fstop123/E+ by way of Getty Photographs

The thought of shopping for a rental property may be very compelling.

You primarily use the financial institution’s cash to purchase a property after which use your tenant to repay your mortgage, whilst you patiently watch for appreciation.

If you get an excellent deal, your property ought to even generate some further money stream, and after 20-30 years, you will personal the property free and clear.

There are additionally some essential tax benefits that will let you depreciate your property to defer taxes.

Sounds fantastic, proper?

It is the last word method to leverage different individuals’s cash to construct wealth and plenty of have efficiently used this technique to construct fortunes.

This entire concept was so compelling to me that I made a decision to specialise in actual property investing throughout my research and ultimately made it my profession. I made some private investments and in addition participated in some very massive offers throughout my time in personal fairness actual property.

Even then, I finally determined to cease investing in rental properties, and right now, I do practically all of my actual property investing by way of publicly listed REITs. I’ve defined why in a number of articles that I’ve posted over time, and the extra I study this matter, the extra satisfied I develop into that I made the precise alternative.

That is as a result of there’s a hidden darkish aspect to rental properties…

I’m positive that you’ve got learn the ugly 3 Ts (tenants, bathrooms, and trash), however it truly goes far past that, and when you contemplate the entire image, you rapidly understand that the income of rental properties are nothing greater than only a mirage typically.

In what follows, I’ll spotlight the hidden fact of rental investing, and clarify why REITs are superior typically:

Rental Properties Are Very Time Consuming And Your Time Has Worth

I begin with the subject of time and alternative prices as a result of it’s the largest challenge that is additionally essentially the most generally ignored by traders.

Lots of people falsely think about that proudly owning rental properties is usually passive. That is largely as a result of there are many YouTubers / bloggers who promote the dream of incomes passive revenue as a way to promote you their costly programs on rental investing.

In actuality, shopping for and managing rental properties is way nearer to working a enterprise than incomes passive revenue, and because it takes a lot time, you could deduct the worth of that point when calculating your returns.

Let’s check out an instance:

You purchase a rental property for $250k.

You fiscal 80% of it with a 4% mortgage.

You lease it out for $2,000 per 30 days and earn $1,200 internet of bills.

In principle, that equates to a 12.8% cash-on-cash return, which sounds nice. Add to that a couple of proportion factors of early appreciation and you might be getting shut to twenty% complete returns.

However in actuality, the economics are usually not practically nearly as good when you correctly account for the worth of your time.

In case you are somebody who’s actively managing your rental enterprise, I’d count on it to take at the least 5 hours per week on common. Some weeks, you’ll put in 0 hours, however in some others, you’ll work 20 hours. 5 hours is a mean and it covers all the things from in search of offers to negotiating, renovating, advertising, and so forth.

Then for those who assume that the worth of your time is $30 per hour, it primarily implies that your alternative price is $150 per week or $600 per 30 days. In spite of everything, for those who had invested your cash in REITs, you might have used this time to work your job so it’s actually simply the price of your labor and never the passive return of your rental property funding.

Now for those who deduct the $600 out of your earlier returns, then your returns truly flip detrimental since you solely had $6,400 of annual money stream.

At this level, your funding is admittedly simply one other job and never a very well-paid one given the dangers that you’re taking. Then you might or might not earn extra upside from appreciation, however that is at all times an enormous query mark and relies upon closely on the place and if you find yourself investing.

The purpose right here is that the administration of rental properties is extraordinarily inefficient and dear, and you can not merely ignore the prices merely since you are doing all of it. You would have used this time to earn a wage working a job and due to this fact, it has worth.

Issues get considerably higher as you acquire scale, however you’ll by no means take pleasure in the identical economies of scale that REITs take pleasure in. As such, you might be at an enormous financial drawback from the get-go.

Property Managers Are Vastly Conflicted And Costly

Maybe a greater answer can be to rent a property supervisor. It’s actually cheaper in case your time is even modestly worthwhile.

However the challenge is that even property managers stay costly, and most significantly, they’re vastly conflicted.

The purpose of the property supervisor is to tackle as many properties as doable as a result of they earn a proportion of income. The time that they can spend in your property is then very restricted. It’s of their finest curiosity to make very fast choices and waste as little time as doable in your property, which then results in neglectful, poorly-informed choices, and elevated dangers.

These oblique prices may be so substantial that many property homeowners nonetheless suppose that self-managing is superior, regardless of the problems that we highlighted beforehand.

REITs are completely different as a result of the managers are internally employed by the REIT typically and so they then solely work for the REIT. Their compensation is just not a proportion of the income, however a set wage + a bonus that is sometimes tied to the efficiency of the REIT. The managers will typically even have a whole lot of pores and skin within the sport, which motivates them to work within the shareholder’s finest curiosity. To offer you an instance, the CEO of Farmland Companions (FPI) owns about 5% of the fairness, representing $34 million, a really massive chunk of his internet price.

Equally, Sam Landy, CEO of UMH Properties (UMH) has about 50% of his retirement financial savings invested within the shares of the corporate.

In consequence, the administration is much better than for those who give your rental property to a random property supervisor who has fully completely different pursuits from yours.

Your Private Legal responsibility is On The Line, Placing You At Nice Danger

I not often hear rental traders speaking about legal responsibility threat and but it’s so essential.

You’re making a extremely leveraged funding and you might be personally signing on to all the loans.

Furthermore, you make a extremely concentrated funding in a single asset during which you might be placing the lives of different individuals.

What might go incorrect?

All it takes is one dangerous shock and you might lose all of it.

A tenant who develops bronchial asthma as a result of mould in your property and sues you for damages…

A tenant who will get electrocuted and sues you for damages since you did not correctly preserve your property as much as the newest codes that change on a regular basis…

The canine of your tenant falls sick due to “XYZ” and sues you for damages…

You’ll be able to put an LLC between you and your property however that solely goes up to now. The tenant will nonetheless sue you personally and you might be simply personally liable for lots of issues.

Since you might be additionally personally accountable for all of the money owed, you take huge threat and that is why so many rental traders find yourself submitting for chapter safety annually. As compared, REIT bankruptcies are extraordinarily uncommon, and never a single REIT shareholder has ever misplaced all of their cash so long as they held a well-diversified portfolio.

The Tax Benefits Are Truly a Drawback If You Assume Lengthy Time period

The supposed tax benefits of rental properties are well-publicized.

Since you may depreciate your property, you may artificially scale back the revenue that it generates and decrease your taxation.

That sounds nice, however there’s a big catch that folks appear to neglect about.

After you have depreciated your property, you may by no means promote it. In any other case, you may be hit with an enormous tax invoice since your price foundation will now be a lot decrease and your tax bracket might have additionally (hopefully) elevated over time.

As such, you are actually caught along with your property without end, and that comes with big oblique prices. It implies that you will not have the ability to transfer out and in of the true property market, even when the market circumstances develop into unfavorable and also you determine higher alternatives elsewhere. That is an enormous price and most of the people ignore it fully.

With REITs, you may fully defer all taxes by holding them in a tax-deferred account, and you continue to retain all flexibility. You’ll be able to transfer out and in of the market immediately. Past that, even for those who maintain REITs in a taxable account, they continue to be very tax-efficient as we clarify in a latest article.

Leverage is a Double Edge Sword

The entire attraction of investing in rental properties is a budget and considerable leverage that it could possibly afford individuals.

If you do not have a lot capital, it means that you can actually turbo-charge your path to wealth by taking up big debt that is secured by an asset that is hopefully going to understand over time.

That is all nice if issues go properly.

However issues by no means go properly 100% of the time. All it takes is one black swan-like the good monetary disaster or the pandemic – and you might lose all of it in a single day.

If you find yourself 80% leveraged, you primarily lose 100% of your fairness if property costs drop by 20%.

Even when the market is performing properly, you might simply undergo a 20% loss for those who simply get the incorrect tenant who trashes your house, otherwise you undergo an surprising bodily break in your property. For example, your roof begins leaking, however it goes unnoticed for some time, and it causes vital water harm to the whole property.

The purpose right here is that leverage may be good, however it could possibly additionally damage you.

That is why REITs solely use 40-50% leverage today. They discovered from the good monetary disaster that it’s higher to persistently earn a 12-15% annual return with extra security than to earn a 15-20% annual return, however then threat going broke if you find yourself hit with a disaster.

More and more Typically, Tenants Are in Energy

The final level that is typically ignored by a whole lot of rental traders.

In a whole lot of states, tenants are already king, and that is true in more and more many locations within the US and in addition overseas.

As a result of housing is unaffordable in lots of locations, there are increasingly more individuals who stay tenants, and politicians naturally wish to attraction to them.

The legal guidelines have gotten extra tenant-friendly and this makes the administration of rental properties much more sophisticated.

In consequence, the significance of scale can also be changing into extra vital. REITs like Mid-America (MAA) and Essex (ESS) personal 1000’s of items and might afford to have one of the best managers working for them, in addition to in-house legal professionals when wanted.

In the event you personal only a few rental properties, you will not have the size that is wanted to cowl these prices, and you might be exposing your self to vital dangers. All it takes is one tenant dispute and it might price you years of returns.

Backside Line

We at all times hear about all the advantages of proudly owning rental properties. Leverage, money stream, appreciation, and tax advantages.

However what we not often hear about are all of the hidden drawbacks that truly far outweigh the advantages once you take a look at the larger image and correctly account for the chance prices and dangers.

That explains why so many profitable traders favor REITs over rental properties. They’ve traditionally been extra rewarding typically, and importantly, they’re so much safer and require so much much less time from you.

Listed below are 3 completely different impartial research that conclude that REITs are extra rewarding when you account for all of the charges and alternative prices:

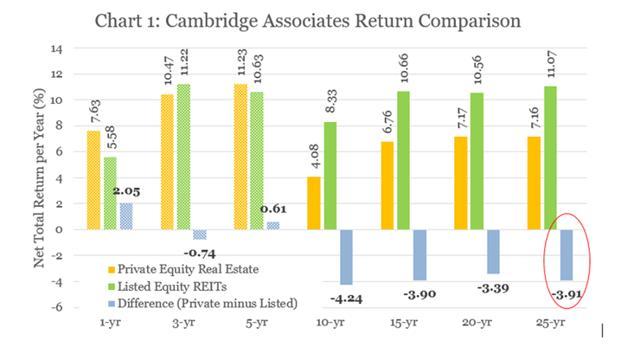

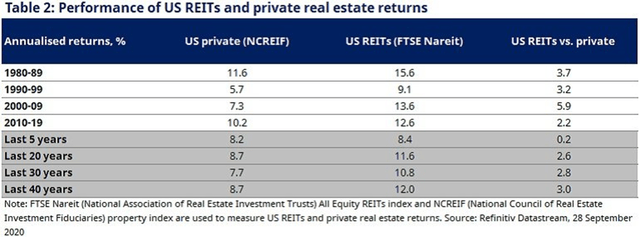

REITs outperform personal actual property (EPRA) REITs outperform personal actual property (Cambridge Associates) REITs outperform personal actual property (Refinitiv Datastream)

Better of all, for the reason that REIT market is notoriously inefficient, you may typically discover bargains, and earn even higher returns by being selective. For example, my REIT portfolio has compounded at 18% per 12 months on common since its inception, in comparison with 10% for the preferred REIT ETF (VNQ) over this time interval.