Whereas many Individuals imagine the U.S. Federal Reserve is the caretaker of the nation’s financial system, its additionally believed to be one of many worst monetary establishments ever created. In 2022, amid a dismal financial system, conflict, and a variety of world crises, the potential for an ideal financial shift has elevated. The previous years stuffed with panic, are similar to the years that led to the creation of the Federal Reserve System.

The Panics That Led to the Final Transition of Wealth Could Assist Us Perceive At this time’s Financial Transformation

Throughout the previous couple of years, simply earlier than the onset of Covid-19, discussions a few “Inexperienced New Deal,” a “Nice Reset,” and a “New Bretton Woods Second” have elevated an ideal deal. These subjects have made individuals imagine an ideal transition of wealth is happening, and the consortium of recent central banking is bolstering the change. Many individuals surprise how these modifications occur so quick, and why the general public merely permits such transformative modifications with out query. One of the best ways to grasp such modifications is to have a look at the good transition of wealth that happened within the late-1800s into the mid-1900s.

The primary historic second that happened again then was the creation of the Federal Reserve System. It’s effectively documented that the Fed was born on December 23, 1913, after president Woodrow Wilson signed the Federal Reserve Act, however the central financial institution’s inception began years earlier than Wilson’s Act. What most individuals don’t know is that J.P. Morgan and the “Cash Belief” or the “Home of Morgan” helped gas the creation of an American central financial institution. Not one of the proof is hidden from the general public because the Pujo Committee, a congressional subcommittee that operated from 1912–1913 investigated the group in nice element.

Within the late 1800s, Individuals grew untrustful of banks as a monetary cartel had shaped that used American deposits for bucket outlets and proposition bets. Monetary manipulation was rising wildly and in 1896, Morgan created the Morgan-Assure Firm. Over the following decade up till the summer time of 1907, the U.S. financial system was extraordinarily risky. Whereas the ‘Panic of 1907’ or the ‘Knickerbocker Panic’ is well-known in historical past. There have been earlier panics and financial institution runs in America in 1873 and 1893. Morgan and his associates reportedly monopolized an excessive amount of companies, and extra particularly Morgan managed near half of the nation’s railroads.

Tim Sablik and Gary Richardson from the Fed’s Financial institution of Richmond department clarify that the “Panic of 1873 arose from investments in railroads.” That summer time in 1907, the U.S. financial system broke and a big swathe of economic establishments and firms went bankrupt. The largest failures stemmed from Westinghouse Electrical Firm and Knickerbocker Belief in New York Metropolis. Richardson and Sablik famous that the Panic of 1884 derived from two main New York Metropolis monetary companies failing. Each of the financial institution’s house owners made “speculative investments” and Marine Nationwide Financial institution and Grant and Ward went bust.

The U.S. Treasury tried to save lots of the day in 1907 by funneling hundreds of thousands of {dollars} into failing monetary establishments. Whereas liquidity was horrid for American banking clients and depositors, a variety of companies and banks created money substitutes. After the Treasury try and money substitutes didn’t work, J.P. Morgan stepped in to repair the state of affairs. Morgan and America’s main finance males channeled plenty of cash into weak banks with assist from the federal government and the nation’s enterprise leaders.

3 Monetary Crises, Jekyll Island, and the Aldrich Plan — Are Panics and Crises Previous At this time’s Financial Shift?

The three monetary crises (1873, 1893, 1907) led a majority of Individuals to imagine america banking system was formally corrupt. After the Panic of 1907, bureaucrats in collusion with a variety of U.S. enterprise leaders, satisfied the general public the banking system wanted reform. In spite of everything, the general public was fed up with banks spending their deposits on speculative investments and bucket outlets, and so they had been rising bored with financial institution runs. U.S. politicians then moved towards strict regulatory reform and Congress launched stop-gap laws and the Nationwide Financial Fee.

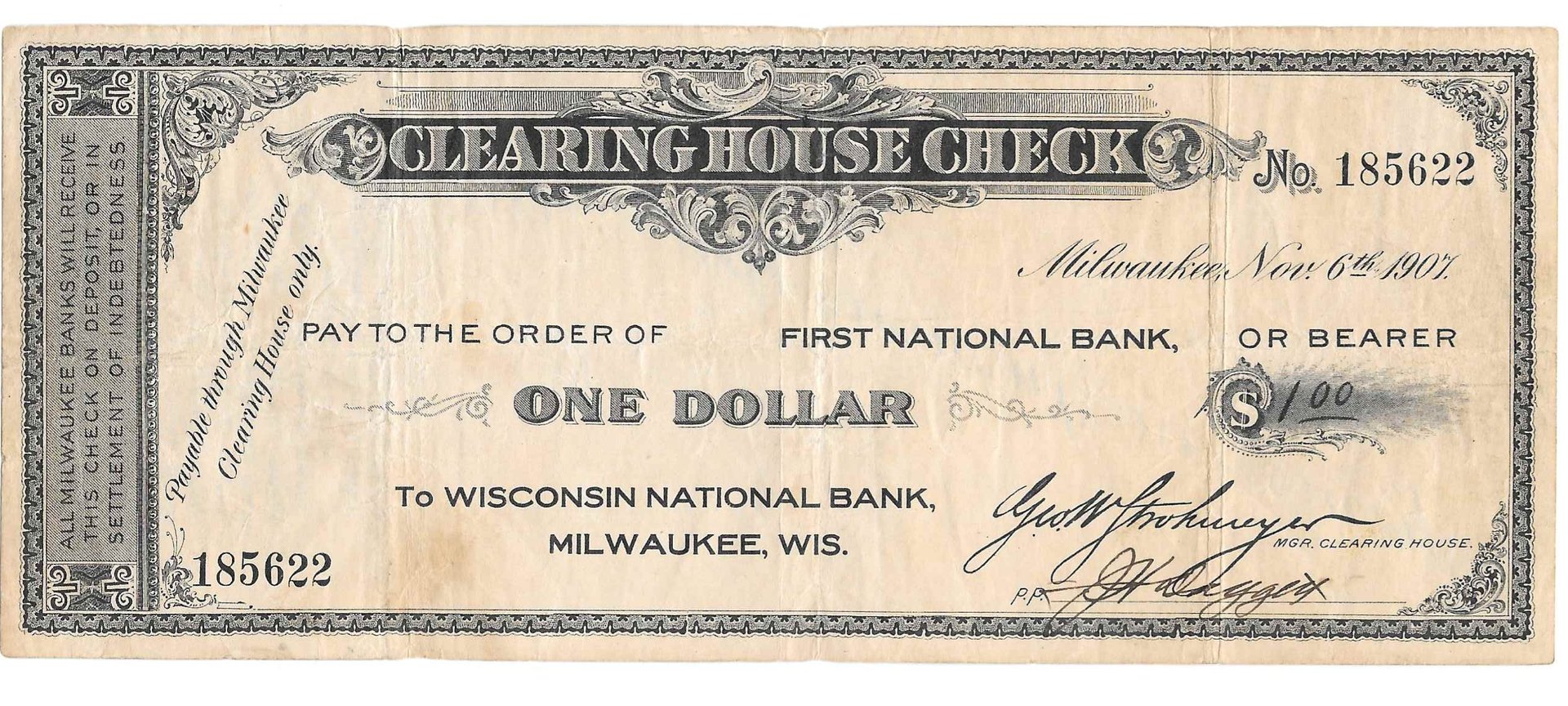

The Aldrich-Vreeland Act (1908) allowed U.S. bankers to begin nationwide foreign money associations, within the occasion a nationwide emergency of liquidity arose. The initiation of the Federal Reserve was sparked by the liquidity crises talked about above, and thru the Aldrich-Vreeland Act, banknotes had been backed by the establishment’s securities and authorities bonds. Authorities library paperwork additional present the Panic of 1907 “made individuals desire a highly effective central financial institution that might ‘defend’ the frequent man from the ‘abuses of the Wall Avenue bankers.’”

Just like the current financial calamities America is dealing with at the moment, with Covid-19 lockdowns and the disruptions from the conflict in Europe, the earlier monetary crises in 1873, 1893, and 1907 invoked one of many largest financial shifts in historical past. Whereas most Individuals are taught in highschool that the Fed’s system manages the cash and credit score all through the nation, G. Edward Griffin’s 600-page e-book “The Creature from Jekyll Island” paints a distinct story. It explains how the “Home of Morgan” and a positive U.S. president colluded to create the U.S. central financial institution.

A descendent of the Rockefellers, Nelson Aldrich was additionally instrumental within the secret assembly on the Jekyll Island Hunt Membership in Georgia. The Federal Reserve System was crafted by Morgan’s ‘Cash Belief,’ choose politicians, and Nelson’s foundational design referred to as the “Aldrich Plan.” In current occasions, descendants of the Rockefellers from the Rockefeller Basis have been accused of designing plans referred to as “lock step” in 2010, which is eerily much like the Covid-19 lockdowns that occurred ten years later. The New York-based philanthropy report discusses how governments might management an influenza-like pandemic by way of lockdown measures.

Whereas Wilson’s December 23, 1913 signing is effectively documented, most Individuals don’t know in regards to the secret assembly held on Jekyll Island in 1910. Historical past academics and faculty books don’t talk about the years earlier than the Fed was created. However those that do find out about how the Fed began and maintain the assumption that it continues to control the free market, need the central financial institution abolished. “The Fed has turn into an confederate within the assist of totalitarian regimes all through the world,” Griffin writes in his Jekyll Island e-book revealed in 1994.

The earlier years that led to the consortium of recent central banking and the Fed are similar to at the moment’s financial crises, and it’s secure to say panic fuels modifications. If an ideal transition of wealth is happening at the moment, the indicators present a transformative end result, deliberate years in the past, could very effectively be on the horizon. It’s unsure what the financial shift will appear to be, however trying again at historical past and issues just like the creation of the Federal Reserve system, clearly exhibits that sure individuals are more likely to profit greater than others.

What do you concentrate on at the moment’s transition of wealth and evaluating it to the panics and crises that occurred over 100 years in the past over the last nice financial transition? Tell us what you concentrate on this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons