small shares. Equally, tech shares are sometimes progress shares with excessive multiples, reflecting enthusiasm over their future prospects. That is in distinction to worth shares, which commerce at low multiples, often as a consequence of their extra modest progress prospects.

As you possibly can see under, the outperformance of enormous shares to small shares, in addition to progress shares to worth shares, is at highs final seen in the course of the dot-com growth.

Picture supply: Charlie Bilello’s State of the Markets weblog.

Picture supply: Charlie Bilello’s State of the Markets weblog.

Is it time to fret?

Provided that higher-valued tech shares now make up a bigger portion of the index, the Schiller price-to-earnings (P/E) ratio, which adjusts for cyclicality in earnings over 10 years, whereas not fairly on the ranges of 1999, has crept as much as the very best stage since 1999, roughly matching the extent from 2021:

S&P 500 Shiller CAPE Ratio knowledge by YCharts. CAPE Ratio = cyclically adjusted P/E ratio.

As everyone knows, 2022 was additionally a horrible 12 months for tech shares. Whereas it did not see a multiyear crash akin to the dot-com bust, 2022 noticed the Nasdaq decline 33.1% on the 12 months. After all, on the finish of 2022, ChatGPT got here out, considerably saving the tech sector because the AI revolution kicked off.

Counterpoints to the bubble thesis

Thus, when in comparison with historical past, tech shares are at worrying ranges. Given the similarities to the 1999 dot-com bubble and the 2021 pandemic bubble, some might imagine it is time to panic and promote; nonetheless, there are additionally a couple of counter-narratives to contemplate.

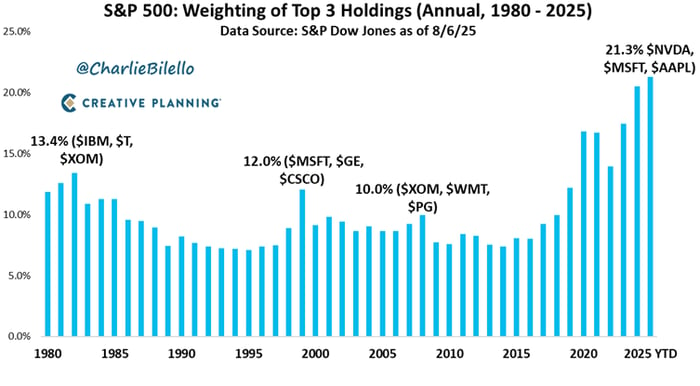

The primary is that, in contrast to in 1999, immediately’s expertise giants are largely actually diversified, cash-rich behemoths that account for a larger and larger share of immediately’s gross home product (GDP). Whereas the late Nineteen Nineties definitely had its leaders — together with Microsoft (NASDAQ: MSFT), the one market chief that’s in the identical place immediately as then — they weren’t actually something like immediately’s tech giants, with sturdy cloud companies, international scale, diversified earnings streams, and super quantities of money.

Whereas market focus within the high three weightings tends to happen earlier than market downturns, index weighting focus seems to be considerably of a long-term development now, rising past prior highs in 1999 and 2008 since 2019.

Picture supply: Charlie Bilello State of the Markets weblog.

Thus, it appears the next weighting of the “Magnificent Seven” shares might be a characteristic of immediately’s financial system, quite than an aberration.

Whereas it is true that a few of immediately’s giant corporations are overvalued, given their underlying energy and resilience, it is maybe not irregular for them to garner higher-than-normal valuation multiples.

What buyers ought to do now

It is necessary to know that whereas paying attention to market ranges is necessary, this can be very troublesome to time market downturns. Famed investor Peter Lynch as soon as stated, “Far extra money has been misplaced by buyers getting ready for corrections, or attempting to anticipate corrections, than has been misplaced in corrections themselves.”

So, one should not abandon one’s long-term investing plan simply because general market ranges could also be frothy. That being stated, for those who want a sure amount of money within the subsequent one to 2 years, it could be a good suggestion to maintain that cash in money or Treasury payments till then, quite than the inventory market.

Moreover, if in case you have an everyday, methodical investing plan, keep on with it. However in case you are constantly including to your portfolio each month or quarter, you could need to take a look at small caps, non-tech sectors, and worth shares immediately, quite than including to giant expertise corporations.

Must you make investments $1,000 in NASDAQ Composite Index proper now?

Before you purchase inventory in NASDAQ Composite Index, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 greatest shares for buyers to purchase now… and NASDAQ Composite Index wasn’t one in all them. The ten shares that made the lower might produce monster returns within the coming years.

Take into account when Netflix made this checklist on December 17, 2004… for those who invested $1,000 on the time of our advice, you’d have $649,657!* Or when Nvidia made this checklist on April 15, 2005… for those who invested $1,000 on the time of our advice, you’d have $1,090,993!*

Now, it’s price noting Inventory Advisor’s whole common return is 1,057% — a market-crushing outperformance in comparison with 185% for the S&P 500. Don’t miss out on the most recent high 10 checklist, out there whenever you be a part of Inventory Advisor.

See the ten shares »

*Inventory Advisor returns as of August 18, 2025

Billy Duberstein has positions in Microsoft. The Motley Idiot has positions in and recommends Microsoft. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.