Asked lately about Amazon’s sprawling community of warehouses Brian Olsavsky, the agency’s finance chief, didn’t mince phrases. “We’ve got an excessive amount of house proper now.” Confronted with a surge in demand throughout the pandemic, the web retailer doubled its capability from 193m sq. ft (18m sq. metres) on the finish of 2019 to 387m sq. ft two years later. Right now it has a glut, which the corporate says is costing it tens of tens of millions of {dollars} a day.

Retailers are bracing themselves for a slowdown, or perhaps a recession, because the Federal Reserve raises rates of interest. However Amazon’s troubles mirror one other essential issue for the American financial system: a shift in spending from items again to providers which might decrease inflation, making the Fed’s job simpler.

Goal, one other retailer, reported a 52% drop in internet revenue within the three months to April, in contrast with the earlier 12 months, which it blamed partially on a speedy slowdown in demand for home equipment, furnishings and televisions. “We [expected] the buyer to proceed refocusing their spending away from items and into providers,” Brian Cornell, the agency’s boss, stated, however “we didn’t anticipate the magnitude of that shift.” General, the change ought to ease stress on world provide chains and decrease inflation. However it has been gradual and uneven.

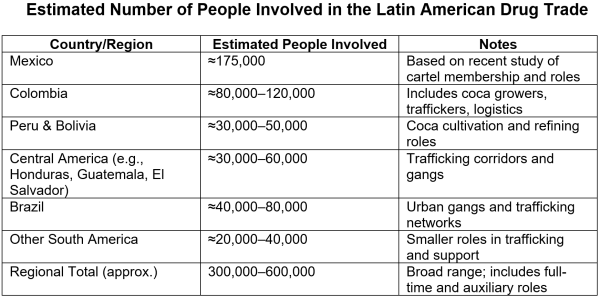

Confined to their houses throughout the worst of the pandemic, Individuals splurged on home equipment, automobiles and furnishings. Fiscal largesse, together with three rounds of “stimmy” cheques, helped gas the shopping for binge. Folks purchased substitutes for the providers they may now not avail themselves of—an train bike, say, to make up for closed gyms. Maybe on account of having slightly further money, additionally they handled themselves to issues like watches and luxurious merchandise. A 12 months into the pandemic the composition of shopper spending had modified dramatically. By spring 2021, items accounted for 42% of family spending, up from 36% earlier than the pandemic; providers accounted for 58%, down from 64%, a drop value greater than $900bn per 12 months.

A number of different Western nations skilled an analogous rise in items consumption, although few witnessed a much bigger increase than America. Daan Struyven and Dan Milo of Goldman Sachs, a financial institution, examine the evolution of actual items spending throughout 23 oecd nations and discover that solely Chile and Norway outperformed America. In Japan, items purchases within the final three months of 2021 have been 7% beneath pre-pandemic tendencies.

America’s spending spree helped raise the financial system out of recession, however it additionally contributed to an inflation headache. The deluge of latest orders overwhelmed world provide chains, which have been already affected by pandemic-related disruptions, resulting in clogged ports and transport delays. With demand outstripping provide, items costs rose. The Bureau of Labour Statistics reckons that items costs boosted consumer-price inflation by 4.9 proportion factors within the 12 months to April 2022, having decreased it by 0.1 factors within the 12 months earlier than the pandemic.

Now spending is beginning to shift within the different course. Information revealed on Could twenty seventh by the Bureau of Financial Evaluation present that spending on items fell within the 12 months to April, and is now 9% above its pre-pandemic development, down from a excessive of 16% final 12 months. Spending on providers is up by 7% in the identical interval, and is simply 3% beneath pre-pandemic tendencies. However some providers have been faster to get better than others. Messrs Struyven and Milo of Goldman Sachs word that whereas “enjoyable” spending classes with pent-up demand similar to meals providers, air journey and resorts have rebounded over the previous 12 months, others have lagged behind. Companies that cater to white-collar professionals have additionally been gradual to get better. Mass transit spending is about 50% down from what it could have been, absent the pandemic; laundry and dry-cleaning revenues are 20% beneath development.

Even some important providers have been gradual to bounce again. Spending on medical doctors’ and dentists’ providers is roughly 15% beneath the pre-pandemic development; little one care is down by 22%. Urge for food for a lot of non-essential items, in the meantime, reveals little signal of abating. Spending on jewelry and leisure autos are 53% and 43% above development, respectively. Spending on pets is up by 23%.

One query is whether or not the composition of shopper spending will return to pre-pandemic norms. The hope is that this eases supply-chain bottlenecks and helps convey down inflation. But a number of uncertainties lie forward. The method appears more likely to be gradual. Though Goal was wrong-footed by the power of the shift in direction of providers, if latest tendencies proceed, items and providers spending would solely return to pre-pandemic ranges by maybe the third quarter of subsequent 12 months. And a few habits might properly stick: the rise of distant work, say, might have completely modified the consumption combine, protecting the relative demand for items increased than it was earlier than the pandemic.

Hovering over all this, although, is a doubtlessly souring financial surroundings. Shopper-price inflation is outpacing wage development, and households are getting gloomier about their private funds. American shoppers powered a unprecedented items growth over the previous couple of years. What they do subsequent is far much less sure. ■