CHAPTER ONE – Introduction

For a very long time, unrestricted cross-border investments had been seen as a supply of financial prosperity, peace, and stability in Western liberal market economies (Rosecrance & Thompson, 2003, pp. 377-379). Within the final decade, nevertheless, pro-liberal market boards have more and more tightened their International Direct Funding (FDI) screening practices on grounds of safety and public order (Esplugues, 2018, pp. 440-443; Liu, 2020). That is notably puzzling within the case of the European Union’s FDI Screening Regulation, which is a rare measure given the EU’s mantra of market openness that’s constructed into its liberal id (Svoboda, 2020, p. 2). It’s socially related to grasp what prompted the introduction of this extraordinary measure that harms the EU’s legitimacy as “one of the open locations to take a position on this planet” (EC, 2021).

Because the official coverage proposal on 13 September 2017, the European Fee’s supporting argumentation is predicated on the storyline of adjusting overseas funding patterns that problem the safety of the Union and the Member States. It emphasises the growing position of rising economies – particularly China – as suppliers of FDI and the lowering FDI inventory of conventional funding companions in Europe equivalent to the USA (EC, 2017d, pp. 3-5). Within the grand scheme of issues, nevertheless, this risk appears to be comparatively weak because the US dominated with 35.1% compared to China’s mere 0.9% by way of FDI inventory held in Europe in 2017 (Eurostat, 2019). It leads one to query: why Chinese language FDI in Europe is perceived as extra threatening than the cross-border investments of a complicated economic system such because the US.

The present literature explains the introduction of the EU’s FDI Screening Regulation by specializing in the fabric pursuits, specifically the US-China Commerce conflict, China’s intensified state capitalism, and the disintegrating forces of Chinese language FDI on the European integration venture (Defraigne, 2017; Paszak, 2017; Bickenbach & Liu, 2018; Roberts et al., 2019; Meunier & Nicolaidis, 2019; Riela & Zámborský, 2020). The overarching declare is that China’s strategic asset-seeking investments impose safety challenges on Europe that led to the EU’s framework to display screen FDI (Hooijmaaijers, 2019; Schill, 2019; Borowicz, 2020; Svoboda, 2020). These essential findings, nevertheless, don’t make clear the ideational pursuits of the EU which might be formed by the ‘China Risk’ discourse. In keeping with Buzan et al., presenting a difficulty as an existential risk, that’s, securitisation can legitimise a rare measure (1998, p. 26). This analysis venture contributes to the educational debate by attending to the ideational as a substitute of fabric dimension, and by analysing the ‘China Risk’ discourse that presumably legitimised the introduction of the EU’s FDI Screening Regulation.

The article of research is the European Fee (Fee) who speaks safety to advocate for the EU’s FDI Screening Regulation because the official coverage proposer. Following a constructivist epistemology, the aim of this thesis is to not assess the validity of the bodily risk, however to grasp the linguistic development of a shared understanding that Chinese language FDI is an existential risk. Subsequently, this thesis goals to reply the explanatory analysis query: Why did the European Union introduce the extraordinary measure of the Regulation (EU) 2019/452 that establishes a framework for the screening of International Direct Funding into the Union?

Utilizing the securitisation principle of the Copenhagen College (Buzan et al., 1998), I argue that the financial, navy and political securitisation of Chinese language FDI in Europe legitimised the enactment of the EU’s FDI Screening Regulation. The discourse evaluation uncovers that the Fee presents the EU Single Market, the competitiveness of EU companies, European staff, the EU’s strategic capabilities and public order, and the EU integration venture as existentially threatened by China’s strategic investments in Europe. It additionally reveals how the EU’s FDI Screening Regulation is introduced because the required device for cover. Furthermore, the findings reveal that the Fee’s arguments to guard the financial competitiveness of EU companies and European staff are linked to navy and political safety arguments. This covers up the protectionist undertone of financial safety arguments, which might be illegitimate in a liberal financial context such because the EU. It is a beneficial contribution to the securitisation literature as a result of it confirms Buzan et al.’s theoretical proposition that securitisation analysts have to think about non-economic arguments in financial risk discourse to comprehensively perceive financial securitisation in a liberal financial context (1998, pp. 100-103).

This thesis is structured as follows. Chapter 2 opinions the literature on the EU’s FDI Screening Regulation. Chapter 3 continues with the analytical framework regarding the principle and the methodology. Chapter 4 examines whether or not and the way the Fee securitises Chinese language FDI in Europe. Concluding, chapter 5 solutions the analysis query, displays on the restrictions of the evaluation and the implications of the findings, and presents recommendations for future analysis.

CHAPTER TWO – State of the Artwork

As chapter 1 has set out the analysis downside, chapter 2 opinions the present literature that explains the introduction of the Regulation (EU) 2019/452. From a macro-perspective, some students think about the US-China commerce conflict that shifted the worldwide order away from liberal multilateralism, which, in flip, normalised FDI screening practices in liberal market boards (Roberts et al., 2019; Scholvin & Wigell, 2019; Aggarwal & Reddie, 2020; Borowicz, 2020). They put the EU’s FDI Screening Regulation in a single basket with the tightening FDI screening practices of the US, Canada, Australia, and Japan as empirical examples of this phenomenon (Esplugues, 2018; Ishikawa, 2020; Heim & Ribberink, 2021; Santander & Vlassis, 2021). Whereas this macro-perspective considers the beliefs and behavioural expectations that information actor behaviour within the worldwide system, it doesn’t acknowledge the sui generis nature of the EU. The EU is just not appropriate with a nation-state or a superstate, as a result of it’s a world organisation with state-like options and multi-level governance (Moskvan, 2017, p. 242). Subsequently, you will need to concentrate on the EU case particularly.

The tutorial debate concerning the causes of the introduction of the EU’s FDI Screening Regulation could be divided alongside the traces of the standard IR theories. Making use of a neorealist analytical lens, some students emphasise that China’s strategic investments and intensified state capitalism threaten the financial and navy safety of the EU Member States (Defraigne, 2017; Paszak, 2017; Hooijmaaijers, 2019; Schill, 2019; Riela & Zámborský, 2020; Svoboda, 2020; Lai, 2021). Within the liberal institutionalist line of thought, nevertheless, Chinese language FDI threatens the EU’s political safety (Christiansen & Maher, 2017). Students on this camp recommend that the disaster of the liberal worldwide order and the disintegrating forces of Chinese language direct funding within the EU integration initiatives are the explanatory elements (Nicolas, 2014; Meunier, 2014b; Casarini, 2015; Bickenbach & Liu, 2018; Simon, 2020). Nevertheless, Meunier has gone furthest as her early work addresses how Chinese language FDI threatens the EU’s unity relating to the cacophony of nationwide FDI guidelines and the competitors amongst the EU Member States (Meunier, 2014a; Meunier, 2014c; Meunier et al., 2014). Her later work analyses how the hostile public opinion in direction of China within the Member States fostered EU integration on FDI coverage (Meunier, 2019; Chan & Meunier, 2020; Meunier & Mickus, 2020). Meunier and Nicolaidis recommend that the securitisation of Chinese language direct investments in Europe led to the EU’s FDI Screening Regulation (2019, pp. 108-109). Nevertheless, they concentrate on a cost-benefit evaluation of financial pursuits that doesn’t present any empirical proof that Chinese language FDI is introduced as an existential risk to the EU’s safety by any actor, which is a spot that this thesis goals to bridge.

Whereas the present research on the Regulation (EU) 2019/452 supply beneficial insights on the fabric pursuits of the EU to display screen FDI, these neglect the ideational pursuits. Their underlying assumption is that the ‘China risk’ to the EU’s navy, financial and political safety is an goal truth. From a social constructivist perspective, nevertheless, the thought of a ‘China risk’ is a social proven fact that solely exists if actors settle for it as such and act accordingly (Wendt, 1992, pp. 392-395). Whereas the Chinese language FDI inflow in Europe could also be a bodily actuality, it is just given which means as being threatening based mostly on a shared understanding. Subsequently, you will need to perceive how coverage discourse constitutes such a shared understanding that legitimises the EU’s FDI screening framework.

A variety of research examines the ‘China risk’ discourse by lecturers and politicians within the West generally and within the US particularly (Pan, 2004; Jerdén, 2014; Track, 2015; Peters et al., 2021). Solely Rogelja and Tsimonis (2020), nevertheless, concentrate on the EU because the geographical area for his or her analysis on the ‘China risk’ discourse. Utilizing securitisation principle, they unpack how European suppose tanks current Chinese language FDI in Europe as an existential risk to the EU’s political unity, id, and strategic belongings. Whereas securitisation principle is their theoretical framework, they make use of the post-structuralist as a substitute of the social constructivist method by concentrating on the facility of language and othering practices as a substitute of the normativity hidden within the language (Rogelja and Tsimonis, 2020, pp. 103-105). Furthermore, suppose tanks do not need the legislative energy of the European Fee, which makes the latter an essential securitising actor that’s nonetheless to be studied. In sum, the hole within the educational literature is a complete evaluation of the Fee’s coverage discourse that securitises Chinese language FDI, which, in flip, legitimises the introduction of the extraordinary measure of the EU’s FDI Screening Regulation. The subsequent chapter units out the analytical framework that helps this thesis to bridge this hole.

CHAPTER THREE – Analytical Framework

The Securitisation Concept of the Copenhagen College

This part explains why and the way the securitisation principle of the Copenhagen College in IR helps to reply the analysis query. Securitisation principle allows gaining insights on “who can “do” or “converse” safety efficiently, on what points, beneath what circumstances, and with which results” (Buzan et al., 1998, p. 27). It reveals how presenting a difficulty as an existential risk can legitimise extraordinary measures as pressing options (Balzacq et al., 2016, p. 495). On this thesis, the dependent variable is the introduction of the EU’s FDI Screening Regulation, which is a rare measure contemplating the EU’s mantra of market openness. Securitisation principle helps to evaluate, whether or not and the way the Fee securitises Chinese language FDI, which is the explanatory variable.

Securitisation principle is break up into the social constructivist and sociological branches. Each agree that presenting a difficulty as existentially threatening is a securitising transfer that solely turns into profitable securitisation if the viewers accepts it as such. Nevertheless, the disagreement centres across the conceptualisation of securitisation (Balzacq, 2011, pp. 1-3). The sociological department considers securitisation as an intersubjective apply and analyses the viewers’s response (Balzacq, 2005; Bigo & Tsoukala, 2008; Salter, 2011), whereas the social constructivist department – the Copenhagen College – conceptualises securitisation as speech act, that’s, the performative expression of knowledge, that presents a difficulty as an existential risk. The analytical focus is on the actor who speaks safety beneath the idea that particular safety rhetoric evokes the logic of survival that, in flip, induces viewers acceptance. The Copenhagen College attends to the socio-political affect of discourse, which is written and spoken communication (Buzan et al., 1998, pp. 24-25; Waever, 2009, p. 22). That is extra applicable for this thesis that concentrates on whether or not and the way the Fee’s securitising speech act legitimises the introduction of the EU’s FDI Screening Regulation.

Following the logic of the Copenhagen College, the central ideas are the securitising actor, the referent object, and the safety sector. The securitising actor is the one who speaks safety from a place of authority outlined by social recognition and experience (Buzan et al., 1998, p. 33). On this thesis, the thing of research is the European Fee – represented by its President and the Directorate Common (DG) Commerce within the coverage strategy of the Regulation (EU) 2019/452 – that takes upon the position as securitising actor for 2 causes. Firstly, the Fee enjoys the authority because the unique coverage proposer in FDI coverage and the experience of the Fee Companies. Secondly, the Fee proposes the extraordinary measure not like the reactive position of the MEPs and the Council by way of debate and voting in addition to the opinion-giving position of the advisory committees. They are often seen because the viewers as a result of these reactive actors can affect the decision-making strategy of coverage, however they don’t assemble the risk discourse (Buzan et al., 1998, p. 33).

Referent objects are issues that the securitising actor portrays as existentially threatened and in should be protected by the extraordinary measure (Buzan et al., 1998, p. 36). This doesn’t imply a risk to the existence per se, but it surely will also be a risk to the “important high quality of existence” (ibid., p. 21, emphasis added). For instance, strategic acquisitions of European companies within the high-tech sector can jeopardise the EU’s competitiveness via the outflow of technological know-how, which doesn’t imply the top of its existence however an erosion of its high quality of existence.

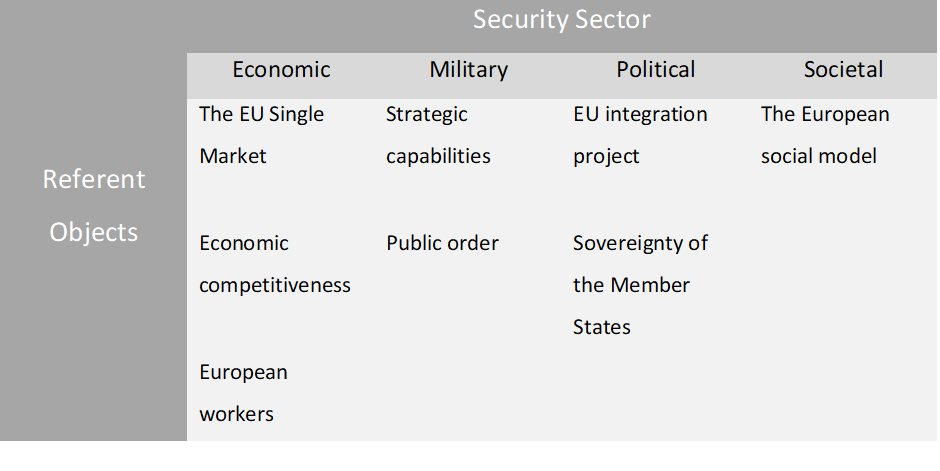

Every referent object belongs to a sure safety sector (Buzan et al., 1998, pp. 36-40). The safety sector is an analytical lens that identifies a sort of securitising discourse based mostly on the kind of relationship and interplay between the actors concerned (Floyd, 2019, p. 174). This isn’t to be confused with sectors in financial phrases that point out an space of financial productiveness (p. 177). Impressed by the analytical framework developed by Buzan et al. (1998, pp. 179-188), this thesis has a deductive method and employs 4 safety sectors. Firstly, the financial safety sector attends to arguments referring to finance, commerce, and manufacturing. Within the liberal financial context of the EU, liberal financial securitisation centres on defending the free market (Buzan et al., 1998, p. 7). Subsequently, the referent object ‘EU Single Market’ compromises the liberal financial guidelines that represent the EU Single Market’s high quality of existence (p. 106). The referent object ‘financial competitiveness’ considerations the place of EU enterprise within the international market and the survival of European firms, while the ‘European staff’ seek advice from the roles and revenue of European residents.

Secondly, the navy safety sector focuses on the arguments about forceful coercion (Buzan et al., 1998, pp. 49-55). On this thesis, the navy referent object ‘strategic capabilities’ compromises the strategic belongings, crucial applied sciences, and infrastructure in Europe, while the ‘public order’ referent object is the conventional functioning of society. Thirdly, the political safety sector focuses on interactions that relate to sovereignty and recognition. Within the EU context, the popularity of the EU integration venture and the sovereignty of Member States could be existentially threatened (Buzan et al., 1998, pp. 145-148). Fourthly, the societal safety sector concentrates on arguments about collective identities. The European social mannequin refers back to the liberal values which might be rooted within the EU’s post-war origins and political-legal structure (p. 183). Desk 1 under reveals the codebook with the referent objects of every safety sector for the evaluation.

Buzan et al. recommend that the financial safety sector is just not a stand-alone analytical lens in a liberal financial context (1998, pp. 100-103). Apart from the EU Single Market, financial referent objects do not need a respectable declare to survival as a result of liberals consider that financial governance ought to solely shield the free market. Therefore, it’s seemingly that the securitising actor hyperlinks the financial referent objects to different sorts of referent objects in order that intellectually incoherent arguments are prevented (p. 106). For instance, the securitising actor might argue that the EU’s financial competitiveness within the high-tech sector must be protected as a result of it should additionally safe Europe’s crucial applied sciences. The Copenhagen College means that solely taking a look at financial arguments is just not enough to comprehensively perceive financial securitisation in a liberal financial context (p. 116). The subsequent part builds additional on this theoretical proposition.

Case Choice

The motivation to look at the single-case research of the EU’s FDI Screening Regulation is twofold. Empirically, it’s a distinctive case of the phenomenon of tightening FDI screening practices in liberal market boards over the last decade. The EU is a world organisation with state-like options (Moskvan, 2017, p. 242), which is incompatible with nationwide governments. Theoretically, the securitisation of Chinese language FDI in Europe is a almost certainly case, which checks the validity of the Copenhagen College’s theoretical proposition on financial securitisation (Buzan et al., 1998, pp. 100-103). That is questioned by Floyd, who makes use of an action-based method to securitisation with process-tracing because the analysis technique (2016, p. 688; 2019, p. 180). Nevertheless, the Copenhagen College’s analytical framework based mostly on discourse evaluation is extra applicable for this analysis venture that analyses coverage discourse as a substitute of its actions, therefore, it checks the validity of the theoretical proposition.

Knowledge Assortment

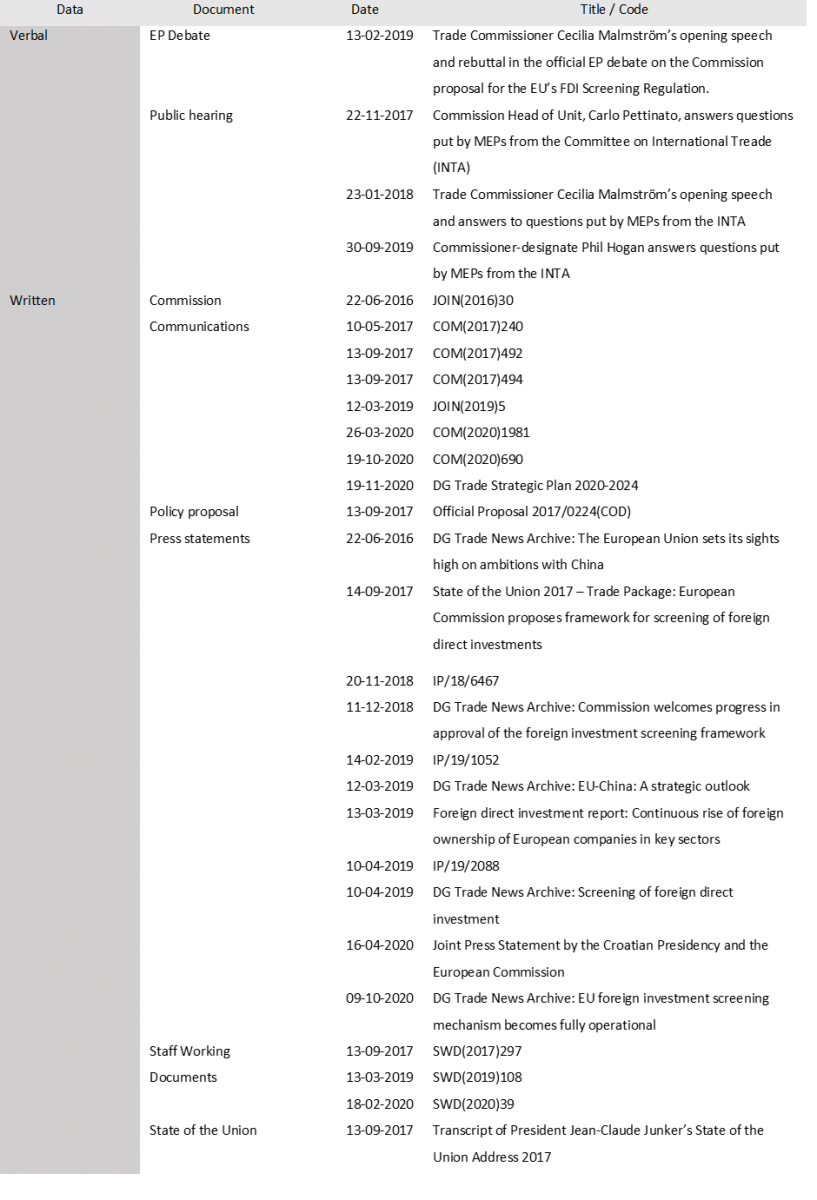

Written and verbal information had been used within the evaluation. I collected twenty-four written paperwork compromising the Fee’s coverage proposal, Fee Communications (CC), Workers Working Paperwork (SWD), and press statements. The number of various kinds of paperwork enhances the validity of the evaluation. Salter warns that analyzing one sort of information or doc in a securitisation evaluation is over simplistic and fails to comprehensively hint securitisation (2011, p. 117). The dataset doesn’t embrace any assembly minutes of the Fee representatives through the trialogue part of the Regulation (EU) 2019/452. This casual assembly interval is behind closed doorways, thus, such information is just not accessible. However, I triangulated the written information with verbal information, specifically speeches held by the Fee President and the DG Commerce representatives on the European Parliament. Subsequently, the dataset sufficiently represents the Fee’s coverage discourse on the ‘China risk’ and FDI screening. To reinforce the transparency of the evaluation and the reliability of the findings, Desk 1 within the Appendix reveals an summary of the dataset.

The first information was collected by way of on-line analysis within the databases of the European Fee Paperwork Archive, EUR-Lex, and the European Parliament Multimedia Centre in April and Could 2021. The EU’s declare to be clear results in the web publication of all press statements, formal communication, public hearings, and the EP debate (Watson, 2012, p. 283). This enabled entry to all genuine information required for the evaluation, and thus no copies or solid paperwork had been analysed. I used the next key search phrases: “FDI screening”, “direct funding screening”, “screening overseas investments”, “overseas direct funding”, “strategic funding”, “Chinese language funding”, “FDI Regulation” and “China technique”. The timeframe of the dataset begins with the Chinese language FDI peak in Europe in 2016 and ends in 2020, when the Regulation (EU) 2019/452 grew to become totally operational.

Methodology – Discourse Evaluation

The conceptualisation of securitisation as speech act is inextricably certain up with discourse evaluation because the analysis technique. Discourse evaluation attracts consideration to the co-constitutive relationship between language and societal norms that inform the pursuits and behavior of actors. The analytical focus is just not on the intention or motives of the speaker, however on the socio-political affect of 1’s speech act (Stoffers, 2021, p. 14). This analysis venture goals to uncover how talking safety legitimises a rare measure, a socio-political affect of speech act, thus, discourse evaluation is essentially the most applicable technique. As discourse evaluation is interpretative (Hardy et al., 2004, p. 21), I coded the first information with the software program programme ATLAS.ti to carry out the evaluation rigorously and systematically. Furthermore, ATLAS.ti allows the web sharing of analytical selections, empirical findings, and analysis notes, which boosts the transparency and reliability of this analysis venture.

To operationalise securitisation, the Copenhagen College argues that the indicator of securitisation is when a difficulty is introduced as an existential risk. Therefore, the criterion is that the speech act should illustrate which designated referent objects shall be misplaced if the extraordinary measure is just not enacted (Buzan et al., 1998, pp. 29-32). Waever stresses that solely an existential risk, not only a risk, induces a way of urgency and necessity – the logic of survival – of the viewers that legitimises the extraordinary measure (2009, p. 22). The inducement of such logic is the so-called actuality impact, which is how the social actuality of the viewers is formed by the securitising actor. Along with the socio-historical context, one should take into account rhetorical mechanisms, equivalent to figures of speech, binary distinctions, the precise use of pronouns, the repetition of phrases, and the storyline within the discourse that each one collectively form the viewers’s worldview. Binary distinctions create a division between the protagonist, the main character, and the antagonist, who works in opposition to the pursuits of the protagonist based mostly on essentialist language (Stoffers, 2021, pp. 17-20). The following chapter applies this operationalisation of the securitisation principle of the Copenhagen College to elucidate the introduction of the extraordinary measure of the EU’s FDI Screening Regulation.

CHAPTER FOUR – Findings and Dialogue

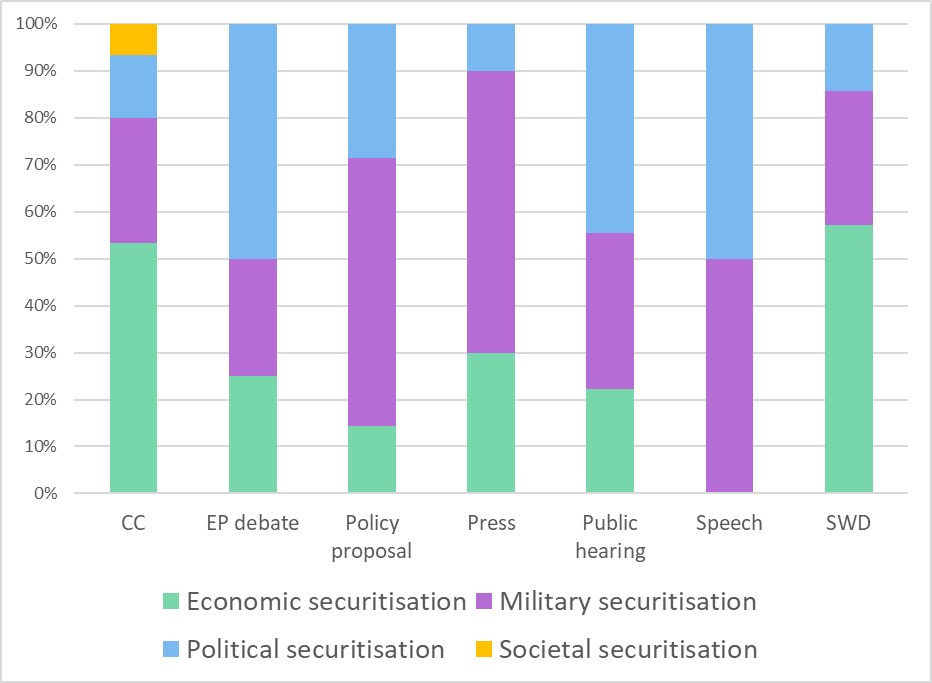

Having established the speculation and methodology in chapter 3, it should now be potential to use the analytical framework in chapter 4. On this discourse evaluation, you will need to take into account the variations within the securitising speech act throughout totally different codecs of linguistic expression (Stoffers, 2021, p. 12). Determine 1 under reveals an summary of the securitisation of Chinese language FDI within the Fee’s discourse on the EU’s FDI Screening Regulation for every speech act format within the dataset.

The financial securitisation of Chinese language FDI reveals dominance within the Fee’s experiences, specifically the Fee Communications and Workers Working Paperwork. This format is acceptable for financial safety arguments contemplating the size of those experiences, which permits for deliberate securitising discourse with graphs and statistics that set up an financial undertone. The navy securitisation of Chinese language FDI reigns supreme within the coverage proposal and the press statements, which could be defined by the previous’s authorized context and the latter’s strain of public opinion. Because the EU’s open market mantra is constructed into its political-legal structure (Manners, 2002, p. 240), Bickenbach and Liu recommend that European policymakers and the general public would solely understand the EU’s framework to display screen FDI as respectable whether it is based mostly on navy safety arguments (2018, p. 19). Political securitisation appears to be essential within the Fee’s speeches, specifically the general public hearings, the EP debate, and the State of the Union in 2017. An evidence is that the format of political speeches permits for extra emotional language and rhetorical mechanisms to specific a sentiment of EU unity greater than the opposite codecs. Whereas solely the societal securitisation of Chinese language FDI proves to be irrelevant, this appears to be outweighed by the opposite types of securitisation. In sum, Determine 1 illustrates the prevalence of the financial, navy, and political securitisation of Chinese language FDI throughout all paperwork and speeches. The variations throughout discourse codecs might recommend that the Fee considers which sort of safety rhetoric is extra applicable during which linguistic setting to legitimise the extraordinary measure of the EU’s FDI Screening Regulation.

The rest of chapter 4 compromises 4 sections that systematically analyse whether or not and the way every sort of securitisation is current within the securitising actor’s discourse on the extraordinary measure. Every part considers the ‘China risk’ discourse, the relevance of the referent objects, and, if there are any, their discursive hyperlink to different safety sectors. The latter is especially essential for the financial safety sector evaluation as a result of it should affirm or reject Buzan et al.’s theoretical proposition (1998, pp. 100-103).

Financial Securitisation

The Fee’s financial risk discourse is predicated on the storyline concerning the altering overseas funding patterns that problem the EU’s safety. The ‘China risk’ thought is constructed by the binary distinction between the EU’s conventional funding companions – allies of the EU Single Market – and its rising funding companions who’re introduced as strategic and never compliant with the EU’s financial rulebook (EC, 2017a, p. 15; EC, 2017d, pp. 3-5; EC, 2017e, p. 6). In a public listening to on 23 January 2018, for instance, Commerce Commissioner Cecilia Malmström states:

Historically, our funding companions have been nations with related financial values as ours: utilizing the identical rulebook. Nevertheless, international markets have modified and there are new highly effective gamers rising who don’t at all times have the identical requirements, not at all times have the identical guidelines, and who don’t at all times play truthful […] That is the background that we have to have after we discuss concerning the Fee’s proposal on funding screening. (Malmström, 2018, January 23, 14:36:08).

The emphasis on taking part in truthful by way of a rulebook and the tricolon of requirements underline the concept that the unfair funding practices of rising gamers are incompatible with the EU’s financial rulebook. In keeping with Buzan et al., something that unglues the liberal financial guidelines constituting the EU Single Market is an existential risk to this financial referent object (1998, p. 106). Therefore, the thought of rising highly effective gamers who don’t adjust to the EU’s market guidelines is an existential risk to the EU Single Market. A more in-depth have a look at the SWDs and the CCs, during which financial securitisation is the dominant safety rhetoric, reveals that China is repeatedly singled out as the first instance of this existential risk to the EU Single Market. The DG Commerce makes separate graphs for Chinese language FDI and persistently repeats the phrase teams “China, for example” (EC, 2017e, p. 3), “traders like China” (ECHR, 2019, p. 27), “with China standing out” (EC, 2019, p. 2). Taking all these discursive parts into consideration uncovers the normative affiliation between Chinese language direct investments in Europe and unfair funding practices that existentially threaten the EU Single Market.

Nevertheless, a profitable occasion of securitisation is just not full with out presenting the extraordinary measure because the required coverage answer (Buzan et al., 1998, p. 32). The Fee presents the EU’s FDI Screening Regulation as a coverage device “to revive a degree taking part in subject” (EC, 2017a, p. 15), to “be sure that everybody performs by the identical guidelines” (EC, 2017b, p. 2), while “adapting to a brand new international setting” (Malmström, 2018, January 23, 14:42:45). In different phrases, the Regulation would shield rules that assure the standard of existence of the EU Single Market. Subsequently, it may be argued that the financial securitisation of Chinese language FDI relating to the EU Single Market is current within the Fee’s discourse.

Arguments for shielding the EU Single Market are usually not protectionist in a liberal financial context as a result of these defend liberal financial guidelines. To check the theoretical proposition of Buzan et al. (1998, pp. 100-103), one should concentrate on different financial referent objects. Right here, the Fee hyperlinks the decision to guard the financial competitiveness of EU enterprise, or “the EU’s technological edge” (EC, 2017d, p. 5; EC, 2017e, p. 6), to the navy referent objects. The Fee argues that predatory overseas acquisitions in Europe’s high-tech sector are usually not solely detrimental to the EU’s technological edge but in addition to its strategic capabilities, particularly crucial applied sciences (EC, 2017d, p. 5; EC, 2019, p. 67). Furthermore, the Fee underlines that unfair funding practices endanger the survival of European firms that, in flip, will trigger monetary instability that harms the general public order throughout the Union (ECHR, 2019, p. 4; EC, 2020b, p. 5). This risk description matches the way in which the Fee portrays China within the Fee Communications on the EU’s technique on China. The securitising actor warns in opposition to China’s strategic and unfair funding practices in cutting-edge sectors, most notably the EU’s high-tech sector (ECHR, 2019, pp. 8-10), to create “nationwide champions capable of compete globally” (ECHR, 2016, p. 6). In the meantime, it presents the Regulation (EU) 2019/452 as a device to cease China’s unfair state-subsidised investments in Europe (ECHR, 2019, p. 11). Subsequently, the Fee establishes the financial securitisation of Chinese language FDI relating to the EU’s technological edge based mostly on navy safety arguments. This type of military-economic securitisation confirms the theoretical proposition.

One other discursive hyperlink was discovered between the financial referent object ‘European staff’ and the political referent object ‘EU integration venture’. In opposition to the background of the ‘China risk’ discourse, the Fee presents the EU’s FDI Screening Regulation as a device to guard EU initiatives which might be a supply of jobs, which serves the EU’s wider goal of defending European staff (EC, 2017b, p. 3, p. 18). This type of political-economic securitisation was comparatively weak as solely two cases of it had been discovered, but it surely nonetheless confirms the theoretical proposition by Buzan et al. that the financial safety sector is just not a stand-alone analytical lens in a liberal financial context (1998, pp. 100-103). In sum, the discursive hyperlinks between the financial, navy, and political referent objects create a way of cross-securitisation that provides one other layer to the Fee’s existential risk discourse. This enhances the legitimacy of the introduction of the extraordinary measure.

Navy Securitisation

The Fee’s navy ‘China risk’ discourse builds additional on the binary distinction between the EU’s conventional and rising funding companions, as defined within the above-mentioned part. Nevertheless, it juxtaposes the market-oriented pursuits of the EU with the strategic pursuits of the rising powers. An essential discovering in all paperwork and speeches is that overseas State-Owned Enterprises (SOEs) are introduced because the antagonist – the actor working in opposition to the strategic pursuits of the EU – within the storyline concerning the altering overseas funding patterns. Within the context of proposing the EU’s FDI Screening Regulation, studying between the traces reveals that China performs the position of the antagonist:

Up to now two years, as Mr. Lange stated, there was an increase within the buying of strategic belongings within the European Union by non-EU traders. A big variety of these are state-owned enterprises. Some are subsidised or backed by overseas governments. And sometimes, these nations have main funding limitations in place (Malmström, 2018, January 23, 14:36:01).

State-owned Enterprises undertake a major share of outward overseas direct funding, in some circumstances as a part of a declared authorities technique. […] On this context, there’s a threat that in particular person circumstances overseas traders might search to amass management of or affect in European undertakings whose actions have repercussions on crucial applied sciences, infrastructure, inputs, or delicate data (EC, 2017d, p. 5).

These passages implicitly seek advice from Chinese language FDI, given the socio-historical context. The dearth of market reciprocity within the Sino-EU funding relations and the Chinese language FDI peak in Europe in 2016, two years earlier, sparked the political debate concerning the EU-wide FDI screening (Simon, 2020, pp. 44-45). One other reference to China is the mentioning of strategic FDI in Europe by SOEs as a part of a declared authorities technique. The notorious Belt and Street Initiative and the Asian Infrastructure Funding Financial institution are infrastructure growth methods declared by the Chinese language authorities in 2013 and 2015 respectively, during which FDI and SOEs are essential parts (Meunier & Nicolaidis, 2019, p. 107). Subsequently, the securitising actor implicitly portrays China as threatening Europe’s strategic capabilities.

These implicit ‘China risk’ expressions grew to become extra express because the legislative strategy of Regulation (EU) 2019/452 progressed. To compensate for the non-publication of an affect evaluation, the Fee printed an SWD in 2019 on the event of FDI flows in Europe (Grieger, 2019, p. 6). On this doc, Chinese language FDI is linguistically singled out as the first instance of the rise in overseas SOEs that strategically spend money on Europe’s high-tech sector, e.g., “with China standing out by way of acquisitions” (EC, 2019, p. 1). Its publication date is the day after the submission of the Joint Communication by the Fee and the Excessive Consultant on 12 March 2019, which warns in opposition to the strategic investments of Chinese language SOEs and requires the swift implementation of the Regulation (EU) 2019/452 (ECHR, 2019, pp. 8-10). Later, in a public listening to on 30 September 2019, Commerce Commissioner-designate Phill Hogan refers to this Joint Communication after stating that “we share a standard understanding of the safety challenges imposed by China’s subsidies and the heavy involvement of the state in its economic system” (Hogan, 2019, September 30, 18:50:48). The declare to share a standard understanding is an evidentiality that presents the thought of a ‘China risk’ as frequent sense with out offering proof. Whether or not this risk is actual or not, this quote reveals the normativity hidden within the Fee’s ‘China risk’ discourse. These intertextual references and the specific ‘China risk’ discourse represent the truth impact of perceiving Chinese language FDI because the paragon of state-controlled overseas investments that existentially threaten Europe’s strategic capabilities.

There are two linguistic methods that the Fee makes use of to current the navy referent objects as existentially threatened, which deserve consideration. Firstly, it makes use of the metaphor “naïve free merchants”, which was coined by Fee President Jean-Claude Junker to emphasize that Europeans don’t sufficiently take into account the true strategic motives of the antagonist (Rogelja & Tsimonis, 2020, p. 110). In his State of the Union Handle, Junker emphasises that “we aren’t naïve free merchants. Europe should at all times defend its strategic pursuits. Because of this, as we speak, we’re proposing a brand new EU framework for funding screening” (2017, September 13). Not surprisingly, the DG Commerce additionally makes use of this metaphor in a press assertion (EC, 2018, November 20), and in a public listening to as Commissioner Malmström emphasises that “we will not be naïve” (Malmström, 2018, January 23, 14:35:34). This determine of speech is a hypothetical state of affairs during which “the predatory shopping for of strategic belongings by overseas traders” (EC, 2020, p. 5), most notably China, occurs proper beneath the eyes of the EU, if it doesn’t display screen FDI. Subsequently, this metaphor induces the logic of survival that, in flip, achieves the navy securitisation of Chinese language FDI.

The second linguistic technique is the precise use of the adjectives ‘crucial’ and ‘important’ to emphasize the existential risk. It was discovered within the official coverage proposal (EC, 2017b), the press statements (EC, 2017, September 14; EC, 2018, November 20), the experiences (EC, 2017b, p. 5; EC, 2017c, pp. 5-6), and the general public hearings. Within the public listening to on 30 September 2019, for instance, the Commerce Commissioner-designate Hogan argues:

We additionally must strengthen the safety of our crucial infrastructure and our technological base, as outlined within the March 2019 Communication on China […], beefing up this specific screening mechanism is important if we need to shield our crucial applied sciences and our crucial infrastructure (Hogan, 2019, September 30, 18:52:08).

Whereas the quote reiterates the normative affiliation between Chinese language FDI and safety threatening FDI, the emphasised passages current the crucial applied sciences and infrastructure as misplaced if the FDI screening mechanism is just not applied. The rhetorical speculation – we have to strengthen the safety, which is important if we need to shield the strategic capabilities – urges the viewers to behave in a approach that might guarantee such safety, on this case, the implementation of the EU’s FDI Screening Regulation. This existential risk state of affairs induces the logic of survival that’s integral to profitable securitisation (Waever, 2009, p. 22). The identical linguistic technique is used to current the general public order within the Union as existentially threatened as a result of it’s certain to the EU’s strategic capabilities. The mentioning of the latter persistently precedes the previous, e.g., “the acquisition of European firms that develop applied sciences or preserve infrastructures which might be important to carry out crucial capabilities in society and the economic system” (EC, 2017b, p. 10). Public order is the power to carry out crucial capabilities in society. Whereas navy securitisation based mostly on the general public order doesn’t happen independently, it provides one other layer to the Fee’s risk discourse.

The findings recommend that Europe’s strategic capabilities play the starring position within the Fee’s safety rhetoric, as it’s the most regularly talked about of all referent objects throughout all paperwork. Provided that the political-legal structure of the EU is anti-protectionist and anti-discriminatory, the navy safety arguments are most applicable in legitimising the extraordinary measure in a legislative context (Bickenbach & Liu, 2018, p. 19). This helps to elucidate why the strategic capabilities within the EU are usually not solely essential within the navy securitisation of Chinese language but in addition within the financial and political safety rhetoric, which is elaborated on in sections earlier than and after.

Political Securitisation

The Fee’s political ‘China risk’ discourse is much like the navy variant because it centres across the thought of accelerating Chinese language direct investments that purchase Europe’s strategic capabilities, which, in flip, are detrimental to the EU integration venture. Consequently, the political securitisation of Chinese language FDI is intertwined with the navy safety argument to guard the EU’s strategic belongings. As Determine 1 reveals, political securitisation is essential if not dominant within the speeches, as President Junker’s State of the Union is illustrative of the political risk discourse:

At the moment we’re proposing a brand new EU framework for funding screening […] If a overseas, state-owned, firm needs to buy a European harbour, a part of our vitality infrastructure or a defence expertise agency, this could solely occur in transparency, with scrutiny and debate. It’s a political accountability to know what’s going on in our personal yard in order that we will shield our collective safety if wanted (Junker, 2017, September 13).

The quote’s risk discourse turns into political by the emphasis on the EU because the protagonist within the storyline. Not surprisingly, the evaluation discovered that each one cases of the political securitisation of Chinese language FDI are based mostly on the EU integration venture, not the sovereignty of Member States. Right here, President Junker emphasises that it’s a political accountability to guard these strategic belongings, with a particular use of the pronouns ‘we’ and ‘our’. To state ‘our personal’ is redundant as a result of ‘our’ already signifies a type of possession. This linguistic development fosters a relationship between the speaker and the viewers that, in flip, enhances the sentiment of being a Union of Europeans that’s to be protected. The mentioning of “our personal yard” refers to Greece given its geographical location that’s not within the coronary heart of Europe however on the southern border of the Union, that’s, the yard of the EU. With a navy undertone, the emphasised passages a few overseas SOE buying a European harbour implicitly seek advice from the infamous purchases of enormous stakes within the Greek Piraeus Port by the Chinese language transport group COSCO in 2008 and 2016. As COSCO is a former SOE with ties to the Chinese language authorities, this funding deal has been perceived for example of China’s ‘divide and conquer’ funding technique in Europe that disintegrates the EU (Meunier, 2014c; Rogelja & Tsimonis, 2020, p. 116). Up to now decade, Greece adopted a extra lenient diplomacy method in direction of China than different Member States due to its financial dependence on Chinese language FDI, which is seen as detrimental to the EU’s inner unity (Meunier, 2019, p. 21; Chan & Meunier, 2020, p. 22). Equally, Commissioner Malmström implicitly refers back to the Sino-Greek funding relations as she states within the public listening to on 23 January 2018:

There’s a Chinese language proverb saying that the perfect time to plant a tree was twenty years in the past, however the second-best time is now. So, public order and safety is just not about being proper in the future. It’s about being proper on a regular basis from day one […] The way forward for our Union is determined by how we put together for the longer term […] We have to safe the foundations of the European Union […] As I began with a Chinese language proverb, I’ll finish with a Greek one, saying that: “a society grows nice when previous males plant timber whose shade they know they shall by no means sit in”. On this case, issues are extra pressing than it would recommend within the proverb” (Malmström, 2018, January 23, 14:34:20).

The phrases ‘pressing’, ‘the perfect time is now’ and ‘must safe’ create a way of urgency that fosters the thought of being existentially threatened. The emphasised passages categorical that the longer term and the muse of the EU will lose their high quality of existence if the EU’s FDI Screening Regulation is just not applied, which meets the precise standards of a profitable occasion of securitisation (Buzan et al., 1998, p. 26). The Chinese language and Greek proverbs don’t solely foster a way of urgency, however the very mentioning of them additionally implicitly refers back to the quickly growing Sino-Greek funding relations that had been a difficulty of concern within the wider public debate about Chinese language FDI in Europe (Rogelja & Tsimonis, p. 120). The truth impact of those discursive parts is the concept that Chinese language FDI existentially threatens the EU integration venture, with a specific concentrate on China’s alleged technique to woo Greece to its facet with FDI.

In the meantime, the EU’s FDI Screening Regulation is persistently introduced as a mechanism “to cooperate and alternate data on investments from third nations” (EC, 2018, November 20; EC, 2019, February 12). This describes the coverage instrument as a device to counter the disintegrating affect of hostile FDI in Europe. Furthermore, the Fee presents the EU’s FDI Screening Regulation as a device to guard “initiatives and programmes which serve the Union as entire” (EC, 2017a, p. 18), “our Union” (Junker, 2017, September 13), “venture or programmes of Union pursuits” (EC, 2017b, p. 20), and “initiatives of the Union’s curiosity, like Galileo or Horizon 2020, elementary for our future” (Malmström, 2019, February 13; 18:51:32). It turns into clear that the Fee’s discourse establishes the political securitisation of Chinese language FDI relating to the EU integration venture, which legitimises the introduction of the EU’s FDI Screening Regulation.

Societal Securitisation

The societal safety sector focuses on arguments about collective identities (Buzan et al., 1998, p. 7). Right here, the Fee juxtaposes the EU because the promoter of liberal democracy (Junker, 2017, September 13), with China as an authoritarian “one-party system with a state-dominated mannequin of capitalism” (ECHR, 2016, p. 17). Nevertheless, there was just one occasion of societal securitisation within the March 2019 Communication on the EU’s China Technique. The Fee states that the European social mannequin shall be misplaced if the EU doesn’t adapt to the altering funding setting and strengthen its home insurance policies with the EU’s FDI Screening Regulation (ECHR, 2019, pp. 2-6, p. 17). Therefore, the societal securitisation of Chinese language FDI is comparatively weak. An evidence is that brazenly securitising Chinese language traders based mostly on collective identities would contradict the Fee’s declare that the EU’s FDI Screening Regulation is non-discriminatory (EC, 2017b, p. 3). However, Determine 1 reveals that the opposite types of securitisation outweigh the just about absent societal safety rhetoric and legitimise the EU’s FDI Screening Regulation.

CHAPTER FIVE – Conclusion

The introduction of the EU’s FDI Screening Regulation is just not solely extraordinary but in addition dangerous to its legitimacy, because the open market mantra is constructed into its liberal id. This thesis aimed to reply why the EU launched this extraordinary measure. Presenting a difficulty as an existential risk – securitisation – can legitimise a rare measure (Buzan et al., 1998, p. 26), therefore, discourse evaluation was performed on the Fee’s paperwork and speeches concerning the Regulation (EU) 2019/452 from 2016 to 2020. Utilizing the securitisation principle of the Copenhagen College, this thesis uncovered the securitisation of Chinese language FDI within the Fee’s coverage discourse on the proposal for establishing a framework for the screening of FDI into the Union. It reveals that the thought of a ‘China risk’ is predicated on a binary distinction between the EU because the market-oriented protagonist and China because the strategic antagonist. In opposition to this background, financial, navy, and political securitisation had been prevalent within the Fee’s discourse, with every exhibiting dominance in a discourse format that’s applicable for his or her designated fashion of talking safety. This will likely recommend that the Fee considers when to talk which sort of safety rhetoric. Solely societal securitisation proved to be irrelevant, however it’s outweighed by the opposite types of securitisation.

The findings present that the political securitisation of Chinese language FDI presents the EU integration venture as existentially threatened by the strategic asset-seeking investments from China. It’s based mostly on the identical risk discourse because the navy variant. The navy securitisation of Chinese language direct investments centres across the thought of China’s predatory shopping for of Europe’s strategic capabilities by way of its SOEs, which, in flip, is detrimental to the general public order within the EU. In the meantime, the financial securitisation of Chinese language FDI is predicated on the thought of Chinese language traders who don’t adjust to the EU’s financial rulebook, which existentially threatens the EU Single Market, the EU’s financial competitiveness and European staff. To keep away from protectionist arguments that might be illegitimate within the liberal financial context of the EU, the Fee discursively linked the decision to guard the financial competitiveness, and European staff to arguments for shielding the strategic capabilities, the general public order, and the EU integration venture. The theoretical implication of this specific discovering is that this thesis confirms the suggestion by Buzan et al. that securitisation analysts should embrace different safety sectors to comprehensively perceive cases of financial securitisation in a liberal financial context (1998, pp. 100-103). In abstract, it may be argued that the Fee implicitly and explicitly expressed the concept that Chinese language FDI in Europe existentially threatens the EU’s safety, which, in flip, legitimised the introduction of the extraordinary measure of the Regulation (EU) 2019/452.

The chance of utilizing discourse evaluation because the analysis technique is that the evaluation is interpretative and will change into normative (Hardy et al., 2004, p. 21). Nevertheless, using a codebook and the software program programme ATLAS.ti that permits for sharing the analytical notes aimed to determine an empirically legitimate and dependable research. Moreover, utilizing the securitisation principle of the Copenhagen College didn’t permit for analysing the response of the MEPs to the Fee’s securitising speech act within the EP debate and the general public hearings. For these fascinated about finding out the response of the viewers, a suggestion for future analysis is to make use of the sociological securitisation principle developed by Balzacq (2011) and Salter (2011). Appropriate analysis strategies are course of tracing, ethnographic analysis, and content material evaluation to grasp the socio-cultural context that enabled the MEPs’ acceptance of the EU’s FDI Screening Regulation (Balzacq et al., 2016, p. 519).

However, this analysis venture completed to disclose the Fee’s implicit and express ‘China risk’ discourse on FDI screening. Given the authority of the securitising actor, the broader societal implication is that the Fee feeds into the development of a shared understanding that Chinese language investments are usually not an financial alternative however a safety risk. The sensation of urgency to display screen FDI has been carried on by the so-called geopolitical Fee beneath President Ursula von der Leyen. On 17 June 2020, it proposed a basic market scrutiny instrument that addresses the market-distorting results of overseas subsidised investments, most notably from China, via funding screening (EC, 2020c, pp. 4-5). Whereas this Fee proposal requires the safety of truthful competitors, the joint letter of Germany, France, and Italy requesting EU-wide FDI screening that preceded the Regulation (EU) 2019/452 was rejected by smaller Member States for the very same argumentation (Simon, 2020, pp. 45-48). Since this thesis doesn’t supply an evidence on this difficulty, it might be that framing Chinese language FDI as an existential risk is essential within the Fee’s agenda-setting practices. Analysis on the coverage entrepreneurship of the Fee relating to the framing of the Chinese language FDI might present additional insights into this matter.

References

Aggarwal, V. Okay., & Reddie, A. W. (2020). New financial statecraft: Industrial coverage in an period of strategic competitors. Points & Research: A Social Science Quarterly on China, Taiwan and East-Asian Affairs, 56(2), 1-29. https://doiorg.ezproxy.ub.unimaas.nl/10.1142/S1013251120400068

Balzacq, T. (2005). The three faces of securitization: Political company, viewers, and context. European Journal of Worldwide Relations, 11(2), 171-201. https://doi.org/10.1177/1354066105052960

Balzacq, T. (2011). A principle of securitization: Origins, core assumptions and variants. In T. Balzacq (Ed.), Securitization Concept: How safety issues emerge and dissolve (pp. 1-30). Routledge.

Balzacq, T., Léonard, S., & Ruzicka, J. (2016). ‘Securitization’ revisited: Concept and circumstances. Worldwide Relations, 30(4), 494–531. https://doi.org/10.1177/0047117815596590

Bickenbach, F., & Liu, W. H. (2018). Chinese language direct funding in Europe – Challenges for EU FDI coverage. CESifo Discussion board, Ifo Institut–Leibniz-Institute for Financial Analysis on the College of Münich, 19(4), 15-22. https://www.econstor.eu/bitstream/10419/199017/1/CESifo-Discussion board-2018-4-p15-22.pdf

Bigo, D., & Tsoukala, A. (2008). Terror, Insecurity and Liberty: Intolerant Practices of Liberal Regimes after 9/11. Routledge.

Borowicz, A. (2020). The shift of the coverage in direction of FDI in European Union: Determinants and challenges. European Integration Research, 14(1), 117-124. http://dx.doi.org/10.5755/j01.eis.1.14.27556

Buzan, B., Wæver, O., & De Wilde, J. (1998). Safety: A New Framework for Evaluation. Lynne Rienner Pub.

Casarini, N. (2015). Is Europe to learn from China’s Belt and Street Initiative? Istituto Affari Internazionali & JSTOR, 15(40), 1-11. http://www.jstor.org/secure/resrep09729

Chan, Z., & Meunier, S. (2020). Behind the display screen: Understanding nationwide assist for a International Funding Screening Mechanism within the European Union. Social Science Analysis Community. Advance on-line publication. https://dx.doi.org/10.2139/ssrn.3726973

Christiansen, T., & Maher, R. (2017). The rise of China: Challenges and alternatives for the European Union. Asia Europe Journal, 15(2), 121–131. https://dx.doi.org/10.1007/s10308-017-0469-2

Defraigne, J. C. (2017). Chinese language outward direct investments in Europe and the management of the worldwide worth chain. Asia Europe Journal: Research on Frequent Coverage Challenges, 15(2), 213–228. https://doi.org/10.1007/s10308-017-0476-3

Esplugues, M. C. (2018). Extra focused method to International Direct Funding: The institution of screening methods on nationwide safety grounds. Brazilian Journal of Worldwide Regulation, 15(2), 440-468. https://doi.org/10.5102/rdi.v15i2.5365

European Fee (EC). (2017a). Reflection Paper on Harnessing Globalisation (COM(2017)240).

European Fee (EC). (2017b). Proposal for a Regulation of the European Parliament and the Council. Establishing a Framework for Screening International Direct Investments into the European Union (COM(2017)487).

European Fee (EC). (2017c). Communication from the Fee to the European Parliament, the European Council, the Council, the European Financial and Social Committee and the Committee of the Areas. A Balanced and Progressive Commerce Coverage to Harness Globalisation (COM(2017)492).

European Fee (EC). (2017d). Communication from the Fee to the European Parliament, the European Council, the Council, the European Financial and Social Committee and the Committee of the Areas. Welcoming International Direct Funding whereas Defending Important Pursuits (COM(2017)494).

European Fee (EC). (2017e). Fee Workers Working Doc. Accompanying the doc (COM(2017(487) (SWD(2017)297).

European Fee (EC). (2017, September 14). State of the Union 2017 – Commerce Bundle: European Fee Proposes Framework for Screening International Direct Funding. The Official Web site of the European Fee, Information Archive. http://commerce.ec.europa.eu/doclib/press/index.cfm?id=1716

European Fee (EC). (2018, November 20). Fee Welcomes Settlement on International Funding Screening Framework. The Official Web site of the European Fee, Press Nook. https://ec.europa.eu/fee/presscorner/element/en/ip_18_6467

European Fee (EC). (2019). Fee Workers Working Doc on International Direct Funding within the EU (SWD(2019)108).

European Fee (EC). (2020a). Fee Workers Working Doc on the Motion of Capital and the Freedom of Funds (SWD(2020)39).

European Fee (EC). (2020b). Communication from the Fee. Steerage to the Member States Regarding International Direct Funding and Free Motion of Capital from Third Nations, and the Safety of European Strategic Belongings, forward of the Software of Regulation (EU) 2019/452 (FDI Screening Regulation) (COM(2020)1981).

European Fee (EC). (2020c). White Paper on Levelling the Taking part in Area as Regards International Subsidies (COM(2020)253).

European Fee (EC). (2021). EU Funding Coverage. https://ec.europa.eu/commerce/coverage/accessing-markets/funding/

European Fee and the Excessive Consultant of the Union for International Affairs and Safety Coverage (ECHR). (2016). Joint Communication to the European Parliament and the European Council and the Council. Components for a New Technique on China (JOIN(2016)30). European Fee.

European Fee and the Excessive Consultant of the Union for International Affairs and Safety Coverage (ECHR). (2019). Joint Communication to the European Parliament and the European Council and the Council. EU-China: A Strategic Outlook (JOIN(2019)5). European Fee.

Eurostat. (2019, July 1). International Direct Funding – Shares. Eurostat Statistics Defined. https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Foreign_direct_investment_-_stocks

Floyd, R. (2016). Extraordinary or peculiar emergency measures: What and who defines the ‘success’ of securitization? Cambridge Assessment of Worldwide Affairs, 29(2), 677-694. https://doi.org/10.1080/09557571.2015.1077651

Floyd, R. (2019). Proof of securitisation within the financial sector of safety in Europe? Russia’s financial blackmail of Ukraine and the EU’s conditional bailout of Cyprus. European Safety, 28(2), 173-192. https://doi.org/10.1080/09662839.2019.1604509

Grieger, G. (2019). Briefing EU Legislative Course of – EU Framework for FDI Screening. European Parliament Analysis Service. https://www.europarl.europa.eu/thinktank/en/doc.html?reference=EPRS_BRI(2018)614667

Hardy, C., Harley, B., & Phillips, N. (2004). Discourse evaluation and content material evaluation. Two solitudes? Qualitative Strategies, 2(1), 19-22. https://doi.org/10.5281/zenodo.998649

Heim, I., & Ribberink, N. (2021). Between development and nationwide safety in host nations: FDI regulation and Chinese language outward investments in Australia’s crucial infrastructure. AIB Insights, 21(1), 1-6. https://doi.org/10.46697/001c.19506

Hogan, P. (2019, September 30). European Fee Consultant Solutions Questions put by Members of the European Parliament from the Committee on Worldwide Commerce [Speech video recording]. European Parliament Multimedia Centre. https://multimedia.europarl.europa.eu/en/hearing-of-phil-hogan-commissioner-designate-trade_20190930-1830-SPECIAL-HEARING-2Q2_vd

Hooijmaaijers, B. (2019). Blackening skies for Chinese language funding within the EU? Journal of Chinese language Political Science, 24(3), 451-470. https://doi.org/10.1007/s11366-019-09611-4

Ishikawa, T. (2020). Funding screening on nationwide safety grounds and worldwide regulation: The case of Japan. Journal of Worldwide and Comparative Regulation, 7(1), 71-98. https://www.jicl.org.uk/journal/june-2020/investment-screening-on-national-security-grounds-and-international-law-the-case-of-japan

Jerdén, B. (2014). The assertive China narrative: Why it’s unsuitable and the way so many nonetheless purchased into it. The Chinese language Journal of Worldwide Politics, 7(1), 47-88. https://doi.org/10.1093/cjip/pot019

Junker, J. (2017, September 13). Transcript of the State of the Union Handle 2017. The Official Web site of the European Fee, Press Launch. https://ec.europa.eu/fee/presscorner/element/en/SPEECH_17_3165

Lai, Okay. (2021). Nationwide safety and FDI coverage ambiguity: A commentary. Journal of Worldwide Enterprise Coverage, 1-10. https://doi.org/10.1057/s42214-020-00087-1

Liu, I. T. (2020, July 7). The economics of nationwide safety in Hong Kong. The Lowy Institute. https://www.lowyinstitute.org/the-interpreter/economics-national-security-hong-kong

Malmström, C. (2018, January 23). European Fee Consultant Solutions Questions put by Members of the European Parliament from the Committee on Worldwide Commerce [Speech video recording]. European Parliament Multimedia Centre. https://multimedia.europarl.europa.eu/en/committee-on-international-trade_20180123-1430-COMMITTEE-INTA_vd

Malmström, C. (2019, February 13). European Fee Speech within the European Parliament Debate concerning the Proposal for the EU Regulation to Display screen International Direct Investments into the Union [Speech video recording]. European Parliament Multimedia Centre. https://www.europarl.europa.eu/plenary/en/vod.html?mode=chapter&vodLanguage=EN&playerStartTime=20190213-18:41:58&playerEndTime=20190213-19:38:52#

Manners, I. (2002). Normative energy Europe: A contradiction in phrases? JCMS: Journal of Frequent Market Research, 40(2), 235-258. https://doi.org/10.1111/1468-5965.00353

Meunier, S. (2014a). A Faustian discount or only a good discount? Chinese language International Direct Funding and politics in Europe. Asia Europe Journal, 12(1), 143-158. https://doi.org/10.1007/s10308-014-0382-x

Meunier, S. (2014b). ‘Beggars can’t be choosers’: The European disaster and Chinese language Direct Funding within the European Union. Journal of European Integration, 36(3), 283-302. https://doi.org/10.1080/07036337.2014.885754

Meunier, S. (2014c). Divide and conquer? China and the cacophony of overseas funding guidelines within the EU. Journal of European Public Coverage, 21(7), 996-1016. https://doi.org/10.1080/13501763.2014.912145

Meunier, S. (2019). Chinese language Direct Funding in Europe: Financial alternatives and political challenges. In Okay. Zeng (Ed.), Handbook on the Worldwide Political Financial system of China (pp. 98-112). Edward Elgar Publishing.

Meunier, S., Burgoon, B. & Jacoby, W. (2014). The politics of internet hosting Chinese language funding in Europe – An introduction. Asia Europe Journal, 12, 109–126. https://doi-org.ezproxy.ub.unimaas.nl/10.1007/s10308-014-0381-y

Meunier, S., & Nicolaidis, Okay. (2019). The geopoliticization of European commerce and funding coverage. JCMS: Journal of Frequent Market Research, 57(1), 103-113. https://doi.org/10.1111/jcms.12932

Meunier, S., & Mickus, J. (2020). Sizing up the competitors: Explaining reform of European Union competitors coverage within the Covid-19 period. Journal of European Integration, 42(8), 1077-1094. https://doi.org/10.1080/07036337.2020.1852232

Moskvan, D. (2017). The European Union’s competence on overseas funding: New and improved. San Diego Worldwide Regulation Journal, 18(2), 241-262. https://digital.sandiego.edu/ilj/vol18/iss2/3

Nicolas, F. (2014). China’s direct funding within the European Union: Challenges and coverage responses. China Financial Journal, 7(1), 103-125. https://doi.org/10.1080/17538963.2013.874070

Pan, C. (2004). The “China risk” in American self-imagination: The discursive development of different as energy politics. Options, 29(3), 305-331. https://www.jstor.org/secure/40645119

Paszak, P. (2017). Chinese language funding coverage in Europe between 2011 and 2017: Challenges and threats to the safety of European Union nations. Polish Journal of Political Science, 3(4), 7-29. http://yadda.icm.edu.pl/yadda/ingredient/bwmeta1.ingredient.desklight-55cb1148-f65e-4101-af7e-529bef31fcd5

Peters, M. A., Means, A. J., Ericson, D. P., Tukdeo, S., Bradley, J. P., Jackson, L., & Misiaszek, G. W. (2021). The China-threat: Discourse, commerce, and the way forward for Asia. A Symposium. Instructional Philosophy and Concept, 53, 1-21. https://doi.org/10.1080/00131857.2021.1897573

Riela, S., & Zámborský, P. (2020). Screening of overseas acquisitions and commerce in crucial items. Asia-Pacific Journal of EU Research, 18(3), 55-83. https://ssrn.com/summary=3774015

Roberts, A., Moraes, H. C., & Ferguson, V. (2019). Towards a geo-economic order in worldwide commerce and funding. Journal of Worldwide Financial Regulation, 22(4), 655-676. https://doi.org/10.1093/jiel/jgz036

Rogelja, I., & Tsimonis, Okay. (2020). Narrating the China risk: Securitising Chinese language financial presence in Europe. The Chinese language Journal of Worldwide Politics, 13(1), 103-133. https://doi.org/10.1093/cjip/poz019

Rosecrance, R., & Thompson, P. (2003). Commerce, overseas funding, and safety. Annual Assessment of Political Science, 6(1), 377-398. https://doi.org/10.1146/annurev.polisci.6.121901.085631

Salter, M. B. (2011). When securitisation fails: The onerous case of counter-terrorism packages. In T. Balzacq (Ed.), Securitisation Concept: How Safety Issues Emerge and Dissolve (pp. 116-132). Routledge.

Santander, S., & Vlassis, A. (2021). The EU searching for autonomy within the period of Chinese language expansionism and COVID‐19 pandemic. International Coverage, 12(1), 149-156. https://doi.org/10.1111/1758-5899.12899

Schill, S. W. (2019). The European Union’s International Direct Funding screening paradox: Tightening inward funding management to additional exterior funding liberalization. Authorized Problems with Financial Integration, 46(2), 105-128. https://www.kluwerlawonline.com/summary.php?space=Journals&id=LEIE2019007

Scholvin, S., & Wigell, M. (2019). Geo-economic energy politics: An introduction. In M. Wigell, S. Scholvin & M. Aaltola (Eds.), Geo-Economics and Energy Politics within the 21st Century: A revival of financial statecraft (pp. 1-13). Routledge International Safety Research.

Simon S. (2020). Funding screening: The return of protectionism? A political account. In S. Hindelang & A. Moberg (Eds.), YSEC Yearbook of Socio-Financial Constitutions 2020. YSEC Yearbook of Socio-Financial Constitutions (pp. 43-52). Springer.

Track, W. (2015). Securitization of the “China risk” discourse: A poststructuralist account. China Assessment, 15(1), 145–169. https://www.jstor.org/secure/24291932

Stoffers, M. (2021). Past credibility: Superior doc evaluation. In M. Stoffers (Ed.), Analysis Strategies: Superior Doc Evaluation (pp. 11-20). College of Arts and Social Sciences, Maastricht College.

Svoboda, O. (2020). The tip of European naivety: Troublesome instances forward for SCEs/SOEs investing within the European Union? Transnational Dispute Administration Journal, 17(6), 1-13. https://www.transnational-dispute-management.com/article.asp?key=2776

Wæver, O. (2009). What precisely makes a steady existential risk existential? In O. Barak & G. Sheffer (Eds.), Existential Threats and Civil-Safety Relations (pp. 19-36). Lexington E-book.

Watson, S. D. (2012). ‘Framing’ the Copenhagen College: Integrating the literature on risk development. Millennium – Journal of Worldwide Research, 40(2), 279–301. https://doi-org.ezproxy.ub.unimaas.nl/10.1177/0305829811425889

Wendt, A. (1992). Anarchy is what states make of it: The social development of energy politics. Worldwide group, 46(2), 391-425. https://doi.org/10.1017/S0020818300027764

Appendix