[ad_1]

peterschreiber.media/iStock by way of Getty Photographs

Some attention-grabbing labor market tidbits.

Goldman Sachs estimates that the labor market is the tightest it has been since WWII

The newest studying of the hole reveals an extra of 5.3 million in labor demand versus provide of employees – “essentially the most overheated degree of the postwar interval each in absolute phrases and relative to the inhabitants,” Jan Hatzius, Goldman’s chief economist, wrote in a be aware Monday.

Caregiving for relations is maintaining numerous folks out of the labor pressure:

Even because the job market quickly approaches the degrees final seen earlier than the coronavirus pandemic, a scarcity of inexpensive look after older and disabled adults is maintaining many out of the workforce. At the very least 6.6 million individuals who weren’t working in early March mentioned it was as a result of they have been caring for another person, in keeping with the newest Family Pulse Survey from the Census Bureau. Whether or not – and when – they return to work will play a job within the continued restoration and will reshape the post-covid labor pressure.

Employees at an Amazon facility in New York voted to Unionize:

Employees on the facility voted by a large margin to type a union, in keeping with outcomes launched on Friday, in one of many greatest victories for organized labor in a technology.

Flex-work is turning into extra of a norm:

A lot of the banking business, lengthy a bellwether for company America, dismissed distant working as a pandemic blip, even leaning on employees to maintain coming in when closings turned Midtown Manhattan right into a ghost city. However with many Wall Avenue employees resisting a return to the workplace two years later and the competitors for banking expertise heating up, many managers are coming round on work-from-home – or at the least acknowledging it isn’t a battle they’ll win.

Let’s take a look at all this information:

- The labor pressure participation charge — the share of individuals both working or looking for work — began to say no within the early 2000s as a result of growing old US inhabitants. Whereas that pattern has continued (to the estimated tempo of 10,000 retirements per day), others have left the labor pressure to look after relations. Add within the “Nice Resignation” — folks leaving jobs as a result of intense dissatisfaction with the working setting — and you’ve got a continued recipe for added declines within the LFPR.

- Consequently, staff are feeling extra empowered to unionize. In keeping with articles on the profitable New Work effort, organizers talked one on one with many staff, speaking about work-life stability and dealing situations.

- On the flip facet, enterprise is clearly feeling the strain to vary its perspective about high quality of life points.

All of it provides as much as a really completely different labor market setting.

Let’s check out some charts:

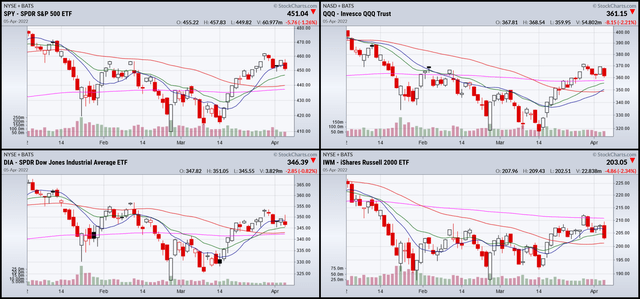

3-month SPY, QQQ, DIA, and IWM (Stockcharts)

The three-month SPY, QQQ, and DIA charts are exhibiting short-term consolidation of the rally that began in mid-March. Nonetheless, the IWM — which by no means broke its 200-day EMA, is headed decrease. As this index is an effective proxy for danger urge for food, we must always concentrate. The IWM led the markets decrease on the finish of final yr.

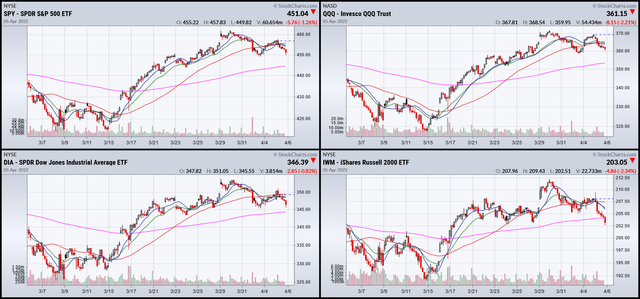

1-month SPY, QQQ, DIA, and IWM (Stockcharts)

The 1-month charts give us extra element in regards to the consolidation. All of the indexes are shifting sideways. The IWM is true at help.

Consolidation is a wholesome growth. And there’s no magic method for the way lengthy it ought to final. The excellent news is that costs are proper at help. The unhealthy information is the IWM was headed decrease for a lot of the day, probably build up momentum for an extra transfer decrease.

[ad_2]

Source link