For months, I, together with many outstanding housing market analysts, have been forecasting an enormous shift within the housing market in some unspecified time in the future in 2022.

For many of the final two years, we’ve been in an unbalanced housing market that strongly favors sellers. Bidding wars, affords over asking, and waived contingencies have change into the norm. However as rates of interest rise, affordability declines, and fears of a recession loom, consumers are gaining again some energy within the housing market.

Because the dynamics of the market change, appreciation charges ought to cool dramatically and change into flat and even adverse. However actual property is native, and I imagine the most certainly state of affairs over the approaching months is that some markets will decline whereas others will proceed to develop, albeit at a much more modest tempo than over the past a number of years.

The query then turns into, which markets are vulnerable to decline, and which can see costs keep regular and even develop? On this article, I’ll discover knowledge to find out the short-term power of particular person housing markets within the U.S. that can assist you determine alternatives and make knowledgeable investing selections.

Under you’ll discover a full evaluation and a downloadable city-level spreadsheet.

The Large Image

Earlier than we get into the localized knowledge, let’s have a look at June’s housing market knowledge on the nationwide stage because it helps present context for the regional variations.

Firstly, issues haven’t modified an excessive amount of when it comes to costs and appreciation charges simply but. The median house worth for the week ending July 3 was nonetheless up about 12.5% year-over-year. That’s down from final summer season’s peak when appreciation charges have been round 20%, however this stage of progress could be unprecedented in any pre-pandemic interval.

Though costs haven’t come down on a nationwide stage simply but, it’s price noting that worth drops are up virtually 4% YoY and are a lot greater than at any level since at the very least 2019.

A fast observe on worth drops: They’re price monitoring, however I don’t put a lot weight on this knowledge level. Worth drops usually mirror the conduct of overzealous sellers relatively than a scarcity of demand. Following two years of unprecedented vendor energy, I’d anticipate a rise in worth drops in virtually each market—even the robust ones. Big will increase in worth drops fear me (Austin, TX has seen an almost 500% improve in worth drops YoY), however seeing double-digit will increase doesn’t concern me as a lot.

That being stated, worth drops generally is a lead indicator for shifts out there however needs to be thought-about alongside different indicators.

As I’ve written earlier than, the primary development shifts that have to happen for housing costs to average or decline is that each lively listings and days on market (DOM) want to extend. You may learn all about why I imagine this right here, however in brief, lively listings and days on market are good measurements of the stability between provide and demand within the housing market. When stock and DOM are low, it’s a vendor’s market, and costs typically rise. When stock and DOM rise, consumers acquire energy, and costs flatten or decline.

As you possibly can see on this chart supplied by Realtor.com, lively listings are beginning to tick up nationally and are up about 19% over June 2021. To be clear, lively listings are nonetheless dramatically under the place they have been pre-pandemic. Nonetheless, we’re now not within the declining stock (on a year-over-year foundation) period that lasted from April 2020 to Might 2022.

June 2022 was the primary month we’ve seen year-over-year good points in lively listings for greater than two years.

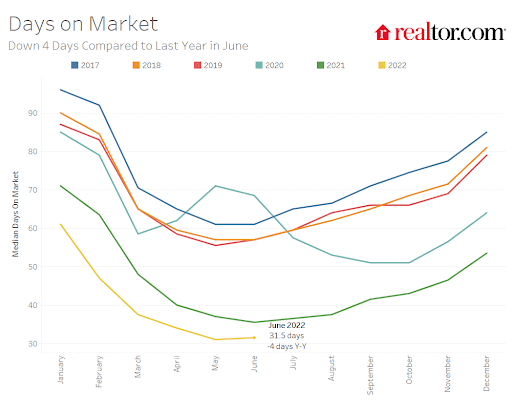

Alternatively, days on market (DOM) continues to be close to all-time lows and is about half of what it was in 2019. This implies at a nationwide stage, there’s nonetheless robust demand for housing. If demand had evaporated, listings could be sitting in the marketplace longer, however they’re not.

Observe that in each of those charts, a few of the latest will increase are as a consequence of seasonality. You’ll discover that lively listings and DOM usually rise over the summer season and decline within the winter, and it’s good to account for that. We’re on the lookout for when DOM sees year-over-year good points, which hasn’t occurred but.

All advised, on the nationwide stage, the housing market looks like it’s beginning to shift, however modestly. DOM continues to be low, signaling enough demand, resulting in costs remaining up a whopping 12.5% year-over-year. For costs to average or decline, DOM and lively listings have to get a lot nearer to pre-pandemic ranges, and we’re not even near that but.

So, why then do I imagine the housing correction has began? Whenever you have a look at the info for particular person housing markets, it tells a way more nuanced story.

Regional Housing Markets

As is usually stated on this business, actual property is native. Latest housing market knowledge makes that very obvious.

To showcase the variations, let’s have a look at a couple of of the latest growth’s largest winners: Boise, ID, and Asheville, NC.

Boise was maybe the most well liked housing market over the past a number of years, with costs growing 59% from June 2019 to June 2022. These are unimaginable good points, however to me, Boise is vulnerable to shedding a small quantity of these good points.

Keep in mind, my speculation is that markets the place lively listings and days on market are close to pre-pandemic ranges are on the biggest threat of a correction. For Boise, not solely have lively listings risen 130% year-over-year, they’re really 8% above pre-pandemic ranges (which I measure as June 2019 in comparison with June 2022)! There are solely a handful of markets the place that is true, and Boise is probably the most notable.

| Boise, Idaho | Median Checklist Worth | Energetic Listings | New Listings | Days on Market | Worth Drops |

|---|---|---|---|---|---|

| June 2019 – June 2022 | 59% | 8% | 40% | -13% | 86% |

| Yr-over-Yr | 10% | 130% | 20% | 4% | 182% |

DOM is up 4% year-over-year however continues to be down 13% from earlier than the pandemic. However should you mix these two knowledge factors with an enormous improve in new listings and big will increase in worth drops, this appears like a housing market in transition to me.

Does this imply that Boise will see a crash in costs? No. That would occur, however I believe the extra doubtless state of affairs is a balanced market the place consumers even have some energy. That is simply an knowledgeable guess, however I do anticipate we’ll see worth declines in Boise in some unspecified time in the future within the coming yr or so, however in all probability solely single-digit declines. What’s extra sure to me is that consumers will be capable of negotiate, and higher offers will emerge in markets like Boise.

To distinction Boise, let’s have a look at one other latest growth city, Asheville, North Carolina.

Asheville’s appreciation since 2019 was 41% (extra modest than Boise however nonetheless huge) and has been up practically 20% in simply the previous yr.

| Asheville, North Carolina | Median Checklist Worth | Energetic Listings | New Listings | Days on Market | Worth Drops |

|---|---|---|---|---|---|

| June 2019 – June 2022 | 41% | -65% | -7% | -47% | -53% |

| Yr-over-Yr | 19% | -11% | 1% | -8% | 18% |

However wanting on the lead indicators for Asheville, the story is totally different from Boise. Somewhat than skyrocketing, lively listings are down 11% year-over-year! Days on market are additionally down 8% year-over-year, and worth drops are up solely 18% YoY. To me, this exhibits a housing market that may be very robust and is unlikely to see an enormous change in costs. Sellers nonetheless have the ability right here.

As you possibly can see from these two examples, totally different housing markets level in several instructions. I picked two well-known sizzling markets for this instance, however you possibly can see these discrepancies throughout the board. Reno, Austin, and Phoenix appear to be they’re transitioning, whereas Miami, Richmond, and Tallahassee nonetheless appear to be robust vendor’s markets.

It’s good to have a look at knowledge for every particular person market. Fortunate for you, I’ve put collectively a spreadsheet with knowledge from Realtor.com’s Residential Listings Database that can assist you see what is going on in your market. You may obtain that under.

Conclusion

On a nationwide stage, the housing market continues to be doing very properly. Costs are up double-digits year-over-year, stock is beginning to tick up, however days on market stay extraordinarily low.

However if you learn between the traces and study some dependable lead indicators for the housing market, you possibly can see that it’s in transition. Sellers are shedding their iron grip in the marketplace, and consumers are gaining energy. Homebuyers and traders are higher positioned to barter and discover offers.

On a localized foundation, these shifts in developments are much more pronounced. Some markets appear very robust and can doubtless continue to grow (however extra modestly), whereas different markets seem to be they might be heading for worth corrections within the coming months. To be an knowledgeable investor, you should perceive your native market. To me, an important issues to have a look at are lively listings (or different stock measurements) and days on market. You may Google these in your native space or obtain my spreadsheet that compares June 2022 numbers to each June 2021 and June 2019 for tons of of markets.

Keep in mind, the metrics I’m overlaying listed below are lead indicators for the short-term prospects of the town in query. To take a look at the long-term potential, you need to have a look at macroeconomic knowledge like inhabitants progress, earnings progress, and development.

On The Market is offered by Fundrise

Fundrise is revolutionizing the way you spend money on actual property.

With direct-access to high-quality actual property investments, Fundrise lets you construct, handle, and develop a portfolio on the contact of a button. Combining innovation with experience, Fundrise maximizes your long-term return potential and has shortly change into America’s largest direct-to-investor actual property investing platform.

Be taught extra about Fundrise

What are you seeing in your native market? Is the dynamic between purchaser and vendor beginning to change? Let me know within the feedback under.